Summary

- We expect Asian credit spreads will tighten gradually over the coming months, supported by a solid rebound in gross domestic product (GDP) growth for most Asian economies in 2021 and stable to slightly better corporate credit fundamentals.

- Credit-supportive fiscal and monetary policies are also expected to remain in place in most developed and Emerging Market (EM) countries, even if incremental easing measures are likely to start to moderate. Progress on vaccine development and better treatment for COVID-19 cases further reinforce this positive backdrop.

- That said, valuation is no longer cheap given the sharp rally in credit spreads over recent months, and there may be periods of market consolidation amid the spread tightening trend.

- We prefer Asian high-yield (HY) credits to Asian investment grade (IG) at the start of 2021, given expectations that Asian HY will generate a higher total return during the year. There is more room for spread compression within Asian HY, which will also be less affected by rising long-end US Treasury (UST) yields given its shorter duration. Within HY, we prefer short-dated Chinese property bonds over the industrial sectors across China, India and Indonesia. Within Asia IG, we also prefer compression, favouring BBB-rated credits over those that are A-rated and above.

2021 Asian credit outlook

Fundamentals

Macro

Following a year in which global economies were ravaged by the COVID-19 pandemic and the mobility restrictions implemented to curb the spread of the virus, GDP growth of Asian economies is expected to solidly rebound in 2021, with the International Monetary Fund projecting the Emerging and Developing Asia region to expand by 8% . This recovery will be driven by a gradual return to normalcy in social mobility and economic activity, particularly in the external and domestic services sectors, as well as continued support from both fiscal and monetary policies. The key to this normalisation is the gradual rollout and distribution of COVID-19 vaccines around the world, which will enable those sectors hit hardest by the pandemic, such as air travel, tourism, and restaurants, to revive from a deep slump in 2020. Manufacturing has already started to recover in most Asian economies and the recovery likely to continue in 2021. As the major advanced economies also rebound in 2021, external demand should further solidify and export growth in most Asian economies should continue to pick up, particularly if demand for commodities continues to strengthen. Private investment demand may remain subdued in the first half of the year but could gather momentum into the second half of the year as business confidence and the consumer outlook improve.

In terms of country performance, China and other North Asian economies should continue to lead, at least in the first half of the year. However, towards the second half of the year, India and Southeast Asian economies may exhibit stronger growth as they catch up after their slower recovery thus far in 2H 2020, and as vaccine distribution may take longer in the larger economies of South and Southeast Asia. Some of these countries may also be constrained in terms of their fiscal policy space, hence their fiscal impulse may be weaker compared to the North Asian countries in the early part of 2021.

We expect fiscal and monetary policies to remain accommodative in most Asian economies. However, we may see moves to withdraw some of the extraordinary policy support as the year progresses if the growth trend improves as expected. This process is likely to be led by China. That said, with domestic inflation remaining benign, rising gently with domestic demand, and central banks in developed market economies unlikely to raise policy rates anytime soon, the room for monetary policy to stay accommodative through 2021 will likely remain intact across most Asian countries.

We expect the sovereign credit ratings of most Asian economies to remain stable in 2021. The biggest risk remains with India, given its negative credit outlook (rated Baa3 by Moody’s and BBB- by Fitch). While a downgrade to non-investment grade is not our base case for India, at least in 2021, clearly much hinges on the robustness of its GDP growth recovery and the ability of the Indian government to manage the country’s fiscal deficit and debt-to-GDP ratio. There is also a slight risk that S&P could follow Fitch and downgrade Malaysia’s rating to BBB+ if the country’s GDP growth does not recover strongly enough and enable the fiscal consolidation trend to return.

1International Monetary Fund, World Economic Outlook, October 2020

Credit

Given the backdrop of economic recovery and continued policy measures to ensure ample liquidity and lending support, we expect Asian corporate credit fundamentals to remain stable to slightly better in 2021 with recovering earnings and broadly stable debt levels. Compared to 2020, we are likely to see fewer idiosyncratic “fallen angel” cases, although the many Indian banks and state-owned enterprises whose ratings are sovereign-linked remain a source of uncertainty. The Asian HY corporate default rate is likely to remain manageable at around 2.5% in 2021.

