Summary

- Revived trade war jitters drove US Treasury (UST) yields higher in early February. However, a series of weaker-than-expected US economic data prompted economists to downgrade their first-quarter growth forecasts, leading markets to price in additional US Federal Reserve (Fed) easing for the year. As a result, yields reversed course and moved lower. At the end of February, the benchmark 2-year and 10-year UST yields had settled at 3.99% and 4.21%, respectively, 20.8 basis points (bps) and 33.2 bps lower compared to end-January.

- Within Asia, central banks in India, Thailand and South Korea all cut their benchmark interest rates by 25 bps. Headline inflation prints for January were mixed across the region. Inflationary pressures increased in China, South Korea and Thailand while subsiding in India, Singapore and Indonesia.

- We continue to believe that Asia’s local government bonds are positioned to perform well in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Within the region, we expect investor appetite to remain strong for higher carry bonds such as those of Malaysia, India, Indonesia and the Philippines relative to their regional peers.

- Asian credits gained 1.73% in February, supported by declining UST yields and a 1.79 bps tightening in credit spreads. Asian investment grade (IG) credits underperformed Asian high-yield (HY) credits, with IG credits returning +1.60% despite spreads widening by 2.36 bps. Asian HY credits returned +2.53% as spreads narrowed by 14.91 bps.

- Against a benign macro backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits that may be impacted by tariff threats or US policy changes. Overall revenue growth may see some moderation, but it should still remain at healthy levels, with profit margins holding steady due to lower input costs. With the removal of the weakest credits from the Asia HY space, we expect the Asia credit default rate to continue declining. We also expect a smaller percentage of fallen angel credits in the Asia IG space.

Asian rates and FX

Market review

UST yields fall amid tariff turmoil

Renewed tariff threats drove UST yields higher at the start of February. US President Donald Trump imposed an additional 10% tariff on all imports from China, prompting retaliatory tariffs from Beijing on select US goods. Trump also announced plans to introduce reciprocal tariffs on countries that impose duties on US imports. Yields rose further after a higher-than-expected January consumer price index (CPI) print led investors to scale back their expectations for Fed rate cuts. However, a series of weaker-than-expected US economic data prompted economists to trim their first-quarter growth forecasts. This led markets to anticipate additional easing from the Fed during the year. As a result, yields reversed course and declined. By the end of the month, concerns about an economic slowdown deepened after Trump further escalated trade tensions with an additional 10% tariff on Chinese imports and reiterated that tariffs on Canada and Mexico would take effect in early March. At the end of February, the benchmark 2-year and 10-year UST yields settled at 3.99% and 4.21%, respectively, 20.8 bps and 33.2 bps lower compared to end-January.

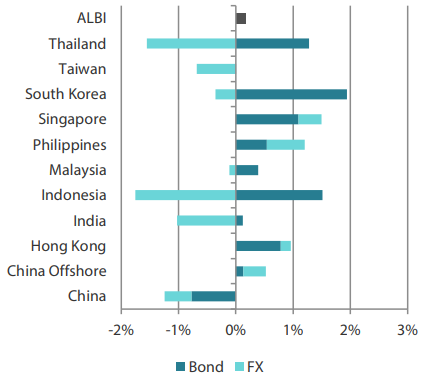

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 28 February 2025

For the year ending 28 February 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 28 February 2025.

Central banks in India, Thailand and South Korea lower policy rates

In February, Thailand’s central bank unexpectedly cut its policy rate by 25 bps. The Bank of Thailand (BOT) cited “structural impediments in manufacturing production” as a key factor behind its weaker-than-expected growth outlook and also flagged “heightened risks from trade policies of major economies”.

The Bank of Korea (BOK) also cut its policy rate by 25 bps, while lowering its 2025 GDP growth and core inflation forecasts. BOK Governor Rhee Chang-yong emphasised the need for fiscal measures and an additional budget alongside rate cuts, while suggesting that the pace of future reductions could slow as the full effects of previous cuts are yet to materialise.

