Snapshot

While 2022 was the year of upside inflation surprises, a strong consensus appears to be building that 2023 will be a year of recession for many developed countries. The seemingly strong conviction from investors seems at odds with economic data that is still feeling the chaotic effects of the pandemic and remains difficult to predict. Perhaps the same indicators that preceded prior recessions will provide the same warnings, but we see greater potential uncertainty around these forecasts in this pandemic decade. Nevertheless, we also foresee slower growth, believing earnings in the US are due to decline—but with a relatively shallow negative impact on the strength of private sector balance sheets. While forward-looking survey data does seem to support the recessionary proposition, the actual activity data has not yet validated these concerns. Earnings releases for the fourth quarter of 2022 will soon be upon us, and we can assess the damage in earnest.

China pivoted hard from its rigorous zero-COVID policy to a complete re-opening; this was accompanied by massive increases in infections, along with some signs of stress in the healthcare sector. If the Omicron experience of the rest of the world is any indication, China may come out the other side with demand improving commensurately. We are not there yet, but China equities are certainly responding to this likely positive outcome.

In our view, the change from dollar strength to relative weakness is meaningful for the shift in relative growth prospects, favouring the rest of the world over the US. We lean to fortunes moving from the West to the East (and growth to value) as well as beneficiaries of Eastern demand. We remain constructive mainly for the significant decline in valuations across so many asset classes and geographies, as well as improving demand in China, while still keeping a cautious eye on US equity risk given elevated valuations and yet-to-be-seen earnings downgrades.

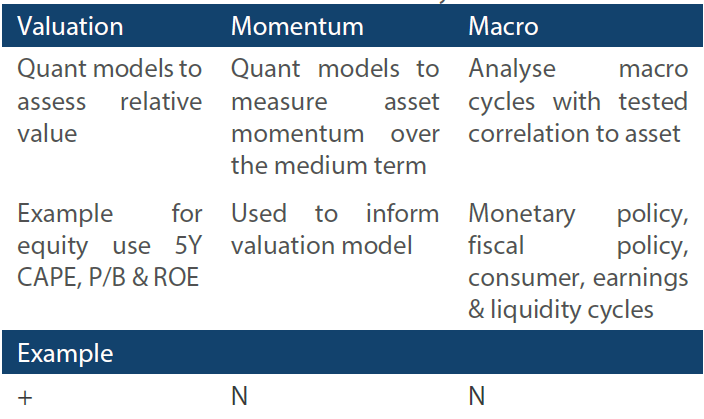

Cross-asset 1

We retained our cautious view on both growth and defensive assets this month. The relief rally that raised investors’ hopes in November seemed to run out of steam in December 2022. This was partly due to the reinforced hawkish tone from central banks despite easing inflation data and punctuated by the Bank of Japan (BOJ) widening its yield curve control (YCC) corridor on the cusp of the traditionally illiquid holiday season towards the end of 2022.

On one hand, leading economic indicators are weakening in the West, while on the other, China has made a complete about-face on its zero-COVID policy, promising better demand once the current coronavirus wave begins to dissipate. Given the struggling growth dynamics in the US, earnings prospects are likely to weaken in the first quarter. However, improving demand in China offers a counterbalance offering support to the country and those that benefit from its demand—mainly Asia and broader emerging markets (EM) that export to China.

Within growth assets, we reduced our developed market (DM) equities exposure to neutral in order to add further to our overweight position in EM equities. We kept our overweight in commodity-linked equities which may benefit from improving China demand and still-tight supply conditions, while maintaining an underweight to both listed infrastructure and REITs, which remain volatile on the back of fluctuating rates. Within our defensive assets, we maintained our bias to gold and sovereign bonds over high yield and investment grade credit, which remain vulnerable to weaker demand in the US.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

