The latest Global Investment Committee (GIC) meeting was held on 2 December. As we looked back over the past quarter, we noted that long-term interest rates had been adjusted in line with our projections in Q3. In addition, multiple interest rate cuts that had been factored into the US yield curve after easing by the Federal Reserve (Fed) in September were priced out again. US growth remained positive in line with our forecast; in fact, the growth rate came close to the upper end of our guidance range set in Q3. The dollar regained support after November's US presidential election. In addition to the presidency, the Republican Party secured majorities in both houses of Congress.

Key takeaways are as follows:

- We upgraded our near-term US growth outlook because the softer signals in the US labour market and household consumption have either proven slow to progress or have adjusted upward. Meanwhile, the Fed has signalled that its rate cut cycle is not yet complete. Furthermore, anticipation that the incoming US administration will implement stimulus also appears to be buoying market sentiment, and that of higher-income households. We continue to see heightened tail risks associated with inflation rising in the US. We would therefore continue to look for assets resilient to inflation and volatility to hedge tail risks within a global portfolio. We remain constructive on gold and the Japanese yen as portfolio diversifiers.

- We continue to favour Japanese equities due to ongoing indications of Japan's structural reflation and relative undervaluation. The competitive risk premium Japanese equities now offer is also appealing. Within this context, we continue to look for value among Japanese domestic demand-related stocks as these may be more resilient in the face of any correction in US markets.

- We take a wait-and-see approach going into 2025 following the correction in long-duration US bonds, given expectations for the Fed to ease aggressively have already been reversed. We are cautious over fiscal risks and trade uncertainty as potential disrupters of the longer end of the US yield curve. We have emphasised that US bonds no longer provide adequate downside diversification in the event of a pull-back in US equities, and we continue to search for better diversifiers in case US growth eventually slows. We continue to view long-term US bonds with caution.

- We also await announcements about additional Chinese stimulus. These measures could be unveiled once the incoming US administration has settled on their trade policy with China. The stimulus measures could be a combination of fiscal easing and renminbi (RMB) depreciation.

Q4 2024 in review: stocks emerge as winners of the "great dispersion" trade

The US economy was firmer than expected, with Q3 GDP growth approaching 3% year-on-year (YoY). This came in near the upper end of our Q3 inter-quartile guidance range. US employment seemed to be on the verge of weakening in September, but now appears to be holding steady, albeit less strong than in earlier quarters. US consumption also remains firm. Stubborn services inflation and its impact on the US core PCE continues to prevent the Fed from easing aggressively. While the Fed delivered another cut after its surprise 50 basis points (bps) cut in September, it has removed forward guidance from its monetary policy statement.