In India, the Reserve Bank of India (RBI) also took action, kicking off its easing cycle with a 25-bps rate cut while maintaining a neutral policy stance. Recently-appointed RBI Governor Sanjay Malhotra emphasised that the central bank remains “unambiguously focused” on aligning inflation with its target while supporting economic growth. He also addressed concerns over the rupee’s depreciation, reaffirming the RBI’s commitment to intervening as needed to smooth excessive volatility.

Headline CPI prints mixed in January; region sees mostly solid economic expansion

Headline CPI data for January were mixed across the region. Inflation rose in China, South Korea and Thailand, held steady in the Philippines and Malaysia, and eased in India, Singapore and Indonesia.

In China, consumer inflation accelerated to 0.5% year-on-year (YoY) in January, though numbers were boosted by seasonal effects arising from Lunar New Year holidays falling in January this year. Indonesia saw its annual inflation rate drop sharply to 0.76% in January, the lowest since 2000.

On the GDP front, Thailand’s GDP growth for the fourth quarter of 2024 fell short of the BOT’s expectations, rising modestly to 3.2% YoY from 3.0% in the previous quarter, bringing full-year 2024 GDP growth to a lacklustre 2.5%.

In Indonesia, fourth-quarter GDP growth picked up to 5.02% from 4.95% in the previous quarter, resulting in a full-year growth of 5.03% in 2024, supported mainly by resilient domestic demand.

India’s economy expanded 6.2% in the October-December quarter, rebounding from the near two-year low of the previous quarter, on increased government spending that helped offset a stubborn weakness in consumption.

Singapore’s economy grew faster than initially estimated, expanding 5.0% YoY in the fourth quarter and surpassing the earlier projection of 4.3%. Similarly, Malaysia’s fourth-quarter GDP growth was revised higher to 5.0% YoY, exceeding the initial estimate of 4.8%.

Market outlook

Remain constructive on higher carry bonds

We continue to believe that Asia’s local government bonds are positioned to perform well, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Concerns over potential growth shocks from US tariffs are likely to provide additional support for regional bond markets.

Within the region, demand for higher-yielding bonds in Malaysia, India, Indonesia and the Philippines is expected to remain firm relative to regional peers. Government bond yields in India, Indonesia and the Philippines could decline further, as we expect their central banks to further ease monetary policy in 2025.

Amid the uncertainties associated with the Trump administration, we remain broadly cautious on Asian currencies in the near term. However, we see the region’s strong economic fundamentals cushioning the impact, with the Malaysian ringgit remaining our preferred currency.

Asian credits

Market review

Asian IG credits register gains in February

Asian credits gained 1.73% in February, supported by a continued decline in UST yields and a 1.79-bps tightening in credit spreads. Asian IG credits underperformed Asian HY credits, with IG credits returning +1.60%, despite a 2.36-bps widening in spreads, while HY credits returned +2.53% as spreads narrowed by 14.91 bps.

Overall, Asian credit markets remained resilient in February despite escalating US tariff risks and bouts of volatility in USTs, underpinned by strong technical support. Spreads initially widened but quickly retraced after Chinese markets reopened following the Lunar New Year holidays.

Early in the month, South Korean financials faced some weakness after regulators revealed nearly Korean won (KRW) 400 billion in “improper” loans at major banks. Meanwhile, Chinese HY credits had a strong start to the month, buoyed by risk-on sentiment in Hong Kong and mainland equity markets. Chinese Technology, Media and Telecommunications (TMT) credits rallied on optimism surrounding artificial intelligence (AI) developments and ongoing strength in Chinese equities.

Sentiment in the Chinese property sector also improved following news of additional government support for a major developer, easing near-term default risks. Further momentum came from data suggesting signs of stabilisation in the property market. Confidence in Chinese credits was bolstered further after President Xi Jinping met with a select group of prominent private entrepreneurs from key industries—including internet, AI, new energy, robotics, semiconductor, agriculture and home appliance— to address growing concerns over “the advancement of the state sector and the retreat of the private sector".

Towards the end of the month, spreads drifted wider as investors stayed cautious ahead of China’s annual National People’s Congress meeting in early March, which was expected to provide clearer guidance on the country’s growth trajectory. Fourth-quarter GDP data across the region signalled continued economic resilience, adding to the supportive backdrop.