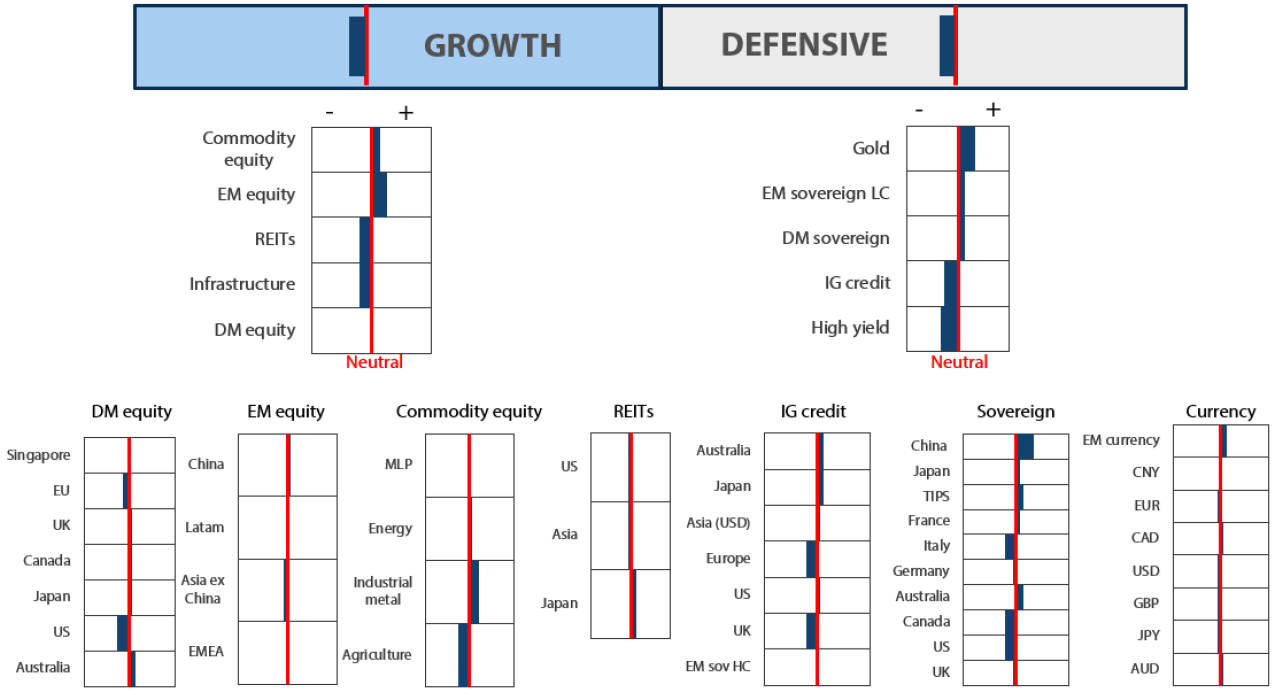

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Market prognosticators were well-aligned into late 2022, believing that the first half of 2023 would still be challenging (weakening growth) while the second half would look much better in light of the US Federal Reserve (Fed) finishing the tightening cycle and perhaps beginning to ease. This narrative follows the trajectory of a typical US equity bear market that finds a trough into a recession when earnings near a bottom, but the post-COVID economic cycle is anything but normal.

Suppose the US avoids a recession, which is plausible for now given the strength of private sector balance sheets with better demand from China, and even Europe, which has so far has avoided a recession. A weaker dollar may help lift US multinational earnings on top of improving external demand. All this is to say that even if US earnings continue to weaken as we project, much of this may be priced short of the country falling into recession which remains to be fully observed.

In our view, better equity bargains mainly reside outside of the US. China has rebounded significantly but is still far from historical highs, with earnings already downgraded by about 19% despite better prospects ahead. Europe has recovered about two-thirds from the late September 2022 equity low but is still looks relatively cheap with better demand prospects emanating from China. Of course, a weak euro makes the region more competitive, which is a key economic adjustment Europe desperately needed, as real wages remain elevated and globally uncompetitive for most of the last decade.

Of course, there are many risks, but the shifts in growth dynamics over the last month have turned for the better just as sentiment could not have been any worse through the end of 2022. We are aiming to position for a strong first half of 2023 as valuations normalise from negative sentiment extremes and earnings growth improve.

