Snapshot

Growth prospects look to be improving—a sharp shift from late 2022 when the markets had strong conviction that a first half slowdown was to be followed by a better second half. Yes, the US Federal Reserve (Fed) has tightened aggressively, but arguably there is still a fair bit of stimulus in the system in terms of liquidity and strong private sector balance sheets. Coupled with China’s economic activity picking up, Europe averting an energy crisis and central banks potentially nearing the end of their tightening cycle, the global demand outlook has fundamentally improved. The key question is, to the extent that a slowdown in growth remains shallow in the US, will inflation continue to fall at a rate that can allow the Fed to ease its foot off the tightening break?

Earnings have disappointed in the US, much as markets were expecting, but caused no significant headwind against markets that were busily adding risk over the month as bearish positioning was unwound. Is this the beginning of a new bull market in US equities? It could be, but the fast squeeze up seems unsustainable over the near term given that the market remains expensive while earnings have downgraded to a degree not seen since 2008 and 2000. Can a bull market emerge from such a combination of high valuations and weaker earnings?

High expectations for the continued moderation in inflation seem to be the ingredient lending support, and any disappointment on this front would not be taken well by markets, in our view. On the other hand, the rest of the world remains inexpensive—particularly on a relative basis—and earnings look set to improve. The year-to-date snapback in the US tech sector (non-profitable tech even more so) has been impressive, but we see capital likely to continue its flow to more attractive opportunities outside the US.

Dollar momentum has clearly broken to the downside since its mid-October peak and we believe this trend should continue, reinforced by capital flows from the US to the rest of the world. Of course, periodic bouts of risk aversion may take the dollar higher over short periods. Duration is challenging for its disconnect from conventional pricing, but we believe it does serve as a better hedge against negative growth surprise. The outlook for duration hinges on the speed of the inflation decline. Better growth and potentially stickier inflation is a risk that we will be watching closely in the coming months.

