Summary

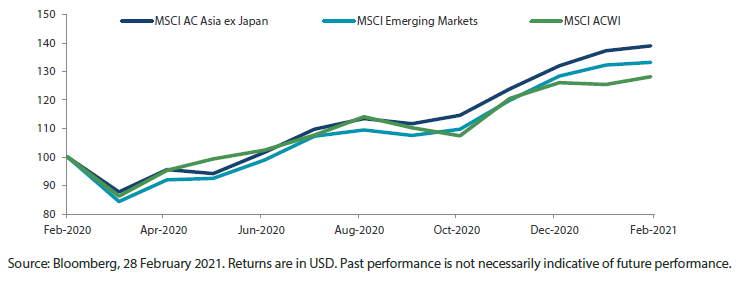

- Asian stocks gained in February as investors upheld optimism about a vaccine-led regional economic recovery. The MSCI AC Asia ex Japan Index rose 1.2% in US dollar (USD) terms over the month.

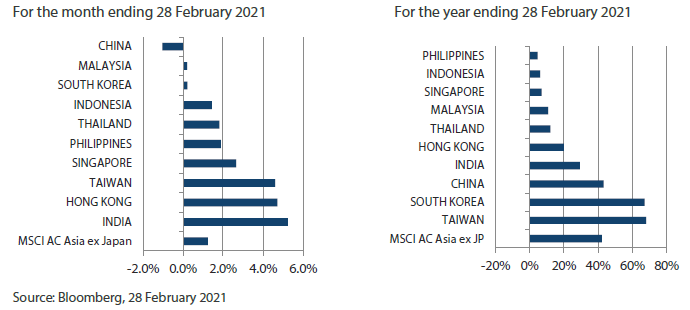

- India, Hong Kong and Taiwan were the best performers in February. India was buoyed by its pro-growth Fiscal Year 2022 Union Budget, while positive economic data underpinned gains in Hong Kong and Taiwan.

- Conversely, China and South Korea lagged. Fears over policy tightening caused China stocks to fall in February as investors fretted over liquidity conditions. South Korean stocks were weighed down by a spike in COVID-19 cases in the country and a slump in global technology stocks.

- While reflation and bond yields have garnered much attention recently, underlying those moves were better news on vaccine transmission data and a rapid fall in caseloads in countries rolling out their programmes. These should all be welcome news to equity markets given they are indicative of improvements in economic outlook.

Market review

Regional stocks hold on to gains for the month

Despite rising concerns about reflation, which triggered a surge in US bond yields and a downturn in global equities near the end of February, Asian stocks managed to hold on to gains for the month as investors upheld optimism about a vaccine-led regional economic recovery. For the month, the MSCI AC Asia ex Japan Index rose 1.2% in US dollar (USD) terms. Within the region, India, Hong Kong and Taiwan were the best performers (as measured by the MSCI indices in USD terms), while China, Malaysia and South Korea were the laggards.

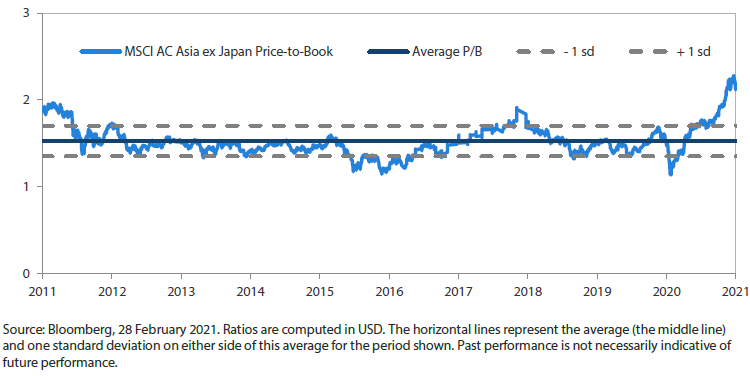

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

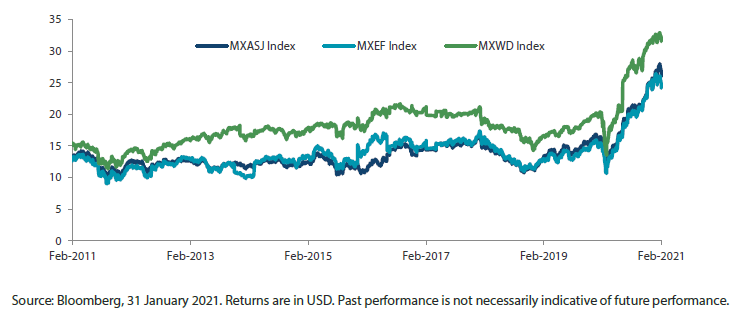

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

India, Hong Kong and Taiwan outperform

In India, stocks jumped 5.2% in USD terms in February, buoyed by the country's pro-growth Fiscal Year 2022 Union Budget, which set capital expenditure at Indian rupees 5.54 trillion or 35% more than the previous year's budget estimate. Stocks were also boosted by India's expanded COVID-19 vaccination campaign as well as news that its economy returned to growth territory in the last quarter of 2020 quarter after two quarters of contraction.