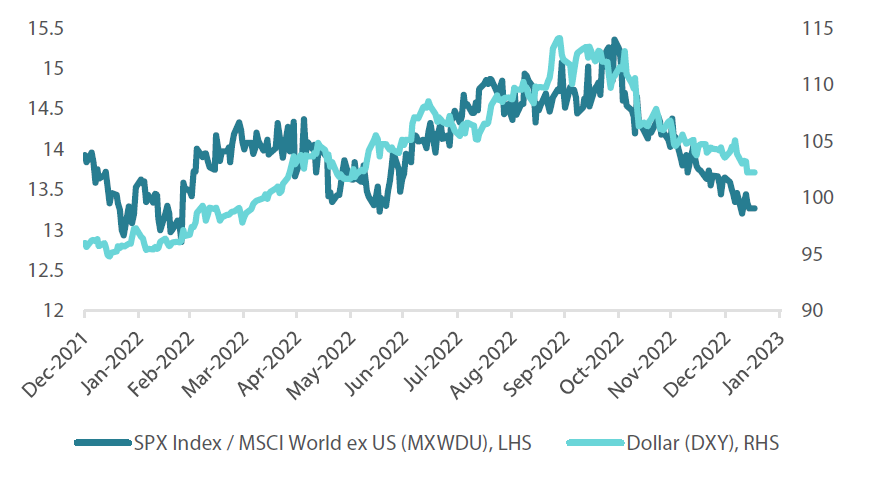

Opportunities in Europe

When the dollar is strong (as it largely has been for the last decade), equities around the world typically struggle to compete with the US. This is because a strong dollar generally means weak global demand where capital tends to flow to the US. This feature accelerated through most of 2022 on the back of Fed tightening and perceptions of a coming global recession. However, the dollar peaked in mid-October, partly for peak inflation signifying the closing innings of the tightening cycle while China pivoted away from zero-COVID, greatly improving global growth opportunity prospects. As is often the case when the dollar turns, equities around the world have firmly outperformed the US.

Chart 1: Dollar vs. SPX/MSCI World ex US

Source: Bloomberg, January 2023

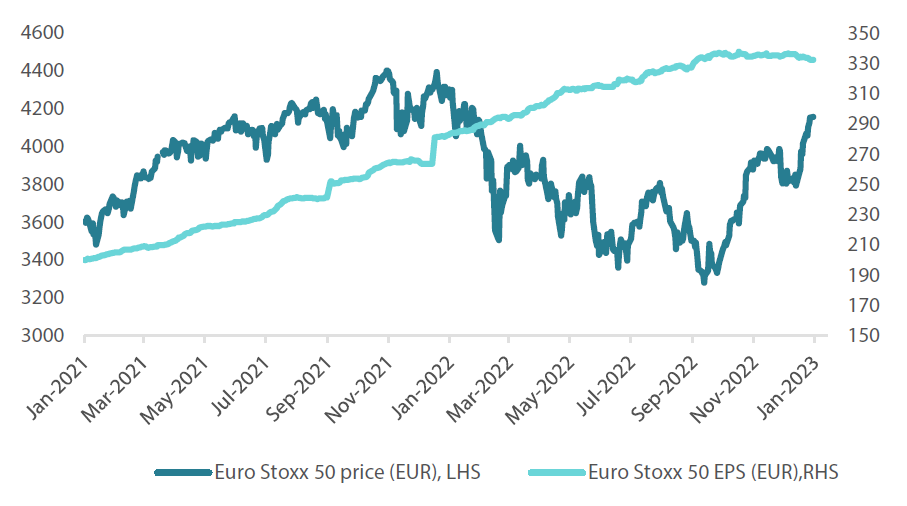

Europe certainly benefits from improving China demand, but importantly it has apparently avoided what was deemed to be a near-certain recession—with the so-far warm winter helping to avoid an energy crunch while energy prices have fallen. European equities had a challenging 2022, but less so than in the US largely because earnings held up much better than expected. While demand was not as weak as expected, a weak euro is also an important tailwind for Europe’s earnings as well as its competitiveness.

Chart 2: European equities (price vs EPS)

Source: Bloomberg, January 2023

We hold a more constructive outlook for compelling valuations which remain mostly outside the US, where earnings seem more promising on the back of better growth prospects supported by improving China demand and a weaker dollar. Europe is a particularly interesting opportunity in the DM space for its exposure to China demand as well as better-than-expected growth prospects at home on account of a milder winter.

A weaker euro also supports better competitiveness and better earnings, which build upon already decent earnings throughout 2022 despite so many headwinds. Of course, risks remain abundant; they include a potential deeper decline in US growth which remains a key watchpoint for 2023.

Conviction views on growth assets

- Constructive on beneficiaries of China demand and a weaker dollar: While the Fed remains the key driver of global monetary policy (which is a tight but late cycle), China remains the key driver of global demand and is due to significantly improve. We like both DM and EM quality markets that benefit from China demand and also from a weaker dollar that eases global liquidity conditions.

