Summary

- The US Treasury (UST) curve bull flattened in July. The Federal Open Market Committee (FOMC) meeting was largely uneventful, although the forward guidance on asset purchases was tweaked slightly to indicate that progress had been made towards the Committee’s goals although still shy of the “substantial further progress” needed for the start of tapering. The benchmark 10-year yield ended the month at 1.22%, about 25 basis points (bps) lower compared to end-June, while the benchmark 5-year yield declined by about 20 bps.

- Asian credits returned -0.42% in July, with credit spreads widening by 28 bps, which more than offset the decline in UST yields. There was a significant divergence in performance between the Asian high-grade (HG) and high-yield (HY) segments this month. Asian HG gained 0.54%, owing to the drop in UST yields which compensated the moderate widening in credit spreads of 15 bps. However, Asian HY returned -3.64% due to the sharp widening in credit spreads of 110.5 bps.

- Meanwhile, COVID-19 continued to plague Asian economies, with new cases rising in countries such as Indonesia, Thailand, Malaysia and Singapore. Inflationary pressures also mostly eased across Asia in June.

- We have turned more neutral on the rates market in the near term, as a resurgence of the COVID-19 Delta variant threatens to slow down the global recovery. On currencies, we favour the Singapore dollar (SGD) and Chinese yuan (CNY) given both countries’ swift vaccination progress but are more cautious on the Thai baht (THB) due to Thailand’s slower vaccination progress.

- We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the second half of the year. However, near-term downside risks have increased, which calls for a more cautious, gradual and selective approach to adding credit risk over the next few months.

Asian rates and FX

Market review

USTs rally in July

The UST curve bull flattened in July. The month started with non-farm payrolls at a decent 850,000. However, the unemployment rate rose to 5.9%. Separately, headline inflation in the US continued to climb at 5.4% year-on-year (YoY) for June, higher than the 5% YoY in May. The FOMC meeting in July was largely a non-event, with a relatively hawkish official statement on progress of the economy subsequently offset by a slightly dovish press conference. While tapering was discussed in the policy meeting, the Fed chairman indicated that such a move was not “imminent” and that the committee needed to see “further progress” before it can move forward. Overall, the benchmark 10-year yield ended the month at 1.22%, about 25 bps lower compared to end-June, while the benchmark 5-year yield declined by about 20 bps.

