Researching for certainty

The last 12 months have seen a significant rotation of topics discussed at investment meetings worldwide. The agenda has moved from macroeconomic data to infection rates, hospitalization rates, vaccinations and other issues related to the COVID-19 pandemic. The shift is understandable given the impact the crisis has had on financial markets. However, it has proved difficult to forecast the path of the pandemic; experts are struggling as well as politicians and investment managers. It has been challenging to assign a higher likelihood to any of the discussed scenarios. Even with vaccination programs launching, a high degree of uncertainty remains.

We think that it is extremely challenging to build investment cases on scenarios with low assigned probabilities. We therefore aim to focus our investments on the “knowns” rather than the “unknowns”. We believe that building an investment thesis on the former improves the predictably of investment returns.

But what are the “knowns”? Firstly, we can assign a high probability to our forecast that fiscal and monetary measures will remain on an unprecedented scale and therefore support financial markets globally. Secondly, we expect liquidity for credit markets to remain difficult and thirdly we continue to believe that diversification is the only “free lunch” available to investors. All three factors will form the cornerstones of our global credit outlook and investment plan for 2021.

We will elaborate on why we think fiscal and monetary support, liquidity and diversification are the critical factors for investing in 2021.

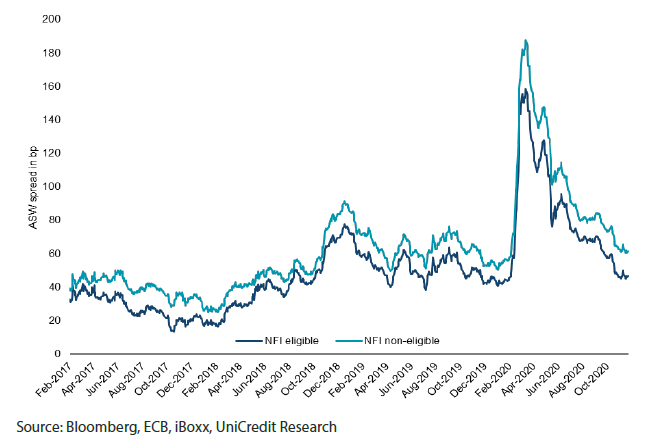

Let us start with fiscal and monetary support. With the ECB raising its PEPP (Pandemic Emergency Purchase Program) in December by EUR 500 billion and extending it until March 2022, we now expect the ECB to support the corporate bond market going forward with bond purchases of EUR 10 billion per month on average. Even with a lower number of monthly purchases, the ECB was able to control volatility in the corporate bond market and spread widening was more muted for eligible bonds back in March 2020 (Chart 1). Therefore, our credit research team is focusing now on ECB-eligible bonds. Companies rated BBB or BB still offer attractive spreads but now come with reduced volatility, given the ECB support. One sector we favour in particular and where we see potential for further spread tightening is real estate. Spreads haven’t returned yet to fair value and we still see attractive opportunities for our global credit strategies.

Chart 1: Credit spreads eligible vs non-eligible bonds

The second area to single out is liquidity. Over the last decade the asset management industry enjoyed significant growth while banks had to decrease their trading books following the GFC. This situation is now creating regular imbalances in bond trading that leads to spikes in bid-offer spreads, even making bond trading impossible at times. The last time we experienced such an imbalance was in March 2020 when the COVID-19 pandemic started impacting credit spreads. We think a solution to the reduced bond liquidity is an increased use of CDS.

Our liquidity assessments of the last couple of years have shown that liquidity of CDS indices is superior to that of bonds. An increased use of CDS enables investors to change the risk profile of their portfolios quickly and efficiently when bond trading is expensive or even impossible.

Last but not least of the “known” factors is the benefit of diversification. This might not sound new and innovative and in the past we have more than once experienced asset classes that were supposedly uncorrelated suddenly move in the same direction in a crisis situation.

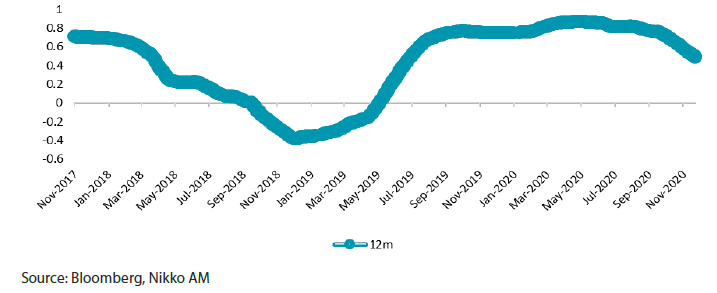

But extensive research has convinced us that it’s possible to identify asset classes that have low to negative correlation. Often these opportunities can be found in the Asian fixed income market. For example, Chinese and US government bonds tend to have a low correlation at certain periods (Chart 2). Compared to G7 countries, China still has a higher growth rate and yields which makes its government bonds an attractive investment for a broadly diversified portfolio.

Chart 2: Correlation between UST 10-year and CGB 10-year yields

The three factors discussed above will play a pivotal role in our credit strategies for 2021.

We will also focus on lower rated companies with ECB and state support, but only after they make it through our well-defined research process. The main benefit of focusing on lower rated bonds in 2021 will be their above-market yield and the strong spread income they potentially offer.

Still, an above-market yield often goes hand in hand with an above-average risk profile for portfolios. Screening the Asian fixed income market for diversification opportunities and using CDS indices to control liquidity risk are ways to mitigate such above-average risk profiles, in our view.