Summary

- The three Japan-related news topics that have overwhelmingly dominated the attention of Western media so far this year are COVID-19 (by far), the Tokyo Olympics and the showdown at Toshiba.

- However, we believe that there are other important events and developments taking place in the Japanese market that deserve attention as we look ahead to 2022 and beyond.

- In Japan’s capital markets, structural reform is currently taking place on multiple fronts that is expected to benefit investors in Japan in the long term. The reform is linked to the following developments:

i. Preparations for the reshuffling of the Tokyo Stock Exchange’s (TSE) market segments scheduled for 2022

ii. Ongoing Corporate Governance reform and revision to the Corporate Governance code (2021)

iii. The rise of shareholder activism

Reshuffling at the Tokyo Stock Exchange

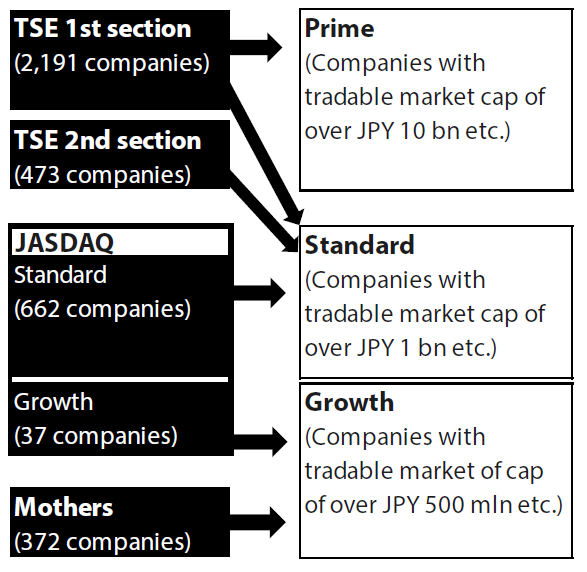

The TSE is scheduled to reorganise its market segments within the bourse in April 2022. The current TSE First Section, Second Section, JASDAQ (Standard), JASDAQ (Growth) and Mothers will be reorganised into three new segments: Prime, Standard and Growth.

Chart 1: About 30% of TSE’s First section companies do not meet listing requirements for the Prime section

Source: Nikkei as at 10 July 2021.

Source: Nikkei as at 10 July 2021.

The biggest rationale behind the reform is to enhance the bourse’s global competitiveness by ensuring its listed companies have incentive to continue improving their business operations, therefore leading to higher shareholder value and attracting more capital into the Japanese market.

The Prime section will be for companies that can have “constructive dialogue” with investors, the Standard section will be geared towards companies that have sufficient liquidity and possess governance levels that are high enough for investors in an open market and the Growth section will focus on companies with high growth potential.

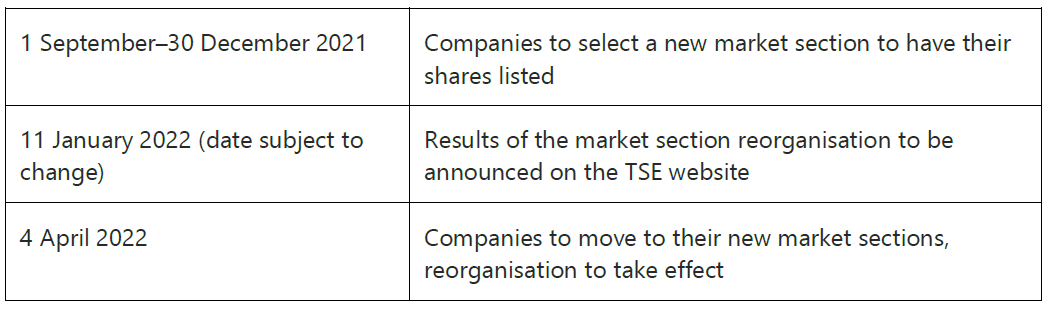

From September through December this year, each company will select a new market segment to have their shares listed. However, the TSE’s new, stringent listing requirements will force companies to make hard decisions when they make their selections.

According to the TSE, there are currently 664 companies (roughly one-third) on the First Section that do not meet the listing requirements for the new Prime section. These companies unable to meet the listing requirements are faced with two options: either satisfy the requirements for Prime through corporate actions or settle with Standard or Growth. For a company to be listed on Prime, it must have tradable shares accounting for over 35% of shares outstanding and have a tradable market cap of over JPY 10 billion.

