Here are the key takeaways from the Global Investment Committee (GIC)’s central scenario:

- Robust corporate earnings and firm employment alongside expectations for rate cuts are seen keeping markets more buoyant than anticipated by average consensus estimates.

- The Federal Reserve (Fed) appears committed to delivering cuts. The Fed, however, may only be able to deliver one cut this year if growth and inflation do not slow as much as expected. The ability to deliver at least one cut thanks to early disinflation may still act as a tailwind to growth thereafter.

- The European Central Bank (ECB) could maintain its monthly reductions of its balance sheet assets but may find it difficult to deliver cuts amid higher-than-anticipated inflation.

- With Japan’s “virtuous circle” of reflation likely to remain intact, our central scenario includes stronger private investment and domestic consumption assisted by real wage growth.

- Chinese growth is likely to remain constrained below 5%, but the composition of the country’s GDP is expected to improve alongside better-than-expected external demand.

- The risks to our outlook are concentrated toward higher inflation, which could potentially restrict real GDP growth. These risks are expected to intensify toward the end of 2024 on issues including resource-driven inflation and escalating fallout from political divisions in the US.

Q1 2024 in review: heartier growth and disinflation disappointment

As the GIC convened on 27 March, we found that our scepticism at our December meeting toward aggressive rate cuts by the Fed was justified. As growth remained much more robust than markets had been expecting at the time, disinflation continued at an accordingly much more gradual pace than expected through the end of 2023.

The slowdown in US growth that the markets had anticipated in December 2023 has not materialised, and expectations were revised from a “soft landing” to a “no landing” scenario (a temporary slowdown in growth). GDP figures remained robust, topping 3% in the US; at the same time, core inflation had come down to mid-2% levels, of which Fed officials spoke approvingly. Markets continue to price in three Fed rate cuts this calendar year. However, unexpected weakness in the labour market did not occur, and markets have priced in minimal risk of an immediate downturn. Growth in the Eurozone, while struggling to remain positive, continued to muddle through; core inflation remained stubbornly above the ECB’s target rate of 2%, although markets continue to price in a June cut. The Bank of Japan (BOJ), having recently exited unconventional easing measures including negative interest rates, yield curve control and ETF purchases, signalled that it will remain accommodative for quite some time as it watches for signs of Japan’s reflationary “virtuous circle” gaining traction. Meanwhile, China’s ailing property markets continued to dampen domestic market sentiment; the government’s commitment to support domestic demand fiscally continues to contrast with officials’ desire to stave off the moral hazard stigma typically associated with public bail-outs in the wake of market crashes. The National People’s Congress (NPC) matched its 2023 commitment to boost China’s economy by 5% year-on-year (YoY). As with 2023, the NPC will also issue ultra-long special government bonds.

Amid this backdrop, and alongside ongoing signals of significantly accommodative financial and monetary conditions, the GIC found it difficult to find immediate catalysts for a downturn in growth.

Current consensus: US and most major economies to avoid recession, China seen struggling to maintain 5% growth

According to consensus forecasts, US growth will likely slow substantially to the 1% range. This would justify the three Fed rate cuts already anticipated by markets. The rate of inflation is projected to ease below 2.5% within the next year, allowing the Fed to pre-empt the slowdown and potentially help the US avoid a recession. According to Bloomberg, potential US growth is estimated to be less than 2% (and falling). This implies that the consensus is for any decline in US growth below its potential to be temporary and highly responsive to the Fed’s stimulus. Nonetheless, consensus estimates show all components of US GDP slowing, with the domestic consumer being the largest driver of the slowdown, before growth rebounds again in early 2025. Meanwhile, private investment is forecast to pick up significantly before the end of 2024 with a cyclical recovery the likely driver. As for exports and imports, both are expected to slow alongside the economy and pick up at the tail end of 2024.

Despite predictions of stagnant Eurozone GDP until the end of 2024, consensus forecasts are for real GDP growth to surpass 1% again and slowly improve into 2025. Meanwhile, the zone’s CPI is forecast to ease from above 3% in Q1 2024 to near 2% by Q2 2025. The consensus is for the ECB to lower rates by at least 100 basis points (bps) over the next four quarters with the first cut coming in June or July with some probability of more aggressive 50-bp cuts along the way if data turn unexpectedly weak.

