News headlines are making much of the recent rally in Japan’s Nikkei 225 stock index to historic highs. A favourable market environment as well as an assortment of Japan-positive commentary by overseas investors—supported by robust overseas purchases of Japanese stocks—have subsequently helped the index hold those gains. However, the main question among global investors, particularly those who have been present during Japan’s years of stop-start recovery attempts, is if this time is truly different—whether Japan is really at the point of emerging from its decades-long deflationary growth stagnancy, and not merely benefitting from the easy conditions currently prevalent in global markets.

Japanese equities have been, undoubtedly, a beneficiary of significant global liquidity and of dollar strength and yen weakness amid relatively tighter monetary policy in the US and other markets. It has also benefitted from willingness by global investors to take risk.

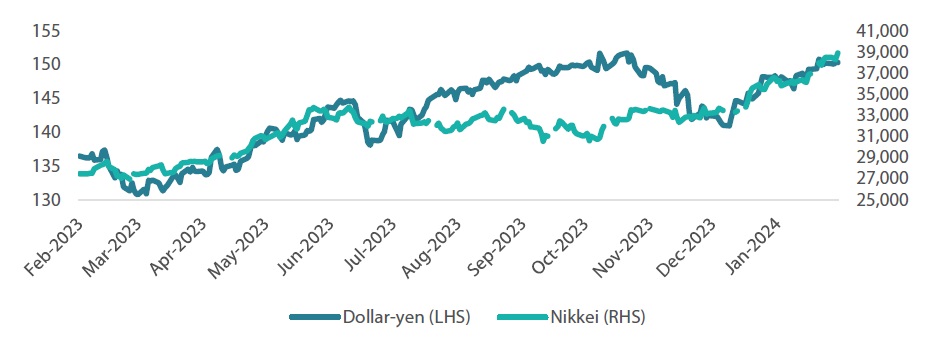

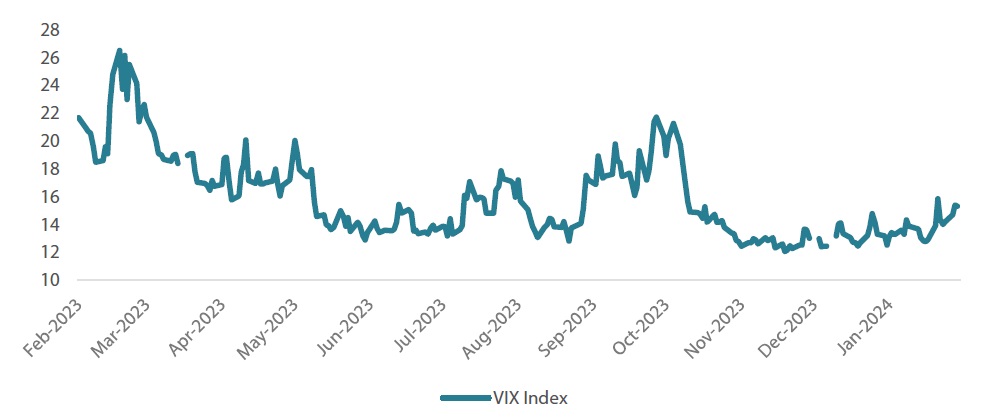

Chart 1 shows the resumption of the tight relationship between dollar-yen and the Nikkei in late 2023, around the time when markets, which had been temporarily disquieted by fears of slowing growth from the late third quarter, once again showed appetite for equity risk, as proxied by the decline in the CBOE VIX index (see Chart 2). Reflation has certainly had its cyclical elements, but it also plays a role as a necessary—albeit on its own insufficient—precondition to structural recovery.

Chart 1: Dollar-yen and the Nikkei

Source: Bloomberg, Nikko AM Global Strategy. Data as at 24 February 2024.

Chart 2: CBOE VIX Index

Source: Bloomberg, Nikko AM Global Strategy. Data as at 24 February 2024.

