Reflecting on 2024

As we approach 2025, it is an appropriate time to review the performance of Singapore’s equity market in 2024. The market performed strongly in 2024, with the Straits Times Index (STI) delivering double-digit gains of 21.7% as of end-November 2024 in Singapore dollar (SGD) total return terms. The rally was mostly concentrated in the second half of the year, and the Singapore market was one of the few in Asia to maintain positive momentum after Donald Trump’s US election victory. This positioned Singapore as the second-best performer in the Asia ex-Japan region in 2024, meaning that it trailed only Taiwan and outpaced major emerging markets like India and China.

Drivers of strong sustainable returns

The primary driver behind these robust gains was better-than-expected earnings in 2024, particularly from sectors such as banking and industrials. Market bellwethers like DBS, Yangzijiang Shipbuilding and SATS produced healthy sustainable returns and positive growth surprises, which also showcased their resilience. These signals highlighted the overall strength of the Singapore market against a subdued global economic backdrop. Investor confidence was reinforced in 2024 as growth was matched by performance.

Valuation remains attractive

Looking ahead, despite the market’s stellar performance, valuations remain reasonable. Although rerating occurred in 2024, it was primarily driven by earnings growth rather than price-to-earnings (PE) expansion. The Singapore market currently trades at the lower end of its valuation range of 11-15 times, suggesting that further upside is possible without the market becoming overvalued.

In addition, dividend yields remain attractive at around 5%, with growth supporting solid payouts. The outlook for equities remains encouraging, particularly as interest rates have peaked and are expected to ease over the next 6-12 months. This environment provides a supportive backdrop for the equity market.

More alpha, less beta

While 2024 was characterised by broad market gains (or “beta” returns), we expect 2025 to be more centred on generating excess returns (or “alpha”). In this environment, we anticipate greater bifurcation opportunities in Singapore amid more modest markets gains, but with the potential for selective outperformance in specific sectors and stocks.

We see opportunities in certain sectors in 2025 where structural growth drivers remain intact. These sectors offer the potential for continued outperformance, particularly as the market moves towards a more selective phase of growth. We highlight some of these key sectors and our structural convictions in our Singapore market strategy, where we believe there is still room for strong performance despite more tempered overall market returns.

A word on macroeconomics

We expect Singapore’s 2024 economic growth to modestly accelerate towards the upper end of the government’s 2-3% forecast. We see this growth to have been driven by continued strength in manufacturing, particularly in electronics, along with a recovery in services, notably within the financial and tourism sectors. We expect growth to moderate in 2025 due to slower business activity amid escalating geopolitical tensions, ongoing trade conflicts, the lack of clarity regarding China’s policy interventions and uncertainty over the pace of global monetary easing.

Impact of Trump’s win

With Trump’s US election win, we are wary of the external implications for Singapore given the country’s high dependency on global trade, which will likely face challenges from the president-elect’s more mercantilist policies. The threat of new tariffs could dampen trade growth and impact Singapore’s broader macroeconomic performance. In addition, Asia could be hurt by a stronger US dollar, which may slow capital flows, drive interest rates higher and steepen yield curves.

However, Singapore may not be as affected as its Asian counterparts. Firstly, the country’s relatively small bilateral trade deficit with the US (as a net importer of US goods and services) suggests a lower likelihood of impact from additional tariffs. Secondly, Singapore continues to benefit from trade diversification and supply-chain relocation tailwinds from multinational corporations looking to diversify outside China, a trend we expect will continue even with Trump back in office. Finally, due to its trade-weighted policy, Singapore has a relatively high correlation with US interest rates, which will also grant the economy some resilience against these macroeconomic challenges.

Monetary policy outlook

Considering that growth is expected to moderate in 2025, the Monetary Authority of Singapore (MAS) may consider easing monetary policy by reducing the slope of the Singapore Dollar Nominal Effective Exchange Rate (SGD NEER). This would represent a shift towards a more accommodative stance, which could help alleviate liquidity conditions and cushion the impact of a slowdown in economic growth arising from slower trade.

Milder growth outlook for corporate earnings in 2025

We expect a more moderate expansion in corporate earnings for 2025 following the strong performance seen in 2023 and 2024. Bank earnings are likely to face pressure from lower lending margins as interest rates decline, particularly with anticipated rate cuts by the US Federal Reserve (Fed). However, we believe the impact will be manageable, as interest rates are expected to remain structurally higher than the pre-2022 levels seen before the Fed began its rate hikes.

Beyond the banking sector, we anticipate broader earnings growth across other sectors. We are particularly optimistic about industries such as industrials, consumer goods and communications services, where we expect to see better performance.

New Singapore: success in service exports

We continue to support the “New Singapore” narrative as we head into 2025. First coined during the country’s 50th anniversary celebrations in 2015, the concept represents the future of the nation’s economy built on innovation, adaptability and global relevance. It also embodies Singapore’s success in establishing itself as a key exporter to the world, as well as its role as a critical hub for financial and trade intermediation (Charts 1 and 2).