Japan’s GDP growth is expected to pick up from anaemic levels in Q4 2023 (thanks to robust Q4 private capex, GDP figures were revised and a technical recession was avoided), rising above 1% YoY by Q1 2025. This would be comfortably above most estimates of potential GDP growth, estimated to be around 0.5% by Bloomberg Economics. Due to historic wage rises agreed during the spring “shunto” rounds of negotiations, real wage growth is expected to buoy consumption and keep Japan’s “virtuous circle” of reflation alive. In addition, corporates are seen continuing to support private non-residential investment with healthy capex through 2024. The BOJ is expected to follow its exit from unconventional monetary policy with one or two rate hikes in 2024.

China, meanwhile, is expected to harness fiscal stimulus to keep its growth near 5%. However, consensus forecasts are for China’s growth to slip below 5% by the second half of 2024, eventually decelerating to near 4% by Q1 2025.

In the equity markets, we continue to see considerable tolerance for the historically high valuations of large-cap tech stocks, particularly in the US. This is driven by the market’s anticipation of productivity gains from the widespread use of artificial intelligence (AI) across a variety of sectors. The expected increase in demand and subsequent earnings within these sectors, particularly those that can implement AI efficiently, like large cap tech-adjacent sectors in the US, is likely to keep the market buoyant. This could potentially create a spillover effect to other sectors.

GIC outlook vs. consensus: high liquidity, industry cycle to buoy confidence

The GIC considered the consensus scenario alongside two additional central scenarios. It also considered “tail” scenarios both on the upside and downside of consensus forecasts and settled on one that was mildly to the upside of consensus. Sentiment within the GIC was widely dispersed regarding risks to the outlook. However, one point acknowledged by the attendees was that financial conditions remain extremely accommodative, and they appear to be feeding back into major economies. Not only do risk assets and the “carry trade” remain in demand, but domestic demand indicators (jobs, wages, retail sales) partially owe their resilience to the continuation of accommodative conditions even after the Fed’s rate hikes (see Chart 1: Financial Conditions in the US, EU). Meanwhile, we note that signs of many major PMI’s bottoming out and ongoing adjustments in US inventories-to-shipments provide some additional support to GDP growth. Although a slowdown is possible, the GIC’s view is that even a single rate cut by the Fed, particularly amid already buoyant conditions, may extend the economic cycle. Even if a slowdown does take place, it may not happen within our immediate forecast horizon, but perhaps later, for example later in 2025. As a result, the GIC foresees slightly higher-than-target inflation that compels the Fed to pause after delivering one cut. Following the rate cut, the Fed is expected to remain on hold, watching vigilantly for signs of a slowdown in the labour market.

Chart 1: Financial Conditions in the US, EU

Source: Bloomberg

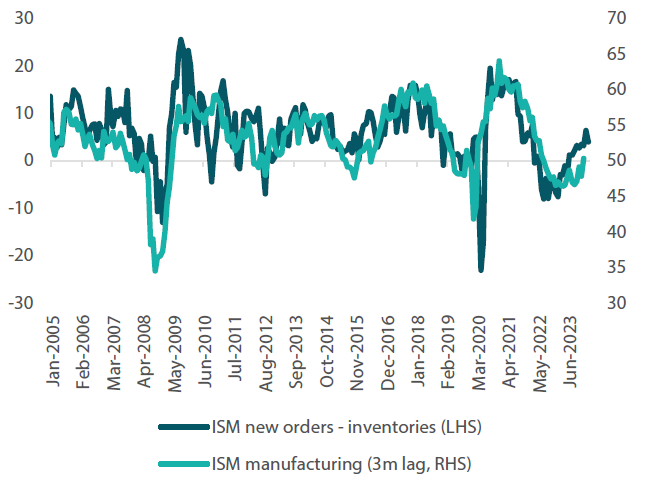

Chart 2: ISM new orders-inventories vs. ISM manufacturing

Source: Bloomberg

Growth and inflation: very constructive across the board

Our committee outlook is for growth to remain above 2% in the US throughout our investment horizon. Additionally, we forecast core inflation to dip toward 2.5% but not sustainably reach disinflation below this percentage. Partially, the forecast for the stubbornly high figure is due to favourable basis effects in H1 2024 disappearing in the latter half of the year. However, given the market has foreseen the potential for a rise in YoY inflation as basis effects are priced out, favourable headline growth should prove the greater force attracting attention. Inflation slowing toward mid-year may allow the Fed to step in with one rate cut before prices rebound modestly, which should only help spur further growth without provoking fears of an inflationary spiral. Meanwhile, we foresee Japan’s healthy above-potential growth continuing for the full calendar year, even with two additional rate hikes over our one-year horizon with the BOJ taking rates to 50 bps by the end Q1 2025. Eurozone growth is likely to remain comparatively muted yet rise back above 1% over our forecast horizon. We still expect the ECB to only match the Fed’s solitary mid-year rate cut due to stubbornly higher-than-target inflation. Although we, along with consensus forecasts, see China being unable to sustainably keep growth above 5%, the composition of growth will be such that domestic demand will recover more than anticipated. Moreover, even as fixed asset investment sustainably regains the 4% YoY growth rate, we see industrial production and domestic consumption surpassing 5%. Inflation is projected to remain modestly positive but below 1% until late 2024.

