Policy directions and key economic targets for 2023 unveiled

China’s National People’s Congress (NPC) convened for its annual session on 5 March. Chinese Premier Li Keqiang kick-started the nine days of meetings by unveiling the Government Work Report, which outlined policy directions and key economic targets for 2023 (Table 1).

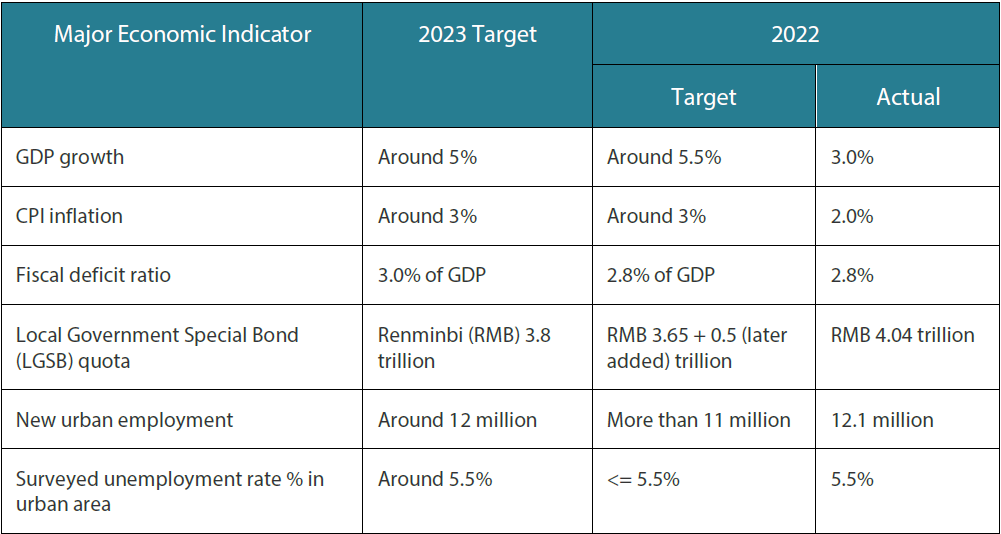

Table 1: Key targets for 2023 vs. 2022 (target and actual)

Source: Goldman Sachs Investment Research, Yicai, Nikko Asset Management

The official GDP growth target of “around 5%” is lower than many external forecasts, and fiscal policy looks less accommodative relative to both market expectations and that of 2022. In our view, these conservative targets leave room for outperformance and likely reflect cautiousness over unexpected events and reluctance in overstimulating the economy. Nonetheless, China has a multitude of fiscal tools (such as drawing on more state-owned enterprise profit repatriation, increasing LGSB quotas, and targeted lending by policy banks) to draw upon if needed.

The guidance on monetary policy was largely unchanged, with M2 and credit growth generally aligned with nominal GDP growth. Inflationary pressures are projected to remain benign, providing the People’s Bank of China space, if needed, to provide support—albeit we expect this to be done largely via increased liquidity and targeted credit support.

Similar to previous years, the recommendations set forth in the Work Report were high level and directed broadly. Details are likely to be unveiled after the new government leaders are in place.

Other highlights of the Work Report

1. To emphasise boosting consumption

The Work Report declared that “reviving and expanding consumption” will be prioritised. The recovery in service-related consumption will be promoted, and multiple channels will be adopted to increase the incomes of urban and rural residents. The higher job creation target this year may be a reflection of the intent to boost consumption and the service industry, which is generally more labour-intensive.

2. To prevent financial risks–specifically from housing and local governments

The central government’s policy tone for the property sector was largely unchanged as expected. Notably, the Work Report mentioned the need to “resolve leading developers’ risks and improve their balance sheet”, albeit qualifying that authorities will also seek to “prevent disorderly expansion” by property developers.

For local government debt, China aims to maintain fiscal discipline, preventing a build-up of new debt while finding solutions to reduce existing debt. For one, the fiscal budget this year is less expansionary than expected and targets to have central government debt issuance bear more of the burden for financing. Local government financing vehicles will rely on methods such as another round of debt swaps and/or restructuring (patterned after prior cases). The issues are complex—considering the need to generate growth—but signs that the government is taking these seriously is encouraging.

3. To attract private capital and foreign direct investment

Supportive measures for private enterprises will be encouraged and entry barriers reduced. Specifically, they repeat the call for equal policy treatment towards private and state-owned enterprises. At a meeting on 6 March, Chinese President Xi Jinping also pledged support for private enterprises. The authorities are expected to support the promotion of foreign enterprise projects in China and the modernisation of industrial sectors.

Implications for China rates and FX

Rates

The more cautious growth target is a reminder that China’s recovery may not be a sharp V-shaped one nor highly inflationary. We maintain our base case that inflation remains in check (similar to what is mentioned in the Work Report) and as a result, the central bank would be able to maintain its accommodative stance. In this environment, rates are more likely to trade in a rangebound fashion as compared to what happened to global yields in 2022.

FX

High frequency data and the recent purchasing manager survey readings indicate a rebound in economic activity with China’s exit from zero-COVID underway. Property sales have picked up from low levels and may help to sustain the momentum near term. The recovery in the Chinese economy would mean it is likely still attractive for foreign investors (who as a whole had pulled out money from China) especially if there is a global slowdown this year. Hence, we are constructive on the renminbi. Further out, we will continue to monitor the pace of the recovery and remain mindful of the return of outbound tourism which may counter investment inflows.