Summary

- US Treasury (UST) yields rose in February, with the benchmark 2-year and 10-year yields climbing 25.5 basis points (bps) and 4.8 bps, to 1.43% and 1.83%, respectively.

- The inflationary picture was mixed in January. Headline consumer price index (CPI) inflation in India, Indonesia and Thailand accelerated, while similar inflation gauges in China, Malaysia, South Korea and the Philippines moderated. In Singapore, the headline CPI inflation remained at 4.0% year-on-year (YoY) In January but its core inflation rose to 2.4% YoY.

- Both India and Singapore announced narrower fiscal deficit budgets for the coming fiscal year (FY). Indian Finance Minister Nirmala Sitharaman presented a growth-oriented budget for FY2023. Singapore Finance Minister Lawrence Wong focused on new revenue-raising measures as part of the budget.

- Chinese policymakers announced more supportive measures for the property sector in February. Fitch affirmed its “BBB” rating on the Philippines and Moody’s affirmed its “Baa2” rating on Indonesia.

- We are generally neutral to slightly cautious in our view of countries whose bonds are relatively more sensitive to UST movements. Within Asia currencies, we prefer the Chinese renminbi and Malaysian ringgit over the Indian rupee and the Philippine peso.

- Asian credits retreated 2.20% in February, as overall spreads widened by 30.3 bps and UST yields jumped. Asian high-grade (HG) credits declined 1.70%, with spreads rising 20.4 basis points (bps). Asian high-yield (HY) fell 4.41%, with spreads widening by 107.3 bps. Spreads of all major country segments ended wider in February. South Korean credits outperformed, with spreads widening by about 9.1 bps. On the other hand, Chinese credits underperformed, with spreads widening around 44.9 bps.

- We believe that the macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. However, downside risks will continue to dominate for the time being; developments in the Russia-Ukraine conflict are a key swing factor and we remain cautious and selective towards risk over the near-term.

Asian rates and FX

Market review

UST yields rise in February

The UST yield curve continued to bear flatten in February, with yields climbing about 2.3 to 25.5 bps across the curve. The initial jump in yields was prompted by a broad-based gain in US nonfarm payrolls that far exceeded expectations and the growing hawkishness by the Bank of England and the European Central Bank. US January headline CPI also accelerated to 7.5% YoY—the highest level since 1982—against expectations of moderation, pushing the 10-year UST yield above 2%. Tensions between Russian and Ukraine took centre stage towards month-end. Russia’s eventual invasion of Ukraine on 24 February triggered flight to safety, driving down UST yields. However, yields reversed higher later in the day as the market refocused on US inflation. At the end of February, the benchmark 2-year and 10-year UST yields rose 25.5 bps and 4.8 bps, to 1.43% and 1.83%, respectively.

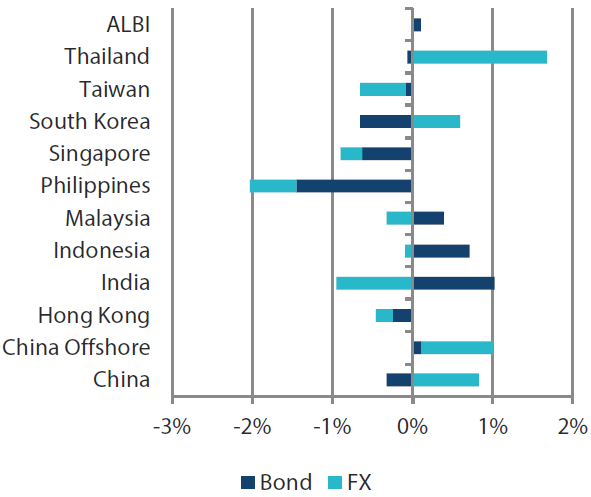

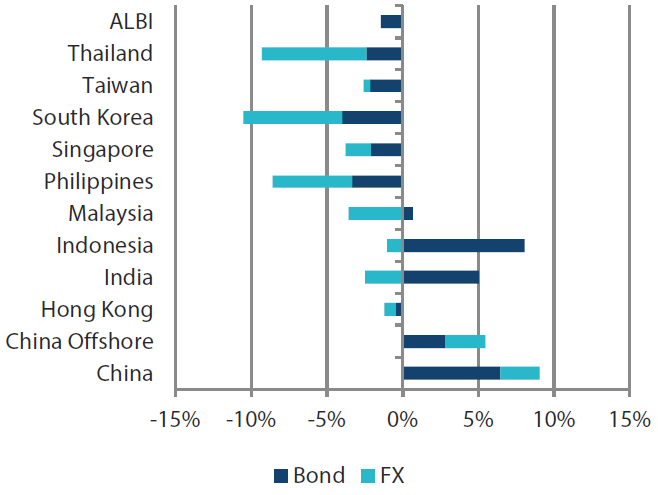

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 28 February 2022 | For one year ending 28 February 2022 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 28 February 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary picture mixed in January