Asian corporates generally reported robust results in the second half of 2024 apart from commodity producers and certain real estate names in China and Hong Kong. The robust results reflected resilient corporate credit fundamentals across the region. Asian banks showed strong profitability, benefiting from high net interest margins amidst mild asset quality concerns. The sector’s strong fundamentals were further strengthened by a solid capital base.

By the end of February, credit spreads tightened in China, Hong Kong, India, South Korea and Thailand, while widening in Indonesia, Macau, Malaysia, Philippines, Singapore and Taiwan. Indian credits outperformed, driven by Adani group’s sustained strong gains.

Primary market activity moderates in February

Following the initial surge of supply in January, primary market activity slowed significantly in February. During the month, the IG space saw just seven new issues totalling USD 2.64 billion. The HY space saw three new issues totalling USD 1.0 billion.

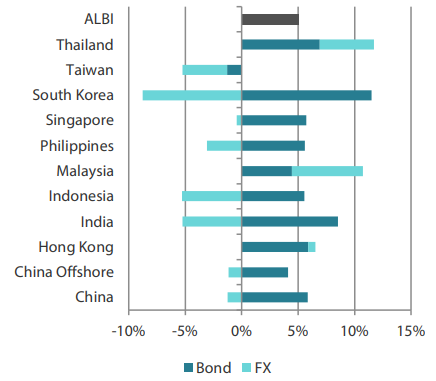

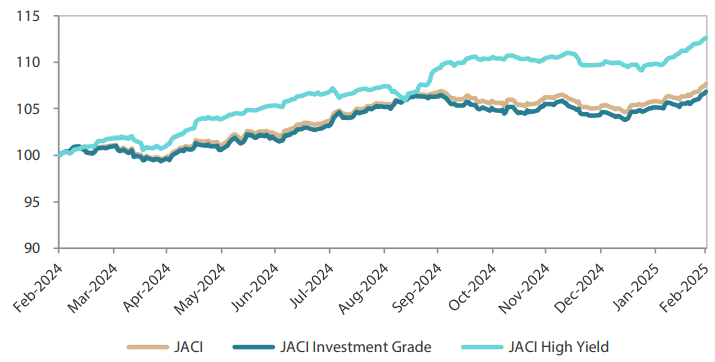

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 February 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2025.

Market outlook

Asia credit yields remain attractive; spreads likely to be bound in range, returns to be driven by carry

We expect Asia credit fundamentals to stay resilient in 2025. China is expected to maintain efforts to rebalance its economy, adopting more accommodative policies to mitigate the effects of a challenging external environment, due primarily to US tariff risks, and to stabilise overall growth. The macroeconomic fundamentals of Asia ex-China may moderate slightly from the robust levels seen in 2024 as export growth comes under pressure. However, they are expected to remain resilient overall. We believe that Asian central banks have ample room to manoeuvre on interest rate cuts to support domestic demand recovery.

Against a benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to also stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or US policy changes. While overall revenue growth could moderate, it is expected to stay at healthy levels, with profit margins holding steady due to lower input costs. We believe most Asian corporates and banks started 2025 with strong balance sheets and adequate rating buffers. As the weakest credits in the Asia HY space have been removed, we expect a much lower default rate in 2025, along with a smaller percentage of fallen angel credits in the Asia IG space.

We anticipate an increase in gross supply in the Asia credit space in 2025 compared to the past two years, as the decline in US yields reduces the funding cost gap between offshore and onshore debt. Many regular issuers may also wish to refinance in the USD-denominated market to maintain a longer-term presence. However, net supply will likely be subdued given still elevated redemptions. At the same time, we expect demand from regional investors to stay firm given the still high all-in yield.

While credit spreads are historically tight, the combination of supportive macroeconomic and corporate credit fundamentals, along with robust technicals, is expected to keep spreads mostly bound in range in 2025. We remain cautiously optimistic and prefer the cross-over BBB- and BB-rated credit space trading in the low-to-mid 200 bps spread. We anticipate carry to be the main driver of Asia credit returns in 2025.