Japanese equity market off to a convincing start in 2024

It’s been an exciting start to the year for Japanese equities, reinforcing what was an impressive 2023 in performance terms. At the time of writing, the TOPIX Index is up 7.4% for the year-to-date (23 January), having touched three-decade highs and reigniting last year’s rally. The magnitude 7.6 earthquake that struck the Noto Peninsula in Ishikawa Prefecture in Japan on New Year’s Day led investors to believe that monetary policy would stay supportive for the time being. In addition, less dovish comments by the US Federal Reserve (Fed) early in the month was also a driving force behind a weaker yen, moving Japanese stocks higher.

Last year, global investors turned their attention firmly towards Japan as a way of increasing their Asia exposure while avoiding perceived geopolitical and regulatory risks linked to China, and amid the high inflation environment dominating western economies. But this year, Japan’s success is more based on its own merits.

One of the reasons that retail investors are likely to contribute to the rise in the Japanese market is that for the first time in decades, Japan is expected to benefit from sustained inflation. Following the first meeting of 2024 for the Bank of Japan (BOJ), Governor Kazuo Ueda spoke of feeling “confident” about the BOJ achieving its 2% inflation target, with the likelihood having “risen gradually”. This means that real interest rates will be negative. Sustained inflation has huge potential for nudging investors towards the Japanese equity market—particularly if those investors are also convinced about the ongoing improvement in corporate practices of Japanese companies.

And so far this year, developments have taken place that are likely to help maintain that positive momentum on two key fronts. These are the strong push from the Tokyo Stock Exchange (TSE) to “name and shame” companies into improving their financial strategies to enhance shareholders’ value, and the introduction of the revamped NISA (Nippon Individual Savings Account) scheme.

TSE’s “Name and Shame” list

In March 2023, the TSE warned listed companies that it expected them to make progress on delivering corporate value for shareholders. It took this further by requesting that all listed companies on the Prime and Standard Markets disclose “action to implement management that is conscious of cost of capital and stock price”. Later in the year, Hiromi Yamaji, the Chief Executive of the Japan Exchange Group, said that in 2024 the TSE would begin publishing lists of companies that were taking action to meet those goals, saying that in Japan: “peer pressure or a nudge is a very important method to push people to go forward.”1 The implication being that those companies that had not made disclosures—and were therefore not on the list—would come under greater pressure to act.

The TSE will also compile best practices and share these with all companies listed on Prime and Standard Markets to help improve financial strategies overall.

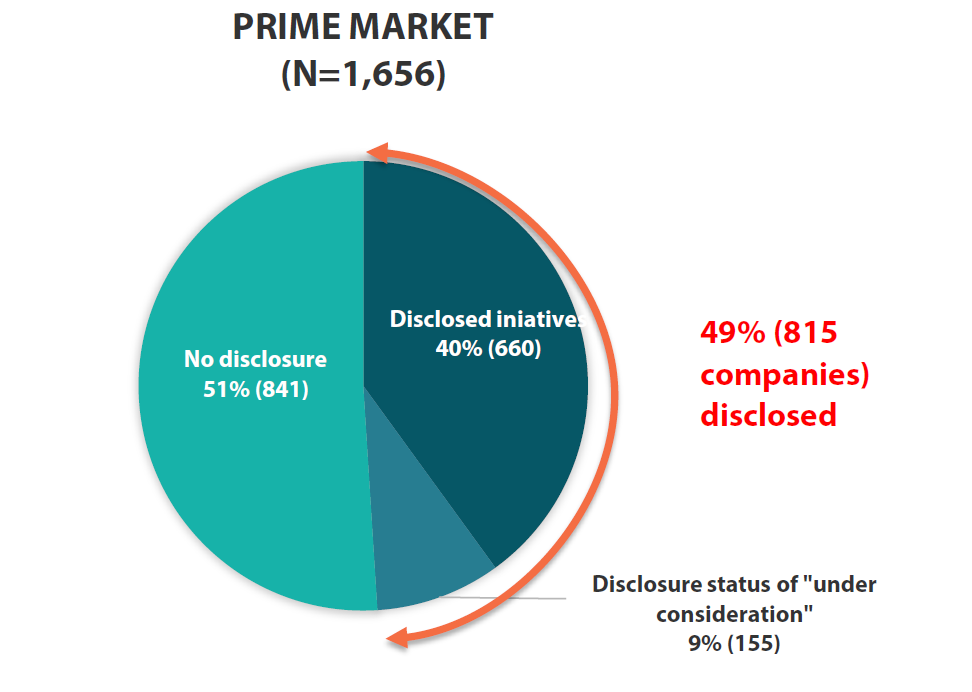

On 15 January, the TSE duly published its first monthly list of companies that have responded to the new guidance. The list made clear that at the end of December 2023, only 49% of Prime Market companies had responded to TSE’s request. Of those responders, 40% had disclosed actual measures while 9% commented it was “under consideration”. The list is to be updated on a monthly basis and the TSE is expected to continue to create peer pressure on the remaining half of companies where no disclosures had been noted.

Encouragingly, this number was considerably lower (31%) as of mid-July 2023, so 18% more companies made disclosures in the latter half of 2023. It appears that many of the laggard companies are adopting a “wait and see” approach, assessing what disclosures have been made by competitors before coming up with an improved strategy themselves.