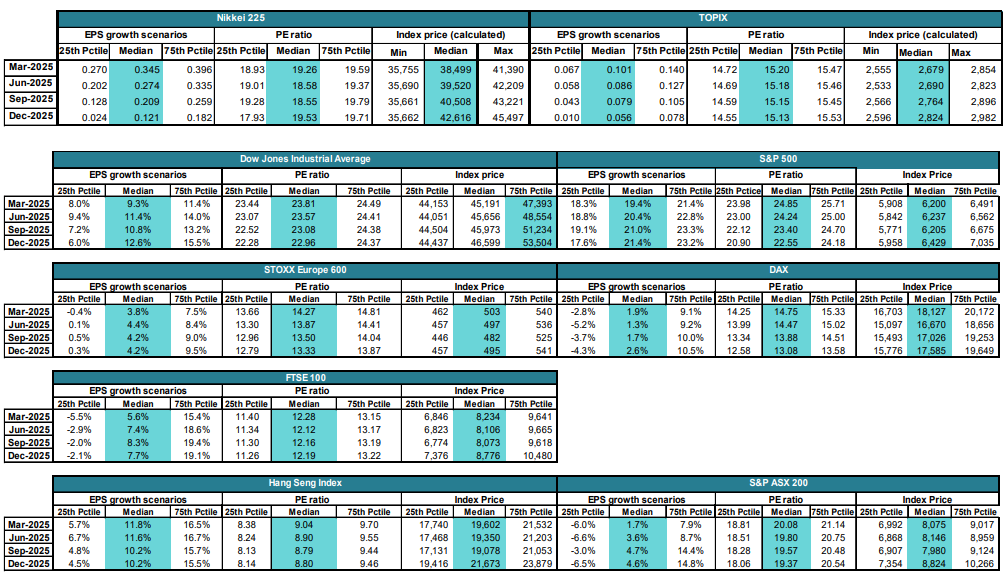

As we near the end of 2024, anticipation that Donald Trump will implement growth-enhancing policies upon his return to the US presidency is boosting equity markets. Prior to the US election, the stock and bond markets had priced in contrasting economic scenarios. Bond pricing pointed towards a significant slowdown in growth, while equity valuations kept getting richer. In the short term, Trump's win put an end to speculation that weak underlying growth would prompt the Fed to cut rates aggressively and rapidly. However, caution may be warranted as already stretched US stock valuations have continued extending, even as the US debt-to-GDP ratio has effectively reached historical highs of 120% (Chart 1). Prior to the election, the GIC had assessed that tail risks, such as disruptions to the US yield curve, had increased. The unexpectedly strong mandate that US voters gave the Republican Party has meanwhile lowered the risk of immediate Congressional conflict over the debt ceiling. However, it has also increased longer-horizon tail risks associated with the anticipated fiscal easing combined with an already stretched US fiscal position.

Chart 1: US debt, current account balance as percent of GDP

Source: Nikko AM, St. Louis Fed, IMF

Meanwhile, markets outside the US have been factoring in potential disruptions from tariffs and other isolationist policies forthcoming from the US. For example, while Chinese stimulus so far may have been disappointing, Chinese government officials have every reason to wait until they can assess the new US administration's plans before offering any additional stimulus for domestic demand. Separately, the October snap election in Japan resulted in a loss by the ruling coalition led by the Liberal Democratic Party (LDP) of its majority. Without a majority the LDP-led coalition has had to compromise with opposition parties. This has led to proposals for fiscal stimulus designed to support lower-income households. These measures have the near-term potential to support domestic demand, even as uncertainty over the impact of US trade policy has tempered the yen's rebound. Compared to Europe, the situation in Japan is still more favourable. Europe, struggling with lagging demand, is dependent on the European Central Bank (ECB) to deliver additional stimulus. This is particularly true as Europe is gripped by trade uncertainty from the US and a political crisis in France, and by a forthcoming snap election in Germany, scheduled for February 2025.

Global macro: run with the bulls but mind the tails

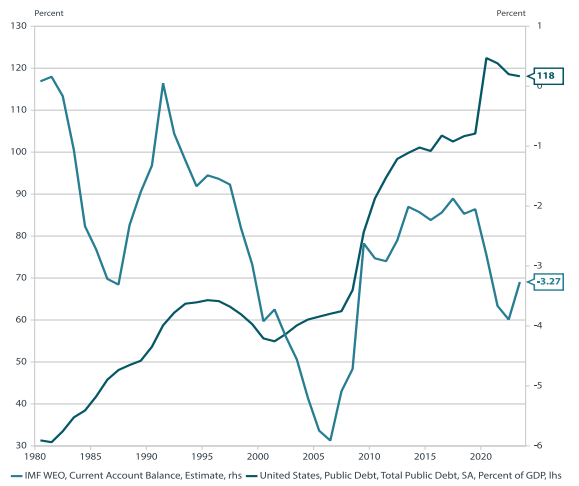

US: Macroeconomic indicators have been surprisingly resilient. This is despite some softening in employment data, particularly in the household survey, which forms the basis for calculating the unemployment rate. Lower-income workers occupy a higher proportion of the household survey than of the establishment survey (the basis of the non-farm payrolls report). Chart 2 shows historical divergence between the job creation estimates of the two surveys. The divergence is consistent with that of US Conference Board Confidence indicators, which have shown upticks in the sentiment of higher-income households, while that of lower-income households remains non-expansive. Amid these indicators of a two-tiered economy, it is possible that the wealth effect—the impact of higher-income households' investment portfolios—along with solid real income growth, has helped boost consumption, particularly among upper-middle-income households. However, the rise in unemployment in November, coupled with surprisingly weak retail sector labour demand—which tends typically to be strong ahead of US holidays—may suggest a potential softening of consumption in the near future. Meanwhile, the ratio of job offers to job seekers also declined.