- Still constructive on commodities: The decline in energy prices may be nearing an end given ongoing supply-side constraints and returning demand from China. Due to the compelling valuations and decent earnings outlook, we believe commodity-linked equities offer interesting opportunities.

- Weakening dollar reinforced: We have been calling for a weaker dollar on the shift in capital flows and relative growth opportunities, and this dynamic is further reinforced as it tends to be self-reinforcing. We believe this is overall bullish for risk assets.

Defensive assets

The near-term outlook for sovereign bonds has improved with the rise in yields over December 2022 providing better entry level, in our view. Central banks raised their target cash rates again in December as expected, with most continuing to see further tightening ahead. Markets had a mixed reaction to this message with European rates initially soaring on the European Central Bank’s hawkish tone before retreating again, while US rates mostly brushed off the Fed's warnings. Either way, global growth is beginning to slow and inflation is coming down from the pandemic highs, providing a more positive backdrop for sovereign bonds.

It was a mixed bag across global investment grade credit in January but returns on average were nearly unchanged. Central banks delivered another round of monetary policy tightening to combat inflation but markets are more undecided about the future path of rate hikes in 2023. Nevertheless, the tightening that has already been delivered is seemingly starting to have the intended impact as the global economy slows and companies begin to address the consequences of tougher trading conditions. As a result, we remain cautious on credit exposures and prefer the duration risk in sovereign bonds.

We remain positive on gold as two main headwinds against the precious metal appear to be easing. As central banks approach the late innings of the current monetary policy tightening cycle, the dollar is beginning to weaken and real yields have stopped rising. Gold is also seen benefiting from buying by the official sector as governments seek to further diversify their foreign exchange reserves.

A divergence of outlooks

Guidance on the likely future course of monetary policy has been a mainstay of the central bank toolkit for many years. The Fed uses this form of communication to guide markets, businesses and households on what to expect for future interest rate levels and borrowing costs. While it’s difficult to pinpoint exactly when this became a “thing”, ex-Fed Chair Alan Greenspan was certainly an early proponent of this strategy and successive leaders have carried on the tradition.

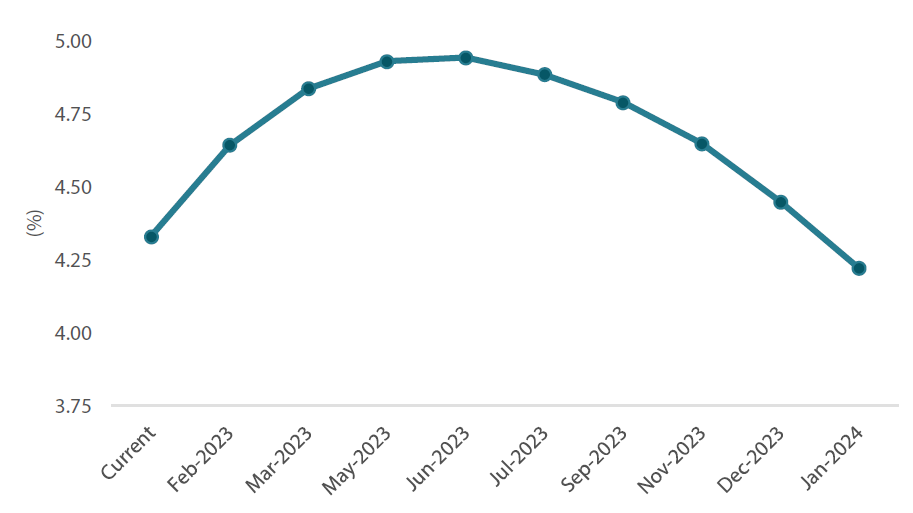

Forward guidance today is found in a range of forms, from formal Fed statements and projections to speeches and comments from Fed officials. While at times it can be taken almost as gospel by markets, it is essentially nothing more than the Fed’s view of the expected evolution of the economy and its monetary policy strategy. And where there is one view, there will almost certainly be other contrasting views. And so it is that market participants can hold views that diverge from the Fed’s view, sometimes significantly. One of those moments appears to be now. Fed officials, including Chair Jerome Powell himself, have been consistently communicating a path for the Fed funds rate that is poised to rise above 5% and then holds those levels in 2023. Chart 3 shows the market implied pricing for the expected Fed funds rate over the next year.