Cross-asset 1

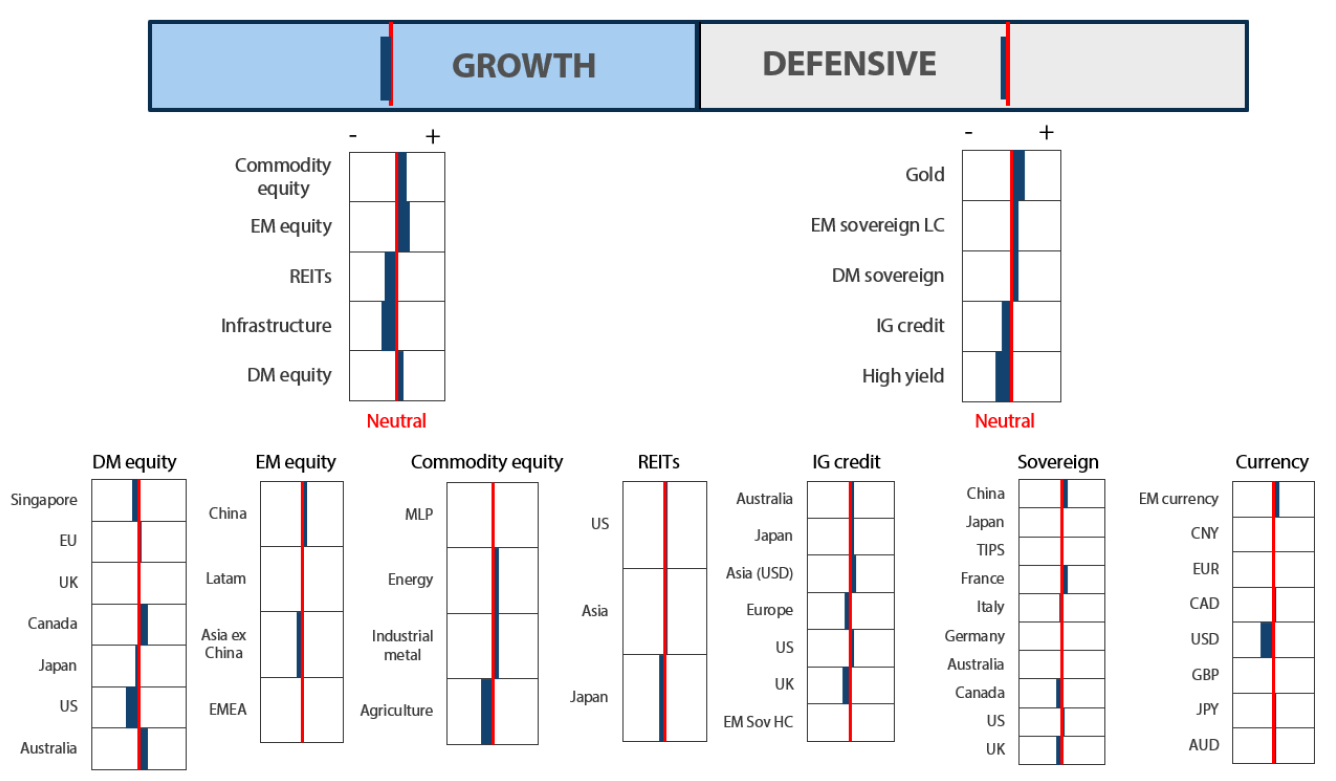

We decreased the underweights to growth and defensive, respectively. Growth concerns remain in the US—and by extension the rest of the world—should the economy fall into a deep recession. However, our base case is that the US can avoid a hard landing while the rest of the world is likely to experience a significant demand lift on account of China re-opening and Europe likely avoiding an energy crisis for the mild winter to date.

Generally, better growth conditions would be negative for defensives, but coupled with declining inflation and ongoing growth concerns, defensives arguably can play a better defensive role in case of a negative growth surprise. The risk in defensives is inflation failing to decline as fast as the market expects or what the Fed is aiming for. But we believe this risk will be dependent on data evolution that will take time to unfold.

Within growth, we increased developed market (DM) and commodity-linked equities on account of better cyclical (mainly non-US) growth funded from Infrastructure and REITs deemed less cyclical. Within defensives, we modestly decreased the overweight to gold to reduce the underweight to investment grade (IG) credit, which is appropriate for the cyclical tailwinds outside the US.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The January rally was impressive—albeit one that may be hard to sustain as newfound optimism was so quickly priced and may prove difficult to hold. Tech and consumer cyclicals rallied the most, but at least part of it appeared to be short covering from the December low while poor earnings and guidance barely seemed to matter. No, we do not think this is the rebirth of the tech outperforming the other sectors much as it did for the decade preceding 2022. Much of this sector still looks expensive, particularly in the context of likely flat to declining earnings in 2023.

We expect that an overarching growth theme for 2023 will be the beneficiaries of China demand—both geographically and by sector where valuations are still attractive. Among the sector beneficiaries, commodity-linked equities remain an important component. Slowing growth in the US is seen as a headwind to energy, in particular, in the case of no or a mild US recession; pent up demand and activity in China is a compelling offset. Metals struggled in the second half of 2022 with China’s repeated lockdowns and its ailing property sector, so demand should improve here as well. In both cases, energy and metals have suffered structural shortages in production and still low investment.

Commodity-linked equities are attractive for valuations and earnings prospects, but they also serve an important function in a portfolio sense—to hedge inflation risks. General consensus seems to suggest that inflation will continue to moderate. But without the US falling into a recession while China demand improves, the risk of stickier inflation is real, and that may not be kind to certain assets like bonds and long duration equities (like tech). Commodity-linked equities are a natural hedge to such a risk, in our view.