Chart 2: Employment conditions in the US

Source: Nikko AM, BLS

The GIC upgraded its near-term US GDP growth guidance. The GIC anticipates YoY growth to fluctuate around the mid-2% range in the first half of 2025. It then sees growth slowing modestly to below 2% by the second half of the year, although it anticipates some downside risks. As such, the growth upgrade comes with some caveats. One GIC member expressed concern that although there is widespread anticipation that the incoming US administration will offer growth-supportive fiscal stimulus, there is the possibility that such expectations could be disappointed. Another member saw risks that the incoming administration's announced plans to cut jobs in the federal government sector (which employs around three million people according to the Bureau of Labour Statistics) could backfire at a time when job growth is slowing significantly. However, voters almost unanimously expect both headline CPI and core PCE to remain above the Fed's 2% target throughout 2025. The lower end of our inter-quartile guidance range is seen remaining above 2% over 2025, with the higher end anchored below 3%.

Japan: Recent indicators are consistent with an above-trend Japanese GDP growth trajectory; potential GDP has been estimated at around 0.6% by the BOJ. The GIC's median scenario is for GDP growth to slow only modestly, continuing to grow above 1% YoY over 2025. However, risks to the downside are also apparent, particularly given the unknowns inherent in US trade policy and its subsequent repercussions on external demand. Although positive growth above 1% remains our base case, the lower end of the GIC's interquartile range drops below zero during 2025, with a probability of 25% or less that growth will turn negative due to an external shock, especially in the latter half of the year. Nevertheless, it is significant that Japanese household consumption continues to strengthen, even at a slow pace. Compared to net exports' negligible share of GDP, household consumption accounts for over 50%. This means that the longer Japan maintains its "virtuous circle" of positive wages and prices, the more likely it is to establish domestic demand as a buffer to any downturn in external demand. Headline CPI is foreseen dipping below 2% as early as the September quarter of 2025, with imported price inflation being mitigated by a slowly strengthening yen. So long as expectations for the yen to gradually strengthen hold, the GIC also foresees ex-fresh food inflation dipping below 2% in the latter half of 2025.

Euro area: The GIC expects eurozone GDP growth to break above 1% YoY in early 2025 and gradually pick up over the course of the year. The GIC also expects headline HICP to fall below 2% by Q2 2025 and core HICP to slow towards the 2% target over the course of the year, allowing the ECB to continue cutting rates. Households continued to build savings even as real incomes improved over recent quarters, but the ECB's rate cuts should eventually reduce households' incentives to save and their spending could keep growth in positive territory. However, if US tariffs targeting China materialise, competition between China and the eurozone may intensify. On the other hand, the single currency bloc may also benefit from Beijing's fiscal stimulus if Chinese authorities, in a bid to allay pressures from US tariffs, are successful in bolstering domestic demand growth. Another source of uncertainty is the political instability in some Euro area member states. Governments in key Euro area economies like France and Germany remain in flux and are facing a deadlock over budgets. This situation, if anything, could put greater pressure on the ECB to provide the stimulus that member states faced with political pressure have yet to implement.

China: The GIC expects China's 5% annualised GDP growth target to remain elusive as the country struggles to spur private investment and export growth to offset weakness in domestic consumption and address a backlog in the residential pipeline. Recent stimulus measures focused on monetary easing and bond swaps. The latter measure is designed to replace the liabilities of local government financing vehicles, which have been capped at Chinese yuan 10 trillion over the next five years. Markets so far have been sceptical about whether measures to date can deliver lasting support to China's ailing growth. However, the GIC believes that China is keeping some of its fiscal powder dry, preserving its ability to react to protectionist measures, such as the imposition of sweeping tariffs by Washington. We would estimate that China would need to generate an additional 1-2% domestic growth to offset the impact of across-the-board tariffs of 60%, and officials may resort to both fiscal easing and RMB depreciation. Still, the better scenario for growth would be if the US threatens high tariffs but implements lower ones (e.g. threatens 60% but delivers 40%). This might cause China, even reluctantly, to embrace more expansive domestic demand-stimulating measures if it believes that tariffs may otherwise push the foundering economy towards civil unrest, which it would likely want to avoid at all costs. Meanwhile, given sluggish demand, the GIC expects China to experience continued price declines , foreseeing core inflation to remain in negative territory in the first half of 2025. Meanwhile, the Chinese bond market remains strongly placed for future issuance, which we see as a positive for China's ability to finance stimulus in 2025.

