Introduction

ESG initiatives are expected to become ever more important for companies and investors around the world in 2022. We expect many Japanese companies to come to the fore amid this global shift towards ESG, with enhancements in ESG disclosures shedding light on their value creation opportunities amid the current drive towards decarbonisation. Political stability that Japan may offer is another factor that is likely to come into focus in 2022. Japan’s new Prime Minister Fumio Kishida will be in a position to solidify and leverage his political capital to push forward his policy agendas; he is also expected to maintain the government’s key policy measures including its accord with the Bank of Japan (BOJ) and corporate governance reform. Competition to attain corporate control is also likely to continue increasing in 2022 and benefit long-term investors in Japan. We expect changing corporate culture encouraged by corporate governance reform to drive such competition, as evidenced by the growing number of hostile takeover attempts in Japan.

Climate change to expose risks as well as opportunities

COP26 in Glasgow ended in November 2021 with an ever stronger global message, calling for countries to implement measures to tackle the climate crisis. In line with the global drive towards combating climate change, the US has been reversing Trump-era policies. For example, the Department of Labor recently proposed amendments to its regulations that were perceived to have discouraged fiduciaries from considering ESG factors in their investment decisions.

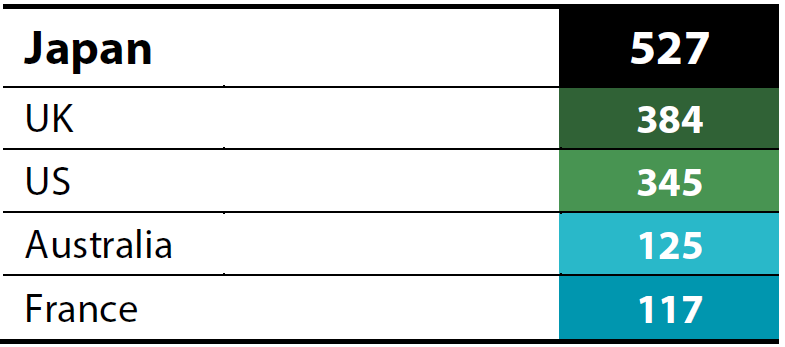

As developments in the sustainability front intensify, that Japan has the highest number of supporters for the recommendations released by Task Force on Climate-related Financial Disclosures (TCFD) is perhaps a lesser known fact (Chart 1).

