Flexibility may be what the market most desires from the new BOJ governor

The first leadership change at the Bank of Japan (BOJ) in a decade has involved a few twists and turns. Current BOJ Deputy Governor Masayoshi Amamiya was initially seen as the top candidate to succeed incumbent chief Haruhiko Kuroda. Amamiya, however, reportedly declined the government’s offer, and the post of governor will instead go to Kazuo Ueda, an economist with experience as a BOJ policy board member from 1998 to 2005.

Ueda will become the first academic in the post-war era to head the BOJ. He assumes the reins of the central bank amid a seeming transition; the BOJ had firmly committed to monetary easing under Governor Kuroda’s 10-year tenure but amid rising inflation investors now expect the central bank to begin reversing its policy. What the market perhaps seeks the most from the new governor is flexibility, with a general sentiment that the BOJ does not have to doggedly stick to the policies it implemented under Kuroda. At the same time, it does not have to introduce drastic changes right away. Given the BOJ’s situation, Ueda seems to fit the bill as governor: an academic who can hopefully assess the situation flexibly and communicate the BOJ’s decisions and intent logically. He is not the only academic with ties to the BOJ, but he has the advantage of being very familiar with central bank policy concepts such as the “time axis effect” (which he himself championed while on the BOJ policy board), where inflation expectations are seeded among the public as a mechanism to cope with deflation.

Ueda’s academic background—he has a PhD from MIT—means he has access to a strong international network of other academics involved in central bank policy. Although he may not be a high-profile figure outside of academia, such a network is expected to help Ueda coordinate policy with other central banks. While he may have the ability to communicate and coordinate with other central bankers, it remains to be seen how he will project his message to the media and the market.

One key difference between Kuroda and Ueda’s tenure may turn out to be the government’s stance towards the BOJ. Kuroda became governor in 2013 under drastically different circumstances. The late Prime Minister Shinzo Abe’s “Abenomics” economic policies were being implemented at the time and the BOJ was basically expected to be on the same page as the government. In contrast, current premier Fumio Kishida’s administration appears less focused on projecting its will on the central bank. As a result, Ueda may be less burdened by political considerations than his predecessor. This may place greater responsibility on the new governor, but it could also enable the BOJ to pursue policy more logically and independently.

Ultimately, it will be up to the Japanese economy, not Ueda, to determine the course of BOJ policy. More important than Ueda’s academic views is whether the current apparent rise in salaries continues. If so, the BOJ can take a more flexible policy approach, such as making further adjustments to its yield curve control scheme.

Focus on tax revenue and inflation as Japan’s spending keeps increasing

It is no secret that Japan is heavily indebted, and the government’s recent spending plans have again brought the country’s state of finances into focus. Notable is the defence budget, which Japan plans to increase to about 2% of GDP by fiscal 2027 from the current 1%; the government is also planning to take “unprecedented” steps via fiscal outlays to reverse the country’s steadily declining birth rate. With the budget for fiscal 2023 set to hit a record high, attention has turned to how Japan can finance its spending needs—especially because the government does not appear set to reign in the spending it increased during the coronavirus pandemic. The market currently appears focused on two risks. The first is the risk of Japan’s fiscal credibility being eroded by the state of its finances. The second is that of GDP growth losing momentum should the government reverse course and begin spending less.

Regarding the first risk, Japan is yet to experience a serious deterioration in its credibility due to an expansion of short-term fiscal expenditure. This is thanks to its strong ability to raise tax revenue. For example, in a move that few other governments would be able to pull off, Japan hiked the consumption tax rate during the Abenomics era despite significant opposition. Japan also excels in its ability to collect taxes, which it can rely on to maintain its sovereign standing should an extreme credit event occur.

Regarding the second risk, stimulating GDP growth is less about how much the government spends, but what they choose to spend on. There will be an acute need to spend in a way that generates future increases in tax revenue, as mandatory outlays, such as social security costs, will only increase. Moreover, even if increased defence spending may not have as much of a multiplier effect on the economy relative to other expenditures.

The Kishida administration, at least publicly, says it is committed to spending wisely. It may be easy to view such a commitment with cynicism, but one cannot assume the administration won’t follow through with its goals, either. Inflation, if maintained, is expected to both reduce government debt and increase tax revenues in real terms. Japan’s fiscal expansion will continue. But as we noted earlier, it may boil down to how the money is spent, not how it is financed.

