Summary

- The US economy continued to exhibit resilience, prompting investors to further adjust their expectations of how quickly the US Federal Reserve (Fed) will move to lower interest rates. At the end of February, the benchmark 2-year and 10-year US Treasury (UST) yields settled at 4.62% and 4.25%, respectively, 41.1 basis points (bps) and 33.8 bps higher compared to end-January.

- We maintain a positive outlook for Asian local government bonds, particularly India, Indonesia and Philippine bonds. In our view, the disinflation trends in these countries should provide the Reserve Bank of India, Bank Indonesia and Bangko Sentral ng Pilipinas with the flexibility to shift towards rate cuts later in the year. We expect this backdrop of a slow but steady easing of monetary policy, coupled with reasonable growth, to be positive for these bonds.

- Asian credits registered total returns of +0.09% in February despite credit spreads tightening about 18 bps, as UST yields moved significantly higher. The pressure from higher rates prompted Asian investment-grade (IG) credit to underperform Asian high-yield (HY), retreating 0.25% despite spreads narrowing about 16 bps. Meanwhile, Asian HY credit gained 2.21% as spreads tightened about 44 bps.

- Technically, Asia credit is expected to remain well supported with subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. Nevertheless, the materialisation of some negative risk factors may exert some widening pressure Asia credit spreads, particularly the IG segment.

Asian rates and FX

Market review

US Treasury (UST) bonds weaken in February

The US economy continued to exhibit resilience, prompting investors to further adjust their expectations of how quickly the Fed will move to lower interest rates. At the beginning of the month, the Fed maintained its key policy rate while shifting towards a more neutral bias in its statement. The Federal Open Market Committee (FOMC) statement also tempered expectations for a rate cut in March, although it was also noted that risks to growth and inflation were becoming more balanced. The robust nonfarm payrolls report, showing employers added 353,000 jobs at the beginning of 2024 compared to an expected 185,000, triggered a jump in UST yields. Subsequently, both the consumer price index (CPI) and producer price index (PPI) reports exceeded consensus expectations and pushed UST yields, particularly those of shorter-term maturities, even higher. Towards the month-end, minutes from the FOMC meeting showed that while some Fed officials expressed optimism about recent improvements in inflation, they collectively felt there was no urgency to reduce interest rates. At end-February, the benchmark 2-year and 10-year UST yields settled at 4.62% and 4.25% respectively, 41.1 bps and 33.8 bps higher compared to end-January.

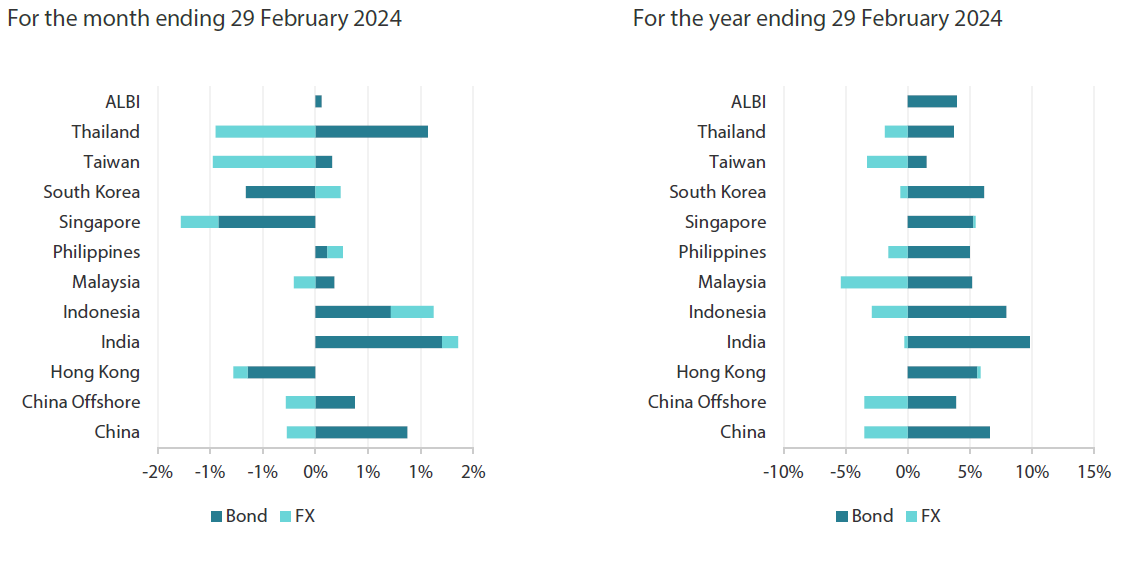

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 29 February 2024.