Chart 1: Top 5 countries by number of TCFD supporters

Source: Task Force on Climate-related Financial Disclosures 2021 Status Report

Source: Task Force on Climate-related Financial Disclosures 2021 Status Report

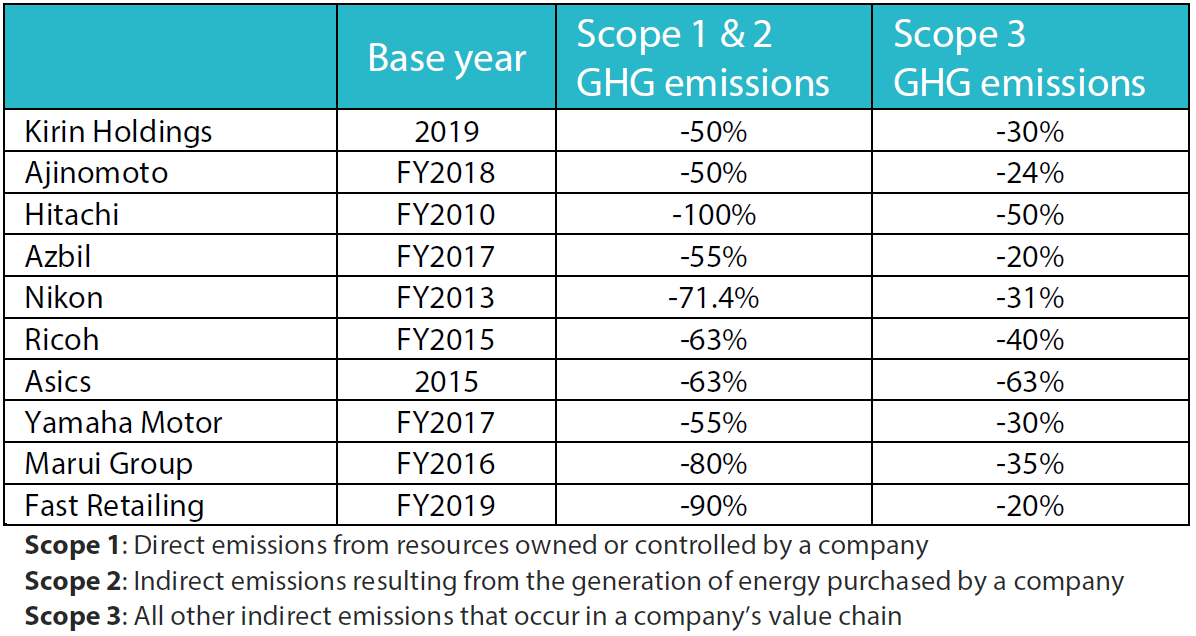

The number of supporters for TCFD, together with its total global market cap coverage, has been on the rise since the launch of this initiative in 2017. There are currently 2,616 TCFD supporters with a total market cap of USD 25 trillion. We expect these numbers to only go up and it is natural to think that it would do so in Japan as well. In addition, the reorganisation of the Tokyo Stock Exchange (TSE) scheduled to take effect in April 2022 is also likely to prompt companies to increase climate disclosure. Companies to be listed on the TSE’s new Prime Market as a result of the reorganisation will effectively be required to make additional corporate disclosure based on TCFD. Moreover, the Financial Services Agency is now said to be contemplating the application of this rule to the broader public equity universe. In light of these initiatives, some key companies with best practices are already starting to disclose GHG emission reduction targets they aim to reach by 2030 (Chart 2).

Chart 2: Japanese companies’ GHG emission reduction targets

Source: Nikkei

Source: Nikkei

We believe that at the moment, the market is not fully pricing in risks and opportunities resulting from climate change. We therefore think that skilled active investors will have opportunities to profit from the market inefficiency as additional climate related disclosure will not only shed light on the additional risks but also on opportunities that can contribute towards creating value.

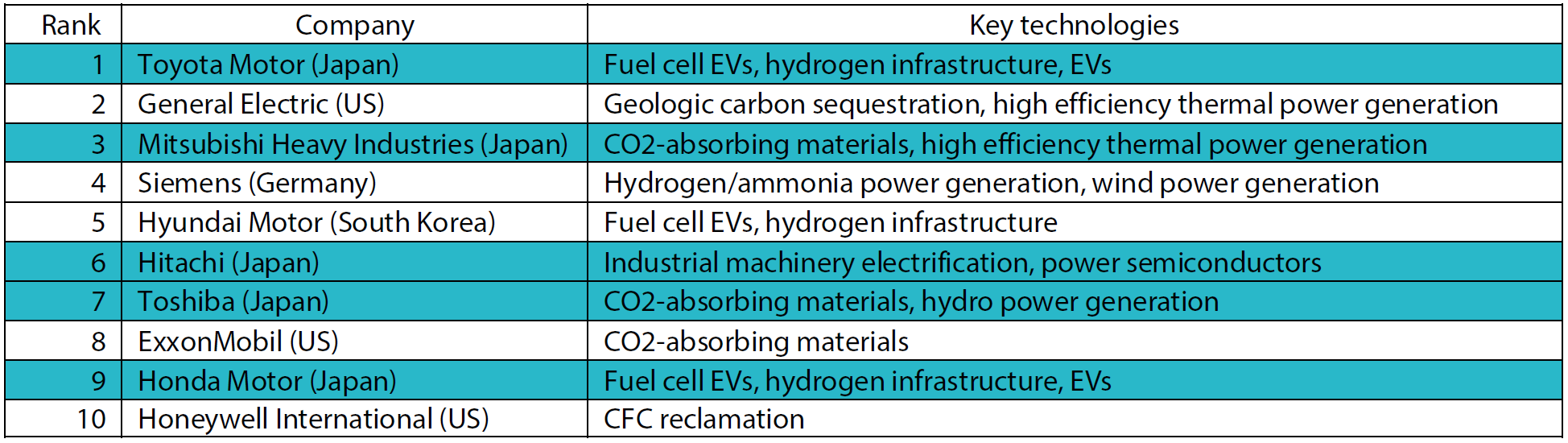

According to estimates released by Japan’s Government Pension Investment Fund (GPIF), the CVaR (Climate Value-at-Risk, which measures the potential impact of climate change on corporate and security values) for Japanese equity is positive at 0.6%, compared to -11.4% for foreign equity under a scenario in which global warming is held at 1.5 degrees Celsius above pre-industrial levels. Such an outcome is a result of patent competitiveness in the automobile, energy supply and chemicals sectors. This means that collectively, there may be more opportunities than risks for Japanese companies as the world moves towards net zero.