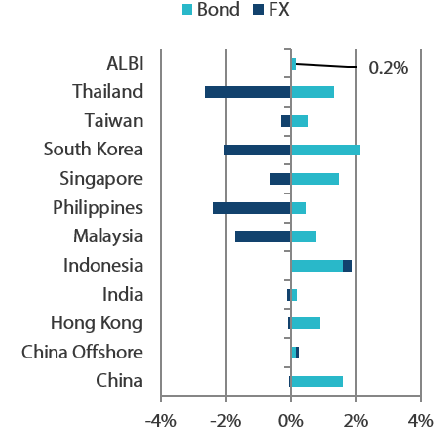

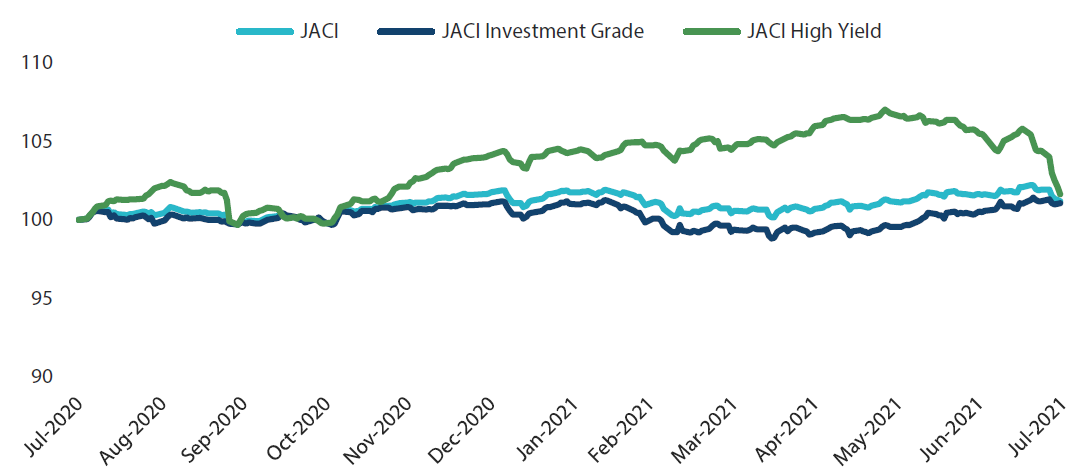

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 July 2021 | For the year ending 31 July 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 July 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Resurgence of COVID-19 cases in Asia

COVID-19 continued to plague Asian economies, with new cases rising in countries such as Indonesia, Thailand, Malaysia and Singapore. Thailand tightened its virus containment measures during the month; it also changed its vaccine policy and allocated more supplies for older people. Thailand also focused on administering vaccines in risk areas in a bid to control the country’s worst round of outbreak since the pandemic began. Meanwhile, in Singapore the rise of new COVID-19 cases prompted the country to increase social restrictions once again. The Philippines also placed its capital under a strict lockdown and implemented additional restrictions on the movement of people to stem the spread of the COVID-19 Delta variant.

Inflationary pressures mostly ease across Asia in June

Inflationary pressures eased across most parts of Asia in June. In the Philippines, inflation rose 4.1% YoY in June compared to 4.5% YoY in May due to the base effect and lower transport costs. The June headline consumer price index (CPI) in Indonesia rose 1.33% YoY versus 1.68% in May on lower food prices. Malaysia’s headline CPI moderated to 3.4% in June from 4.4% in May as transport costs declined. Meanwhile, the rise in Thailand’s consumer prices eased in June to1.25% YoY from 2.44% YoY in May, with government subsidies on electricity and water charges contributing significantly to the slowdown.

Market outlook

Neutral on rates as Delta variant spreads; vaccination progress remains important

We have turned more neutral on the rates market in the near-term, as the emergence of the Delta variant threatens to slow down the global recovery. Market concerns have also increased, as evident from the recent move lower in UST yields. Within Asian rates, we see the supply reduction in Indonesia providing an additional boost to Indonesian bonds. While we are wary of longer-term US dollar (USD) strength, our preference within Asian currencies partly depends on the domestic handling of the COVID-19 situation and vaccination progress. On this aspect, we favour the SGD and CNY given both countries’ swift vaccine rollouts but are more cautious on the THB as vaccinations in Thailand have been relatively slower.

Asian credits

Market review

Asian credit spreads widen; significant divergence seen between high-grade and high-yield

Asian credits returned -0.42% in July, with credit spreads widening by 28 bps, which more than offset the decline in UST yields. There was a significant divergence in performance between the Asian HG and HY segments this month. Asian HG gained +0.54% on the month, owing to the drop in UST yields which compensated the moderate widening in credit spreads of 15 bps. However, Asian HY returned -3.64% due to the sharp widening in credit spreads of 110.5 bps.

After a relatively calm June, Asian credit experienced significant weakness in July, driven by a combination of global market volatility and Asia-specific developments. Throughout the month, a sense of unease permeated through global risk markets. The sense of unease was epitomised by sharp swings in global equity markets and the persistent downward pressure on UST yields and other developed market (DM) sovereign bond yields. A key driver of this weakness was the global spread of the Delta variant, which alongside supply chain disruptions and rapidly rising inflation gave rise to concerns over the resilience of the global economic recovery in 2H 2021. With their lagging vaccination rates, many Asian countries were hit particularly hard by the spread of the Delta variant, and as a result some of the strictest mobility restrictions were reimposed within the region.

