Looking beyond impressive dividends and share buybacks

The estimated amount of share buybacks and dividends paid by Japanese companies reached a record high in the fiscal year through March 2024. This trend appears firmly intact, with numerous companies announcing share buybacks and dividend increases during the April-May reporting season. However, it is worth remembering that companies are naturally inclined to increase their dividends when earnings are robust. For example, a 10% increase in dividends might seem impressive, but it becomes less so when the company announcing it also enjoyed a 10% boost in profits.

Nonetheless, the trend for companies to increase dividends and share buybacks is a positive development. It undoubtedly reflects efforts to maximise shareholder returns in line with one of the objectives of Japanese corporate governance reforms initiated by the Tokyo Stock Exchange (TSE).

That said, there is still room for improvement regarding corporate governance reforms. For instance, the large amount of share buybacks may not necessarily indicate a collective improvement in capital efficiency. Some buybacks could be related to companies unwinding cross-shareholdings, a practice that is targeted for reform and involves firms holding stakes in each other. This suggests that reforms are still in progress.

While it is true that TSE-led reforms are helping corporate Japan become more efficient, the process is still unfinished. Investors are expecting more, and their expectations for a brighter future can provide the stock market with extra headroom. This is because it allows investors the opportunity to price in further, unfolding reforms, as there is still room for capital efficiency to improve.

Engagement between investors and the companies they invest in is likely to be pivotal to further improvements in Japan’s capital efficiency; while the pressure from the TSE plays an essential role, it will not be sufficient on its own. The TSE’s efforts may have the intended effect on listed companies that are clearly in need of reform. However, they are likely to have less impact on companies that are adequate but not exceptionally poor in this area.

We are currently at a stage where engagement and communication between investors and the companies they invest in can potentially extend reforms beyond capital efficiency, which has been the TSE’s prime target. Investors can assist firms in shaping efficient strategic growth and capital expenditure (capex) plans. This will only be possible through active engagement and effective communication.

In conclusion, while it is easy to focus on dividends and share buybacks, we need to adopt a broader perspective when analysing developments in corporate governance reform.

The “quantity effect” may reduce the relevance of currency levels

In April, the yen fell to a 34-year low against the dollar, a development that was widely covered by the media. At one point, a weak yen was considered beneficial for the economy given the perceived boost it provided to Japan's exporters. However, this perception appears to be changing. Japanese consumers, who are already grappling with higher living costs, are seeing the weaker currency pushing up the prices of imported goods. Japanese authorities are estimated to have spent nearly 10 trillion yen in market interventions recently to prop up the currency.

Given these circumstances, we may witness a shift in the long-standing belief, fostered during the Abenomics era, that a weak currency is desirable. Furthermore, with the Bank of Japan poised to eventually hike interest rates, which could potentially support the currency, a strong yen could even be welcomed by some.

The depreciation of the yen under Abenomics indeed provided a crucial boost in sentiment to an economy grappling with the aftermath of the Global Financial Crisis (GFC). Post-GFC, Japan experienced a constant surplus of labour, goods and money. Encouraging firms to increase capex was a challenging task at that time, as it would have resulted in job redundancies in an already illiquid labour market. The depreciation of the yen during the Abenomics era did provide relief to sectors of corporate Japan that had seen their prospects clouded by a strong yen. However, a weaker currency did not necessarily lead to higher wages and increased capex.

Although it seems apparent in hindsight, the problem was that while a weak yen improved the corporate bottom line, it did not address the surplus labour problem. However, the current situation in Japan is different. Labour is now in short supply. Firms are actively raising wages to secure workers, investing in capex and increasing output. These activities are driven by the "quantity effect" generated by the demand for Japanese goods—with a robust US economy playing a role—rather than the "price effect" associated with a weak yen during the Abenomics era.

A prominent example of the quantity effect supporting corporate growth is provided by Japan’s bubble era, which occurred when the yen was strong. This era demonstrates that stock prices can rise even when Japan’s currency is strong. In the current context, the quantity effect may gradually diminish the perceived relevance of exchange rates. This means that attention may shift from the level at which the yen is trading to the quantity of Japan's exports and the source of demand.

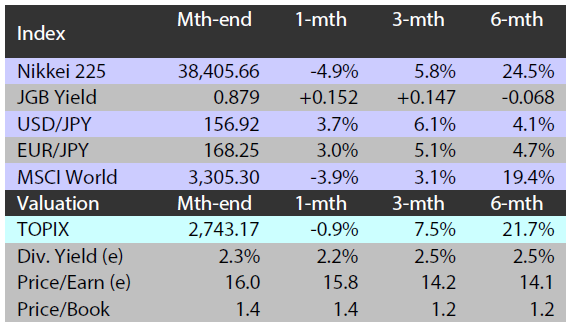

Japan equities edge up in May on Fed easing hopes, solid high-tech stocks

The Japanese equity market ended May slightly higher with the TOPIX (w/dividends) up 1.16% on-month and the Nikkei 225 (w/dividends) rising 0.21%. Stocks were weighed down by a rise in Japanese long-term interest rates spurring equities to appear comparatively richly valued, as well as US Federal Reserve officials’ cautious tone on the possibility of rate cuts at an early stage. However, there were also supporting factors, including expectations for the Fed to slash rates following the release of US economic indicators showing a slowdown in inflation, in addition to the solid performance of high-tech stocks, especially chip-related, on the back of strong earnings results at a major US semiconductor firm. These positives outweighed the negatives and led to an overall rise in Japanese equities.

Of the 33 Tokyo Stock Exchange sectors, 18 sectors rose with Insurance, Other Products, and Electric Power & Gas among the most significant gainers. In contrast, 15 sectors declined, including Real Estate, Land Transportation, and Pulp & Paper.

Exhibit 1: Major indices

Source: Bloomberg, 31 May 2024 |

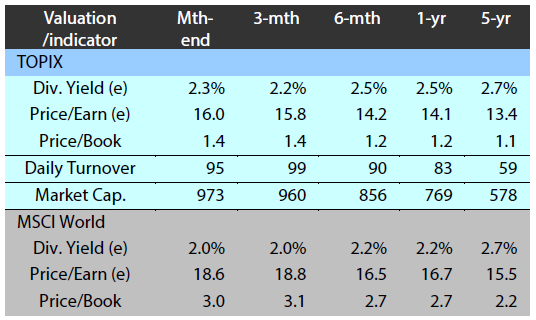

Exhibit 2: Valuation and indicators

Source: Bloomberg, 31 May 2024 |