In a different study conducted by a data analytics firm astamuse, Japanese companies dominate the ranking in decarbonising technology (Chart 3). We expect new markets to be created that leverage their advanced technologies, which include hydrogen, carbon capturing and electric vehicles; as a result, investors are expected to start pricing in these opportunities into stock prices.

Chart 3: Japanese companies dominate decarbonising technology

Source: Nikkei

Source: Nikkei

Japan as a political safe haven

Former Prime Minister Yoshihide Suga resigned in October 2021 after increasing criticism towards his handling of the pandemic led to a steep drop in his approval ratings. Ironically, following Suga’s departure, Japan’s inoculation drive continued and the country now has the highest percentage of fully vaccinated people among G7 countries. Furthermore, the number of new COVID-19 cases in Japan has declined to the lowest level year to date as of this writing.

The Lower House election held on 31 October 2021—an event that was expected to determine the direction of Japanese politics in the wake of Suga’s resignation—resulted in a victory by the ruling coalition. What is worth noting is that the ruling Liberal Democratic Party won an “absolute stable majority” which effectively allows the single party to not only gain the simple majority in the parliament itself, but also control of all sub-committees of the parliament. This enabled the Kishida-led government to put together the largest ever JPY 55.7 trillion economic stimulus package in November. The package includes financial aid for struggling businesses as well as to low income households. It also introduces more forward-looking measures such as a cash handout program to households with children, travel subsidies for the tourism industry and infrastructure spending for disaster prevention.

