Summary

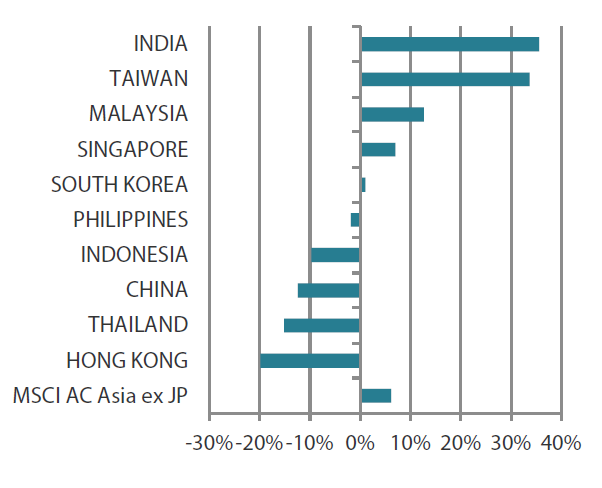

- India remains the long-term growth story in Asia and continues to attract fresh investment flows. China, on the other hand, has become the value play waiting for positive catalysts to turnaround sentiment.

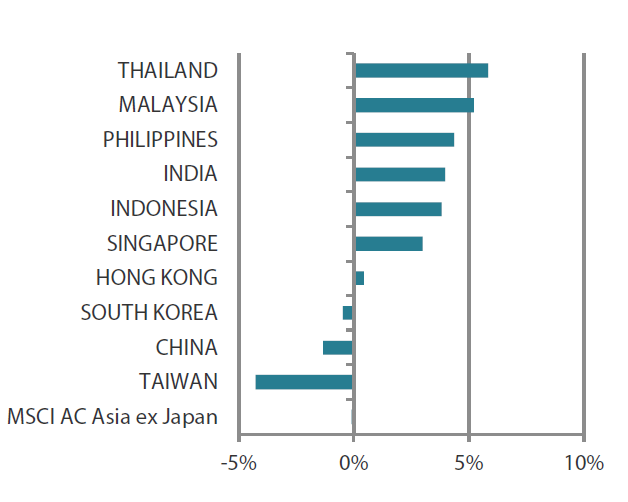

- In July, the MSCI AC Asia ex Japan Index returned -0.1% in US dollar (USD) terms, ending a winning streak stretching over several months. It was a topsy-turvy month, with equities experiencing a significant rotation out of tech stocks amid heightened expectations of interest rate cuts. Taiwan (-4.3%) and China (-1.3%) trailed the regional markets, while Thailand (+5.8%) and Malaysia (+5.2%) were the leaders.

- The artificial intelligence (AI)-driven tech rally looks to be struggling amid the deceleration of US growth, with knock-on implications for the Asian supply chain. On the positive side, the growth trajectory remains intact. The tech-centric markets of Taiwan and South Korea bore the brunt of the sell-off and will likely continue to be under pressure until the market finds direction in the next couple of months.

Market review

Asian markets endure a turbulent month

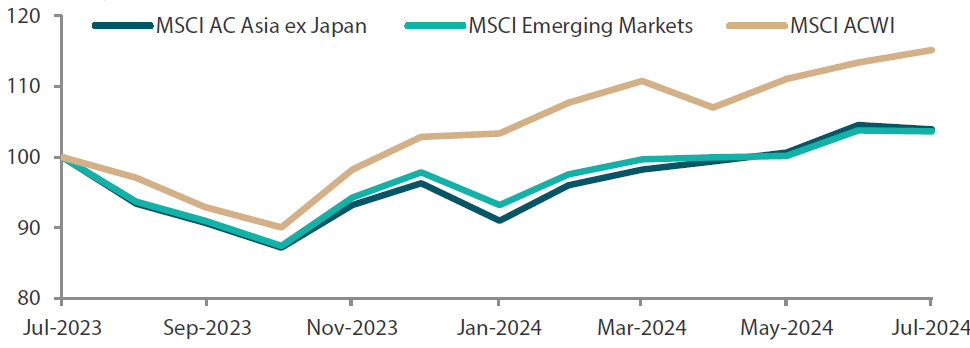

July was a turbulent month, ending with the US Federal Reserve holding interest rates steady while leaving the door open to rate cuts in the coming months. Markets initially reacted to the second-quarter US GDP, which increased at an annualised pace of 2.8%, only to resume their worries about technology stocks. These stocks were pressured by a rapid market rotation into small-caps. In other news, US President Joe Biden abandoned his re-election bid. With her emergence as the party’s presidential nominee, Vice President Kamala Harris has reinvigorated the Democratic campaign. The MSCI Asia Ex Japan Index dipped 0.1% in USD terms, ending a winning streak stretching over several months.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 31 July 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

