Investment Philosophy

The investment team believes that significant alpha can be obtained through bottom up research to identify two types of firms: (1) those with competitive advantages—including positional and/or capabilities-based advantages—that drive sustained earnings growth; and (2) those undergoing structural changes that can be expected to lead to improvement in earnings momentum. By applying these two perspectives to stock selection, the investment team believes it can consistently deliver stable excess returns over the market.

Bottom up research focusing on competitive advantages and corporate reforms

Companies with competitive advantages are expected to continue to grow their earnings; those implementing corporate reforms are also expected to show earnings growth, resulting in re-ratings. The strategy uses bottom-up research to seek out firms with competitive advantages and structural reform potential. Key factors and metrics the portfolio manager focuses on include market share, brand name, product innovation, ROE, rationalization of business portfolio and M&A activity.

Experienced portfolio manager supported by robust research platform

Toshinori Kobayashi, the strategy’s lead portfolio manager, possesses broad experience from across a wide range of investment styles. Since becoming a portfolio manager in 1992, he has managed value, growth and small-cap equity investment portfolios across multiple market cycles.

He is supported by Nikko AM’s robust equity research platform. A major competitive advantage of Nikko AM’s is the depth and quality of its proprietary research, which covers companies across a broad range of market capitalisations. In addition to sector analysis, the portfolio managers are supported by style analysts (small/mid cap and value). The different types of analysts bring different perspectives. This combination of perspectives allows Nikko AM to deliver more comprehensive analysis compared to its peers.

Key Characteristics

Portfolio Construction

The portfolio is constructed through a combination of highly rated stocks from the research universe and the portfolio manager’s own ideas; historically about 80% of the names have analyst “buy” recommendations. The stock selection process identifies a diverse group of companies with high potential for growth and capital appreciation, emphasizing the following two attributes in the context of mid- to long-term industry trends:

Competitive Advantages

- Positional—Dominant market share, network of relationships, brand name, gatekeeper

- Capability—Technology, product innovation, marketing, cross-selling

Corporate Reforms

- Corporate Governance e.g. ROE, shareholder returns

- Restructuring of Business e.g. rationalization of business portfolio, improvements to productivity

- Industry Consolidation e.g. M&A activity, business failure of underperforming firms

The portfolio comprises two distinct groups of companies which differ in terms of capital efficiency (ROE) and valuation (P/B). Weights are determined according to levels of expected return and the portfolio manager’s conviction.

Style agnostic nature of the strategy

The strategy’s portfolio is style agnostic. Its style exposure is controlled, allowing for stock selection across the growth/value spectrum. The strategy is thereby able to generate consistent alpha in different market environments, resulting in an “all-weather” portfolio.

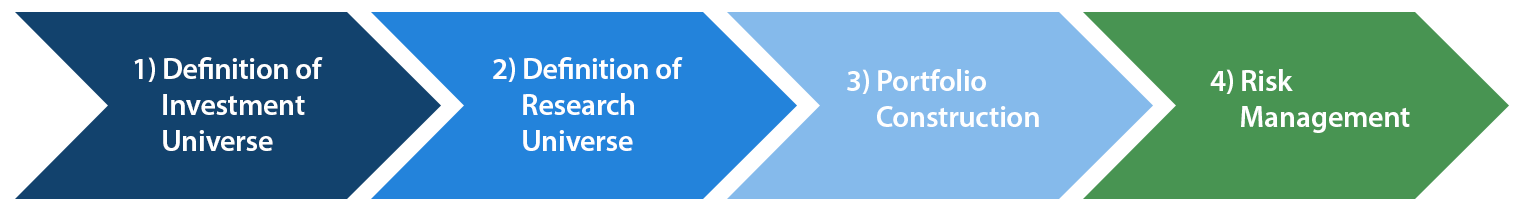

Investment Process