Despite the impact of the pandemic on earnings, overall the IG corporate sector in Asia managed to retain stable leverage and debt servicing ratios through the first half of the year. Clearly, there are some variations around this trend; for example, sectors such as retail and transportation were more adversely impacted, while those such as technology actually showed improvements due to the shift to work-from-home and changing consumer spending patterns. Furthermore, the global fall in yields likely reduced overall borrowing costs, leading to stronger debt servicing metrics for some companies as debt levels have remained broadly stable. We expect this trend of stable to mildly improving credit metrics for the Asian IG non-financial corporate sector to continue in 2021. Asian banks could face some earnings pressure from low net interest margins, but as the majority of the banks are witnessing an improvement in repayments and a reduction in loans under moratorium, we are expecting a manageable deterioration in asset quality in 2021 when the relief measures expire. We also expect regulators to remain supportive of banks to ensure the bank lending channel is not disrupted during the nascent recovery phase.

On the HY side, the differentiation, both between and within sectors, will likely continue in 2021. The Chinese property sector will likely see stable to modest positive presales growth in 2021. Larger developers may continue to outpace the national level given their leading positions and generally stronger financial flexibility. Aggressive land acquisitions and leverage build up is unlikely in the Chinese property sector given the deadline to meet the requirements under the so-called “three red line” policy pertaining to the developers’ credit metrics. As with 2019 and 2020, credit metric trends for Chinese HY industrials will be more credit specific, although the tighter onshore credit conditions may exert pressure across the sector. Tight liquidity may also pressure select HY companies in Indonesia and India, especially those facing near-term refinancing needs.

Valuations

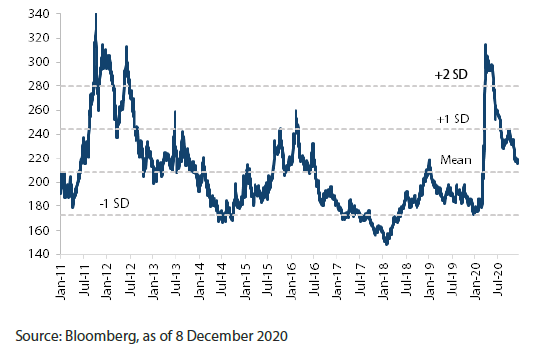

After widening sharply in 1Q 2020 on concerns over the impact of the pandemic, Asian credit spreads have tightened significantly since end-March, although they are still slightly wider than at the start of 2020. Asian high-grade (HG) spreads currently sit at 217 basis points (bps) , about 40 bps wider than at the end of 2019. Meanwhile, Asian HY spreads are at 656 bps, having widened about 122 bps since the end of 2019. Both HG and HY spreads remain above their post-Global Financial Crisis mean levels.

Asian credits remain attractive compared with US credits, with the Asian IG premium over US IG currently at 85 bps2 versus 50 bps at the start of the year. Within IG Asian credits, BBB-rated pickup over the A-rated segment is currently at 89 bps, slightly wider than 69 bps, the average level for the last five years. We thus prefer BBB-rated credits over A-rated ones for their higher pickup. Within HY, Asian credit provides a more attractive yield pickup versus its US peers. Within Asia, the single B-rated segment shows higher relative value as its pickup over the BB-rated segment has increased substantially to 471 bps2, although credit selection remains paramount.

Chart 1: Asian High-Grade Spread

Chart 2: Asian High-Yield Spread

2J.P. Morgan, Bloomberg, as of 8 December 2020

Technicals

We expect the technical backdrop for Asian credit to remain robust. After sharp outflows in 1Q 2020, external flows into EM funds have recovered and are likely to remain strong in 2021 given the ample global liquidity and re-allocation of funds towards higher-risk assets as market and economic uncertainties subside. In addition, the low funding cost environment is likely to continue shoring up private bank demand. China-based investor demand for USD-denominated Chinese credits is also expected to remain strong, with recent onshore credit concerns impacting only some of the offshore bonds issued by weaker HY private companies and local state-owned enterprises. Gross supply is likely to remain elevated in a USD 300 billion–350 billion range after another record year of gross issuances close to USD 315 billion in 2020. A large part of the gross issuance will be for refinancing, leaving net issuance at a manageable level of around USD 100 billion. More stringent regulation will likely cap Chinese property USD bond issuances, although there could be more opportunistic issuances by IG companies to lock in the historically low yields and to fund selective mergers and acquisitions.