Chart 2: Schedule of TSE’s market segment reorganization

Source: Tokyo Stock Exchange

Source: Tokyo Stock Exchange

In light of these developments, an increasing number of large shareholders are already disposing their shares at the request of companies. In addition, share buybacks by companies have also picked up so far this year to ensure that they meet the TSE’s new listing requirements. Management buyouts and full consolidation of listed subsidiaries have also increased—thereby unlocking value—and we expect the trend to accelerate towards the end of the year.

The revised Corporate Governance Code

|

Japan’s Corporate Governance Code was first introduced in 2015 and subsequently revised in 2018. It was revised again in June 2021 to strengthen corporate governance practices within companies. The main points of the revisions include 1) “Enhancing Board Independence”, 2) “Promoting Diversity” and 3) “Sustainability and ESG”. Under Enhancing Board Independence, Prime-listed companies will be required to increase the number of independent directors to a minimum of one-third of their board from at least two. The Code also calls for companies to have independent directors with managerial experience at other companies. The promotion of diversity is expected to open up old school, male-dominated boardrooms to new talent with different perspectives. As for Sustainability and ESG, Prime-listed companies will be required to improve climate-related disclosure based on Task Force on Climate-related Financial Disclosures (TCFD) recommendations or equivalent international frameworks. Other important changes include calling for English disclosure and higher transparency on strategies with respect to business portfolios, which will not only help investors gain better understanding of companies but enable them to engage management teams more effectively. |

|

Booming shareholder activism and increasingly vocal investors

Shareholder activism was taboo in Japan at least until the pre-GFC days in the early 2000s. However, activism by shareholders is now a regular news topic. Toshiba-related news may dominate international headlines, but there is a lot more happening in the market today.

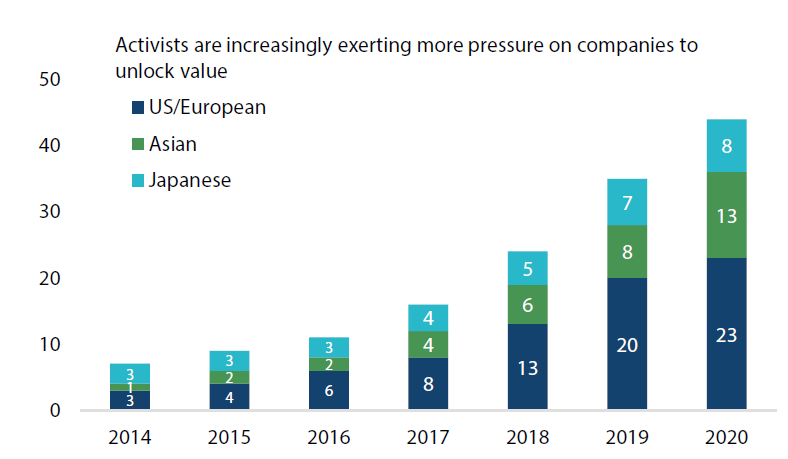

Activists in the Japanese market have grown significantly in number over the past few years. In 2014, there were only seven activist investors in the market, but the number has significantly increased to 44, all targeting Japanese companies. There are now more varieties of activist investors, including the old school “asset stripper” (greenmailer), entities focusing on constructive engagement and others that take a more hands-on approach. Currently there is even a Japanese retail fund employing an activist strategy.

Chart 3: Growing number of activists in Japan

Source: IR Japan

Source: IR Japan

We are also seeing shareholder proposals by activists on the rise. As of end-June, there were 64 proposals (in terms of agenda items) year to date, already exceeding the total number (60) in the 2020 full calendar year. Market culture has been changing dramatically, allowing shareholders to be more vocal, and sometimes even hostile, to the companies they invest in.

The key point is that if an activist investor insists on issues that would be in the collective interest of shareholders, they now have more support from traditional, institutional investors, who in turn need to abide by the Stewardship Code to act in the best interests of their clients. This means that activists now have the leverage to make things happen. We therefore expect pressure from increasingly vocal shareholders to serve as catalyst for many of the value stocks that have the potential to improve business operations and capital efficiency.

Conclusion

We believe that as the COVID-19 crisis fades, investors will become more focused on structural change that unlocks and creates value in the new normal. The current structural reform in the capital markets, taking place on multiple fronts behind the COVID-19-related headlines, will inevitably force companies to place greater emphasis on shareholders, thereby benefiting new investors entering the Japanese market in the post-pandemic era.

The promotion of diversity is expected to open up old school, male-dominated boardrooms to new talent with different perspectives

The promotion of diversity is expected to open up old school, male-dominated boardrooms to new talent with different perspectives