We explain how reflationary dynamics underpin the foundations of incipient structural recovery and illustrate why we believe the current equity comeback should not be written off as another flash-in-the-pan cyclical upturn headed for an eventual return to deflationary dynamics.

Pass-through: a characteristic of Reflation 101

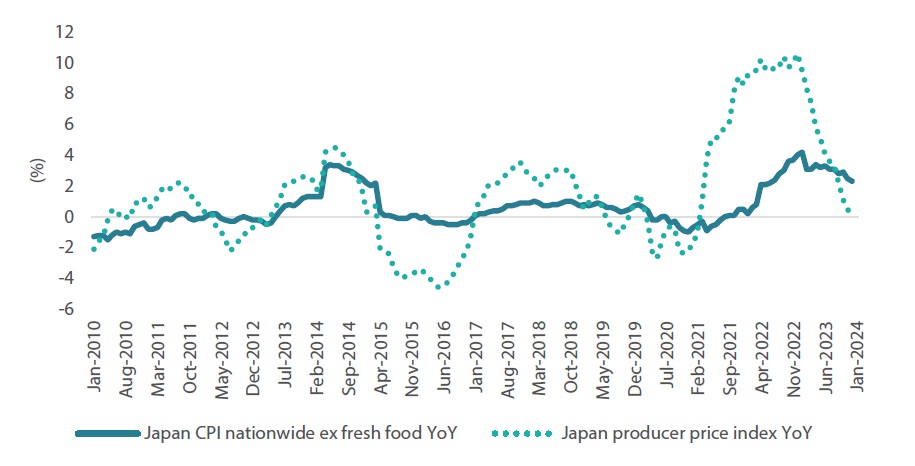

As the Bank of Japan (BOJ) is fond of reiterating, a “virtuous circle” of growth and reflation is necessary for the central bank to conclude that Japan has truly left its “lost decades” of growth in the rear-view mirror. On one hand, increases in Japanese consumer price index (CPI) excluding fresh food (“core” CPI) have spent the better part of two years above the BOJ’s 2% inflation target, a feat just until recently seen as unachievable in previously deflation-beset Japan (see Chart 3). Since then, the surge in global energy and commodity prices starting in 2021 eventually broadened and passed through to consumers. What more evidence however, ask the policy hawks, does the central bank need to conclude that its inflation target of 2% has well and truly been achieved?

Chart 3: Pass-through to consumers of elevated input prices

Source: Bloomberg, Nikko AM Global Strategy. Data as at 21 February 2024.

The doves would likely respond to this question by pointing out that not only have energy as well as other commodity prices shown more subdued increases of late, allowing for disinflation in many developed economies, but also that Japanese real GDP has fallen back into a technical recession, by posting its second consecutive quarter of negative quarterly growth in Q4 2023.

Data meanwhile both reinforce the BOJ’s deliberation on the permanency of the country’s reflationary tendencies but also show how Japan sits at the threshold of achieving a much clearer structural recovery.

