One: Domestic spending to be unleashed by pent-up demand and highest wage hike in decades

It was somewhat surprising in February that Japan was initially reported as having dipped into a technical recession in late 2023, following two consecutive quarters of negative gross domestic product (GDP) growth (according to data released on 11 March, Japan’s annualised Q4 2023 GDP was revised to show a growth of 0.4%; the preliminary figure showed a contraction of 0.4%). It is worth remembering, however, that those GDP figures are in the rear-view mirror, whereas stock market investors look further out and expect to see an economic recovery in 2024.

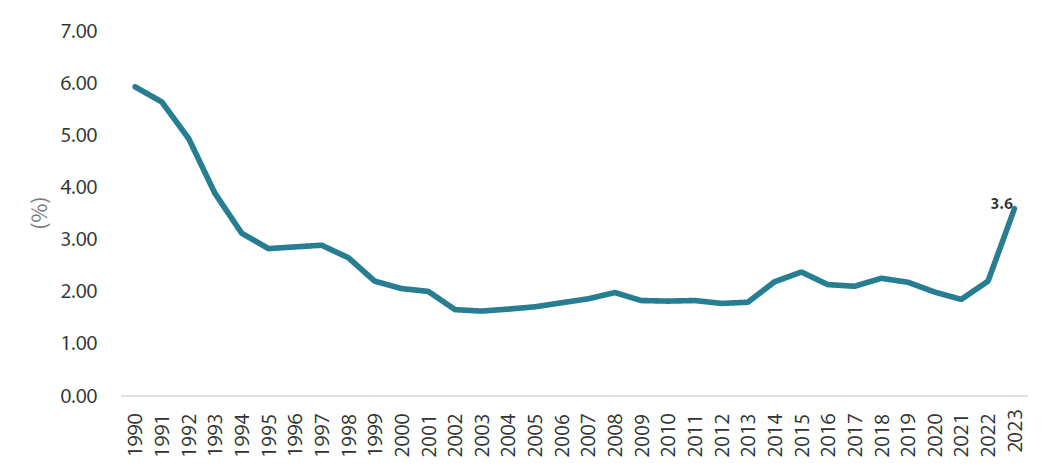

One such example can be seen in the expected recovery in Japanese consumption. The combination of extended pent-up demand and the highest wage hikes in decades, following the 2023 “Shunto” spring wage negotiations, is likely to lead to higher consumer spending in Japan in 2024 and beyond. Those Shunto negotiations in 2023 marked a crucial milestone for the Japanese economy as confidence returns. These annual wage negotiations between labour unions and employers resulted in the highest wage increases in decades, a response not only to the rising cost of living but also as a strategic measure to boost economic growth through enhanced consumer spending, and wage growth appears to be gaining momentum in 2024.

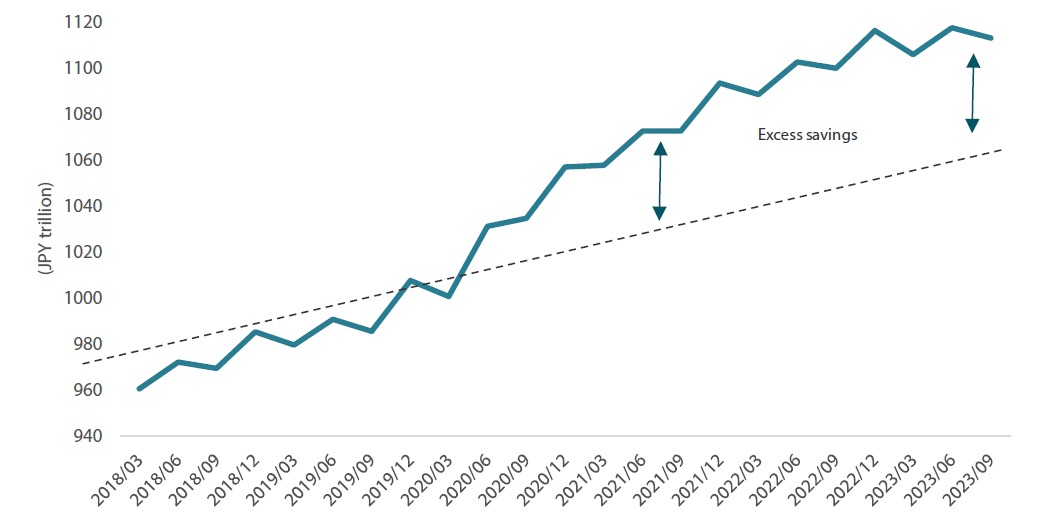

The “forced savings” of Japanese consumers, estimated at Japanese yen (JPY) 50 trillion, could serve as a catalyst for sustained economic growth as these savings are deployed across a number of different sectors. And never before has Japan looked so exciting for cash-rich domestic consumers.

