With the global outbreak of COVID-19 in the first half of 2020, the world was turned upside down. Under such circumstances, Japanese companies are now faced with new challenges to adapt to this “new normal”.

The “new normal”

With the global outbreak of the novel coronavirus (COVID-19) in the first half of 2020, the world was turned upside down and people have been forced to change the way they live in ways never imagined. Japan is no exception, and while the number of confirmed cases within the country have been relatively controlled so far, public health experts warn of a potential surge in the number of new cases as the virus continues to spread globally.

The paradox

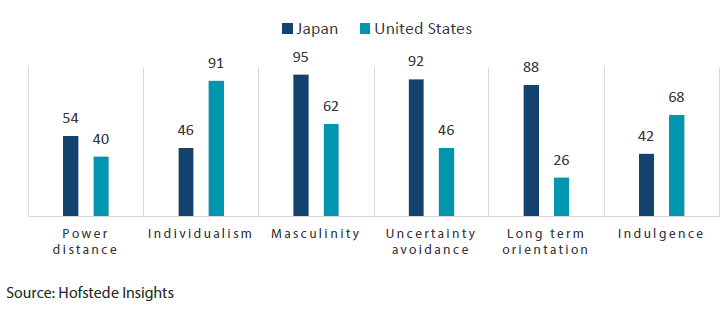

Under such circumstances, Japanese companies are now faced with new challenges to adapt to this “new normal”. However, there has always been a perception among global investors that Japan is slow to change. Among the reasons cited are that Japan is a consensus-driven society with a unique corporate hierarchy that places greater emphasis on age rather than merit. An important underlying factor behind many of these explanations appears to be the country’s strong inclination for “uncertainty avoidance” (see Chart 1). According to consultancy Hofstede Insights, historically, this is “often attributed to the fact that Japan is constantly threatened by natural disasters from earthquakes, tsunamis, typhoons to volcano eruptions. Under these circumstances Japanese learned to prepare themselves for any uncertain situation.”

Chart 1: Culture compass

Such “uncertainty avoidance” can be found everywhere in Japan, with risk-averse bureaucrats and corporate managers sticking to their lowest risk options at the expense of potential gains. However, given the dramatic changes to their operating environment currently taking place, corporate managers are faced with a situation in which risks from inertia outweigh risks from implementing change. We thus believe companies are in a position to accelerate change in order to best prepare for the new uncertainty. In other words, the very reason Japan was perceived as slow to change is now a factor that is expected to drive change in the new normal.

Digital transformation (DX)

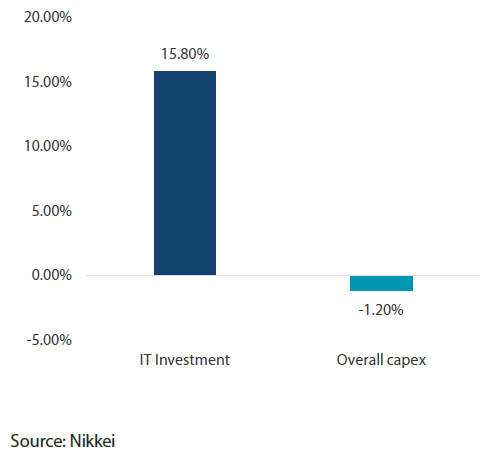

One of the areas in which we expect a dramatic change is digital technology, which has seen its use accelerate. Over the past several years, Japanese companies have been investing in an effort to boost productivity amid the tight labour market. Now, however, they are expected to accelerate investments in technology, aimed more to transform their business models in order to deal with the new uncertainty.

In early July, Fujitsu, as a leader in the DX market, announced aggressive plans to transform the company. It is expected to cut its office space by half, allowing the majority of its 80,000 employees in Japan to work from home by March 2023. The company, in turn, will invest the costs saved to technology and improve its operational process. This is also expected to be done in tandem with a change to its HR system being introduced to place greater emphasis on meritocracy. The company aims to leverage the experience gained from its transformation and replicate its success at client companies.