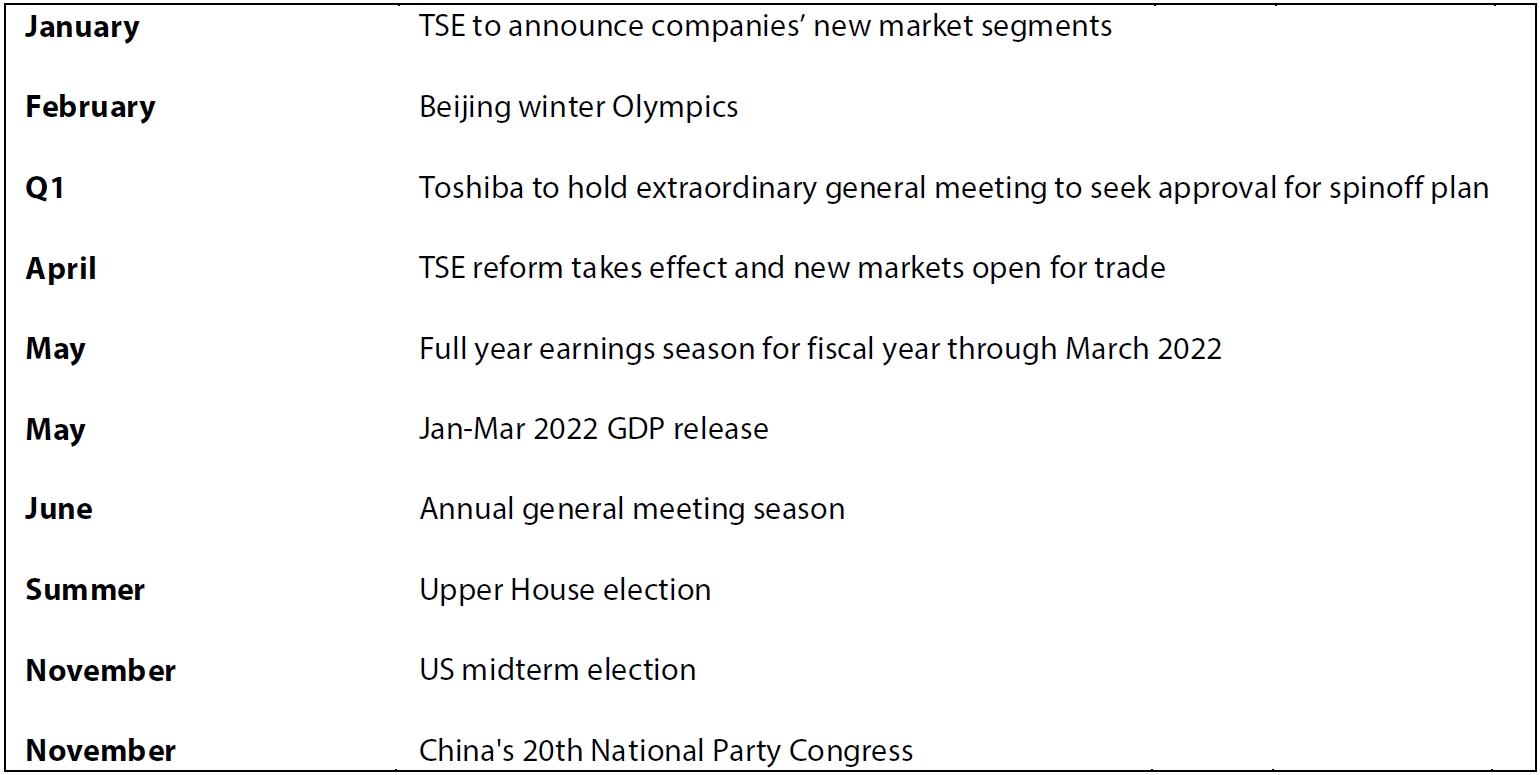

In 2022, another key political event, the Upper House election, is scheduled in the summer. At this election, half of the Upper House members will face re-election. In order to retain his party’s dominance, Prime Minister Kishida and his cabinet are expected to try and boost economic growth ahead of the election and the first quarter GDP figures to be announced in May 2022 will be in focus (Chart 4).

Chart 4: Key Japan market-related events in 2022

If the ruling coalition wins the Upper House election, it will dominate both houses of parliament, and it will not have to face another election through 2025. Such an election lull is expected to result in higher visibility and stability on the political front.

On the contrary, there remains much political uncertainty in the US. President Joe Biden faces the November 2022 midterm election with deep divisions not only between the Republicans and Democrats but also within the two parties. Thus, as the US gears up towards the midterm election, Japan could be viewed as a country with a relatively higher level of political stability and lower political risk.

Since Kishida took office in November, the Japanese government wasted no time in reconfirming its accord with the BOJ signed in 2013 whereby they will work together to achieve 2% inflation and sustainable growth. Therefore, monetary policy is expected to remain accommodative, which would be positive for the overall equity market. We also do not expect a reversal in corporate governance reform as the changes seen in corporate culture as a result of the reform appears irreversible for the following reasons: i). market reorganization at the Tokyo Stock Exchange and ii). growing competition for corporate control.

No going back on corporate governance reform

Firstly, the TSE is scheduled to reorganise its market segments within the bourse in April 2022. The current TSE First Section, Second Section, JASDAQ (Standard), JASDAQ (Growth) and Mothers will be reorganised into three new segments: Prime, Standard and Growth.

The biggest rationale behind the reform is to enhance the bourse’s global competitiveness by ensuring its listed companies have incentive to continue improving their business operations, therefore leading to higher shareholder value and attracting more capital into the Japanese market.

The Prime section will be for companies that can have “constructive dialogue” with investors, the Standard section will be geared towards companies that have sufficient liquidity and possess governance levels that are high enough for investors in an open market and the Growth section will focus on companies with high growth potential.

According to the TSE, there were 664 companies (roughly one-third) on the First Section that do not meet the listing requirements for the new Prime section before they made applications in 4Q2021. These companies unable to meet the listing requirements are faced with two options: either satisfy the requirements for Prime through corporate actions or settle with Standard or Growth (or face delisting if they cannot meet requirements for any of the new markets). For a company to be listed on Prime, it must have tradable shares accounting for over 35% of shares outstanding and have a tradable market cap of over JPY 10 billion. It will also be required to increase the number of independent directors to a minimum of one-third of their board from at least two. The promotion of diversity is expected to open up old school, male-dominated boardrooms to new talent with different perspectives.

In light of these developments, an increasing number of large shareholders are already disposing their shares at the request of companies. In addition, share buybacks by companies have also picked up to ensure that they meet the TSE’s new listing requirements. Management buyouts and full consolidation of listed subsidiaries have also increased—thereby unlocking value.

