The momentum gained by the global credit market in 2020 has continued into 2021 and we appear to be on track for another strong year of performance. Low government bond yields, ample liquidity and improving credit quality have supported a market that now trades with spreads at all-time lows in some pockets.

However, compared to 2020, the global credit market has become more relative value-driven and it is important for investors to focus on short as well as long-term themes impacting portfolio performance to keep returns positive.

Emerging credit themes that need to be navigated carefully

Rising corporate taxes

Firstly, over the past few months we observed a trend toward higher corporate tax rates across the globe. This trend, led by US President Joe Biden, would not only help fill depleted government coffers but also create an incentive for corporations to increase their debt levels or at least not to deleverage. On the one hand, interest payments are tax deductible and higher debt and interest payments create an opportunity to reduce the tax burden. One the other hand, higher tax rates will reduce the free cash flow available for debt reductions and reduce deleveraging efforts.

In particular, A-rated companies in the technology and healthcare sectors might feel less inclined in the future to defend their outstanding creditworthiness, in our view. In the last few months, we have seen a strong rating migration from A to BBB and expect more to come.

Energy sector in a changing world

Beside quality deterioration in certain rating buckets we also expect a faster pace of downgrades in some sectors. This bring us to the second theme which is credit quality decline in the energy sector driven by a global focus on renewable energy generation. While the first two themes might overlap in some areas, we still wanted to highlight the special situation unfolding in energy.

We have already seen massive write-downs from several of the oil majors as past investments into exploration are unlikely to generate expected returns. Although some of the expected long-term quality deterioration might be offset on a short-term basis by the recent rally in oil prices, we do not expect companies such as Exxon or Aramco to be in the AA category in a couple of years.

Sector allocation has been always a strong performance driver in the credit market. Avoiding defaults and downgrades in the tech, media and telecom sector in 2002 or in the banking sector in 2008 was crucial. Therefore, we will pay special attention to developments in the energy sector.

Sustainability bonds

Thirdly, we are focused on the sustainable bonds market. For a long time, green bonds were the only choice for ESG investors, but the market has continued to evolve and provide investors with a growing universe of bond structures. In particular, sustainability-linked bonds (SLB) are increasingly popular with issuers as well as investors. SLBs contain key performance indicators (KPI) in the bond documentation and the issuer is increasingly prepared to accept penalties in the form of coupon step-ups if the KPIs are not met. One of the first issuers to go down this road was Enel, the Italian electricity provider, when they issued bonds back in 2019. Compared to green bonds, SLBs are less vague in terms of their sustainability focus, although some issuers were accused of setting the bar too low for their sustainable efforts. However, we like the transparency offered by SLBs and see this as a positive step for the markets.

Portfolio risk and management

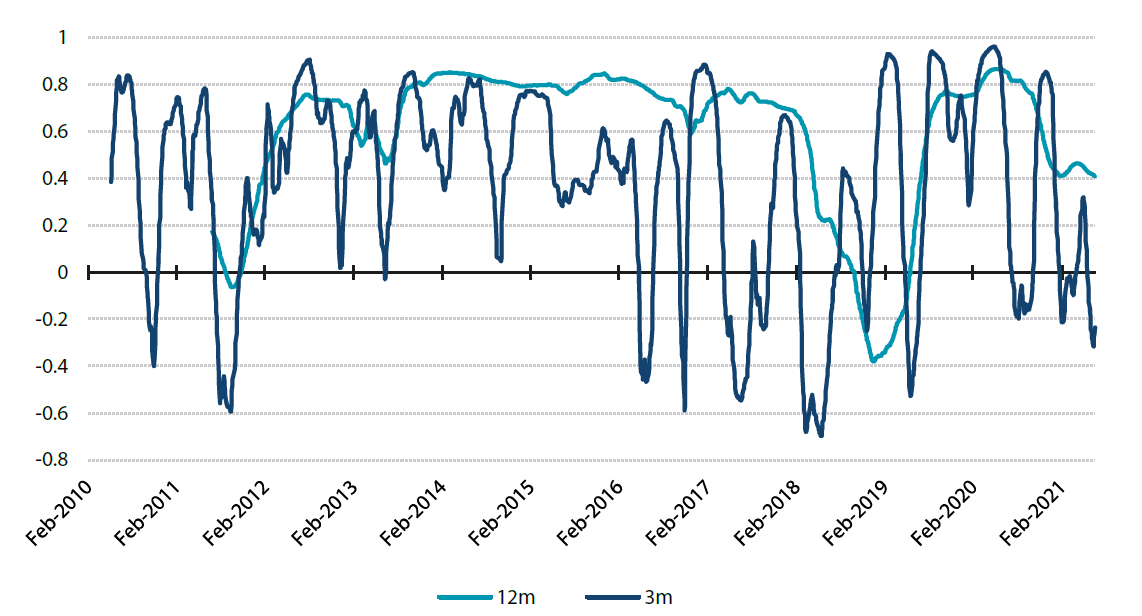

One of the core missions as a fixed income portfolio manager is to identify uncorrelated opportunities for our clients. Clearly, finding such opportunities is difficult, but active research within the large global credit universe does turn up gems from time to time. We discovered one such opportunity through a combination of Chinese and US rate risk in fixed income portfolios. These two markets have gone into opposite directions in terms of total returns for 2021. While returns in US fixed income have been negative, rate returns in China have been positive. The longer-term time series for both markets show that they were not always negatively correlated but at least offered a low correlation combination over the long run. This makes the combination of both markets an interesting opportunity for fixed income portfolios.

Chart 1: Correlation between 10-year US Treasury and 10-year Chinese government bond rates

Source: Bloomberg

Source: Bloomberg

We believe that maintaining a strong focus on the above mentioned themes of 1) reducing A-rated issuers, 2) caution when investing in oil majors, 3) preference of SLBs and 4) looking out for low correlated markets should enable investors to outperform in 2021. The markets, however, are dynamic and more opportunities within the global credit universe exist and will continue to present themselves. In our view, a research-driven investment approach best positions one to capitalise on these opportunities.