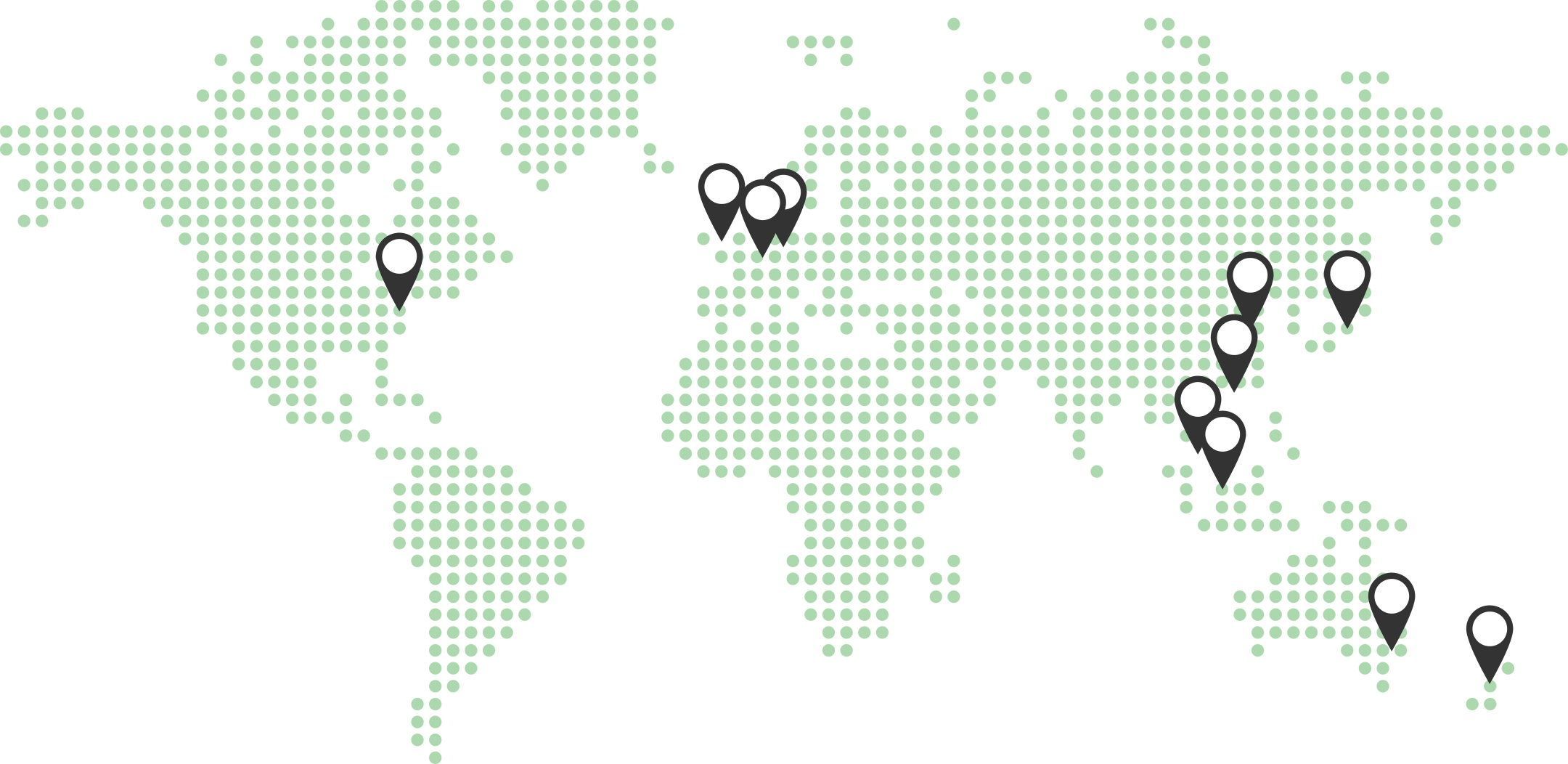

countries

nationalities**

USD

*

total AUM

Extensive global resources

Japan

Singapore

Australia

New Zealand

United Kingdom

Americas

China

Hong Kong

Malaysia

Luxembourg

Germany

Netherlands

France

Qualitative insight through a broad range of global investment capabilities

Total Assets Under Management (USD bn*)

| Total Equity | ||

| Total Fixed Income | ||

| Cash Equivalent | ||

| Balanced | ||

| Alternative/Others |

Our Specialisations

Equities

Global, Asia Pacific ex Japan, Japan, Australia, China, New Zealand

Fixed Income

Global Bonds, Green Bonds, Asian Local Currency, Asian Credit, Australia, New Zealand

Multi-Asset

Global, Emerging Markets

ETFs

Equities, Bonds, REITs

Employees** across all asset classes, located globally

Investment Professionals**

Portfolio Managers**

with extensive, and locally-driven research coverage

** Including employees of Nikko Asset Management and its subsidiaries as of .

+

years in Asia

One of the largest distributor networks in the Asian region

1st SRI Fund established in Japan*1

1st investment in-kind ETF established in Japan*1

1st Robotics Equity fund established in Japan*1

1st Asia ex Japan REIT ETF established in Singapore*1

Nikko AM works with the UK-based international organisation Carbon Footprint Ltd. to offset carbon emissions through offset programmes, and has been certified as carbon neutral since 2018.