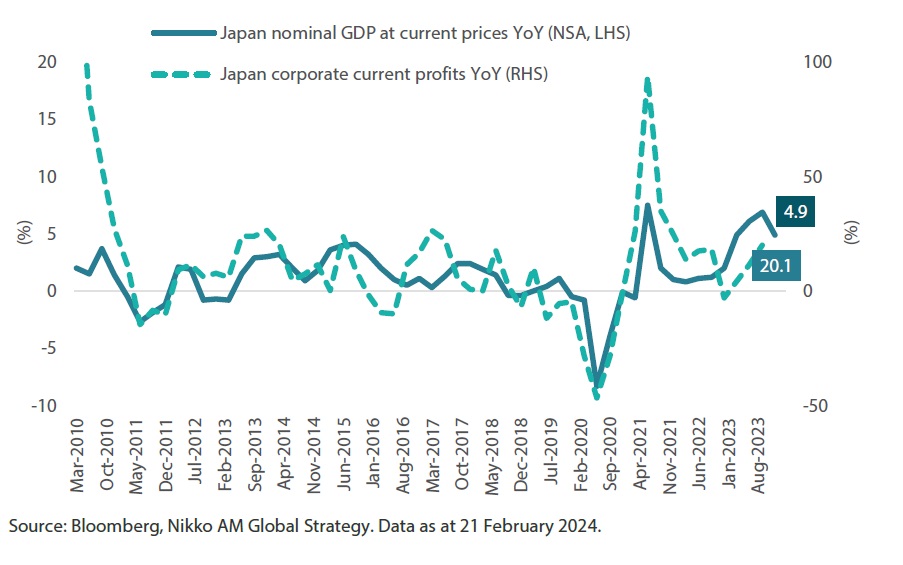

Reflationary tendencies emerging in structure of Japanese growth

Firstly, we will examine the structure of Japan’s recent growth dynamics. The real GDP did contract quarter-on-quarter (QoQ), but this was primarily due to a yet-elevated deflator in Q4; nominal growth still expanded 0.3% QoQ, or a healthy 4.9% year-on-year (YoY). This distinction is important because corporate revenues are denominated in nominal terms, and the ability by firms to maintain a volume of revenue at higher prices is an incipient reflationary signal (see Chart 4). As we may observe, corporate profits were up 20.1% YoY as of Q3 2023.

Chart 4: Nominal growth drives corporate profit recovery

Source: Bloomberg, Nikko AM Global Strategy. Data as at 21 February 2024.

Reflation before (structural) reform: lessons from recent history

This dynamic is a veritable sea-change from that of the “lost decades” in Japan, where the economy was reliant on price declines to eke out anaemic growth in real GDP, while nominal GDP remained mired in negative territory. In this prior dynamic, it was fully rational for corporates in a deflationary environment to hang on to their cash (expecting it to be worth more in a deflationary future), defer expenditures and dilute equity investors given the corrosive impact on balance sheets of issuing debt into an environment of no—sometimes negative—future growth and inflation. But Japan’s shift in dynamics toward nominal output growth—despite the slow recovery of corporate pricing power—changes the game. It creates conditions in which putting corporate cash to use via investment, buybacks of under-valued shares, raising wages and selling cross-shareholdings are all possible in pursuit of greater profit margins. By these measures, firms can retain capital attracted initially by the rebound in nominal growth and revenues. These are the structural reforms that investors have been awaiting for decades. Prime ministers Junichiro Koizumi and Shinzo Abe tried to initiate structural reform. But their initiatives required the spark of reflation to take place at all; current conditions offer a stronger reflationary “spark” and hence are more conducive to structural reform than they were in the past.

