Asian rates and FX

Market review

The Fed cuts its benchmark policy rate by a quarter point

In November, UST yields ended lower, while the US dollar displayed broad-based strength. Treasuries initially sold off following Donald Trump's election victory and the prospect of a Republican-controlled government, as investors anticipated stronger economic growth, higher inflation and larger budget deficits. However, a wave of short-covering reversed much of the sell-off. In a widely expected move, the Fed lowered interest rates by 25 bps. Market expectations for another rate cut at the Fed's final December meeting waned after data revealed persistent underlying inflation in October and resilient economic growth, pushing yields higher again. Additionally, comments from Fed officials, including Chair Jerome Powell, emphasising a cautious approach to further rate cuts also dampened easing expectations. The US dollar pared some gains, and Treasuries rallied after president-elect Trump nominated a fiscal conservative as Treasury secretary, signalling potential restraint on fiscal policy. Meanwhile, escalating Russia-Ukraine tensions added downward pressure on longer-end yields. At the end of November, the benchmark 2-year and 10-year UST yields settled at 4.15% and 4.17%, respectively, 2 bps and 12 bps lower compared to end-October.

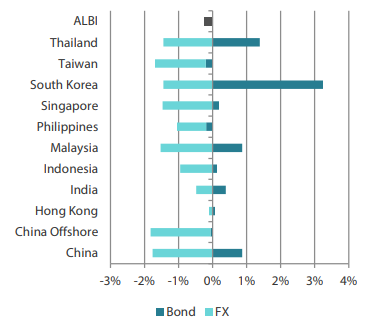

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 November 2024

For the year ending 30 November 2024

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 November 2024.

South Korea lowers policy rates again; Malaysia and Indonesia keep key rates steady

The BOK lowered interest rates by 25 bps for the second consecutive meeting, defying expectations of no change. It also revised down its growth forecasts for 2024 and 2025 to 2.2% and 1.9%, respectively, from previous projections of 2.4% and 2.1%. This revision was primarily due to weaker export performance. Additionally, the central bank now anticipates inflation to average 2.3% in 2024 and 1.9% in 2025, compared to its earlier estimates of 2.5% and 2.1%.

In contrast, Bank Indonesia (BI) maintained its policy rate, prioritising foreign exchange (FX) stability amid heightened global uncertainty following the US elections. BI Governor Perry Warjiyo noted that the evolving global environment has constrained the central bank's ability to ease monetary policy. BI also revised its expectations regarding how much in total the Fed could cut interest rates and highlighted the risks posed by higher UST yields. The central bank upheld its 2024 gross domestic product (GDP) growth forecast of 4.7–5.5% and reaffirmed its commitment to pro-growth macroprudential policies.

Similarly, Bank Negara Malaysia (BNM) left its policy rate unchanged at 3% during its final Monetary Policy Committee meeting of the year. As with the previous meetings, the policy statement maintained a neutral tone. BNM projected inflation to remain “manageable” in 2025, supported by “easing global cost conditions and the absence of excessive domestic demand pressures”. However, the central bank cautioned about potential upside risks to the inflation outlook, particularly due to further government subsidy rationalisation.

Headline inflation prints remain subdued in October

Headline consumer price index (CPI) inflation exhibited mixed trends across countries. In Malaysia, the headline CPI rose slightly to 1.9% year-on-year (YoY) in October from 1.8% in September, primarily due to a sharp increase in food price inflation. Core inflation, however, remained unchanged from the prior month at 1.8% YoY.

In Thailand, headline inflation accelerated to 0.83% YoY in October from 0.61% in September, due to higher energy and transportation inflation. However, it remained below the central bank's target range of 1–3%. As broadly expected, core CPI inched up by 0.77% in October.

In the Philippines, inflation picked up to 2.3% YoY in October from a record low of 1.9% in September, with food and non-alcoholic beverages driving the increase. Policymakers attributed this rise partly to disruptions caused by adverse weather conditions.

Indonesia's headline and core inflation rates for October slightly exceeded expectations but remained relatively subdued. Headline inflation eased to 1.71% YoY from 1.84% in September, surpassing forecasts of 1.66%, while core inflation edged up to 2.21% from 2.09%, partly due to rising gold prices. BI expressed confidence that inflation will “remain manageable” moving forward.