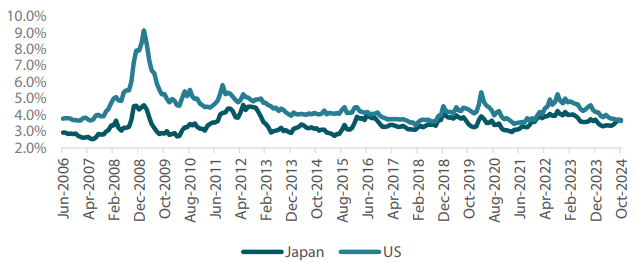

Interest rates: narrowing differentials vs yen rates

FOMC: In line with market expectations, the GIC expects the Fed to continue cutting rates gradually throughout 2025. The GIC's central scenario is for the Fed Funds rate to bottom out in Q3 2025, with the Fed remaining on hold the rest of the year. The GIC's central estimates are for the Fed Funds rate to reach between 3.4% and 4.0% at the end of 2025. If growth continues to exceed expectations, the Fed may stop cutting rates earlier. The GIC does not expect inflation to dip below 2% in 2025 and if this scenario is realised, the Fed may pause or end its cut cycle earlier than markets anticipate.

BOJ policy rates: Unlike most central banks, the BOJ remains on a path of gradual rate increases. The GIC expects the BOJ to hike policy rates, currently at 25 bps, by an additional 25 bps before the end of March 2025. Although we expect the pace of the BOJ's tightening to remain gradual, our central scenario is for it to hike an additional 25 bps in the latter half of 2025, taking the policy rate to 75 bps. We see US-Japan interest rate differential narrowing roughly by 75 bps and the differential with European policy rates decreasing by a full percentage point over the year. One voter however cautioned that if the BOJ accelerates the pace of its rate hikes, it risks upsetting the delicate balance of Japan's wage and price rises, known as the "virtuous circle" of reflation.

ECB: The GIC anticipates that the ECB will continue to cut rates to offset poor economic growth in the eurozone, which may be compounded by political instability in some of its member states. One GIC voter voiced concern that the ECB's forthcoming rate cuts may not be timely enough, thereby prolonging the eurozone's slow growth. That said, the GIC's main scenario is for interest rates to be well below 3% by the end of March 2025 and to end the year below 2%. Our inter-quartile guidance range suggests that policy rates could be between 1.65% and 2.5% at the end of 2025.

10-year interest rates: For most of 2024, the correlation between equities and 10-year bond prices had been positive, meaning long-term bonds did not provide sufficient diversification from market risk. Recently, this trend shifted, with stocks favoured and experiencing a rally while bonds adjusted in anticipation of a Trump election victory. However, as Trump's presidency nears, there are not many reasons left to drive bond yields higher, especially considering the Fed's ongoing easing bias. Last quarter, we noted the strong influence financial markets have on policy. This influence could dilute the usefulness of financial market indicators, such as term structures of interest rates which serve as forward indicators of economic activity. We remain cautious, even after the recent bond market correction, as further disruptions in the longer end of the yield curve could yet occur. Despite differing monetary policy trajectories, we continue to emphasise the positive correlation that exists across geographies in longer-term bond markets. That said, the GIC anticipates that the JGB yield curve will remain positively sloped, reflecting gradual BOJ normalisation amid above-trend growth. The GIC's central scenario is for 10-year Treasury yields to remain in a close range from their current levels, with fluctuations between 3.9% and 4.4% over 2025. Any disruption in the longer end of the yield curve remains a tail risk. GIC members see slightly more potential for movement in 10-year Bund yields over 2025, with an inter-quartile guidance range of 1.83% to 2.38%.

Foreign exchange: stronger dollar, but not against the yen

The GIC upgraded its outlook for the US dollar due to uncertainty over protectionist measures that the incoming US administration may enact. However, in consideration of the relative economic fundamentals across geographic regions, we no longer expect the dollar to show strength against the yen. The GIC expects the dollar to be strongest against the euro , the Australian dollar and the British pound , driven chiefly by widening yield differentials favouring the dollar. However, as we noted above, we expect the BOJ to continue withdrawing stimulus, in contrast to the Fed, ECB, Bank of England and the Reserve Bank of Australia. We expect the euro/yen to remain particularly soft on narrowing yield differentials, with the pair seen eventually falling below 150 as the euro/dollar approaches parity. While we see some probability that euro/dollar may reach parity at some point in 2025, our central scenario is for the pair to generally remain above parity.