It is also worth noting that of those companies that have disclosed measures to improve management practices with a focus on cost of capital and share prices, only 47% have disclosed their measures in English. This means that currently only about one in five companies on the Prime Market has disclosure measures available in both Japanese and English. We expect more inflows into the Japanese market from overseas investors as more companies are pressured into a) disclosing measures and b) disclosure measures additionally in English.

Chart 1: Compliance status to TSE’s request

Source: Nikko AM based on data from Japan Exchange Group

The improved NISA scheme set for a big 2024

Japanese retail investors have long been known to be risk-averse, which is one of the key reasons why they have not been as exposed to equity markets as their western counterparts. But this year, the Japanese domestic tax-free savings scheme – NISA – celebrates its tenth anniversary, and we expect it to be an important year for the scheme. We published an insight piece about the new-look NISA last year, that can be read here.

The NISA has undergone a meaningful revamp, and from January 2024, the General NISA and Tsumitate NISA will be consolidated into a new Tsumitate framework for investing in funds, while the General NISA will be replaced by a “Growth Investment” NISA that investors can have alongside the Tsumitate NISA. Other key changes include:

- Doubling the annual investment limit from Japanese yen (JPY) 1.2 million to JPY 2.4 million (approx. EUR 15,200) for the Growth Investment NISA and tripling the annual limit from JPY 0.4 million to JPY 1.2 million for the Tsumitate NISA.

- Raising the tax-exempt lifetime investment limit to JPY 18 million.

- Abolishing the tax-exemption period, meaning NISAs are now exempt from tax for the lifetime of the investor.

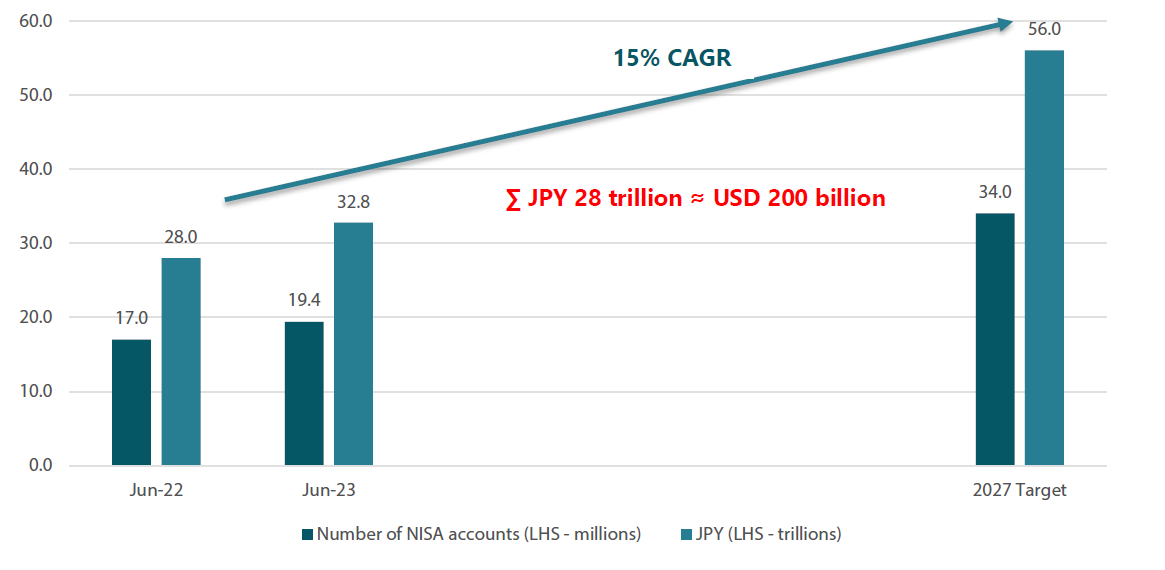

The move is expended to help ignite an investment boom among household savers. In fact, the Japanese government has set an ambitious target of doubling the assets under management in NISA accounts by 2027. While some retail investors are likely to choose to invest outside of Japan, the strength of Japanese equities mean a significant amount of additional inflows are expected in the Japanese equity market. Therefore, how Japanese companies respond to the TSE’s guidance will also play an important role in terms of inflows.

Number of NISA accounts (millions) and AUM (JPY trillions)

Source: Nikko AM based on data from Financial Services Agency and Cabinet Secretariat of Japan

Moreover, this all comes at a time when Japanese companies are under an increasing level of scrutiny by activist investors. Those companies now have a strong incentive to grow a more stable investor base, and to encourage a burgeoning number of retail investors with accommodative actions such as hiking dividends and carrying out stock splits to make their shares not only more attractive, but also affordable.

All of these reform initiatives – both at the TSE and within Japanese companies themselves—are converging in 2024 to create a more attractive and hospitable environment for domestic and overseas investors. Nearly half of the companies in the TOPIX index are still trading below book value and we expect the market to unlock value from these companies—not only as they look to comply with the TSE’s nudging strategy to reveal their improved measures, but also as they recognise the inherent benefits of being more appealing to retail investors everywhere, particularly those in Japan.

To learn more about unlocking Japan’s hidden value, read Nikko AM’s investment guide here.

1 Japan stock exchange adopts name and shame regime to boost corporate valuations (ft.com)