In January, headline CPI inflation in India, Indonesia and Thailand accelerated, while similar inflation gauges in China, Malaysia, South Korea and the Philippines moderated. Thailand’s January CPI rose to 3.23% YoY, led largely by higher prices of energy and meat. Similarly, Indonesia’s CPI picked up in January, rising to the highest level since May 2020, due partly to increases in food, transportation and household equipment inflation. Although headline CPI inflation in Singapore remained at 4.0% YoY in January, unchanged from December, core inflation accelerated to 2.4% YoY, driven partly by higher inflation for food, electricity and gas. In contrast, overall inflation in the Philippines eased in January, reflecting slower increases in the prices of certain food and utilities.

India and Singapore announce narrower fiscal deficit budgets for the coming Fiscal Year (FY)

Indian Finance Minister Nirmala Sitharaman presented a growth-oriented budget for FY2023 (ending March 2023), unveiling a fiscal deficit target of 6.4%, down from 6.9% in FY2022. The budget included a near 25% rise in capital expenditure for FY 2023 and a rise in net borrowing to Indian rupee (INR) 11.2 trillion in the same year. In Singapore, Finance Minister Lawrence Wong presented the FY2022 budget, projecting an overall deficit of Singapore dollar (SGD) 3.0 billion (0.5% of gross domestic product (GDP) for the year, narrower than the SGD 5.0 billion (0.9% of GDP) deficit in FY2021. In view of rising expenditure needs due to an aging society, new revenue-raising measures were the main focus of the budget. Among other things, property and carbon taxes will be raised and the top marginal personal income tax will be increased. Owing to inflation concerns, the hike in the Goods and Services Tax (GST) will be delayed and be staggered in two steps.

China reveals further supportive measures for the property sector

Chinese policymakers announced more supportive measures for the property sector in February. Among others, policymakers unveiled implementation details to regulate developers’ access to cash flow held in their escrow bank accounts—a move which is anticipated to somewhat alleviate developers’ financing burden. In addition, China’s central bank reportedly urged commercial banks to accelerate property loans in selected cities, and several local banks purportedly cut mortgage rates for classifications of home buyers.

Fitch affirms “BBB” rating for the Philippines; Moody’s affirms “Baa2” rating for Indonesia

Fitch affirmed its “BBB” rating for the Philippines and left the outlook at negative. According to the credit rating agency, the negative outlook “reflects uncertainty about medium-term growth prospects as well as possible challenges in unwinding the policy response to the health crisis and bringing government debt on a firm downward path”. Separately, Moody’s affirmed Indonesia’s “Baa2” rating with a stable outlook, citing the country’s continued economic resilience and the credit rating agency’s expectations that “monetary and macroeconomic policy effectiveness will be maintained, containing risks as global interest rates rise”.

Market outlook

Still cautious on bonds of low-yielding countries; prefer renminbi and ringgit over rupee and peso

Given our view that UST yields will continue to rise heading into US Federal Reserve’s (Fed) initial lift-off and normalisation phase, we are generally neutral to slightly cautious in our view of countries whose bonds are relatively more sensitive to UST movements. As foreign investors’ positioning in Asia bond markets is seen to be relatively light, the risk of capital outflow would be relatively low, in our view. We also expect global rates to stabilise after the initial phase of the Fed’s rate hike cycle.

While the direct trade and economic impact of the Russia-Ukraine conflict to Asia could be limited, a long, drawn-out war may translate to a protracted period of elevated commodity prices. Consequently, inflationary pressures are expected to rise and would cause household purchasing power to decrease. On whether the external accounts of various Asian countries will deteriorate or improve, this will depend on if they are a net energy exporter or importer.

Given that most Asia countries are large net importers of energy and commodities, (with lesser extent for Malaysia and Indonesia), we expect a prolonged period of elevated oil prices to deteriorate Asia’s external balances. Within Asia currencies, we prefer the Chinese renminbi and Malaysian ringgit over the Indian rupee and the Philippine peso.

Asian credits

Market review

Asian credits end lower in February

Asian credits retreated by 2.20% in total return, as overall spreads widened by 30.3 bps and UST yields moved sharply higher. Asian HG credits declined 1.70%, with spreads rising 20.4 bps. Asian HY continued to underperform, returning -4.41%, with spreads widening by 107.3 bps, as idiosyncratic risks in selected Chinese property issuers continued to negatively impact market sentiment.

Asia credit spreads remained largely unchanged at the start of the month as most Asian investors took a break for the Lunar New Year holidays. Spreads subsequently widened significantly starting mid-month, as rising tensions between Russia and Ukraine prompted a sell-off in risk assets. Russian forces launched an attack on Ukraine on 24 February, following months of military build-up along the shared border. As markets uncertainty rose, risk assets further sold off and Brent crude oil jumped more than 5%, breaching US dollar (USD) 100 per barrel for the first time since 2014. Over in China, the government announced more supportive measures for the property sector. However, weak market sentiment prompted investors to focus on negative idiosyncratic news, particularly on identified Chinese property issuers.