Elsewhere, retailers are set to accelerate expanding distribution channels by setting up e-commerce platforms, and AI-driven technology such as order management systems are also gaining traction. Deregulation is expected in the field of distance healthcare, paving the way for patients to see doctors online, and remote learning and the use of digital devices in the public school system is also expected to accelerate. The Japanese government is also contemplating incentivizing IT investment by amending tax codes.

Chart 2: Capex plan (YoY) at Japanese companies in FY2020

Portfolio transformation

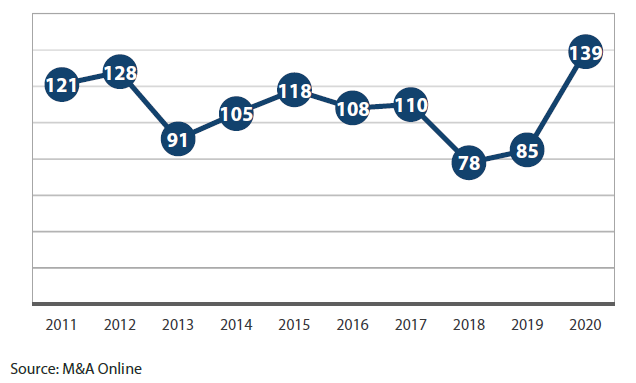

Companies are also faced with the need to reallocate capital to corona-proof themselves. Just as an equity portfolio manager can trade in and out of stocks, corporate managers have the ability to optimize a company’s business portfolio by buying or selling businesses in order to maximize shareholder value. In fact, the number of M&A transactions in Japan had been rising to all-time highs for three consecutive years through 2019, driven by the government-led Corporate Governance reform. We believe portfolio transformation will be at the front and centre for corporate managers at Japanese companies, and is due to gain momentum amid the coronavirus outbreak.

For companies that are struggling from falling revenues amid the coronavirus outbreak, divesting non-core businesses is effective in unlocking value, and will also create value if the proceeds from the sale are reallocated to investments in more profitable segments. While making decisions to divest legacy businesses may be difficult under normal circumstances as it would undermine past management decisions, the dramatic change in the operating environment will make it easier to take drastic measures to combat the crisis. In fact, business divestitures are up 64%yoy in the first half of 2020 (see Chart 3) to reach their highest level in ten years, and we think the number of transactions will continue to grow.

Chart 3: Number of divestitures in Japan (January-June)

The Japanese government is also pushing the agenda. In August, Japan’s Ministry of Economy, Trade and Industry came out with comprehensive guidelines for corporate restructuring, which is meant to help companies navigate the crisis by facilitating M&A, including spin-offs.

The current macro headwinds are also creating opportunities for buyers of businesses. While the overall equity market has shown a significant recovery helped by policy support (TOPIX Index 5.5% YTD as of September 24), divergence in returns has developed between growth stocks and value stocks. This offers opportunities for corporate managers and private equity investors to buy out companies at attractive prices. In fact, tender offers are on the rise (+21.1%yoy in 1H2020) as companies take advantage of the situation. Of particular note is that of the 23 tender offers announced in 1H2020, six were listed subsidiaries being acquired by their parent companies, with the “parent-child dual listing” arrangements unique to Japan coming under increasing criticism for undermining minority interests amid the corporate governance reform.

In addition, bankers and corporate managers are said to be in more frequent talks regarding potential plans for companies to go private through management buyouts; such transactions have been taking place at a greater pace this year relative to last year. Given the uncertain operating environment, going private will allow companies to engage in drastic restructuring focused on longer term competitiveness under the leadership of a private shareholder. We believe these trends will continue.

The global pandemic in 2020 will likely be remembered as a wake-up call and a catalyst that brought many changes to businesses and broader societies around the world. The changes will inevitably vary by country, and we believe Japan offers a unique, uncorrelated investment opportunity with corporate actions driven by an ever stronger sense of crisis to avoid uncertainty.