Chart 1: Household cash and deposit

Source: Bank of Japan as at end-September 2023

Chart 2: Percentage wage increases in spring wage offensives

Source: Minister of Health, Labour and Welfare of Japan as at August 2023

Two: Recovery in inbound tourism set to gain further momentum

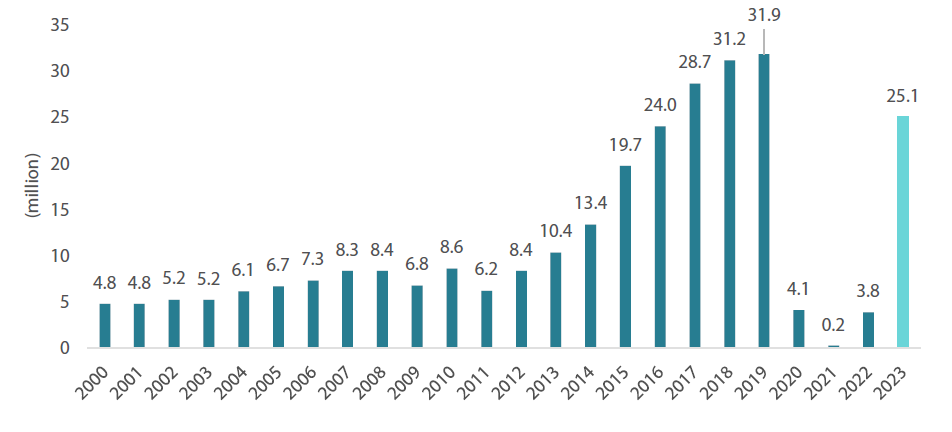

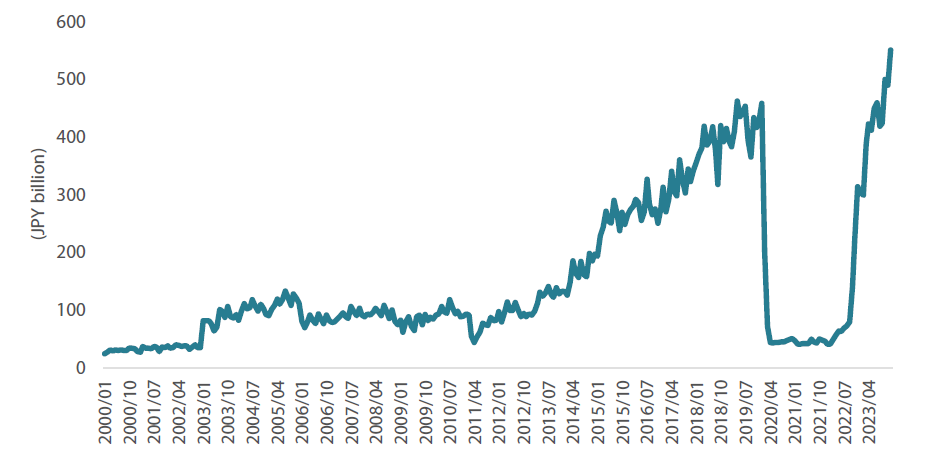

Domestic consumption is not the only important factor for Japan’s economic strength. The tourism sector is also on the brink of a significant resurgence. Pre-pandemic, Japan's tourism sector was a significant economic contributor, with spending by inbound tourists reaching JPY 4.8 trillion in 2019, accounting for approximately 0.9% of Japan's GDP. However, pandemic-related travel restrictions led to a sharp decline in inbound tourism, damaging related industries and the broader Japanese economy.

But the turning point for Japan's tourism sector came in April 2023 when the government lifted all COVID-19-related border control measures. The easing of restrictions has led to a rapid increase in inbound tourists, revitalising Japan’s tourism industry and associated businesses, including hospitality, retail and transportation.

Nowhere is the recovery of Japan’s tourism industry more relevant than for China. Chinese tourists' affinity for Japanese goods—from electronics and cosmetics to fashion and culinary delights—has helped make tourism such a significant component of Japan's GDP. Back in 2019, China stood as the largest contributor to inbound tourism spending in Japan, accounting for a staggering 37% of all such expenditures.

Up until now, however, China’s economic recovery has been more muted than expected. But as China rebounds in 2024, its burgeoning middle class, armed with savings and a pent-up desire for travel and consumption, will likely look towards Japan as its primary destination. This revival is not merely about restoring pre-pandemic levels of tourism but expanding them, driven by both the volume of tourists and the intensity of their spending in the years to come.

The weakness of the Japanese yen is another key factor in driving the recovery of inbound tourism. A weaker yen makes Japan a more attractive destination for international tourists, reducing the cost of travel, accommodation, and shopping in Japan. This advantage is likely to increase not only the number of tourists visiting Japan but also the amount they spend per visit.

Chart 3: Number of inbound tourists

Source: Japan National Tourism Organization (JNTO) as at December-end 2023

Chart 4: Monthly inbound tourism spending

Source: Bank of Japan as at December-end 2023

Three: TSE shows its teeth in improving corporate governance

The Tokyo Stock Exchange (TSE) has initiated a series of initiatives aimed at fostering transparency, accountability and shareholder value. The most significant of these was its 2023 Guidance aimed at driving companies to adopt improved corporate governance practices. The goal is to ensure Japanese companies listed on the premier stock markets comply with a governance framework that promotes sustainable growth and protects investor interests.

Moreover, since January 2024, the TSE has adopted a “naming and shaming” strategy of publicly disclosing lists of companies that are either in compliance with or in defiance of these governance initiatives. Those failing to comply with the guidelines are left off the compliance list, creating a highly conspicuous and direct incentive for companies to elevate their governance practices or face reputational risks.

The TSE's more proactive stance on corporate governance could have far-reaching advantages for the Japanese equity market, providing a clearer framework for assessing company performance beyond traditional financial metrics. These initiatives, which should see compliant companies attracting greater foreign investment, present Japan as a maturing investment market that is increasingly attractive from a governance perspective.

Four: Japanese companies are finally ready for shareholder engagement

Shaking off its characterisation as inherently conservative in its approach to corporate governance, Japan is now actively embracing shareholder activism, a shift confirmed by a significant increase in activist campaigns and shareholder proposals demanding transparency, accountability and enhanced corporate performance. Since 2019, the number of activists and shareholder proposals in Japan has more than doubled and quadrupled, respectively, with shareholders becoming more vocal and assertive in their demands. This increase in activism is not just about challenging management but about fostering a culture of constructive engagement, aiming to unlock value and drive long-term growth.

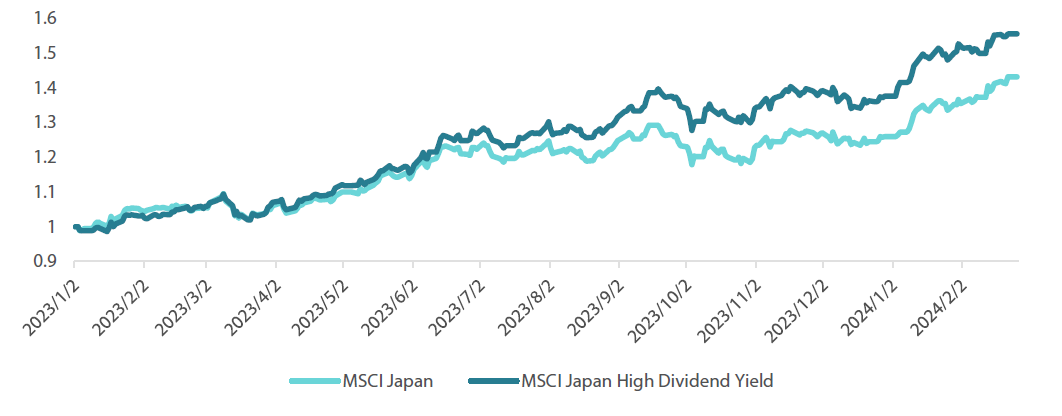

Another key indicator of Japan's readiness for shareholder engagement is the more strategic approach to dividends. Current dividend yields of Japanese companies are significantly higher than long-term interest rates, signalling confidence in earnings and an improvement in governance practices. High dividend stocks not only offer attractive income but also low interest rate sensitivity and downside protection, appealing to a wide range of investors seeking both growth and stability in the form of capital and income gains.