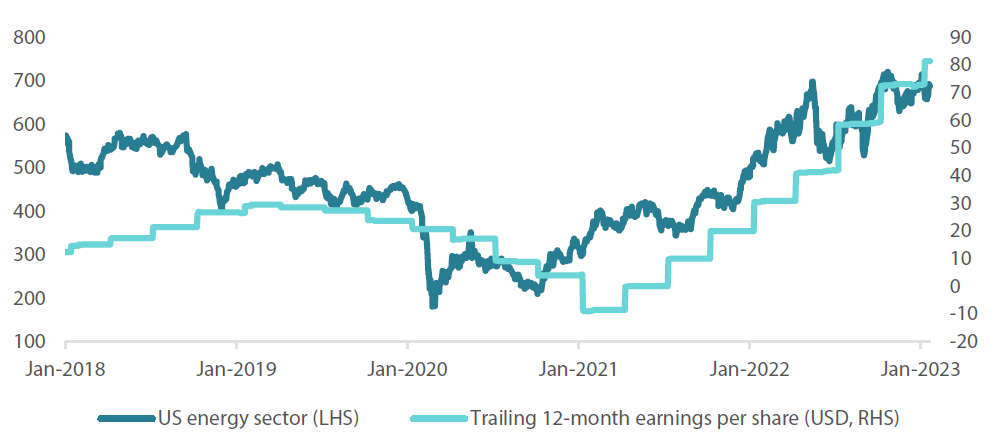

Opportunities in energy and metals

Oil prices moved up aggressively in the first half of 2022 following the start of the Russia-Ukraine war. However, most of these gains were reversed in the second half of the year as energy disruptions from the war proved to be less severe than anticipated and markets priced rising risks of a US recession as the Fed entered an aggressive tightening cycle in June 2022. While energy equities participated in the volatility of the mid-2022 spike in energy volatility, ultimately price follows earnings and in the case of energy companies, earnings remained strong (Chart 1). Oil prices have since stabilised in 2023, likely for improving demand prospects in China, and earnings should continue to find support. Furthermore, energy equities remain inexpensive.

Chart 1: Energy equities vs. reported earnings

Source: Bloomberg, February 2023

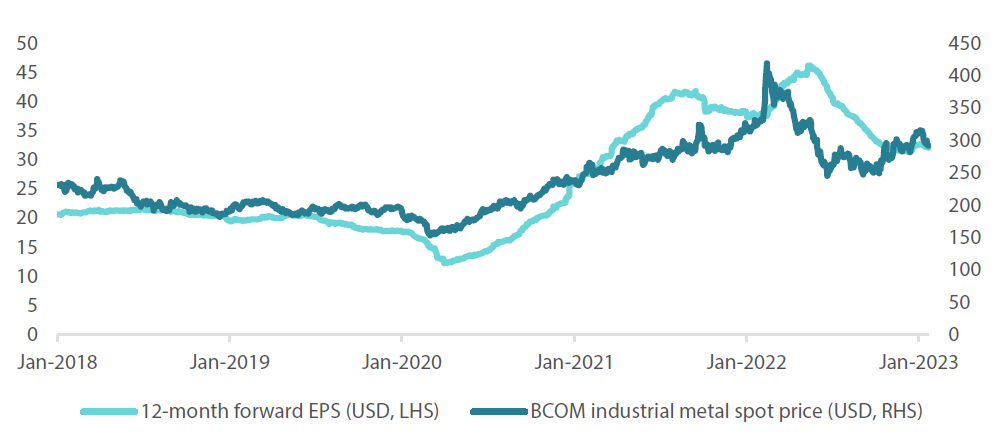

With respect to metals and mining, in our view earnings are more dependent on metals prices and China demand remains the chief driver of global demand and price. In 2022, given the repeated China lockdowns and still tight policies concerning property, prices were weak and the earnings outlook suffered. Industrial metals bottomed in July of 2022, but they have since gained support for likely improving demand that is well-supported by China’s re-opening and now policies to support the property market. Forward earnings are stabilising and are expected to improve (Chart 2).

Chart 2: 12-month forward industrial metals EPS vs. Bloomberg Commodity Index (BCOM) industrial metals

Source: Bloomberg, February 2023

The outlook is still murky, but demand is set to improve due to China’s re-opening and the US economy still holding up on a relative basis to expectations just a couple of months ago. The key risk in demand improvement is that the inflation problem is not yet resolved. Production capacity across the commodity complex is still tight and to the extent that demand stabilises and perhaps improves, inflation can re-emerge as a risk that the market is not currently pricing.

Commodity-linked equities remain an important hedge to inflation volatility, which would likely re-emerge across asset classes if inflation does not return to historical norms as many are pricing. The risk to commodities, in our view, is a recession in the US that could offset new demand from outside. These remain watchpoints for the months ahead.

Conviction views on growth assets

- Cautious on US equities: Technically, US equities appear to have crossed the bearish threshold to the upside suggesting a new bull market may be ahead. However, the large unwind of bearish positioning feeding into a powerful January rally looks overbought with perhaps excessive optimism of a Goldilocks outcome of falling inflation without having to sacrifice growth. It is possible, but given the fast decline in earnings and still high valuations, this scenario would have to play out perfectly to sustain the rally. We are very cautious near-term on US equities for this reason.