Commodities: strong gold, weak oil

Despite ongoing geopolitical risk events, such as the recent deposition of Syrian leader Bashar-al-Assad, oil prices remain subdued due to plentiful supply from non-OPEC economies and decreasing demand from China, the world's largest oil consumer. The incoming US administration's plans to expand domestic oil production may also be placing downward pressure on prices. However, given the recent record highs in US oil production, the appeal of expanding oil production capacity in an already soft market may not be as strong for producers as it was when oil prices were high. Still, supply continues to trend upwards, even as demand appears to have peaked. The GIC expects these developments will result in Brent crude futures falling below USD 70 per barrel in 2025. The GIC remains constructive on gold in 2025, anticipating the precious metal to climb past USD 2,800 per ounce and potentially break above USD 3,000. The unusual positive correlation between equities and US Treasuries, a traditional risk haven, has reversed according to some measures. Still, the GIC does not expect the large, liquid bond market of an indebted US to provide the diversification value it once did and gold remains a viable diversifier against the risk of disruption in the longer end of the US yield curve or, more generally, against the inability of US Treasuries to act as an adequate hedge against market risk.

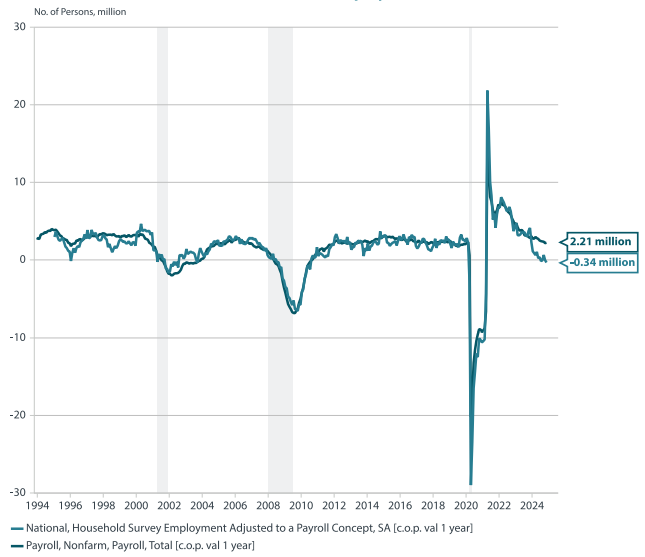

Earnings growth robust in the US and Japan, valuations likely peaking

It is undeniable that the US equity markets, which are highly concentrated, are richly valued when historical and geographical comparisons are made. As we see in Chart 3, US P/E multiples are far above their recent 20-year range. This is also causing global portfolios to exceed their historical valuation ranges due to the rapidly growing relative US market capitalisation. Despite this, there are few apparent catalysts to bring equity prices immediately lower. This is largely due to double-digit earnings growth that continues to exceed expectations alongside accommodative financial conditions. For example, US and European credit spreads are near historical lows while the Fed is still cutting rates. The GIC's outlook for US earnings remains upbeat. Nonetheless, we believe that valuations may have peaked, and we expect index gains to lag earnings growth in 2025.

Chart 3: Relative equity market valuation

MSCI, Mid & Large Cap, 12m-forward P/E

Data for the last 20 years

Source: Nikko AM Global Strategy and Macrobond, data as of December 2024

Meanwhile, we continue to foresee healthy earnings growth driving gains for Japanese stocks . Although Japanese stocks are in the lower end of their 20-year valuation ranges, we see valuations as likely to remain relatively flat over 2025. The GIC expects US valuations to remain higher than their global counterparts over the near-term horizon. Meanwhile, we also see European earnings remaining mired in the low single digits, possibly even turning negative as growth in the region remains sluggish and the impact of US tariffs are as yet uncertain. For UK and Australian stocks, the GIC foresees a reasonable probability that earnings growth will fall into negative territory at some point in 2025, with valuations unlikely to rise beyond average historical levels. The Hang Seng , which is driven by internet stocks and financials, may receive a modest boost from ongoing tech sector interest and the possibility of stimulus from China in response to US protectionism over the course of 2025.