Keeping the “virtuous circle” alive: what needs to happen and what to watch

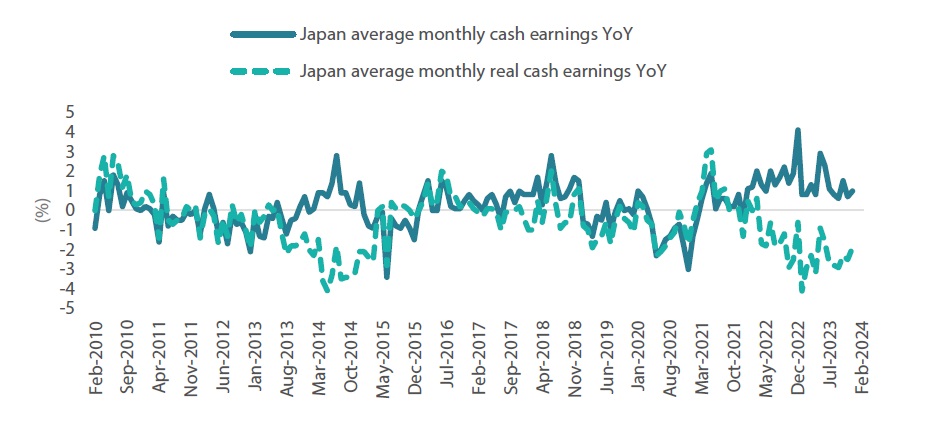

While we view the foundations of Japan’s sustainable recovery as very much intact, a true structural shift is still under way and by no means over and done with. This is true both on an economy-wide (macroeconomic) basis as well as at the household level. We can start being optimistic about Japan’s prospects, but we should watch out for signs that may tell us that the country has definitively turned a corner from a structural perspective. To this end, we demonstrate that the tight employment conditions currently characterising Japan’s labour force have structural elements. Prior to 2021, Japan’s labour force has been declining for over a decade whilst labour participation rates had been rising—particularly among women and those of traditional retirement age (above 60 years old). Until the COVID-19 pandemic, the rising participation trend helped keep wages contained. In 2021 nominal wages rose into positive territory, where they have remained ever since (see Chart 5).

Chart 5: Nominal versus real labour cash earnings

Source: Bloomberg, Nikko AM Global Strategy. Data as at 21 February 2024.

Increases in labour participation are finite and have little further potential to continue containing the rise in wages. Meanwhile, the annual “spring offensive” by Japan’s labour unions is likely to bring another round of increases in unionised wages, with non-union employers likely to follow with a lag. Now that the more volatile components of inflation have become subdued, we may be at the verge of seeing real wages increase before 2024 is over. Real wage growth is of paramount importance to reflation as it allows households to accept price rises without cutting their volume of consumption; it may, eventually, lead to an increase in consumption over the longer term.

The next turn of the circle—why real wages are so important to future growth

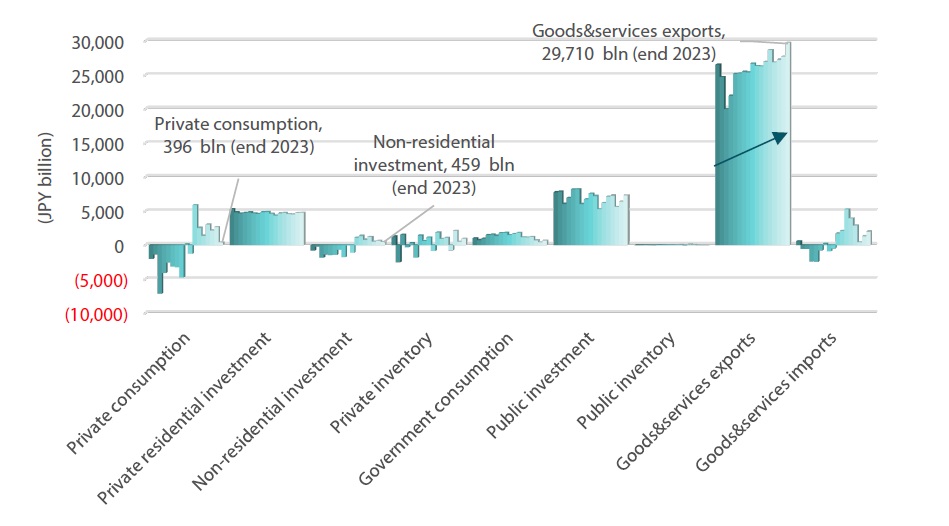

We mentioned above that the shift toward positive nominal GDP growth—even amid an elevated deflator—was a sea change for Japan. However, what has not changed much is the composition of growth. Over recent quarters, exports have continued to pull far above their weight in keeping growth intact.

Chart 6 shows, in year-on-year terms, the real contribution of each sector to Japan’s GDP growth since 2020. Net exports (responsible for only 1% of GDP) made outsized contributions to annualised growth, and the much larger household and private non-residential corporate sectors (38% and 11% of GDP respectively) meanwhile made positive, but much smaller, contributions. Meanwhile, we point out that both sectors have the wherewithal to contribute much more to Japanese GDP growth—if only growth and reflation expectations remain intact.

Chart 6: Elements of real 2020-2023 GDP YoY growth (in Japanese yen [JPY] billions)

Source: Bloomberg, Nikko AM Global Strategy. Data as at 21 February 2024.