In Singapore, headline CPI also softened to 1.4% YoY, below forecasts and down from 2.0% in September, driven by slower accommodation inflation, a sharper decline in private transport costs and easing core inflation. Core CPI, which excludes private road transport and accommodation costs, slowed significantly to 2.1% YoY in October—its lowest level in nearly three years—down from 2.8% in September. Policymakers attributed the decline primarily to a slowdown in inflation for services, electricity and gas, as well as retail and other goods.

ASEAN economies register third-quarter growth

Thailand's GDP growth accelerated to 3.0% in the third quarter, exceeding expectations and improving from a downwardly revised 2.2% in April to June. The growth was primarily driven by a substantial increase in government spending, while private sector spending growth slowed, reflecting weaker private consumption.

In Singapore, third-quarter GDP growth was revised sharply higher to 5.4% YoY, up from the initial estimate of 4.1%. The revision was supported by strong performance in both the manufacturing and services sectors. Consequently, the government raised its full-year 2024 GDP growth forecast to “around 3.5%” from the previous range of 2.0–3.0% and set a 2025 growth forecast range of 1.0–3.0%.

Indonesia recorded a GDP growth of 4.95% YoY in the third quarter, slightly lower than the 5.05% growth posted in the second quarter. The moderation was largely attributed to slower household consumption growth.

Meanwhile, the Philippines' GDP growth decelerated to 5.2% YoY in the third quarter, down from an upwardly revised 6.4% in the April–June period. The slowdown was partly due to a contraction in the agriculture sector. According to the National Economic and Development Authority, the average GDP growth for the first three quarters of 2024 stands at 5.8%, slightly below the government's target range of 6–7% for the year.

S&P Global Ratings upgrades the Philippines' credit outlook

Towards the end of November, credit rating agency S&P Global Ratings upgraded the Philippines' credit outlook to positive while both its long-term foreign currency and local currency debt ratings were affirmed at “BBB+”. S&P stated that the adjustment reflects the nation's progress in fiscal reforms, improved infrastructure, and policy environment, which have supported strong economic growth over the past decade. The agency further noted that a ratings upgrade could be considered if current account deficits narrow as anticipated or if the government achieves faster fiscal consolidation.

Market outlook

Asian local government expected to perform well in 2025

We believe that Asian local government bonds are positioned to perform well in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. The ongoing global easing cycle is expected to lower global yields and further support Asian bond markets. Furthermore, we expect global growth to moderate in the medium term, driven in part by potential tariff threats from the US. This scenario is likely to support bond markets overall. Despite uncertainties regarding Trump's second administration, any impact on Asian currencies could be tempered by the region's strong fundaments and the Fed's easing path. Additionally, Asian bonds and FX have shown subdued volatility compared to other markets over the past two years, reflecting the region's resilient economic fundamentals.

As the Fed continues easing, Indian government bonds are becoming increasingly attractive due to their high real yields. Additionally, India's services account is improving, buoyed by rising exports of software, travel and business services, which is alleviating pressures on its current account deficit. The inclusion of Indian bonds in JP Morgan's GBI-EM Index is also expected to drive sustained foreign inflows, boosting demand further. Moreover, the Reserve Bank of India's recent shift to a neutral monetary stance hints at a possible pivot to more accommodative measures going forward. Lastly, S&P's positive outlook on India signals the potential for a long-awaited ratings upgrade in medium term.

Asian credits

Market review

Asian credits gain in November as UST yields fall

As US yields fell, Asian credits posted a return of +0.46% in November despite credit spreads widening by about 1.2 bps. The gains in USTs led Asian IG credits to outperform Asian HY credits. IG credits returned +0.56% with spreads staying largely unchanged, while Asian HY credits retreated 0.12% as spreads widened by about 15 bps.

Asian credit spreads tightened in early November as Trump's election victory led to strong performance of risk assets in the US that spilled over to other asset classes globally. The sell-off in USTs that immediately followed the US election also attracted yield-seeking investors who had remained on the sidelines leading up to the election.

In China, attention centred on the 12th session of the legislative body, where policymakers unveiled a Chinese renminbi (RMB) 10 trillion package to tackle local government debt issues and announced plans for additional fiscal stimulus in 2025. However, the absence of further stimulus measures to boost consumption and support the real estate sector left many investors disappointed, exerting some pressure on Chinese HY property credits in particular. While Chinese activity data pointed to early signs of recovery, markets questioned the sustainability of this rebound. Moreover, Chinese credit expansion continued to fall short of expectations, dampening sentiment.