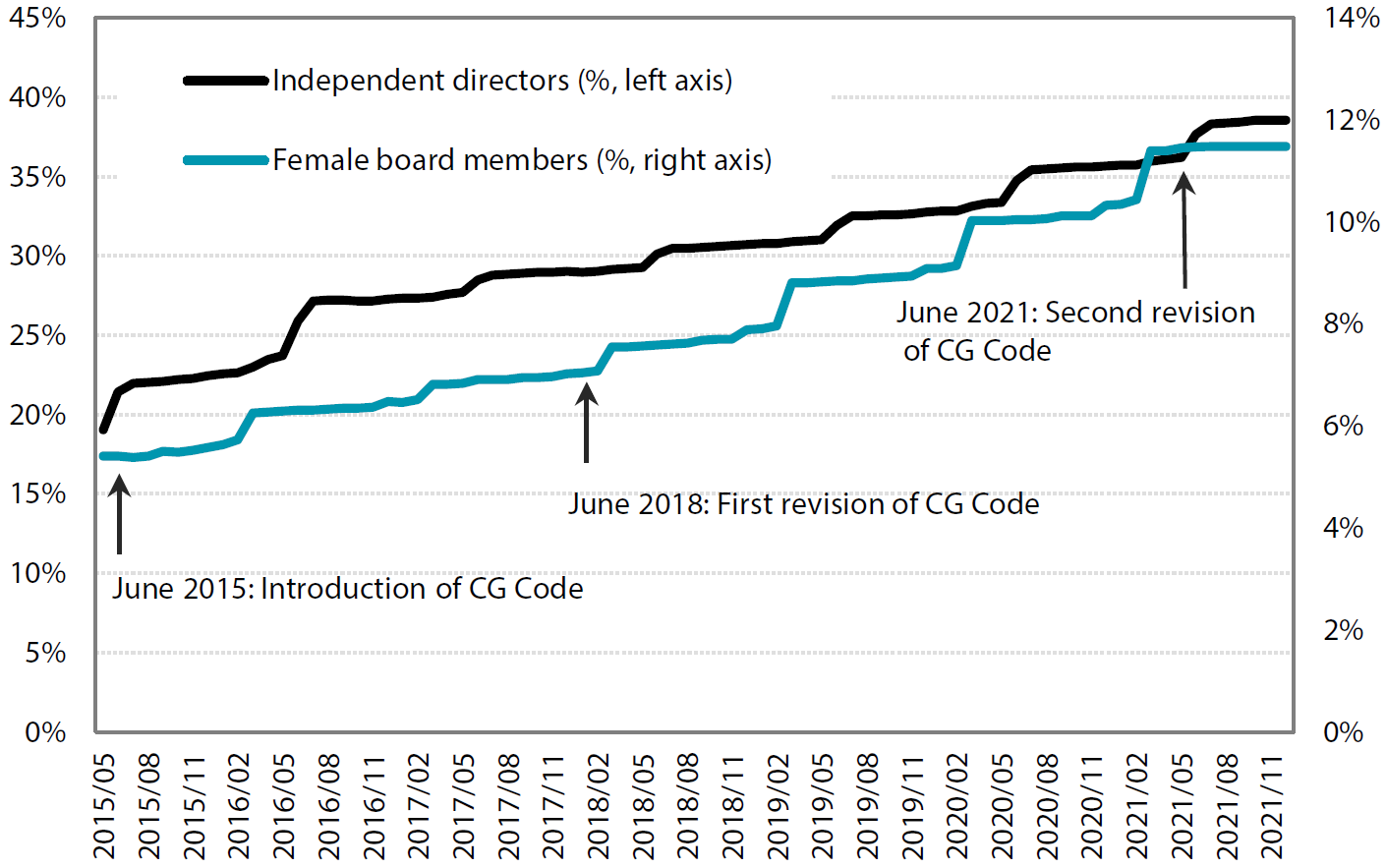

We have also seen a steady increase in the number of independent directors and women on company boards since the Corporate Governance (CG) Code was first introduced in 2015 (Chart 5) and we expect the trend to continue.

Chart 5: Change in the governance structure of TSE First Section companies

Source: QUICK

Source: QUICK

Secondly, we think that the government has clearly laid the groundwork with the comply-or-explain rule to provide a level playing field for various investors in Japan. The number of activist investors who consider Japanese market to be attractive has been on the rise (now at 44 in the market including homegrown Japanese activists) and the number of shareholder proposals is growing in tandem. Toshiba’s recent announcement to split its business into three segments is also seen as a result of activist investors pressuring the company to remove its conglomerate discount.