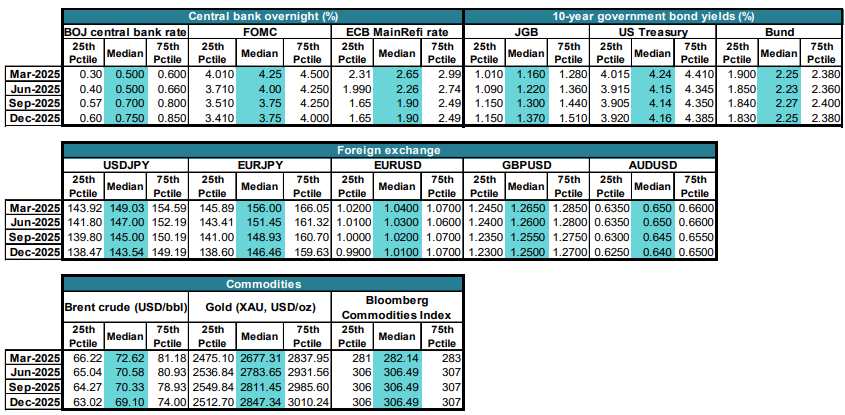

Japan equities: "virtuous circle" to continue and help diversification value

Given the dearth of diversifying assets to counter increasing concentration in US equity markets, we expect that maintaining a certain allocation in yen in a multi-asset portfolio could provide downside protection. This is because the yen tends to appreciate when investors turn risk-averse. Investors also have alternatives for yen allocations other than cash. In fact, we see additional value in Japanese stocks, both on an absolute basis in the short term, and on a relative basis in the longer term. As long as the US equity rally continues, we believe that a combination of cyclical factors—including the carry trade, the yen's weakness and risk tolerance—is likely to continue buoying Japanese stocks. Furthermore, we see Japan's relative fundamentals remaining attractive even when the US growth cycle eventually slows. As we noted in Japan's pivotal improvement in risk premium | Nikko AM Insights the US equity risk premium has been declining while that of Japan has started to offer a competitive payoff (Chart 4).

Chart 4: US and Japan equity risk premium: parity achieved

Source: Bloomberg, Nikko AM, October 2024

We expect Japan to offer good diversification and downside protection primarily because of its solid structural reflation credentials. These include labour supply shortages (which are driving real wage gains as well as investment in software), as well as steady improvements in corporate governance, profit margins and return on equity. These factors are gradually penetrating the domestic side of Japan's economy. The longer the rebound in domestic demand growth continues, the more likely Japan is to offer value through a shift from export-oriented large manufacturers to more domestically oriented smaller-cap firms. For Japan to remain resilient even if US growth eventually loses momentum, it will be crucial for smaller firms to continue absorbing wage rises and passing on costs to customers.

Risks to our outlook: tariffs, inflation, Trump slump

Although we upgraded our US growth outlook, GIC voting members generally saw tail risks as elevated. Such risks include the following:

-

The other side of the "Trump bump", policy disappointment and inflation: The highest-probability risk cited by GIC voters (assigned between 25% and 50%) is a potential policy mishap or setback from the incoming US administration. Given the markets' optimistic reaction to the election outcome, one GIC voter sees a significant potential for disappointment. This could potentially disrupt capital flows if the incoming administration's policies fail to live up to market expectations. Even without poor policy implementation, GIC voters remain alert to the risk that US government spending and job cuts may coincide with the end of fiscal expenditures from the IRA and other past government spending.

There is concern that future tax cuts will be unable to offset the drag on growth resulting from this drop in spending. A high-probability risk is the imposition of tariffs against various trade partners, particularly China, which has been threatened with across-the-board tariffs of up to 60%. The tariffs, together with stated intentions to deport undocumented immigrants, may be inflationary for the US. Higher-than-anticipated inflation could prompt the Fed to cut short its monetary easing regime, which could also offset the stimulatory effect of any income tax cut.

-

Political risks outside the US: Although US policy uncertainty may be the most prominent and possibly the most impactful factor for global investors, it is clear that geopolitical risks elsewhere have also risen. In Europe, political instability comes at a time of weak economic growth; should political deadlock persist in Europe's largest economies, one voter foresees the possibility of the euro/dollar falling through parity and remaining under pressure. Likewise, Asia is not free of political instability, as demonstrated by the South Korean president's recent attempt to impose martial law. As trade pressures rise and Chinese economic woes continue, GIC members are also keeping an eye on the peripheral risk of escalating militarisation and China's threats of Taiwan annexation.