Contrary to the Fed’s forward guidance, markets expect the Fed funds rate to fall short of 5% at its peak before an easing cycle takes over soon after—with Fed funds falling below the current rate of 4.35% a year from now. This results in a divergence of almost 1% between markets and the Fed for the Fed funds rate in January 2024.

Chart 3: Implied US overnight cash rate

Source: Bloomberg, 11 January 2023

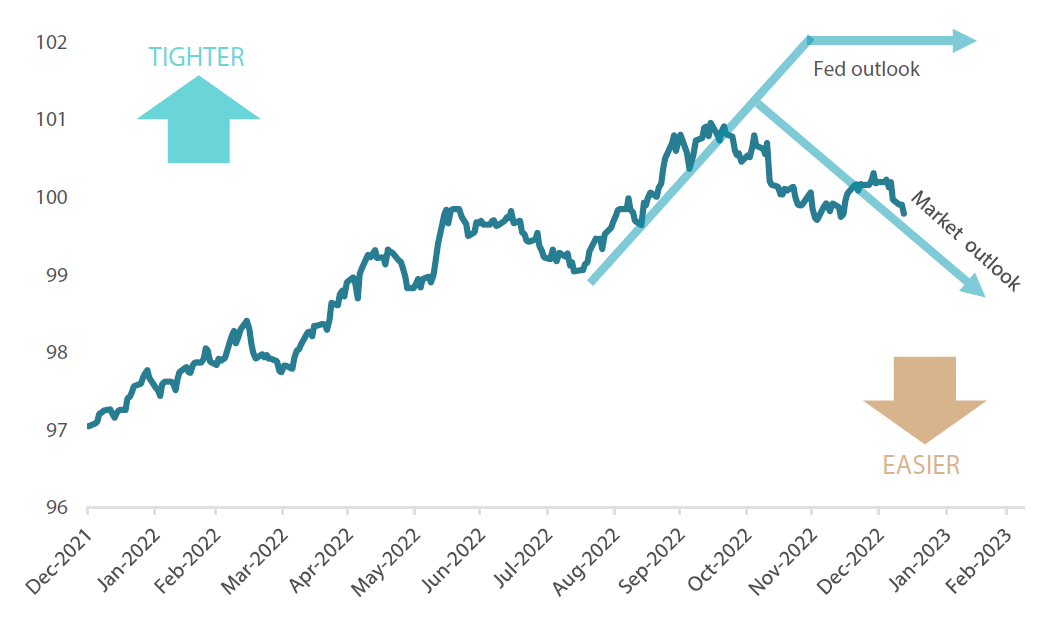

Another way to compare the Fed’s outlook with the market’s is by looking at a measure of financial conditions. The purpose of doing this is to consider a broader set of indicators apart from just interest rates, such as the value of the US dollar, stock prices and credit spreads, for example. The theory being that Fed policy is also expected to have an impact on other asset prices aside from just cash rates and bond yields. One widely used index is calculated by Goldman Sachs and shown in Chart 4.

Chart 4: US financial conditions (Goldman Sachs index)

Source: Bloomberg, 11 January 2023

When the Fed began its hiking cycle in March 2022, financial conditions had already begun to tighten in anticipation and the Fed’s actions reinforced that trend. Conditions reached their tightest in October 2022 and then began to diverge from the Fed’s forward guidance. Fed officials believe that a premature loosening of financial conditions can make its goal of restoring inflation to its 2% target more difficult. Nevertheless, markets are seemingly ignoring the Fed’s repeated warnings by loosening financial conditions in the wake of recent encouraging US inflation readings. Ultimately, we will find a resolution to this divergence of views through upcoming data release on inflation and economic activity.

Conviction views on defensive assets

- More constructive on duration: Central banks are approaching the late stages of this tightening cycle and the mean reversion of goods inflation is driving more favourable inflation outcomes.

- Prefer sovereigns over credit: As global monetary policy tightening translates to slower global growth, pressures are likely to mount on corporate credit quality and spreads can continue to widen.

- Gold can continue to perform: The twin headwinds of rising real yields and a stronger US dollar are fast receding, fuelling support for gold prices.

Process

In-house research to understand the key drivers of return: