We believe our active approach to credit investing allows us to better serve clients, as indiscriminate waves of downgrades following the turbulence that has rattled global financial markets this year presents us with compelling opportunities.

We are living in challenging times with COVID-19 impacting our social life as well as the financial world. Our experienced credit research team has now incorporated this new challenge into the analysis of credit quality for our investments during the pandemic. Even for the most experienced teams, this has presented new unknowns that need to be addressed. In the current environment, the credit research community scrutinises two very binary approaches when assessing credit quality. In our view, neither approach, on a standalone basis, fully helps to access the impact of COVID-19 on the credit quality of companies. On one hand of the discussion, we find companies making use of a newly created term in their earnings reporting, EBITDAC (Earnings Before Interest, Taxes, Depreciation, Amortisation and Coronavirus), to demonstrate their view of what normalised earnings would have been without the virus’ impact. On the other hand, rating agencies have been less benign, downgrading companies more aggressively than in any other crisis within the last 15 years. They have reacted to the current crisis by applying mass downgrades across their rating universe.

As is often the case in life, we think the truth lies somewhere in the middle. EBITDAC, which most analysts first saw as a slogan on a mug, has some informational value. But what it is missing is the fact that we can’t expect all lost earnings to be recovered in the months to come. Some business models, i.e. cruise ship operators, will have to undergo significant changes to survive in the aftermath of COVID-19. We also don’t know the duration of the crisis, and if government aid will support liquidity and the solvency of corporates for the full length of the pandemic.

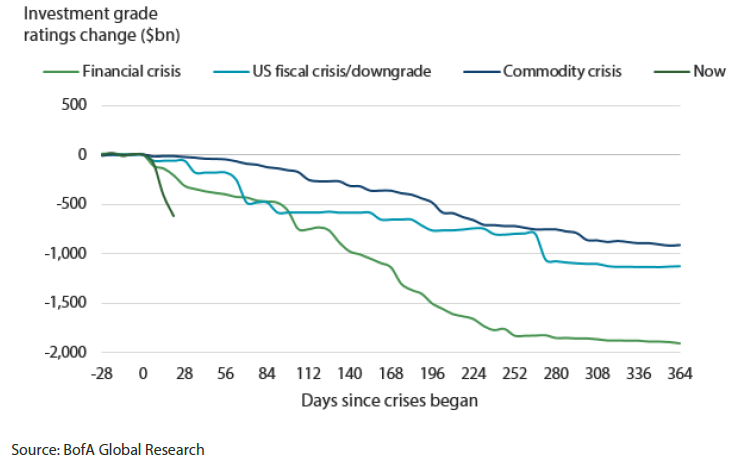

The rating agencies’ approach on the other end of the analytical spectrum also has its merits. The agencies were right in pointing out that COVID-19, in combination with the lockdown measures, was impacting most sectors and businesses. But for the market, the negative rating actions often felt too indiscriminate and investors started to draw their own conclusions as a result.

Chart 1: COVID-19 crisis sparks record US company downgrades

At one point AA-rated energy companies were trading at the same spread level as BBB-rated technology companies. This left investors wondering if spreads might be a better measure to assess credit quality than ratings. At the end of the day, a spread combines the thinking of the analyst community with regards to the credit quality of a particular issuer. But another fear evolved out of the wave of downgrades by the agencies; investors thought that ratings might have become too generous over the last decade and the agencies were now taking the chance to correct this misalignment. As you may remember, in 2008, the agencies faced criticism for being too benign in their assessments. This time, they might have felt the pressure to act quicker and in a more decisive manner. However, investors are hoping that the agencies are looking through the business cycle in their analysis, rather than reacting only to the currently unfolding crisis.

How will the investment community react to the challenges ahead, and which approach is most prudent to follow? We think it is important to take a look through this crisis and develop a normalised EBITDA as the companies’ management teams suggest. However, not every add back that the companies are proposing makes sense and analysts will have to adjust a corporate- calculated EBITDAC to what they think is right. For example, if our analysts see a line of business in a corporation which will be negatively impacted by the current situation on a longer-term basis, it doesn’t make sense to add back past revenues and earnings.

On the other hand, we are critical of the indiscriminate manner in which the rating agencies have made their downgrades. Naturally some of the downgrades were well deserved; for example, the leisure industry will feel the impact of the pandemic for years to come.

However, we think that even in the current environment, some sectors will strive and see potential improvements in their credit quality. Getting the big picture right and identifying attractive sectors and investment themes is one of the key benefits of active portfolio management. For example, in the technology sector we see some companies, such as those in streaming services, gaining from the current situation. The banking sector also might not be hit as hard as some rating actions suggest. The involvement of banks has become a very important part of the central banks’ strategy in transmitting liquidity into the private sector. In order to fulfil this role, banks have been supported by easing of regulatory burdens and cheap funding. We believe these measures will benefit the sector’s credit quality, although the banks are currently out of favour with the rating agencies.

This is where we believe our active approach to credit investing allows us to better serve clients, as indiscriminate waves of downgrades present us with opportunities. We are uncovering situations in which it makes sense to be a contrarian; this involves prudently investing in downgraded bonds that retain solid fundamentals despite their cheap valuations. We believe that strong investment ideas exist even in difficult times, and Nikko AM’s Global Fixed Income team will continue to identify such opportunities for our clients.