Most central banks leave policy rates unchanged; PBOC lowers the five-year loan prime rate

Monetary authorities in South Korea, India, Indonesia, Thailand and the Philippines kept their respective policy rates unchanged in February. The Bangko Sentral ng Pilipinas (BSP) revised down its risk-adjusted CPI inflation forecasts for 2024 to 3.9% from 4.2%, while slightly increasing the forecast for 2025 to 3.5% from 3.4%, noting that inflation expectations are “more firmly anchored.” The BSP views growth momentum “to remain intact over the medium term”, but cautioned that delayed impacts of previous monetary policy tightening could lead to a near-term slowdown. Bank Indonesia (BI) declared that the decision to keep rates unchanged aligned with the its “pro-stability monetary policy,” which aims to strengthen the rupiah stabilisation policy and take forward-looking steps to keep inflation on target. The Bank of Thailand (BOT) also kept its policy rate unchanged, though not unanimously, with two members voting to lower rates by 25 bps. The BOT stated that the domestic economy is expected to decelerate in 2024, partly due to weakening global demand and slower growth in China. Elsewhere, the Monetary Policy Committee of the Reserve Bank of India (RBI) voted five-to-one to keep the benchmark repurchase rate at 6.5%. The central bank also opted to retain its hawkish policy stance, indicating that there is no immediate plan to reduce interest rates. In contrast, the People's Bank of China (PBOC), in a further move to bolster the struggling housing market, lowered the five-year loan prime rate, a key benchmark for home loans, to a new low of 3.95%.

Inflation momentum declines in January

Annualised headline inflation readings in the region eased in January. Singapore saw a decrease in headline inflation to 2.9% year-on-year (YoY) in January from 3.7% in December, attributed to easing accommodation and private transport prices, alongside softer core inflation. Indonesia recorded a slowdown in headline inflation to 2.57% YoY in January from 2.61% in December, with core inflation also moderating to 1.68% YoY from 1.80%. In the Philippines, inflation decelerated for the fourth consecutive month in January, with the headline CPI dropping to 2.8% from 3.9% in December and core inflation decreasing to 3.8% from 4.4% over the same period. Meanwhile, Thailand’s inflation rate fell further into negative territory, reaching -1.11% YoY in January. This marked a more pronounced decline from December’s -0.83%; it was also below consensus expectations, moving further from the BOT’s target range of 1–3%. The drop in the inflation rate was driven by energy prices, although costs of raw food and transportation also continued declining.

Singapore and India present budgets for the coming fiscal year; Indonesia holds peaceful elections

Singapore’s Deputy Prime Minister and Minister for Finance Lawrence Wong announced that Singapore’s overall fiscal balance is expected to return to a small surplus of SGD 0.8 billion, or 0.1% of GDP in fiscal year (FY) 2024 (which begins in April), following a deficit in FY2023. In India, Finance Minister Nirmala Sitharaman reaffirmed the government’s commitment to fiscal consolidation in her Interim Budget speech. The fiscal deficit estimate for FY2024 was revised to 5.8% of GDP, down from the 5.9% estimated in the previous year’s budget. Additionally, the fiscal deficit for FY2025 has been projected at 5.1%.

In Indonesia, unofficial presidential election tallies indicated a decisive victory for Prabowo Subianto, paving the way for him to replace the current president, Joko Widodo. The elections results were well-received by markets, which anticipated policy continuity as Prabowo pledged to uphold Widodo’s policies.

Market outlook

Remain positive on India, Indonesia and Philippine bonds

We maintain a positive outlook for Asian local government bonds. The anticipated decrease in yields in developed bond markets, as major central banks, including the Fed, pivot towards rate cuts amid easing inflationary pressures, coupled with enhanced foreign inflows, is expected to bolster demand for Asian bonds.

We anticipate the disinflation trend in India, Indonesia and the Philippines to persist. In our opinion, this should provide the RBI, BI and BSP with the flexibility to shift towards rate cuts later in the year. We see a backdrop of a slow but steady easing of monetary policy, coupled with reasonable growth, which should be positive for India, Indonesia and Philippine local currency bonds. Additionally, the attractive real yields of these bonds relative to their regional peers should further support demand.