Regionally, the Chinese real estate sector, particularly the HY segment, was deeply affected by the government’s ongoing property tightening measures, as well as persistent negative headlines and liquidity pressure facing a few weak companies which had a spill-over impact across the rest of the sector. The somewhat surprising announcement by the People’s Bank of China of a 50 bps universal cut to the reserve requirement ratio mid-month added to concerns about slowing growth momentum in China. This was despite the fact that the subsequently released 2Q 2021 real GDP growth (+7.9% YoY) and key monthly activity indicators for June were either in-line with, or better than, consensus expectations. Towards the end of the month, a series of regulatory changes pertaining to the Chinese private education and technology sectors again took the market by surprise and caused sharp drops in the Chinese and Hong Kong equity markets. These regulatory changes also significantly widened the credit spreads of the affected sector’s issuers, which are mostly rated investment grade, although some of the widening was partially retraced towards the month-end.

Credit spreads widened across all Asian countries in July, with the frontier markets (Sri Lanka, Pakistan and Mongolia), China, India, Indonesia and Malaysia underperforming, while South Korea, Hong Kong, Singapore, and the Philippines outperformed. Indonesia and Malaysia, in particular, have struggled to contain the latest surge in COVID-19 cases, although in a positive sign the vaccination rollout in Malaysia accelerated. Still, Malaysian credits had to contend with ongoing political uncertainty which has dampened market sentiment. Spreads from the Philippines outperformed within the region, despite Fitch revising the outlook on the country’s “BBB” sovereign rating to “Negative”, citing concerns about weakened fiscal finances and the pandemic’s potentially negative effects on the economy.

Primary market activity remains active in July

In July, 67 new issues raised a total of USD 25.0 billion in the market. The HG space saw 43 new issues amounting to about USD 18.9 billion, including a USD 2.5 billion three-tranche issue by Temasek Financials, USD 3.0 billion dual-tranche issue from the Republic of Philippines and USD 1.65 billion new 10-year tranche and re-tap of 30/50 year tranches from the Republic of Indonesia. Meanwhile, the HY space saw approximately USD 6.1 billion worth of new issues raised from 24 issues.

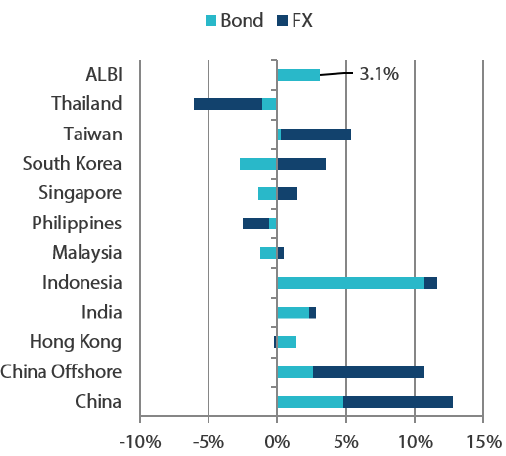

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 July 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 31 July 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 31 July 2021

Market outlook

Fundamentals supportive of tighter Asian credit spreads though downside risks have increased

We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the second half of the year. However, near-term downside risks have increased, which calls for a more cautious, gradual, and selective approach to adding credit risk over the next few months.

The current COVID-19 wave is likely to dampen the recovery in growth across many Asian countries, although this setback is likely to just delay rather than derail the whole recovery process. Progress on vaccine rollouts, as well as supportive fiscal and monetary policies, should revive growth momentum once the current COVID-19 wave subsides. Similarly, overall corporate credit fundamentals should remain robust, although the positive earnings momentum in the second half of 2021 could be softer and may vary in degree by sector. Specifically, certain service industries, such as travel and leisure, are likely to be impacted by the COVID-19 resurgence. In addition, sectors affected by regulatory changes and ongoing policy tightening in China would experience greater pressure on credit metrics. That said, the spread widening in July has likely priced in some of these weaknesses, making valuation more attractive, even though volatility is likely to remain elevated near-term.

In addition to the risk of a more pronounced economic impact from the ongoing COVID-19 wave, as well as uncertainties regarding the scope of regulatory and policy reforms in China, other key risks in the near-term include a more aggressive tightening of monetary policy in the US and worsening US-China bilateral relations. Uncertainties relating to offshore bonds issued by a Chinese state-owned non-bank financial institution remain, and although the contagion to other parts of Asian credit has been limited, the pending resolution for this issuer may still have an impact.