Policy rates may not be as easy as expected, while longer-end yields could see a measured rise

As growth remains stronger for longer, the GIC foresees less opportunities for the Fed to cut rates than the market anticipates. Hence our central scenario is for the Fed to cut rates in June, though corresponding US growth resilience may keep the FOMC on hold throughout the rest of the year and into Q1 2025. Meanwhile, we expect the Fed to reduce the monthly pace of QT from May. We see this nudging up US 10-year Treasury yields toward 5% by the tail end of our forecast horizon. Meanwhile, we see the ECB keeping its current monthly pace of QT this year and then accelerating as it discontinues the reinvestment of their Pandemic Emergency Purchase Programme in 2025. Our view is that like the Fed, both the ECB and the Bank of England will be able to manage one cut this year before inflation reaccelerates. Accordingly, we foresee German 10-year bund yields drifting toward 3% over the same period (by March end 2025). Over the same period, we foresee UK 10-year Gilt yields moving toward 4.75%. Meanwhile, as the BOJ withdraws accommodation in a gradual manner (raising the uncollateralised call rate to 50 bps by the end of March 2025), we see the likelihood for gradual reductions in its balance sheet starting in Q3 2024.

Foreign exchange: dollar remains formidable as appetite for carry persists

Both market watchers worldwide and central banks continue to monitor the Fed’s rate cut prospects for guidance. As such, we expect the combination of robust growth and the prospect of a rate cut by the Fed being limited to a solitary action in June in the near-term keeping the dollar supported over our investment horizon. Nonetheless, our above consensus forecast relies on ultra-easy financial conditions to persist, prolonging central bank liquidity even if the Fed remains on hold in the latter part of 2024. For this reason, we foresee dollar/yen staying elevated at current levels, with little impetus to adjust downward until financial conditions (including equities, credit spreads, volatilities, etc,) tighten. Likewise, we see euro/dollar ranging between 1.05 and 1.09 and sterling/dollar moving between 1.24 and1.28. We see a modest upside for dollar/yen toward 154 at the end of our investment horizon so long as 1) financial conditions remain easy, 2) carry trades continue and 3) the Fed fails to deliver cuts currently priced into the market. Meanwhile, we think that further BOJ rate hikes are already priced in by the market.

A strong liquidity narrative for equities while productivity benefits of AI could be realised early

In light of the favourable growth environment and controlled, albeit higher-than-anticipated inflation, we see a positive outlook for global equities. Until now, many of the gains have been concentrated in the tech sector, particularly those involved in AI-related semiconductors and software development. However, we see some potential for an extended late cycle rally that could broaden the gains beyond tech-centric sectors. This includes those that might benefit from stronger-than-expected domestic demand in the US and Asia including Japan in particular.

Meanwhile, we note that manufacturing PMI’s appear to have bottomed in many areas. This may be particularly supportive for areas with struggling growth such as China and Europe. The continuing adjustment in US inventories is most likely positive for exporter firms world-wide.

The GIC foresees robust earnings growth continuing in most sectors. But given the greater-than-expected surge in global stock indices over the last two quarters, we see upside in price activity to be limited through the remainder of 2024. We expect Japan’s TOPIX to rise further, gaining around 11% over the coming financial year, benefiting from low volatility, a weak yen and rebounding domestic growth. Meanwhile, we foresee decent but slightly lower gains of 6 to 7% YoY for the S&P 500 and the MSCI by March 2025. Hong Kong’s Hang Seng could rebound from low levels, potentially gaining 14% YoY by March 2025; MSCI Asia ex-Japan could also see similar gains.