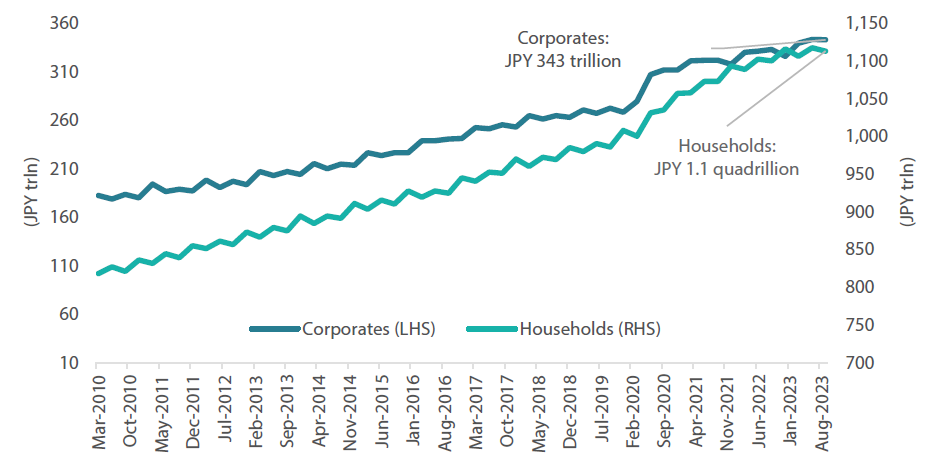

Chart 7 illustrates one significant legacy of deflation that has yet to turn—the massive cash balances held by households (over JPY 1 quadrillion) as well as corporations (over JPY 300 trillion). Cash hoarding is fully rational in deflationary conditions, but not so amid even mild reflation. In reflation, households can put cash to better use in the economy in two different ways. One is to consume more today (since it will be more expensive to do so tomorrow), and the other is to invest in financial market assets with the expectation of a positive return (to be able to afford consuming more tomorrow).

Chart 7: Households and corporates have built up cash holdings

Source: Bloomberg, Nikko AM Global Strategy. Data as at 21 February 2024.

In our next instalment, we will go further into detail on why we would anticipate that the enormous cash balances held by households and corporates might be put to use in ways that might afford Japan a true and lasting exit from its deflationary “lost decades”.

Naomi Fink

Managing Director, Global Strategist

Naomi Fink joined Nikko Asset Management in December 2023 as Global Strategist and Managing Director. As a direct report to the firm’s Chief Investment Officer, Fink is responsible for providing comprehensive investment insights and strategy guidance both internally to colleagues as well as externally to Nikko Asset Management’s clients and media, spanning various asset classes including Japan Equities, Asian Equities, Global Equities, and Global Fixed Income. She also leads the firm’s Global Investment Committee and various internal discussion groups covering global equities and global fixed income/forex.

Prior to Nikko AM, Fink held senior macroeconomic and strategy research positions across diverse markets, geographies and asset classes at global banks and brokerages, including Bank of Tokyo Mitsubishi UFJ (currently MUFG Bank), BNP Paribas and UBS. She then became Chief Japan Strategist at Jeffries Japan Limited. In 2013, she founded Europacifica Consulting, and concurrently held research positions at Capital Group between 2016 and 2023, most recently as Retirement Economist.

Fink holds an MSc in Specialized Economic Analysis (Macroeconomic Policy and Financial Markets) from Barcelona Graduate School of Economics, an M.A. (Honours) from the University of St. Andrews in the UK, and is a certified Financial Risk Manager (FRM). She is especially active in collaborating to advance the investment management industry. She was nominated to the Japan Society of Monetary Economics in 2014, and in April 2022 became Chairperson of US thinktank Employee Benefit Research Institute (EBRI)’s Retirement Security Research Center, where she led research on financial decision-making and portfolios prior to and during investors’ retirement, and received EBRI’s prestigious Research Leadership Award for Retirement Security Research Center Chair. Fink is also a role model to women in the investment management industry, as a fellow of both Women in Leadership Program from Coro Southern California, as well as the University of California, Los Angeles Women Governance program. She is fluent in English, Japanese, Spanish and French.