Hong Kong and Taiwanese shares also did well in February, rising 4.7% and 4.6%, respectively, in USD terms. Hong Kong equities were lifted by optimism over the territory's economic recovery and improving home prices, which climbed 0.13% in January, as compared with a revised 0.3% drop in December. In Taiwan, stocks were buoyed by robust export orders fuelled by rising demand for chips and smartphones. An upward revision in Taiwan's fourth quarter 2020 GDP growth to 5.09% (year-on-year) from the preliminary figure of 4.94% also supported Taiwanese stocks.

China declines, South Korea turns in muted gains

In other North Asian markets, China declined 1.0% in USD terms, while South Korea turned in muted gains of 0.2% for the month. Fears over policy tightening caused China stocks to fall in February as investors fretted over liquidity conditions, following a report that the Chinese central bank was focusing more on money market interest rates than the size of its operations. In South Korea, stocks were weighed down by a spike in COVID-19 cases in the country, a slump in global technology stocks and the temporarily closure of Samsung Electronics' semiconductor factory in Austin, Texas due to power shortages caused by deadly winter storms.

All ASEAN markets see positive returns

In the ASEAN region, Singapore and the Philippines were the best performing markets in February, with respective USD returns of 2.7% and 1.9%. Thailand and Indonesia turned in decent USD gains of 1.8% and 1.4%, respectively, while Malaysia lagged with marginal gains of 0.2%. In Singapore, headline inflation rose 0.2% in January, up from 0% the month before. This is the first time the figure has risen above zero since February 2020. In the Philippines, the central bank remained accommodative, maintaining its interest rate at the record low of 2% as the economy remained in recession due to COVID-19 restrictions.

Chart 3: MSCI AC Asia ex Japan Index1

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Progress of vaccine rollout continues to support Asian equities

A number of important structural changes occurred during February that impacted the outlook of certain sub-sectors and companies in Asia. While reflation and bond yields have garnered much of the attention, underlying those moves were better news on vaccine transmission data and a rapid fall in caseloads in countries rolling out their programmes. These should all be welcome news to equity markets given they are indicative of improvements in economic outlook, albeit perhaps more geared towards services than goods and the more impacted economies versus those that have handled the pandemic well.

Closer to home, we witnessed the border opening between China and Macau, indicating that some tourist channels are beginning to open up. While a full flung return to pre-pandemic tourism numbers still seems some way off, we think the likelihood of travel bubbles forming in parts of Asia is increasingly likely.

Tempering China weighting while staying invested in structural growth areas

China continues to focus on “quality over quantity” and nowhere is that more evident than in the property segment, where efforts to reign in leverage and reform land purchases should bring more sustainability to a historically volatile sector. Elsewhere, the focus remains strong in green infrastructure development. We have tempered our view towards Chinese equities in recent months given the stretched valuations and more attractive opportunities elsewhere, but we continue to favour structural growth areas of healthcare, insurance, content and areas of localisation.

Sharper focus on Indian real estate and infrastructure materials

In India, we witnessed the most expansive fiscal budget under Prime Minister Narendra Modi’s government with priorities including local manufacturing development, infrastructure and promoting activity in the property sector as well as several other positive reforms. We have favoured private sector banks, logistics and health consumption, but we have recently sharpened our focus on the real estate and infrastructure materials sectors to reflect these positive changes and the likely improvement in long-term sustainability of returns.

Selective in South Korea and Taiwan; increasing focus on Singapore

South Korea and Taiwan continue to be major beneficiaries of strong demand for electronic products, semiconductor supply chain relocation and high-end manufacturing. China had been leading demand globally but looks set to be joined by the US and EU as their economies and manufacturing industries re-open fully. Valuations, however, have become rather rich, and we have grown a little more cautious in specific sub-segments. In addition, both the South Korean and Taiwanese economies have benefited enormously from the pandemic, in terms of containing it with less economic disruption and also because of the surge in demand for tech and healthcare products.

In ASEAN, we continue to favour countries that promote structural reform, have stable and productive governments, and those that are likely the next beneficiaries of economic re-opening. We have had a favourable outlook on Indonesia for some time now, and we have recently shifted our focus back into Singapore, notably towards its banking sector. One remarkable feature of this crisis is how well most banks were able to absorb and deal with the downturn, and we find many banks are now in a fantastic position to lend and grow when demand returns.

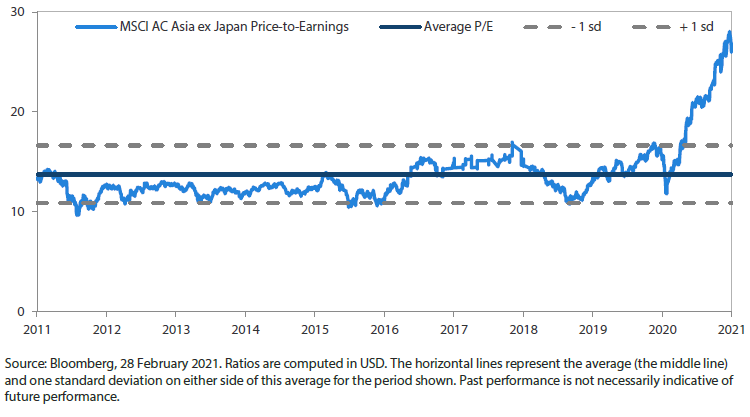

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Chart 5: MSCI AC Asia ex Japan price-to-book