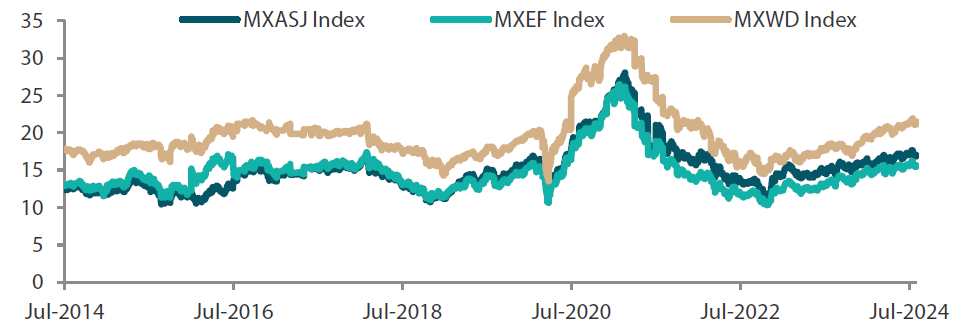

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 July 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asian markets suffer July jitters

The tech-centric markets of Taiwan (-4.3%) and South Korea (-0.5%) were underperformers amid a rocky month for big tech stocks. Traders welcomed South Korea’s bid to lower its inheritance tax rate for the first time in decades, but this will require approval of the opposition-controlled parliament. Index heavyweight Samsung Electronics saw a surge in its second-quarter profit, which fuelled the tech giant’s plans to boost high-end memory output. Taiwan continued to see solid growth in the second quarter, with preliminary GDP rising by a higher-than-expected 5.09% year-on-year (YoY).

Shares in China fell 1.3% in July. The country’s economic momentum remained soft over the month as China's manufacturing activity slipped to a five-month low. Factories struggled with falling new orders and low prices, and China’s purchasing managers' index contracted for a third month in July, easing to 49.4 from 49.5 in June. During the Third Plenum in July, Chinese leaders outlined reforms in areas such as foreign investment, state-owned enterprises and the fiscal and tax system. Following closely on the Third Plenum’s commitment to structural reforms, the People's Bank of China unexpectedly delivered additional stimulus with a 10-basis-point cut in the seven-day reverse repo rate, reducing it to 1.7% from 1.8%. China also launched a tit-for-tat investigation into the European Union’s recent tariffs and actions, underscoring tensions between the two blocs. Meanwhile, Hong Kong shares were little changed, returning 0.4%.

ASEAN markets show remarkable resilience

ASEAN markets fared better than their North Asian peers. Aiming to boost the local stock market, Thailand (+5.8%) approved a proposal to increase tax breaks and reduced the lock-up period for individuals investing in so-called sustainable funds. Thailand also expanded its visa-free status to 93 nations from the current 57 to boost tourism. Based on advance estimates, Malaysia’s (+5.2%) second-quarter GDP rose 5.8% YoY on broad-based gains from manufacturing to consumption. Singapore’s (+3.0%) economy also expanded 2.9% YoY in the second quarter. Indonesia shares climbed 3.8%. While the Indonesian rupiah has recovered some lost ground since Bank Indonesia’s previous meeting in June, the central bank decided to keep its key interest rate at 6.25% for a third straight month due to fiscal uncertainty at home and ongoing geopolitical tensions abroad.

Indian shares sustain upward momentum

Indian shares gained 4.0%. India’s first budget under a new coalition government included a narrower fiscal deficit target (4.9% of GDP), spending on infrastructure and measures to boost employment. India also raised taxes on capital gains from equity investments and hiked the levy on stock derivatives trades in a bid to douse the speculative fervour in the country’s derivatives market. Retail inflation, driven by an increase in food prices, accelerated to 5.08% YoY in June, marking the first uptick in five months.

Chart 3: MSCI AC Asia ex Japan Index1

|

For the month ending 31 July 2024

|

For the year ending 31 July 2024  |

Source: Bloomberg, 31 July 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market view

Await meaningfully sizeable positive fundamental changes in China to attract substantive investment flows

The AI-driven tech rally looks to be struggling amid the deceleration of US growth, with knock-on implications for the Asian supply chain. On the positive side, the growth trajectory remains intact. The tech-centric markets of Taiwan and South Korea felt the brunt and will likely continue to be under pressure until the market finds direction in the next couple of months.

The markets had high hopes for China’s Third Plenum, yet at the same time they prepared for the routine continuation of incremental support. The Third Plenum did not disappoint in this regard, with announcements of incremental support for consumption, real estate, infrastructure and regional governments. Chinese economic data remains on the weaker side; despite this, valuations remain attractive. We are waiting for significant positive fundamental changes in China to trigger substantive investment flows.