In the latter half of the month, attention shifted to Indian corporates following news of a US indictment involving several individuals linked to various Adani companies. Subsequently, spreads traded largely sideways until the end of the month. Negative impact from headlines about Trump's plans to impose additional tariffs on imports from China, Canada and Mexico were offset by hopes for new stimulus measures from China.

By the end of November, spreads for all major country segments—except for China, Singapore, South Korea and Taiwan—widened. During the month, Fitch Ratings reaffirmed Thailand's BBB+ credit rating with a “stable” outlook, while S&P upgraded the Philippines' credit outlook to positive while maintaining its long-term local currency and foreign currency debt rating at “BBB+”. According to S&P, a ratings upgrade could follow if current account deficits decrease as anticipated or if the government achieves faster fiscal consolidation.

Primary market activity moderates in November

The primary market was relatively quiet in November, with total issuance reaching USD 10.9 billion. The IG space saw just 11 new issues amounting to USD 9 billion, including the USD 2.65 billion three-tranche issue from Alibaba Group Holding Ltd, USD 2.75 billion three-tranche sovereign issue from Indonesia and USD 2.0 billion two-tranche sovereign issue from China. Meanwhile, the HY space saw five new issues totalling USD 1.9 billion.

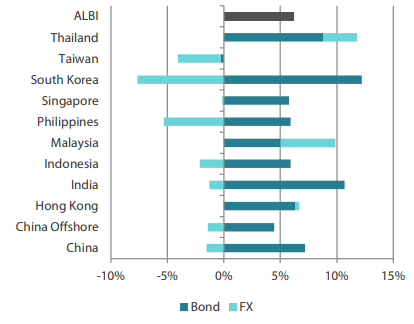

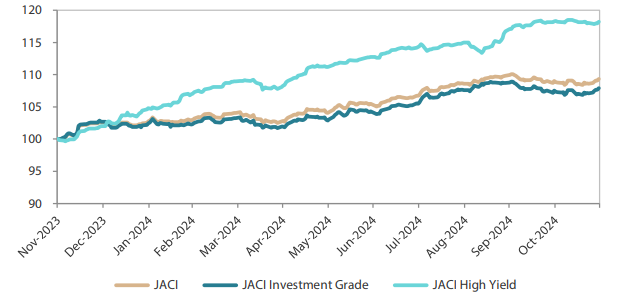

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 November 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2024.

Market outlook

Asia credit yields remain attractive; spreads likely to be rangebound, returns to be driven by carry

We expect Asia credit fundamentals to stay resilient in 2025. China is expected to maintain efforts to rebalance its economy, adopting more accommodative policies to mitigate the effects of a challenging external environment due to US tariff risks and to stabilise overall growth. Asia ex-China macroeconomic fundamentals may moderate slightly from the robust levels seen in 2024 as export growth comes under pressure, but they are expected to remain resilient overall. We believe that Asian central banks have ample room to ease monetary policy to support domestic demand.

Against a benign macro backdrop, we expect Asian corporate and bank credit fundamentals to also stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or US policy changes. Overall revenue growth could moderate but stay at healthy levels, with profit margins holding steady due to lower input costs. Most Asian corporates and banks will enter 2025 with strong balance sheets and adequate rating buffers. As the weakest credits in the Asia HY space have been removed, we expect a much lower default rate in 2025, along with a smaller percentage of fallen angel credits in the Asia IG space.

We expect to see higher gross supply in the Asia credit space in 2025 compared to the past two years. This is because the decline in US yields reduces the funding cost gap between offshore and onshore debt. Many regular issuers may also wish to refinance in the USD-denominated market to maintain a longer-term presence. However, net supply will likely be subdued given still-elevated redemptions. At the same time, we expect demand from regional investors to stay firm due to the still high all-in yield.

While credit spreads are historically tight, the combination of supportive macro and corporate credit fundamentals, along with robust technicals, are expected to keep spreads rangebound for the most part in 2025. We remain cautiously optimistic and prefer the crossover BBB and BB-rated credit space trading in the low-to-mid 200 bps spread. We anticipate carry to be the main driver of Asia credit returns in 2025.