The rise in shareholder proposals, the changing dynamics at AGMs, the acceptance of once-taboo hostile takeovers, the increase in management buyouts, and the strategic use of dividends all point to a significant shift in Japan's corporate governance culture.

Chart 5: MSCI Japan vs MSCI Japan High Dividend Index

Source: Bloomberg as at 26 February 2024

Five: Japanese value stocks still trade at a significant discount to book value

Japanese value stocks have historically offered investors an opportunity to buy into companies at prices less than their intrinsic value. Despite the overall strong performance for Japanese equities in 2023, value stocks—particularly small and mid-cap companies—did not fully participate in the rally. This underperformance has been attributed to several factors including investor preference for large caps and growth stocks amid the technology stocks rally, heightened macroeconomic uncertainties, and a domestic market still overlooked by international investors.

As a result, many of Japan’s small and mid-cap value stocks are still trading significantly below book value, and therefore still have room to move much higher. As the market begins to shift its focus down the market cap spectrum, due to changing economic conditions or a re-evaluation of risk, these stocks stand to benefit significantly.

These five trends should present investors with plenty of good reasons to consider increasing their Japanese equity allocations. For international investors, Japan’s corporate reform progress and expected economic recovery offers a clear and immediate opportunity to tap into a market showing clear signs of a strong rebound. Increasing allocation to Japanese equities now could provide not just diversification benefits but also the potential for meaningful returns as Japan's economic recovery continues to unfold. And when considering investing in Japan, it is worth noting that investors are more likely to benefit from an active approach than in other regions.

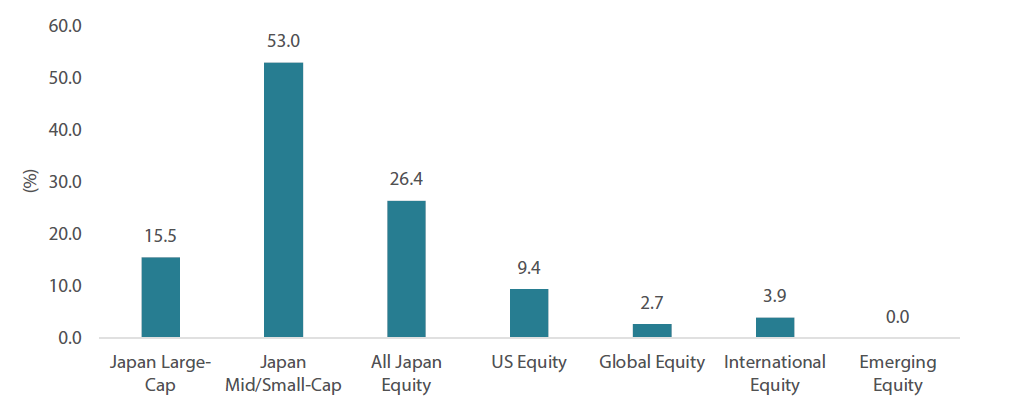

Active management does better in Japan

More so than in any other region, active management in Japan consistently outperforms benchmarks over longer time periods. This is particularly true in the small and mid-cap segments of the Japanese market, where inefficiencies such as less analyst coverage and a general lack of investor attention are more pronounced. Many small and mid-cap companies in Japan are niche market leaders with solid business models and robust growth potential. Active managers are adept at identifying these companies, assessing their true value, and understanding their growth drivers.

For investors considering an allocation to Japanese equities, an active management approach presents a compelling proposition, ensuring investors benefit from a deeper and richer understanding of the dynamism and potential of Japan's equity markets.

Chart 6: Percentage of Japan funds outperforming their benchmarks (10 years)

Source: Nikko AM based on S&P Dow Jones SPIVA Japan Scorecard Mid-Year 2023