Summary

- Under the watchful eyes of the financial world, the US Federal Reserve (Fed) cut interest rates for the first time in years with a bold half-percentage-point move. As a result, US Treasury (UST) yields declined broadly, with short-dated bond yields falling more significantly. By the end of September, the benchmark 2-year and 10-year UST yields settled at 3.64% and 3.78%, respectively, 28 basis points (bps) and 12 bps lower compared to the end of August.

- In Asia, the Indonesian central bank trimmed its benchmark interest rate just hours before the anticipated Fed rate cut, and its counterpart in the Philippines lowered the reserve requirement ratio (RRR) for larger banks. China signalled its intention to revive its sagging economy with a slew of stimulus measures.

- The start of the Fed’s rate cut cycle has created room for monetary easing across Asia. We expect Asian government bond yields, particularly high yielders like those of India, Indonesia and the Philippines, to trend lower. We also view South Korean and Thai government bonds positively, as we see their respective monetary authorities nearing a rate-cutting cycle.

- Asian credits gained 1.21% in September, supported by tightening credit spreads and a decline in UST yields. Asian investment-grade (IG) credit underperformed its Asian high-yield (HY) counterpart, returning 1.10%, as spreads narrowed 6 bps. Asian HY credit returned 1.85%, with spreads tightening by 23 bps.

- The fundamentals backdrop for Asian credit remains supportive. In China, authorities have finally unveiled a more substantial and coordinated policy stimulus package across the monetary, fiscal and property fronts. This move could at least provide some stabilisation in market sentiment, although it remains to be seen if there will be a sustainable and meaningful impact on the property sector and broader real economy. Additionally, we expect macroeconomic and corporate credit fundamentals across Asia ex-China to stay resilient.

Asian rates and FX

Market review

The Fed lowers policy rates by 50 bps

The Fed delivered its long-anticipated rate cut on 18 September with a 50-bps reduction. The rate cut, the first by the Fed in over four years, initially prompted a broad decline in UST yields, with short-end yields falling more relative to those of the longer-dated maturities. Market expectations for the Fed to take aggressive action had risen earlier in the month following a weaker-than-expected US labour market report. Nonfarm payrolls rose by 142,000 in August, missing forecasts, while job gains for the prior two months were revised down by a combined 86,000.

The decline in yields slowed when the US core consumer price index (CPI) for August came in marginally above expectations. The Fed had lowered rates in response to growing risks in the labour market. However, both the Fed’s Summary of Economic Projections (SEP) and remarks from the Chair Jerome Powell at the post-meeting press conference were interpreted as more hawkish, causing yields at the long-end of the curve to drift higher.

The SEP indicated an additional 50 bps of cumulative rate cuts over the remaining two meetings this year, followed by 100 bps of cuts in 2025, and another 50 bps in 2026, targeting a terminal rate of 2.9%. Longer-dated UST yields continued rising toward the end of the month as risk sentiment improved, buoyed by strong stimulus measures from China that boosted risk assets. By the end of the month, the benchmark 2-year and 10-year UST yields settled at 3.64% and 3.78%, respectively, 28 bps and 12 bps lower compared to the end of August.

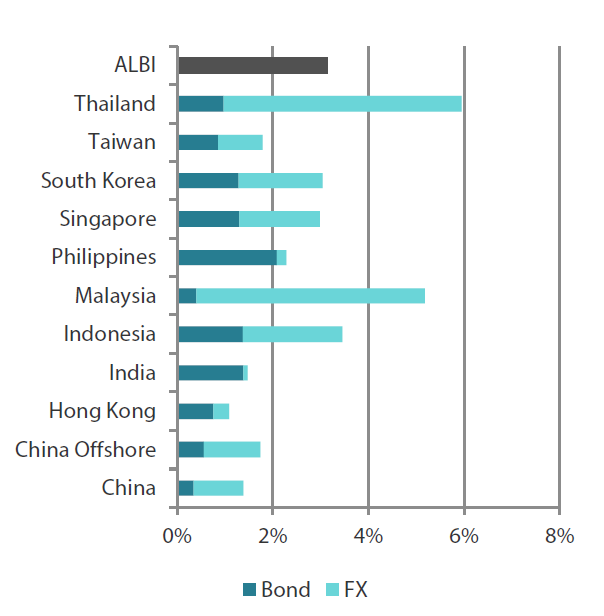

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 30 September 2024

|

For the year ending 30 September 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 September 2024

BI eases its policy rate by 25 bps; BSP lowers banks’ RRR

Over in Asia, Bank Indonesia (BI) lowered its policy rate by 25 bps, aligning its trajectory with a growing number of Asian central banks easing interest rates. BI Governor Perry Warjiyo highlighted a stable and strengthening Indonesian rupiah, well-managed low inflation and the need to bolster economic growth as key factors behind the decision to reduce rates. He also mentioned the central bank’s shift from its previous “pro-stability” policy, which prioritised supporting the rupiah, to a new approach aimed at achieving a “balance between stability and growth”.