Asian credits

Market review

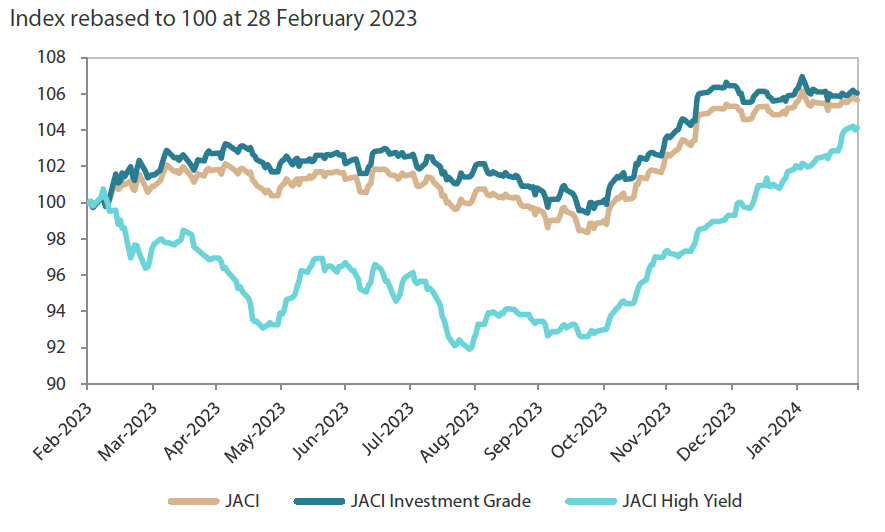

Asian credit spreads tighten further in February

Asian credits registered total returns of +0.09% in February despite credit spreads tightening about 18 bps, as UST yields moved significantly higher. The pressure from higher rates prompted Asian IG credit to underperform Asian HY (as a whole the former has longer duration than the latter and are thus more vulnerable to rising UST yields); Asian IG retreated 0.25% despite spreads narrowing about 16 bps. Meanwhile, Asian HY credit gained 2.21% as spreads tightened about 44 bps.

Asian credit spreads tightened steadily in the month, buoyed by positive global risk sentiment and Chinese policymakers’ decision to amplify macroeconomic policy support. The continued resilience of the US economy, along with encouraging corporate earnings in the US and Europe, supported a global risk-on sentiment. In China, policymakers took steps to bolster the struggling housing market and support the weak economy. Thousands of residential property projects were added to the “Project Whitelist” by city governments and were recommended to banks for financial support. Additionally, the PBOC lowered the five-year loan prime rate, a key benchmark for home loans, to a new low of 3.95%, and Chinese Premier Li Qiang called for “pragmatic and forceful” action to boost confidence in the economy. Regulators also moved to further stabilise equity markets by cracking down on high-frequency trading. Positive indications of stabilisation in consumer spending demonstrated by consumer activity during the Lunar New Year holidays further supported Chinese credits. In Hong Kong, the government unexpectedly announced the removal of all property cooling measures with immediate effect to boost its ailing property market. Hong Kong property-related credits reacted positively to the news. In Indonesia, the markets responded positively to the likelihood of a decisive victory for Prabowo Subianto in the presidential election.

Separately, Asia corporate earnings reported thus far continued to support robust credit fundamentals. The services industry in hospitality, retail and consumer sectors have reported strong results, indicating firm consumption in the region. Technology hardware companies continued to signal sequential improvements as industry de-stocking pressure eased. Banks, on the whole, also demonstrated strong profitability, robust capitalisation and benign non-performing loan conditions. Selected Hong Kong banks with commercial real estate exposure in Hong Kong and mainland China have reported deteriorating asset quality but capital buffers remain strong. Commodity firms recorded lower earnings, reflective of weaker commodity prices, but their credit profiles remain strong following years of deleveraging and muted capital expenditure spending. Meanwhile, China's property contracted sales continue to decline amid weak confidence and sentiment onshore over big-ticket items.

Overall, spreads for all major country segments tightened in February. Macau credits outperformed, with spreads narrowing by about 41 bps, following a jump in mainland Chinese tourist arrivals during the Lunar New Year holidays. The solid performance of Indian credits was supported by idiosyncratic news and decent results from companies, along with a solid macroeconomic backdrop.

Primary market activity moderates due to the Lunar New Year holidays

Activity in the primary market quietened down in February as Asia celebrated the Lunar New Year holidays. The IG space saw just nine new issues amounting to USD 5.85 billion, including the USD 3.0 billion two-tranche quasi-sovereign issue from Korea Development Bank. Meanwhile, the HY space saw just one new issue amounting to USD 68 million.

Chart 2: JP Morgan Asia Credit Index (JACI)

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 29 February 2024.

Market outlook

Supportive Asia credit fundamentals and strong technicals, but tight valuation calls for cautious positioning

The fundamentals backdrop for Asian credit remains supportive. In China, the recent step-up in fiscal measures suggests that policy makers are aware of the challenging environment. This further supports expectations for Chinese policymakers to deliver additional measures to help revive confidence in the economy and broaden out the recovery in 2024. The 5-11 March National People’s Congress was closely watched for policy direction and continuation. Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient with a recovery in exports growth potentially offsetting softer domestic conditions. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Technically, Asia credit is expected to remain well supported with subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. Nevertheless, following the sharp rally in recent months, these positive factors have been largely priced in, and the materialisation of some negative risk factors such as a weaker-than-expected global economy, as well as local political uncertainties and geopolitical tensions, may exert some widening pressure on Asia credit spreads, particularly the IG segment.