With volcanic activity heating up, there were a few possible outcomes

Last November, I was all packed and ready to set off for my eagerly anticipated holiday to the Land of Fire and Ice—Iceland. A much-needed break from the challenging markets was welcomed. Just a few days before my outbound flight, the news headlines broke: “Iceland's Reykjanes Peninsula bracing for unprecedented volcanic eruption. The town of Grindavík (a tourist destination located on the south coast of the peninsula) has been evacuated. Blue Lagoon geothermal baths (one of Iceland's main tourist attractions) closed as the country is on high alert and experiencing hundreds of earthquakes a day”. A large volcano was threatening to erupt with a massive underground river of magma rapidly rising close to surface of the Reykjanes Peninsula. The thought of cancelling the trip did cross my mind, but with assurance from local experts that aviation is unlikely to be affected and the country's main tourist sites should be safe to visit, I went ahead with the break as planned.

There were a few possible outcomes, listed below:

1) Base case: The volcano erupts, and Grindavík is devastated. But the damage is confined to the area with no loss of human lives.

2) Worst case: The volcano erupts, destroying Grindavík. Iceland closes its airports due to the volcanic ash cloud created by the eruption (this happened back in 2010), causing a standstill in international travel.

3) Best case: The lava flow remains under the earth’s surface and does not result in an eruption at all.

Timing was of essence and the Icelandic authorities acted decisively. They declared a state of emergency and ordered the evacuation of Grindavík.

My two weeks of adventure passed amidst the embrace of waterfalls, lava fields and fresh air. The volcano finally erupted on 18 December 2023, and there have been three more eruptions as of this writing. Thankfully, it is believed that no lives have been lost.

How does Iceland’s situation relate to fixed income markets?

Without downplaying the critical nature of the situation in Iceland, the following parallels can be drawn in making investment choices:

1) Decisions are often made without perfect information. They are based on probability and executed based on the best expected outcomes. A strong fundamental understanding of the subject matter is key.

2) The markets are live and changing constantly. It is important to assess which information matters to the portfolios and which may just be noise or a distraction.

3) The markets trade ahead based on the likelihood of actual events and recalibrates along the way. One needs to act ahead. By the time the actual event takes place, it might be too late.

Throughout 2023, the markets weighed between different economic "landing" scenarios with each data release, and consequent monetary policy decisions by central banks. US Treasury (UST) yields trended up for most of 2023 as the Federal Reserve (Fed) raised rates four times. In October, the 10-year UST yield touched a 16-year high of 5.02% as data pointed to continued resiliency in the US economy. However, the US central bank signalled a change in its stance at its final policy meeting of 2023, acknowledging that growth and inflation were slowing. This dovish pivot, together with increased expectations of a US economic slowdown, caused UST yields to plunge towards the year’s end. As yields fell, the Asia credit market staged a strong recovery to end the year with a gain of +7.02%.

The Asia investment grade index spread touched 129 basis points (bps) in February 2024, reaching its lowest level since the 2008 Global Financial Crisis. The situation has not been helped by the fact that a lack of primary market supply and reach for yield have resulted in investors chasing even tighter spreads. In a way, the credit market seems ripe for a correction.