In the Philippines, the Bangko Sentral ng Pilipinas (BSP) announced a 250-bps reduction in the RRR for universal1 and commercial banks, lowering it to 7% effective from 25 October. The RRR for digital banks and mid-sized or “thrift” banks was also reduced by 200 bps and 100 bps, respectively. Separately, BSP Governor Eli Remolona reaffirmed plans to further unwind what has been the central bank’s most aggressive monetary tightening in two decades.

Meanwhile, Bank Negara Malaysia kept its overnight policy rate at 3.00%, a level it has maintained since May 2023. The Malaysian central bank continues to hold a cautiously optimistic economic outlook, anticipating growth to be supported by export strength amid the global tech upcycle, increased tourist spending, a stable labour market and solid growth in investment activity.

Headline CPI prints mostly ease in August

Headline CPI prints across most of the region’s countries moderated in August. Malaysia’s headline inflation eased to 1.9% year-on-year (YoY), down from 2.0% in July, with core inflation remaining stable at 1.9%.

In Thailand, headline inflation softened as the rise food prices was offset by decreasing energy costs. The CPI rose by 0.35% YoY, down from 0.83% in July. This marked the third consecutive month that inflation has remained below the Bank of Thailand’s target range.

In Singapore, core inflation saw its first increase in six months, rising to 2.7% YoY in August from 2.5% in July, driven primarily by higher services costs. Overall inflation moderated to 2.2% YoY, as a decline in private transport costs outweighed the rise in core inflation.

Headline inflation in the Philippines eased significantly to 3.3% YoY in August, down from 4.4% in July. Policymakers attributed the slowdown primarily to the deceleration in the prices of food and non-alcoholic beverages.

In Indonesia, headline inflation remained mostly stable at 2.12% YoY in August, marginally lower from 2.13% in July, marking the lowest level since February 2022 and well within BI’s target range of 1.5–3.5%.

In contrast, India’s headline CPI rose to 3.65% YoY in August, up from 3.54% in July, driven by a surge in vegetable prices. This marks the second consecutive month in which headline inflation has remained below the Reserve Bank of India’s 4% target.

Chinese policymakers unveil massive stimulus

Towards the end of September, Chinese policymakers unveiled a comprehensive package of measures aimed at stimulating the slowing economy and revitalising the struggling stock market. Measures included interest rate cuts, a reduction in banks’ RRR and new tools to support the stock market. As anticipated, down payment requirements for second homes were also relaxed, and the People's Bank of China indicated it would guide commercial banks to lower mortgage rates. This was followed by the Politburo’s commitment to “necessary fiscal spending” to achieve this year’s growth target and stabilise the property sector. In their most assertive statement yet, top officials vowed decisive action to halt the decline in the real estate market.

Market outlook

Positive on India, Indonesia, Philippine, South Korea and Thailand bonds

Prior to the Fed’s monetary easing, regional central banks had been cautious about lowering rates prematurely even as domestic inflation moderated. The caution was due to concerns of currency depreciation resulting from narrowing interest rate differentials. However, with the Fed now easing, and by a larger-than-expected initial amount, Asian central banks are likely to follow suit, albeit at a more measured pace. This could shift interest rate differentials in Asia’s favour.

In this context, we expect Asian government bond yields to trend lower—particularly high yielders like those of India, Indonesia and the Philippines. We also view South Korean and Thai government bonds positively, as we see their respective monetary authorities nearing a rate-cutting cycle.

Also positive on Asian currencies

With the Fed expected to maintain its easing stance in the coming year, the US dollar could weaken further which we expect will create a favourable outlook for most Asian currencies. Increased portfolio allocations into the region, notably from foreign and domestic investors seeking Asian government bonds, may also support stronger demand for Asian currencies.

