Emerging growth narratives such as semiconductors may come into focus in 2024

While impressive, the flying start for Japanese stocks in 2024—the Nikkei Stock Average surged to a 34-year peak early in January and is up 8.5% year-to-date at the time of this writing—may have left more questions than answers. The reason behind the market’s rally is not entirely clear, especially given the seeming lack of new market drivers. Although the weak yen has been attributed as a factor, a look at the charts shows that a correlation between stock prices and dollar/yen levels has not been strong recently. The revamped Nippon Individual Savings Account (NISA), whose enhanced tax benefits are expected to attract individual investors to stocks, has also been suggested as an incentive behind the early January market rally. The new NISA is expected to support the market over the longer run. In the short term, however, Tokyo Stock Exchange data show that individuals were net sellers of stocks during the first three weeks of January, possibly having sold into the rally to take profits. The driver of the January rally could therefore have been something more mundane, such as fundamental demand that is common at the start of the year but not necessarily linked to specific incentives.

A rally without a clear cause can leave stocks exposed to sudden corrections, and the market could be susceptible to turbulence caused by developments like the Bank of Japan (BOJ) steering monetary policy towards higher interest rates. The question is whether there are factors which can sustain the market through such turbulence and potentially take it higher. In this regard, the recent robust performance by Japan’s semiconductor-related shares could be the next hot topic for the market in 2024. These firms are enjoying support with the semiconductor cycle seemingly having bottomed out and many have seen a strong recovery in revenues. In the longer run, Japan’s semiconductor-related firms stand to benefit from factors such as active government support, partnerships and alliances among the sector’s domestic companies, leading foreign manufacturers setting up production hubs in Japan, and realignment of supply chains.

Japan was once a semiconductor powerhouse and developments towards the country regaining some of its former heft could become the stock market’s growth story for 2024. Such a growth narrative may provide some stability to the market when the time comes for the BOJ to end its negative interest rate policy and pave the way for monetary policy normalisation. It will be worth remembering that when the central bank takes a step towards normalising monetary policy, its decision will be based on confidence that the rise in wages has become sustainable. A sustained rise in wages, coupled with persisting labour shortages, would result in increased consumption and capex, in turn allowing the stock market to ride out any appreciation by the yen resulting from the BOJ’s change in policy. For the time being, we therefore maintain our view of the Nikkei ending the year around 36,500.

BOJ takes a slightly hawkish turn but maintains a slow and steady approach

At its policy meeting in late January the BOJ stood pat on its super easy monetary policy as widely expected, but it raised eyebrows by taking a slightly hawkish turn, with Governor Kazuo Ueda saying that the likelihood of the central bank’s 2% inflation target being reached was gradually increasing. Ueda’s comments may have inevitably heightened market expectations that the BOJ will end its negative interest rate policy (NIRP) within the next several months. One of the key takeaways from the January policy meeting, however, is that the BOJ maintained its slow and steady approach; Ueda emphasised that an end to NIRP would not lead automatically to steep rate hikes and that monetary conditions would be kept accommodative.

Ueda’s comments regarding the inflation target can be seen as gentle reminder that the BOJ is serious about ending NIRP, with an added hint that monetary policy normalisation has now appeared on the horizon. In that respect, Ueda appears to be doing an ample job communicating with the markets and avoiding unwanted surprises. There is only so much even a BOJ governor can do, however. A sustained rise in wages is not one of them—as much as Ueda may want to see wages rise steadily, his only option is to patiently wait for the evidence to gather. In that respect the BOJ is as data dependent as the Federal Reserve (Fed) is. The BOJ’s slow and sometimes seemingly overcautious policy approach also resembles the Fed’s, and as long as Ueda sticks to such a stance, any shocks the market may feel from policy changes should be limited.

We still have to wait for definitive wage-related data, but evidence so far suggests that sometime this year Ueda may eventually see the sustained wage rises he is waiting for. A growing number of domestic companies have announced wage increases for 2024 that surpass those from the previous year. The Japanese Trade Union Confederation, known as Rengo, which is the country’s largest labour union, is demanding a wage increase of at least 5% at the “shunto” negotiations—the annual discussions between labour unions and employers held every spring. Given that the rise in Japan’s core CPI is expected to eventually ease below 2% (with the figure having increased by 2.3% year-on-year in December 2023), wage increases may finally exceed inflation in 2024 as the central bank hopes.

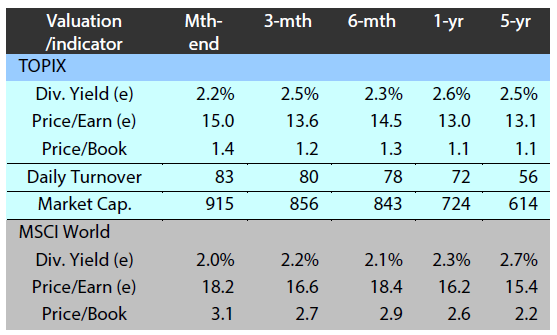

Market: Japanese equities rally in January

The Japanese equity market rallied in January with the TOPIX (w/dividends) up 7.81% on-month and the Nikkei 225 (w/dividends) rising 8.44%. Stocks were weighed down by the rise in Japanese long-term interest rates stemming from the outlook for normalisation of the BOJ’s monetary policy based on remarks made by the central bank’s governor at the press conference following the most recent Monetary Policy Meeting. However, this was more than offset by a number of positive factors including expectations for growth in the semiconductor industry amid AI-related demand, rising interest in Japanese equities from overseas investors on the back of strong corporate earnings and anticipation of solid exporter earnings.

All of the 33 Tokyo Stock Exchange sectors rose on-month.

Exhibit 1: Major indices

Source: Bloomberg, 31 January 2024

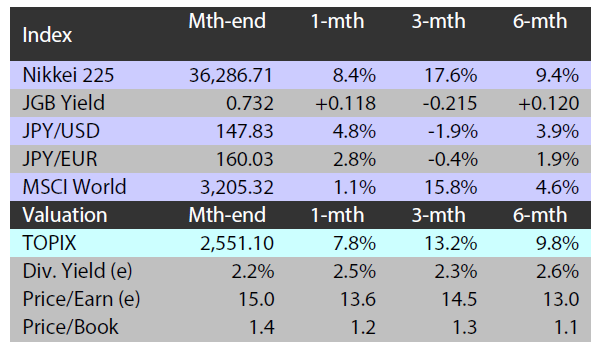

Exhibit 2: Valuation and indicators

Source: Bloomberg, 31 January 2024