Chart 1: Singapore’s market share of global services exports has grown

Source: UNCTAD, DBS

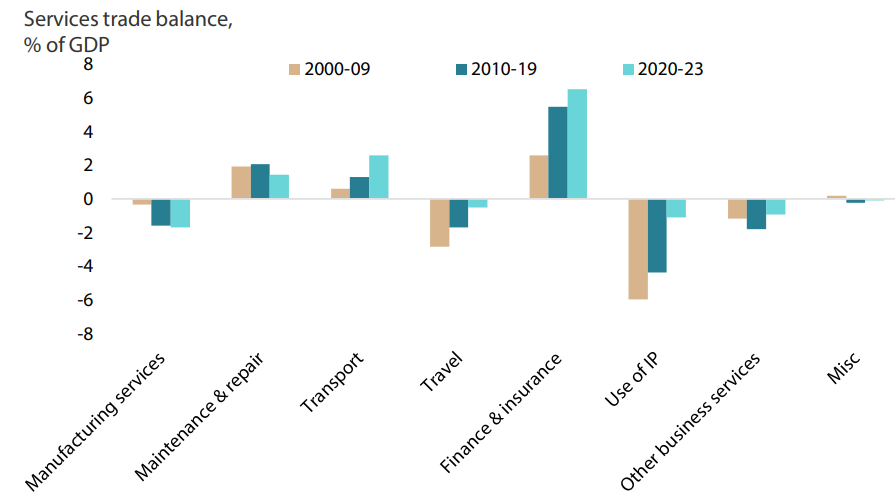

Chart 2: Financial and Transport service exports leading growth

Note: average for each time period

Source: CEIC, DBS

A cornerstone of Singapore’s success has been its service exports, particularly in sectors like financial services and transportation. As Asia’s premier wealth management hub and one of the region’s leading centres for logistics, trading and transportation, Singapore has evolved into a global centre of excellence. Today, the country accounts for 4% of global service exports and continues to thrive as a vital financial and trade conduit for the global economy.

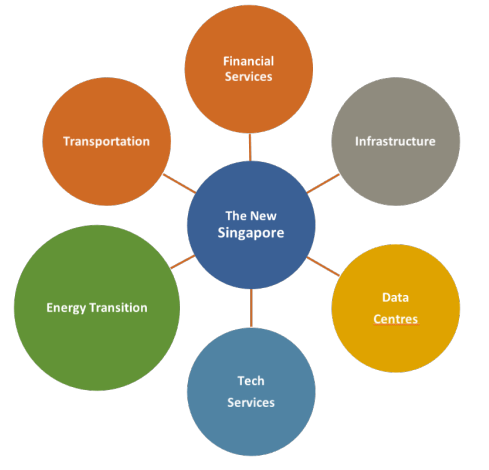

Singapore’s success lies not only in its established service industries, but also in its continuous innovation. Singapore has grown from its early days as a transshipment port to a dynamic global service hub. The nation’s continued competitiveness depends on its ability to innovate and adapt, ensuring that it stays at the forefront of the global economy. We believe the service economy, represented by financial services and transportation, will continue to contain key sectors which offer high sustainable returns, positive fundamental change and growth (Exhibit 1). These sectors are critical for the market’s continued outperformance and the delivery of returns.

Exhibit 1: New Singapore and its key sectors

Focus on financial services, renewable energy, infrastructure and transportation

We remain structurally positive on “New Singapore” stocks, which represent the country’s future economy. Key sectors include financial services, renewable energy, technology, data, infrastructure/utilities and transportation. In recent months, we have become more optimistic on selected stocks in the industrials sector, encouraged by the fundamental strengths of companies in areas such as aircraft maintenance and repair, defence, air cargo and transportation.

Over the past two years, energy transition has become a central theme in our “New Singapore” narrative. Singaporean corporates are well-positioned to capitalise on this trend. We are focused on generators (utilities) shifting from brown to green energy, as well as transport engineering and infrastructure players in the global transportation eco-system. We also see significant opportunities in utility infrastructure, which is benefiting from tight electricity markets in ASEAN amid growing demand from artificial intelligence-driven data centres. The shift toward green energy further strengthens our outlook on energy transition.

Still cautious on REITS but opportunities could be ahead

Singapore REITs faced significant challenges in the second half of 2024 as concerns about global inflation and rising interest rates resurfaced. Consequently, we have maintained a cautious view of the sector for the past year. The pressure on REITs from elevated interest rates may be subsiding. While we remain cautious, we do continue to monitor a select group of REITs that have strong balance sheets, solid underlying demand and exposure to themes within our “New Singapore” narrative. These REITs may offer opportunities in 2025, especially as the ongoing rate-cut cycle will likely boost the sector’s future dividends and valuations.

Value up Singapore?

Policy initiatives designed to revive the Singapore stock market have been progressing and our goal is to identify opportunities arising from overlooked fundamental shifts that have the potential to yield higher-quality, sustainable returns.

As we look towards 2025, we expect the MAS’s proposals in its upcoming review to include both supply-side and demand-side solutions. These measures could help facilitate capital intermediation, enhance market depth and broaden the diversity of the domestic market. We see valuations potentially being rerated in sectors such as industrials, technology and consumer staples. Moreover, we believe that proposed measures could boost liquidity and valuations, particularly for mid-cap stocks.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.