Asian credits

Market review

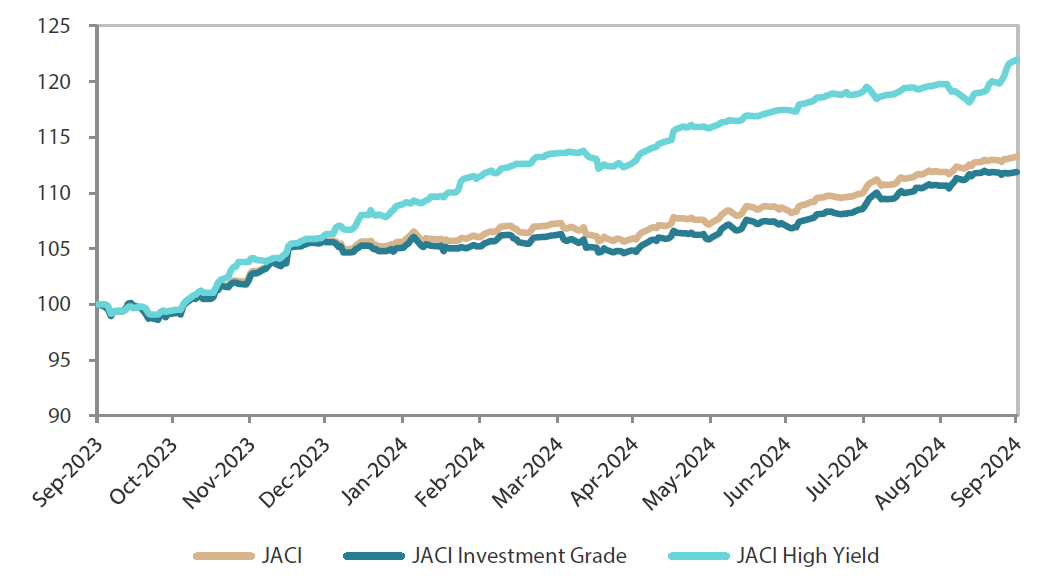

Asian credits register further gains in September

Asian credits gained 1.21% in September, supported by tightening credit spreads and a drop in UST yields. Chinese HY credits, particularly those in the property sector, showed strong performance, driving Asian HY credits to outperform Asian IG credits. Asian IG credits returned 1.10% as spreads narrowed by 6 bps. Asian HY credits returned 1.85%, with spreads tightening by 23 bps.

Asian credit spreads widened at the start of the month amid falling UST yields. Weak macroeconomic data from China pointed to deteriorating domestic demand, raising concerns that the world’s second largest economy might not meet its official growth target. This put additional pressure on credit spreads, particularly those of Chinese property credits.

The Fed’s half-percentage-point rate cut spurred a rally in risk assets and caused spreads to tighten. The comprehensive stimulus package unveiled by Chinese policymakers sparked a significant rally in Chinese HY credits and other sectors closely linked to the Chinese economy. By the end of September, spreads for all major national-level segments—except for Thailand and Taiwan—tightened.

Primary market sees robust activity in September

September was the busiest month for the primary market so far this year, with total issuance reaching approximately USD 18 billion, the bulk of which came from South Korea. The IG space saw 27 new issues amounting close to USD 15 billion, including the USD 2.5 billion two-tranche issue from Meituan, the USD 2.0 billion three-tranche issue from Export Import Bank of Korea, the USD 1.8 billion two-tranche sovereign issue from the Republic of Indonesia, the USD 1.25 billion two-tranche issue from AIA Group Limited, the USD 1.2 billion three-tranche issue from Korea National Corp, and the USD 1 billion two-tranche issue from CK Hutchison International. Meanwhile, the HY space saw eight new issues amounting to USD 3.3 billion.

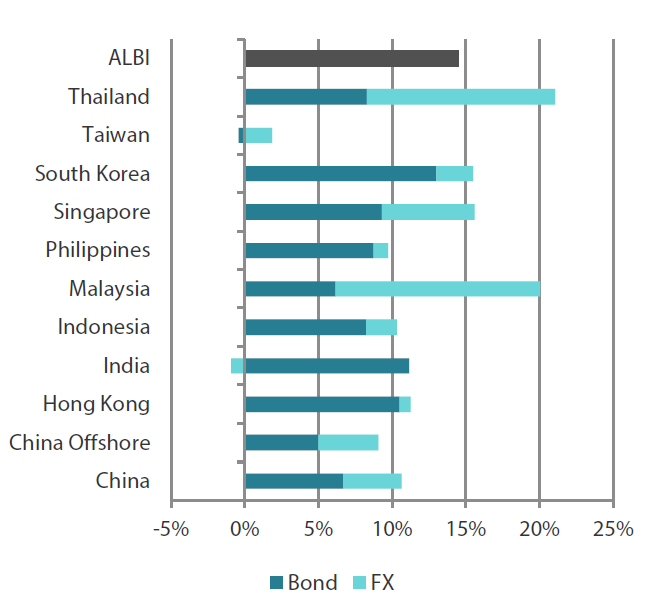

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 September 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 September 2024.

Market outlook

Robust fundamentals and still-strong demand-supply technicals to support credit spreads

The fundamentals backdrop remains supportive for Asian credit. In China, policymakers have finally unveiled a more substantive and coordinated policy stimulus package across the monetary, fiscal and property fronts. We expect this policy package to at least provide some stabilisation in market sentiment although it remains to be seen if there will be a sustainable and meaningful impact on the property sector and broader real economy. Elsewhere, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient, although they may moderate from the strong levels seen in the first half of 2024 as the global economy potentially enters a temporary soft patch. The start of the Fed’s easing cycle provides greater flexibility for Asian central banks to ease their own monetary policies, and this could support domestic demand in the near future. Apart from a few sectors and idiosyncratic situations, most Asian IG corporate and banks are entering this softer period with strong balance sheets and adequate ratings buffers.

These robust fundamentals, along with still-strong demand-supply technicals, may help contain any widening of spreads the elevation of risks may cause. These risks include geopolitical and trade tensions, as well as concerns over the US presidential election outcome in November. The biggest risk, in our view, to Asia’s macroeconomic and credit outlook is a deep US and global economic recession; however, this is not our base case. We still see any healthy correction as creating better entry opportunities for Asia credit, from the perspectives of both excess and total return.

1A universal bank in the Philippines is a commercial bank with the additional authority to exercise the powers of an investment house.