Investment strategy conclusion: cycle extension but with downside protection

We have upgraded our near-term economic outlook for the US and anticipate Japan's "virtuous circle" to remain intact. We expect the Fed's rate cuts to date to enhance already accommodative financial conditions in the US. Meanwhile, US growth has exceeded expectations, coinciding with markets' positive reaction to the US election result. Predicting the timing of any cyclical market downturn remains challenging. However, we also highlight heightened tail risks associated with policy disappointments in the US going into 2025. We continue to see risks as biased towards the inflationary, and we also foresee expansionary US fiscal policy as ultimately unsustainable.

The ongoing cycle extension, along with upside risks of inflation, favour the holding of stocks which may help protect the future purchasing power of investors. In contrast, the upside may be limited for bonds, notably US bonds. Nonetheless, good alternatives to US assets are currently limited when considering the political instability in other major economies such as France, Germany, and South Korea. Over the course of 2025, such sources of instability could either intensify or peter out. For the moment, uncertainty remains high and we would avoid doubling down on areas affected by heightened political risk. The current situation notwithstanding, we continue to favour assets that provide diversification hedges against US market risk. Despite its low yield, we see the yen as a risk haven that is likely to offer downside protection in the event of an equity market correction. We continue to favour gold. We also favour rotating exposure towards Japanese domestic demand-related stocks. These stocks show signs of sustainable structural recovery and are less correlated with US growth and stimulus than Japan's export-oriented firms.

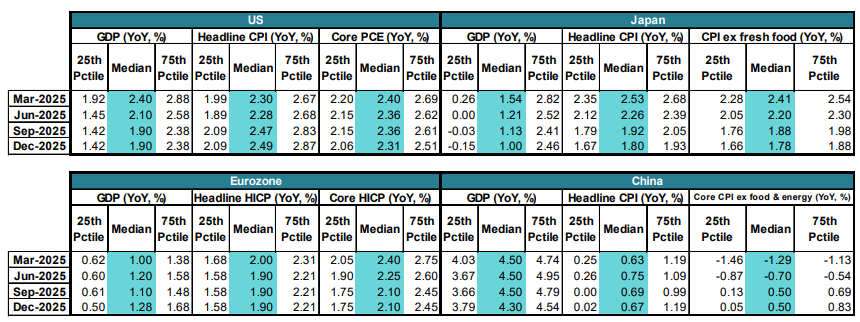

The GIC's guidance ranges may be found in Appendix 1 of this document.

A note on changes to the Global Investment Committee Process:

In June 2024, we made changes to the Global Investment Committee, as to align our quarterly Outlook more closely with the views underlying our portfolio investments. In lieu of forecasts, we

have chosen to provide guidance ranges for indicators and indices that we feel most closely relate to the asset classes we manage. In place of forecasts the Global Investment Committee now

provide aggregate guidance at the median for our central outlook, and at the 25

th

and 75

th

percentiles.

The asset classes represented in our Outlook can change over time, depending on what is most representative of our active investment views.

In the event full ranges are not available, this may be interpreted as to mean that the asset class is not a central focal point for our highest conviction investment views.

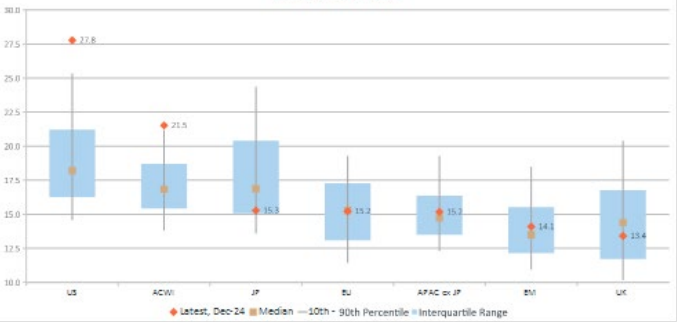

Appendix 1: GIC Outlook guidance

Global macro indicators

Central bank rates, forex, fixed income and commodities

Equities