Spreads of all major country segments ended wider in February. South Korean credits outperformed, with spreads widening by about 9.1 bps. On the other hand, Chinese credits underperformed, with spreads widening around 44.9 bps. This comes as idiosyncratic headlines continued to weigh on China HY sector. Despite affirmation in ratings, Philippines and Indonesian sovereign and quasi-sovereign credits remained very sensitive to hard currency Emerging Market (EM) fund outflows and rates volatility as technicals continued to overshadow fundamentals. Indian credits also lowered on risk off sentiment caused by the to Russia-Ukraine conflict, with spreads widening by about 23.4 bps.

Primary market activity moderates due to the Lunar New Year holidays

Primary market activity moderated in February as Asia celebrated the Lunar New Year holidays. Weak risk sentiment also sidelined issuers. In February, the HG space saw 24 new issues amounting to USD 11.72 billion, including the USD 1.5 billion two-tranche issue from Korea Development Bank, and a USD 1 billion two-tranche issue each from Citic and Bank of China. Meanwhile, the HY space saw approximately USD 1.71 billion worth of new issues raised from nine issues.

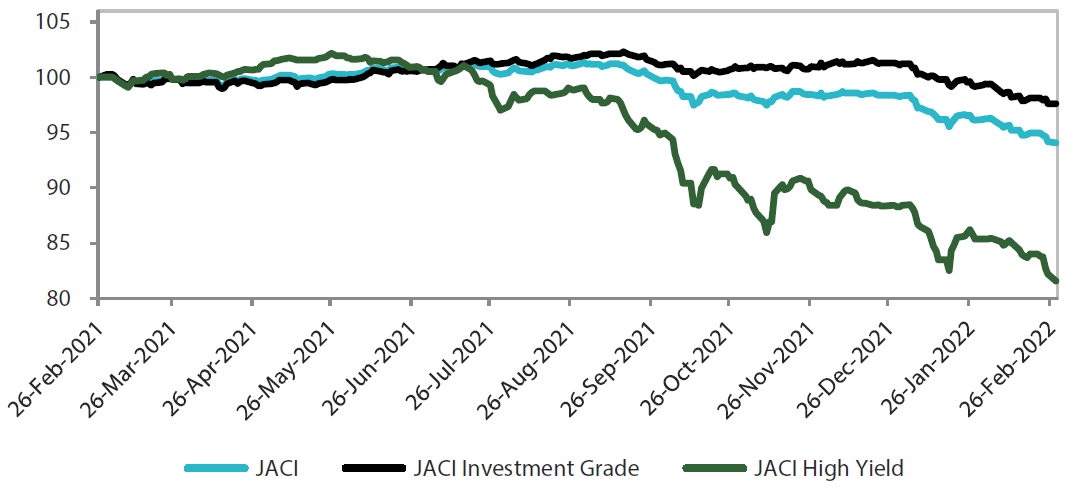

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 26 February 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 26 February 2022

Market outlook

Fundamentals supportive of Asian credit spreads, though downside risks dominate for now

We believe that the macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. However, downside risks will continue to dominate for the time being.

The tragic, rapidly evolving escalation of the conflict between Ukraine and Russia, severe sanctions placed on Russia by the US, EU and their allies, as well as potential retaliatory measures by Russia, have hit global risk appetite. Although Asia ex-China’s direct trade and financial linkages with Russia and Ukraine are relatively low, the indirect impact from higher energy prices and potential tightening of global financial conditions and near-term growth outlook will likely be felt to some extent. Similarly, while most Asian corporates and banks are seen to have manageable exposure to Russia and Ukraine, it is inevitable that there would be some revenue and asset impairment risks arising from this event. With geopolitical tensions rising to the fore, the other global risk factors including the expected aggressive normalisation of monetary policy by the Fed and other major central banks have been put on the back burner for now, but they nonetheless remain in the background.

Meanwhile, the stress in China’s real estate sector continues to intensify even as the authorities have announced more easing measures, including those targeting the demand-side. Risk sentiment is likely to remain extremely weak ahead of what is expected to be a very challenging earnings reporting period, and amidst continuing company-specific credit events. Macro policy easing is underway in China, but clearly, more supportive measures to target the property sector is needed, in our view. In addition, the COVID situation in Hong Kong remains severe. As a result, Hong Kong credits may remain under pressure, especially those focusing in the real estate and consumer sectors.

These developments make it difficult for Asia credit spreads to tighten, even though valuations have turned more attractive. In fact, some further modest widening is likely in the near-term, with developments in the Russia/Ukraine conflict being a key swing factor. We therefore remain cautious and selective in adding risk over the near-term.