Risks to our outlook: elections, geopolitics and central bank policy errors

Given that the GIC’s view is on the higher side of consensus, downside tail risks likely outweigh upside tail risks. Although we do not foresee them as central scenarios, we are also aware that they are sizeable hurdles. The risks include the following:

- Sub-optimal decision-making around elections: Elections will take place in many major economies, including the US. In the initial stages of US presidential campaigns, candidates often employ inflammatory rhetoric, including threats of varying degrees of protectionism. Among such threats issued by presidential candidates are across-the-board implementation of a 10% tariff on all US trade partners and even more punitive tariffs targeting China. Although not our central scenario, imposition of such tariffs would likely pose risks for US trade partners and even Washington itself, and inflation may diverge from the Fed’s target. Should inflation become untethered, the risk of central bank policy errors may rise. The overall impact is likely to be inflationary for the US and unfavourable for cross-border trade, consequently affecting Washington’s trade partners negatively. Protectionism surrounding cross-border investment flows, such as the much publicised resistance to a merger in the US steel sector, may also usher in less favourable conditions for global markets. However, this is likely to have a much smaller impact compared to comprehensive trade tariffs. Cross-party antagonism, both in the run up to and after the US elections, also remains a risk. The US, however, has so far managed to avoid the type of brinksmanship that invites speculation over potential defaults on debt payments. Although our central scenario is for the US to remain free of debt default concerns, there is still a very small probability that political brinksmanship will escalate to a level that may disrupt the trading in US Treasuries and disturb ultra-easy financial conditions. Likewise, although immigration to the US has helped prevent wage rises from spiralling out of control despite tight employment conditions, the approach of the election increases the threats of draconian policies. Such policies could potentially deprive the US of inflation-mitigating labour supply, which is crucial for steering core inflation back towards its target.

- Uneasiness over Ukraine support, escalation of war in the Middle East, protracted disruption of shipping routes: There appears to be no imminent end to Russia’s ongoing war with Ukraine, and therefore few prospects of imminent peaceful growth-enhancing reconstruction. Europe, which has experienced general political opposition to Russia’s incursion, remains the hardest hit by the war, seeing volatility in fuel and food prices. Europe is likely to keep up, if not increase, military spending in response to the ongoing conflict. But lack of resolution, and potential for escalation, are likely to keep sentiment cautious. Although our central scenario does not involve the US halting aid to Ukraine, it remains a remote probability. If it is realised, it may result in a downward adjustment to our Eurozone growth forecast. It could also lead to our Eurozone inflation forecasts being revised higher, with spillover to the zone’s trade partners in particular.

- Central bank policy errors: Although the BOJ withdrew unconventional easing smoothly and the Swiss National Bank initiated the OECD rate cut cycle with little impact, there remains some risk. This risk is particularly relevant at pivot points in central bank policy, where market reactions to decisions—be it rate cuts/hikes or prolonged inaction—could be potentially unfavourable. Even though most forecasters do not hold either risk as their central scenario, a Bloomberg survey shows them seeing a higher impact risk from the ECB cutting rates too soon rather than waiting too long. There remains a similar risk that US markets may react poorly to any Fed rate cut (or lack thereof) should economic data unexpectedly weaken. This might happen in anticipation of Fed rate cuts, or even after the first rate cut. In such a case, the market may come to the conclusion that the Fed kept rates on hold for too long and depended too heavily on financial conditions to supply the liquidity it could not provide. However, this is not our central scenario.

Investment strategy conclusion: continue to see opportunities in the extension of the current growth cycle

As we noted in the Equities section above, our view is that the current US-led global growth cycle has further to run. So long as growth remains above expected in the US, external demand elsewhere (even in the lagging Eurozone) is likely to be buoyed, and economies in which domestic demand is slowly picking up (such as in Japan) or recovering from a slump (such as in China) have some additional time wherein to build a broader base of GDP growth. We expect the steady stream of investment in the tech sector to generate a more diverse range of opportunities for sectors that might be at the forefront of harnessing the productivity benefits of new technologies such as AI. This will likely boost growth. Although we see central banks responding to stronger-than-expected growth by limiting policy stimulus, we have observed that financial conditions still remain extremely accommodative despite rate hikes from the Fed, the ECB, and more recently, the BOJ. We do not expect these conditions to last forever. However, we also see little reason to turn risk-averse, given ample evidence of persistent risk tolerance across global markets. Nonetheless, high-liquidity conditions and low volatilities mean that unexpected events—either policy moves or unforeseen shocks to growth—may take markets by surprise. As such, we believe that it is worthwhile maintaining a well-diversified portfolio that includes currently out-of-favour defensive sectors and inflation-protected securities, in addition to an approach to incorporate longer-dated bonds as yields rise gradually toward the end of our investment horizon.