Promise of India’s future growth offsets risk posed by high valuations

China’s loss continues to be a gain for India, which remains a bright spot for new investment flows. The India story continues to be one of a domestic investment-led cycle in its industrial manufacturing sector that positions the country as an alternative Asian manufacturing base for global companies. India is also a domestic consumption story; we are particularly excited about the formalisation of the retail sector, which presents a very large and enduring growth opportunity. Sectors like real estate, healthcare and even utilities are all investing in growth. While high valuations remain a potential risk, they are presently offset by the promise of long-term growth, in our view.

Malaysia continues to outperform thanks to continued investment

South Korea’s “corporate value-up program” continues to make headlines and enhance prospects for equity holders as businesses work to improve underperforming, undervalued balance sheets. The government unveiled details of a tax incentive package for shareholders and companies participating in the program aimed at listed companies to increase shareholder returns. Despite the correction in the AI-tech sector, the South Korean government’s goal remains to invigorate the equity markets, irrespective of the tech cycle.

In ASEAN, the Malaysian market continues to outperform thanks to continued investment. Cement demand remains robust, suggesting construction activity is on track. Unlike Indonesia, Malaysia has a domestically-oriented investment focus on infrastructure and industry. Indonesia is focused on the electric vehicle (EV) supply chain and Chinese investments. With the slowdown in EV demand occurring simultaneously with continued supply growth, the Indonesian market has lagged the Malaysian market.

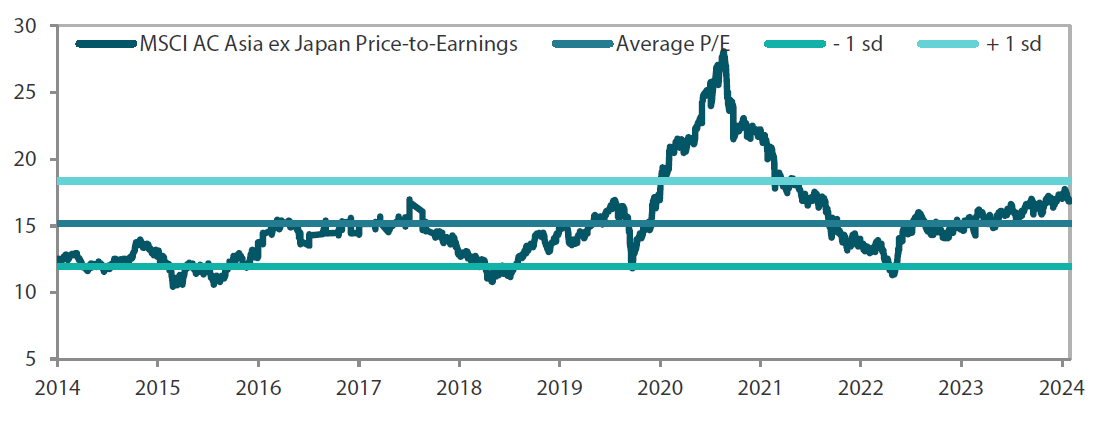

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 July 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

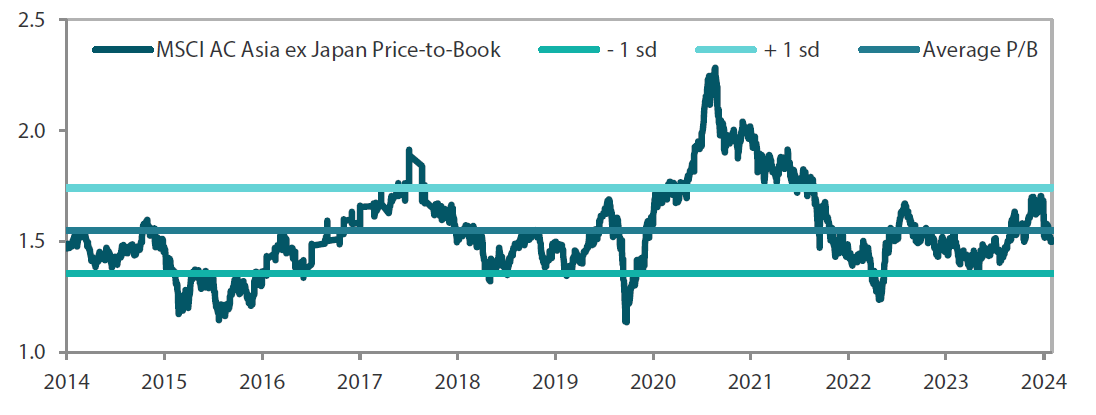

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 July 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way