Strategy

We expect Asian credit spreads to tighten gradually over the coming months. High-frequency indicators suggest a recovery is underway in most Asian economies, lending support to overall corporate credit fundamentals. Credit- supportive fiscal and monetary policies are also expected to remain in place in most developed and EM countries, even if incremental easing measures are likely to moderate hereafter. Progress on vaccine development and better treatment for COVID-19 cases further reinforce the positive backdrop. The technical backdrop is also favourable with inflows to EM hard currency bond funds expected to remain robust. That said, valuation is no longer cheap given the sharp rally in credit spreads over recent months, and we expect more regular episodes of market pull-back going forward.

Given the vaccine and policy-driven reflationary expectations in the developed market economies, long-end UST yields may rise and steepen the curve in 2021. This may offset the positive impact from credit spread tightening and result in low-single digit positive returns for Asian IG credits in 2021, with carry being a more prominent driver. We expect Asian HY to generate a higher total return. There is more room for spread compression within Asian HY, which will also be less affected by rising long-end UST yields given its shorter duration. Hence, we prefer Asian HY credits over Asian IG at the start of 2021. Within HY, we prefer short-dated Chinese property bonds over industrial sectors across China, India and Indonesia. Within Asian IG, we also prefer compression, favouring BBB-rated credits over those that are A-rated and above.

In our view, the key downside risk to Asian credit in 2021 is US-China bilateral relations failing to stabilise under the Biden administration. US president-elect Joe Biden has repeatedly stressed multilateralism as a key foreign policy pillar, and there are hopes of US-China relations being reset after a tumultuous four-year period. However, the underlying technological and ideological tensions between Washington and Beijing could dash such hopes. In addition to geopolitical issues, a premature withdrawal of the accommodative fiscal and monetary policies currently in place is another downside risk that could derail the positive outlook for risk assets, including Asian credit.

Sector outlooks

Financials

As a majority of the Asian financials are witnessing an improvement in repayments and reduction in loans under moratorium, we are expecting a manageable deterioration in asset quality in 2021 when the relief measures expire. While fiscal stimulus and accommodative monetary policies could be cautiously dialled back in 2021, we trust regulators and governments to remain supportive of banks, allowing these entities to fulfil their crucial socio-economic role and prop up economic growth.

In China, Hong Kong, South Korea and Singapore, the pandemic has been relatively well controlled and economic activity has gradually picked up. While pressure on the banks’ profitability will persist and credit costs could remain elevated in 2021, we see attractive risk-reward in going down the capital structure of the larger banks that are well capitalised and possess strong fundamentals, better risk management practices, and limited exposure to the weaker industries and small and medium-sized enterprises. We see minimal non-call risk for these bonds, as Asian banks continue to enjoy favourable capital market conditions and will want to avoid any lasting negative impact to their reputation. In India, the Non-Banking Financial Companies’ (NBFCs) asset quality remains vulnerable despite improving loan collections. Persistent weakness amongst the smaller NBFCs will continue to weigh on the fragile sentiment toward the sector.

We continue to prefer China’s asset management companies (AMCs) and the stronger bank-affiliated leasing companies over China banks seniors. For China’s AMCs, the growing importance of their strategic role in distressed asset management and ongoing reduction in leverage have more than offset the rising risks in asset quality and shrinking profitability. Bank-affiliated leasing companies with a strong onshore parent bank are more profitable than their peers, aided by closely integrated business operations as well as explicit liquidity and capital support from the onshore parent bank under the articles of association of leasing companies.

Real estate

Regarding property, we favour China, have a neutral view of Hong Kong, and find Indonesia relatively unattractive. We continue to see value in Chinese property developers, driven by resilient fundamentals, attractive valuations and improving market technicals.

We expect the following trends to support fundamentals:

- Demand for residential homes: We expect such demand to remain healthy. It is driven by household formation and urbanisation and has demonstrated resilience even during the pandemic.

- Tighter macro-prudential policies: Regulators have tightened macro-prudential policies, and this will improve discipline and limit debt growth among developers, in our view. We expect policies to be implemented in a phased and manageable manner for the industry.

- Better funding structure: Many developers have plans to deleverage or improve their funding structure and have shown progress in executing these plans.

In Hong Kong, we find that wider valuations fairly reflect weakening sentiment and fundamentals, with investment property rental rates and occupancies likely to trend down. In Indonesia, we expect weak sales, as well as liquidity and refinancing concerns, to continue to weigh on the sector and see valuations as relatively unattractive.