Market: Japan stocks edge up in February on central bank policy expectations

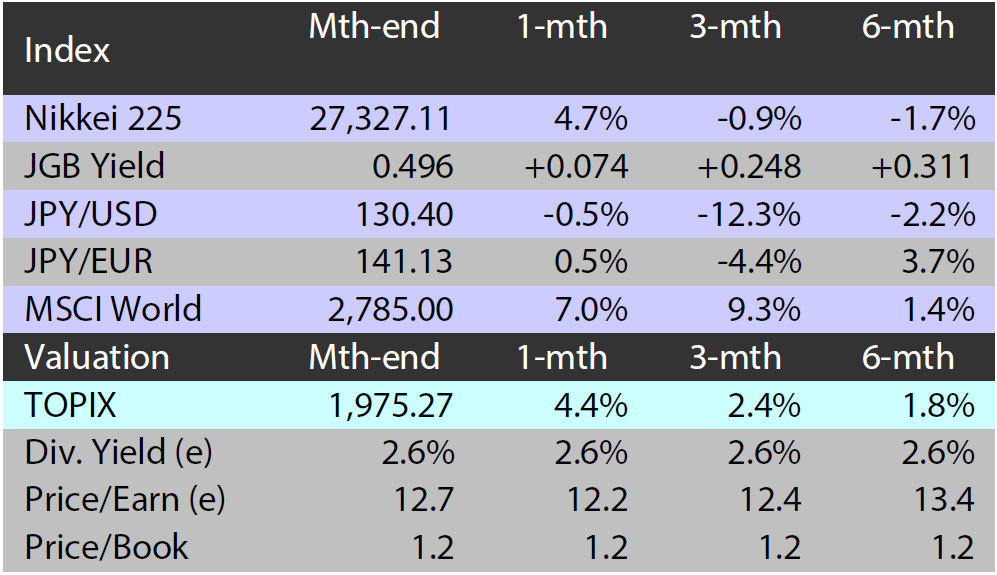

The Japanese equity market ended February slightly higher with the TOPIX (w/dividends) up 0.95% on-month and the Nikkei 225 (w/dividends) rising 0.49%. During the month, stocks were somewhat weighed down by growing views that the US Federal Reserve would prolong its interest rate hikes after US inflation indicators exceeded market expectations. However, this was subsequently offset by positives such as expectations for Japanese exporters’ earnings to improve on the back of the yen’s depreciation against the US dollar stemming from strong macroeconomic data out of the US. Japanese equities were also supported by rising sentiment that the BOJ would maintain its current monetary easing policy for the time being based on the new central bank governor nominee's comments during his confirmation hearing at the lower house of parliament.

Of the 33 Tokyo Stock Exchange sectors, 21 sectors rose with Marine Transportation, Iron & Steel, and Rubber Products among the most significant gainers. In contrast, 12 sectors declined, including Air Transportation, Precision Instruments, and Other Products.

Exhibit 1: Major indices

Source: Bloomberg, as at 28 February 2023

Source: Bloomberg, as at 28 February 2023

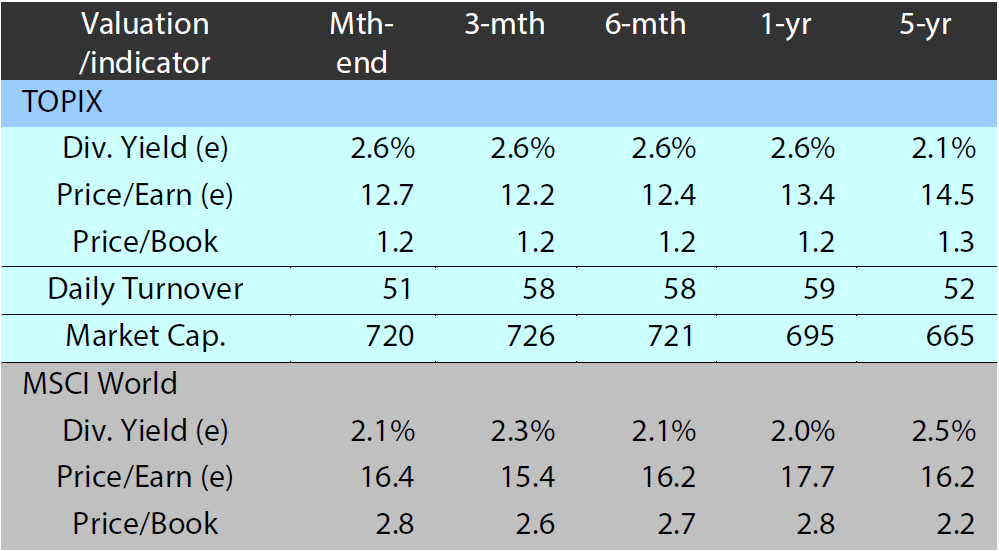

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 28 February 2023

Source: Bloomberg, as at 28 February 2023