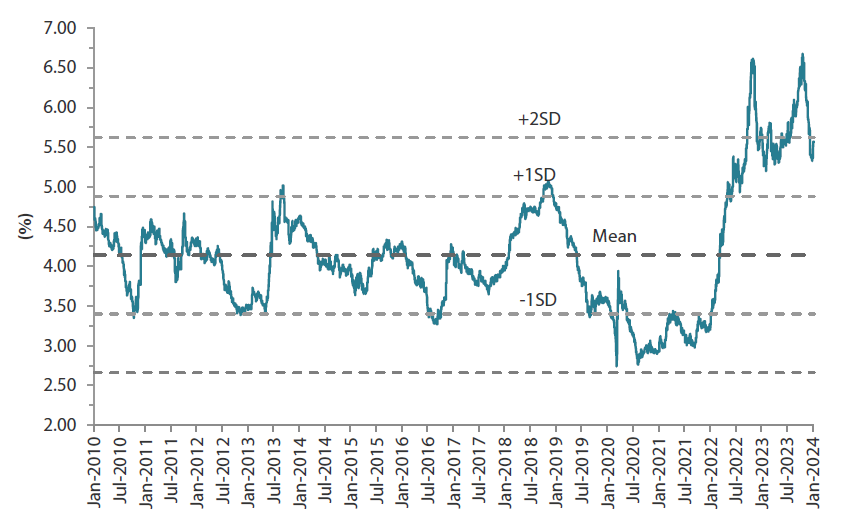

Chart 1: Asian investment grade historical yield

Source: Bloomberg as at March 2024

Still, we can take some comfort in the fact that all-in yields are still attractive on an absolute basis. Asian credits also provide a 40-70 bps spread pick-up versus developed markets. Yields are high on a historical basis, which helps make Asian credits attractive. The Fed is expected to eventually cut rates, which would likely lead to lower yields.

Key investment themes for 2024

Duration amid a looming rate cut

Since the start of 2024, strong labour markets, sticky inflation and hawkish Fed rhetoric have prompted UST yields to bounce back almost 40 bps across the curve. Nevertheless, we are confident that the peak in yields is past us and that the next Fed policy move will be a rate cut. In previous rate cut cycles, bonds tended to rally before the start of actual rate cuts, followed by a strong rally thereafter. We are positive on duration over the medium term and believe that now is the ideal time to consider the possibility of bonds rallying over the longer term.

Asian local currency bonds

We expect a supportive global environment in which the Fed shifts towards lowering rates to support Asian local currency bonds over the medium term, especially those from Indonesia and India. Indonesia bonds offer attractive real yields, and the country is backed by strong fundamentals (low inflation and stable fiscal outlook). We also like India bonds due to their attractive carry and potential capital gains boosted by bond index inclusion inflows. India’s external balances have been improving on healthy services exports. The currencies of Indonesia and India are expected to perform well over time with the dollar seen weakening on the Fed’s rate cuts.

BBB-rated Asia credits

Stronger BBB-rated Asia credits provide a decent spread buffer and are less vulnerable to interest rate movements. Weak issuers face a greater prospect of spread widening, especially during economic slowdowns. On the other hand, very high-quality bonds may trade at very low spreads, resulting in a lower all-in yield. The sweet spot lies somewhere in between, in the BBB space, which offers a decent spread buffer and better overall yield.

SGD-denominated corporate bonds

Closer to home, we hold a favourable view of Singapore dollar (SGD) bonds as issuers generally have good access to funding. Additionally, fundamentals are expected to remain robust enough to prevent any significant widening of credit spreads. The Monetary Authority of Singapore has tightened the FX policy to let the Singapore dollar appreciate, supporting demand for assets denominated in the currency. Finally, the yield of short term SITB (Singapore T-bills) has fallen considerably. In our view, it is worth looking further down the yield curve in search of attractive yields for the next three to five years.

The all-weather nature of an unconstrained fund

An unconstrained fixed income strategy, with its key focus on capital preservation and delivering stable income, gives portfolio managers the ability to express their views and position themselves in line with where they identify the best opportunities across market cycles. We believe that our example represents some of the best ideas in Asian credit, currencies and rates.

Considering current market conditions, a “barbell” approach seems advantageous; short-dated BBB and SGD bonds can serve as an anchor, while long-dated bonds have the potential for capital appreciation. Furthermore, local currency bonds offer high-quality yields, with the potential added benefit of foreign exchange appreciation.

It will not be an easy road ahead, but I am cautiously optimistic. Taking a leaf from the book of the Icelandic authorities, our aim is to protect downside risks while capturing opportunities, navigate the markets as best as possible and constantly stay one step ahead.