- Constructive on China demand beneficiaries: The rest of the world has outperformed the US over the last quarter, largely on the back of a better growth outlook emanating from better China demand helped by Europe averting an energy crisis and a weak dollar feeding global liquidity. Given the earnings outlook and still largely attractive valuations, we are optimistic. Still, the rally has been aggressive into the beginning of 2023, so we would not be surprised to see some consolidation in the weeks ahead.

- Weaker dollar but pause possible: The dollar weakened dramatically from its mid-October peak, giving way to a correction in early February on better growth numbers from the US. The correction makes sense but the long-term proposition that growth is likely to remain stronger outside the US, reinforcing a weaker dollar, has not changed. We still believe the dollar will continue to remain weaker into 2023, which is a tailwind for growth assets.

Defensive assets

Our more positive view on sovereign bonds is unchanged this month. Central banks are approaching a crossroad as they contemplate an end to the rate hikes delivered over 2022. Markets are currently pricing a global easing cycle to follow closely on the heels of these potentially last tightening moves as inflation continues to show signs of moderating. While risks remain for this outlook, monetary policy decisions are likely to become more data-driven and markets could be less reliant on central bank forward guidance in the months ahead.

Global credit has performed well to begin 2023 as risk appetite has seemingly returned with a vengeance. This improvement seems at odds with rising concerns of slowing global growth and potential recessions ahead. Nevertheless, we continue to have reservations about whether this support for credit can be maintained. While the dollar-bloc economies appear to have retained solid growth into Q42022, Europe and the UK are already showing the strains of higher rates and high inflation. Central banks will also continue to pursue their inflation objectives through tight monetary policy, making trading conditions even tougher for companies.

Gold prices charged higher to start 2023 but have since retraced most of those gains. We remain positive despite this volatility as support will continue to arise from multiple sources. With the Fed in the process of slowing its pace of tightening, we expect the dollar to remain weak, creating a tailwind for gold. Demand has also been strong from both investors and speculators, and we expect gold to continue to be a beneficiary of the ongoing diversification of official foreign exchange (FX) reserves.

Gold seen as a top defensive asset

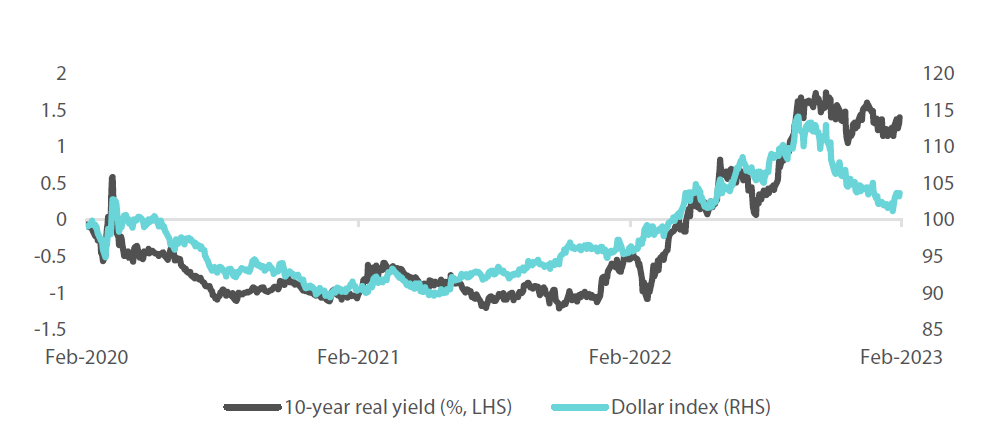

We have become more constructive on gold, after a volatile year. The yellow metal surged to USD 2,050-per-troy ounce shortly after Russia invaded Ukraine in February 2022 before retreating thereafter. Higher real yields and a stronger dollar were the key challenges to the war-induced safe-haven demand. In recent months we have seen turns in both factors which has been supportive of gold, while geopolitical tensions still dominate the headlines. Real yields, measured by the US 10-year TIPs yield, have stabilised in a range of 1.2% to 1.5% over the past three months (Chart 3). This has been a key variable driving gold prices throughout the last decade and in 2022 it jumped sharply because of the Fed’s most aggressive monetary policy tightening in decades. While it is still early, there is nascent evidence that inflation has begun to peak, warranting central banks to slow their pace of tightening and potentially pause in coming months.