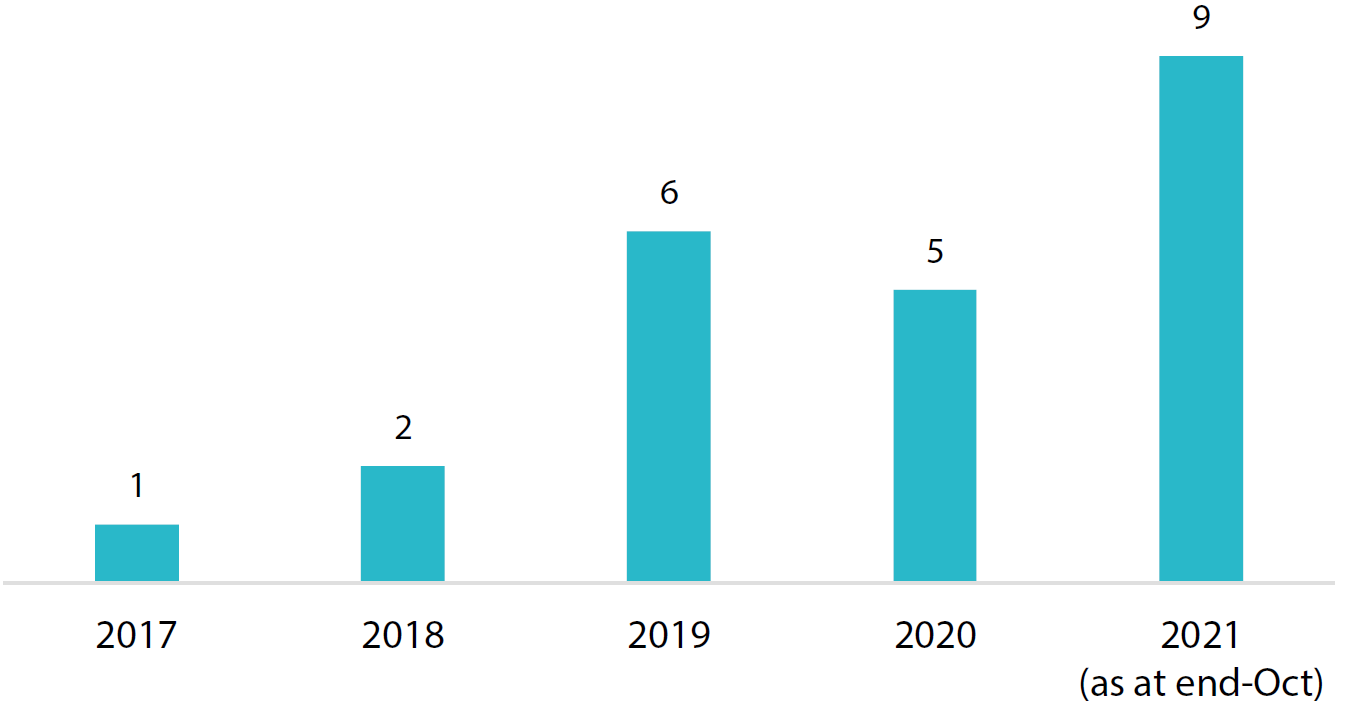

On one hand, financial investors (activists) are trying hard to make their voices heard from the standpoint of minority investors. On the other hand, strategic investors are increasingly making proposals to acquire companies outright, often without prior consent by the target company’s management teams (Chart 6).

Chart 6: Hostile takeovers are increasing

Source: IR Japan

Source: IR Japan

A recent example is the showdown between online financial firm SBI Holdings and Shinsei Bank involving the first ever hostile acquisition attempt in the banking sector in Japan. In September 2021, SBI Holdings launched a tender offer for Shinsei Bank’s shares in an attempt to turn the latter into its subsidiary. In order to fend off the takeover attempt, Shinsei Bank opted to use a poison pill defence and decided to put the proposal to a vote at an extraordinary shareholders’ meeting in November 2021.

What is worth noting is that the Japanese government has a stake in the targeted bank (as a result of a bail out in the late 1990s) and it was widely reported that the government agency (which holds the shares) would not support the poison pill measure. We believe this sent a clear message to the capital markets that the government favours competition for corporate control and views it as beneficial for investors and society. Shinsei Bank eventually withdrew the poison pill and cancelled the extraordinary shareholders’ meeting; SBI Holdings and Shinsei Bank agreed to integrate and collaborate under a new management team to be decided in early 2022.

Corporate culture in Japan is clearly changing. We view this as a positive development as it allows businesses to be left in the hands of “natural owners” to maximise shareholder value.

Summary

We expect 2022 to be a year in which Japanese companies and their competitiveness in the sustainability front to come into focus as ESG initiatives continue to grow in importance globally. Another key focal point for 2022 is the political stability that Japan may offer. With the ruling coalition enjoying firm public support, the country could be seen as a safe haven relative to its developed market peers such as the US. Furthermore, we believe that political stability in Japan will ensure the continuation of corporate governance reform, which has been a key element in changing the country’s corporate culture. Competition for corporate control could thus intensify in 2022.