Infrastructure & transportation

We expect engineering and construction (E&C) companies to record steady top line growth in 2021 backed by solid order book backlog. Under the newly coined “dual-circulation” strategy, the Chinese government may be less inclined to drive infrastructure investments as rigorously as in prior years. But infrastructure investments will continue to be an important pillar supporting economic growth as the economy slowly recovers from the pandemic. Most E&C companies with dollar bonds are owned by China’s central State-owned Assets Supervision and Administration Commission (SASAC) and play an important role in smoothening the economy. We expect leverage on most of these companies to stay elevated due to capital needs in supporting capex and working capital investments. Overall, we still view this as manageable and have a constructive view on the sector.

Asia toll-road and port operators witnessed a V-shaped traffic recovery during 2020 as local economies eased lock down measures. We expect continued improvement to pre-pandemic levels in 2021, driven by better pandemic management and development of vaccines.

The airline sector has been one of the worst hit by the COVID-19 pandemic and is yet to see meaningful recovery. We view airline-related credits as a potential alpha source and our views may turn constructive on some relevant credits once it becomes clear that vaccines can be rolled out and air traffic begins recovering.

Technology

The Asia telecom sector’s competitiveness has been curbed in some markets over the past few months and this trend could continue in 2021. The shift from voice to data and changes in data consumption habits will remain a structural trend that will pressure the industry players’ margins. Hence, we expect telecom operators to retain their focus on cost management and be mindful about 5G investments in 2021. Overall, our view of the sector is neutral as we expect industry leaders to be committed to maintaining stable credit metrics in 2021.

Chinese internet players will see an increased divergence in operating performance in 2021 with leading players to post healthy top line growth at the expense of smaller players who will experience flat or negative growth. Overall, the industry will see positive but slower growth compared to previous years due to a high base effect and as competition will remain fierce. We expect the majority of Chinese internet bond issuers to maintain a stable credit profile in 2021 due to strong capitalisation and net cash positions. However, regulatory risks and impact from US-China tensions will continue to weigh on the sector in the coming year.

Some hardware technology companies have seen a decent recovery in 2020 due to industry restocking and incremental investments in 5G infrastructure and 5G phone launches. This trend could continue in 2021. However, some companies who are more vulnerable to the US-China trade tensions have lagged. We think US-China tensions will continue to impact these companies in 2021, though the upcoming change in US administrations could be a swing factor. Overall, we will remain cautious on the sector until the stance of the next US president becomes clear. We do see attractive investment opportunities in some companies that are less impacted by the US-China trade war, possess strong capitalisation and have a diversified product portfolio and customer profile.

Oil and gas

We expect the fall in oil prices in 2020 caused by the COVID-19 pandemic to weigh heavily on the profitability of oil and gas companies. Resurging virus cases and continued restriction of air travel are curbing overall oil demand, although the curtailment of oil production by OPEC+ members and major producers has greatly alleviated concerns over supply and demand imbalances. The virus could be contained some time in 2021 upon the development of much-anticipated vaccines; as the pandemic subsides, we expect oil demand and prices to recover.

Asian oil and gas companies in the upstream segment are likely to see lower profits in the near term. Most have competitive lifting costs and should still be able to generate positive cash flow despite low oil prices. These companies have sensibly lowered their capex spending and production volume guidance to conserve liquidity. The profitability of downstream segment companies will also be weak as refining margins remain soft due to poor demand. Refining spreads are unlikely to recover in the near term; furthermore, they will be weighed down by new capacity additions in the region. A robust recovery will depend on global economic conditions.

Overall, we expect credit metrics to weaken in the near term. However, Asian national oil companies have strong credit profiles as most are government owned and therefore enjoy solid support. These companies are very strategically important to oil importing countries as they ensure energy security, and this will remain the case regardless of near-term oil price swings. We are neutral on the Asian oil and gas sector.

Casino gaming

As a sector heavily reliant on cross border tourism, Asia’s casino operators were heavily affected by the COVID-19 pandemic. Operators in Macau and Singapore saw visits evaporate during 2Q and 3Q 2020. While Macau and Singapore have managed to bring COVID-19 cases mostly under control, visits to their integrated resorts remain well below pre-pandemic levels. Strict social distancing rules and travel restrictions continue to discourage tourism to these destinations and we expect the sector’s companies to continue reporting weak results in 2021. Despite these challenges, we believe that the casino operators are well positioned to weather the downturn as they hold healthy levels of liquidity and have good access to banking credit lines. The companies have also deferred dividends and discretionary capex to preserve liquidity. As the pandemic is eventually contained and cross border travel restored, we expect the gaming sector to recover slowly and gradually. We are neutral on the Asian casino gaming sector.