Chart 3: US 10-year real yield and US dollar index

Source: Bloomberg, 13 February 2023

Alongside the fall in real yields, the dollar has also weakened meaningfully since November. In our view, the improvement in global growth outlook drove the change, due to China’s surprise pivot in its COVID policy. While the transition was bumpy initially, it is quite clear now that COVID is in the rear-view mirror for China. Economic activity is rebounding rapidly, and authorities appear serious about maintaining this momentum and to potentially provide additional stimulus. This also brightens up the growth outlooks for many in the rest of the world which depend on Chinese demand for growth, with Europe being a major beneficiary. Energy prices have also normalised to pre-Russia-Ukraine war levels, a relief to many but particularly important for the European economy. This broadening of growth prospects beyond the US is typically negative for the dollar and by extension, positive for gold.

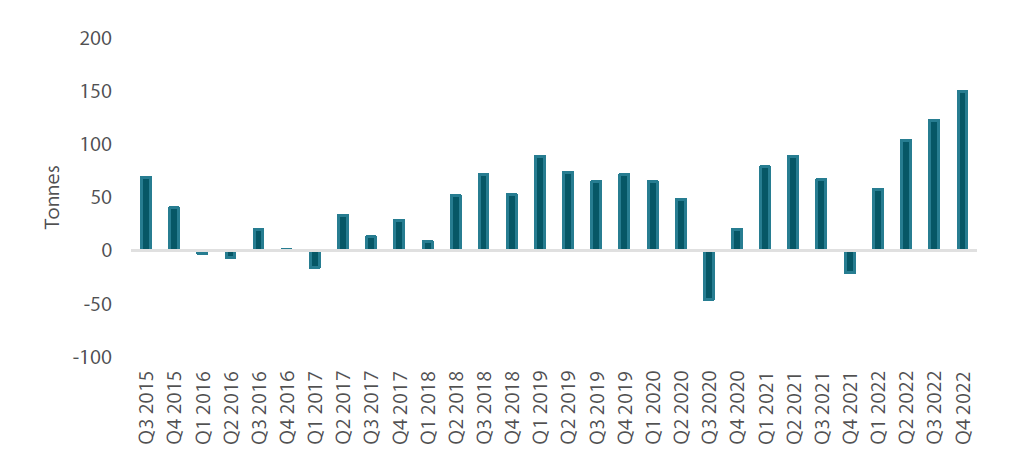

In the longer term, we expect the increase in allocations to gold by FX reserves managers to continue and solidify into a more structural trend, especially among EM central banks. The West’s confiscation of Russian FX reserves in response to the Ukraine war has set a precedent, leading other countries to seriously reconsider their reliance on the dollar as a safe asset. Chart 4 shows that in 2022, central banks had already accelerated the diversification of their FX reserves into gold.

Chart 4: Central bank quarterly gold holdings

Source: World Gold Council, February 2023

Conviction views on defensive assets

- Prefer sovereigns over credit: Central banks are approaching the late stages of this tightening cycle and the mean reversion of goods inflation is driving more favourable inflation outcomes.

- Gold can continue to perform: The twin headwinds of rising real yields and a stronger dollar are fast receding, fuelling support for gold prices.

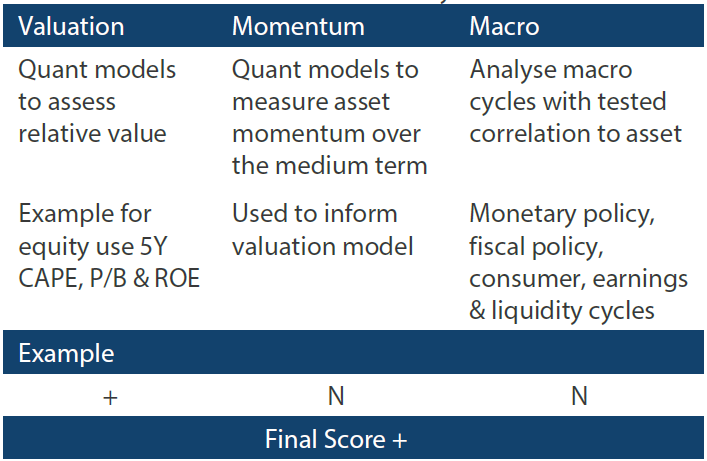

Process

In-house research to understand the key drivers of return: