Higher pay: Change may be afoot, not only in wages but also salaries

Japan has been long associated with stagnant wage growth, but there are signs of change in the air. With inflation gripping the country, Japanese Prime Minister Fumio Kishida has made wage increases a key policy agenda and has called on employers to act. Keidanren, Japan’s top business lobby, has responded to Kishida’s request by urging its members to raise wages. The largest labour group in the country, known as Rengo, has reportedly said it will press for a wage increase of around 5%, the highest in nearly three decades, during the annual “shunto” spring wage negotiations between unions and employers. A survey by Sankei Shimbun showed roughly a third of the 119 respondent companies expressing an understanding towards Rengo’s 5% wage hike request; according to a monthly poll by Reuters, more than half of the 246 companies surveyed are planning to raise wages in 2023. While inflation may be the main factor, the move towards higher pay is likely driven by a labour shortage and is not just a reaction by employers to surging consumer prices. Manufacturers have already been increasing wages to retain workers as steady exports have generated strong demand for labour. With a post-pandemic recovery in domestic demand now on track, demand for labour from sectors such as services, hotels and restaurants have also intensified the competition for workers.

Furthermore, salaries are also showing signs of rising with a number of high-profile companies such as Fast Retailing, Canon, Suntory Holdings and JGC Holdings Corporation recently announcing pay increases. The factors prompting employers to hike salaries appear to be fundamentally different from those driving wage increases, with some firms seemingly focused on remaining competitive globally by retaining and attracting staff through higher salaries. The developments appear to mark a turn away from the lifetime employment system, which provided employees with a high degree of job security but kept their salaries relatively low. If the Kishida administration is serious about improving labour market liquidity, it may have to come up with additional steps. This would include widening the social safety net to address unemployment which may result from a change in hiring practices and promoting a change in society’s attitude towards labour. Such a policy change could encourage firms to further modify Japan’s staid employment structure.

So far 2023 is proving to be an interesting year in which a shift in social values is taking place, with signs that society is embracing the changes occurring in the labour market. Regarding wages, pay increases enacted by large corporations are expected to prompt small and medium sized enterprises (SMEs) to follow suit to attract workers amid a tight labour market. The process could be gradual, however, due to the rise in input costs SMEs have to contend with. And as for salaries, more large companies are expected to raise pay—not as a reaction to labour market conditions or inflation, but as they may have little other option in order to remain globally competitive.

Wage rise sustainability in focus as market waits for BOJ leadership change

After it tweaked its yield curve control (YCC) scheme in December, the Bank of Japan (BOJ) maintained its ultra-loose policy at its monetary policy meeting in January. The altering of the YCC scheme—which doubled the permitted range of the 10-year Japanese government bond (JGB) yield to 0.5% on either side of 0%—was perceived as a de facto rate hike, raising market expectations that the BOJ would begin taking steps to exit its ultra-loose policy in January. Instead, the central bank expanded its fund-supply operation, allowing it to lend funds to financial institutions at low rates and for longer periods. This was perceived a message by the BOJ to the market that it intends to defend the YCC scheme, as the expanded operation allows financial institutions to buy long-term JGBs with cheaply borrowed funds.

Although the BOJ expressed in January its intent to maintain its ultra-loose policy, expectations remain strong for the central bank to end its easy policy in the near future and begin hiking interest rates. Current BOJ Governor Haruhiko Kuroda’s term ends on 8 April and there is speculation that a change in leadership may nudge the central bank away from its current policy. However, a more decisive factor for the market rather than who replaces Kuroda, could be whether wage increases become a sustained phenomenon. The equity market could continue to experience volatility stemming from BOJ-related developments until it becomes clear whether wage increases can be sustained.

The new BOJ governor will of course still have an impact on equity market sentiment. The new governor will ideally be an eloquent speaker; in hindsight Kuroda may actually be perceived as a decent communicator, with the market potentially responding nervously to the new governor’s pronouncements. The BOJ will become less of a source of concern once the market can start to perceive via earnings results that companies are able to fully offset rising wages with increased sales despite an inflationary environment.

Market: Japan stocks rise in January as yen woes recede on central bank stance

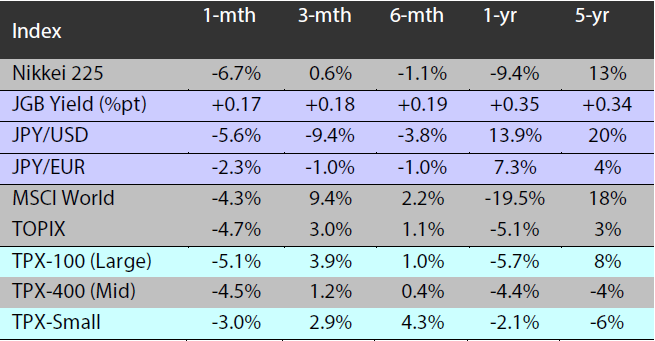

The Japanese equity market rose in January, with the TOPIX (w/dividends) up 4.42% on-month and the Nikkei 225 (w/dividends) gaining 4.73%. Stocks were under some downward pressure from rising concerns regarding an economic downturn in the US after the country’s retail sales numbers came in below market expectations. However, this was offset by positive factors such as the BOJ announcing its intention to maintain monetary easing, which diminished fears that rising domestic long-term interest rates could cause the yen to further appreciate against the US dollar. Japanese equities were also boosted by expectations for a recovery in the Chinese economy following the reversal of its zero-COVID policy and the accompanying pandemic lockdowns.

Of the 33 Tokyo Stock Exchange sectors, 28 sectors rose with Iron & Steel, Electric Appliances, and Machinery among the most significant gainers. In contrast, 5 sectors declined, including Pharmaceuticals; Marine Transportation; and Fishery, Agriculture & Forestry.

Exhibit 1: Major indices

Source: Bloomberg, as at 31 January 2023

Source: Bloomberg, as at 31 January 2023

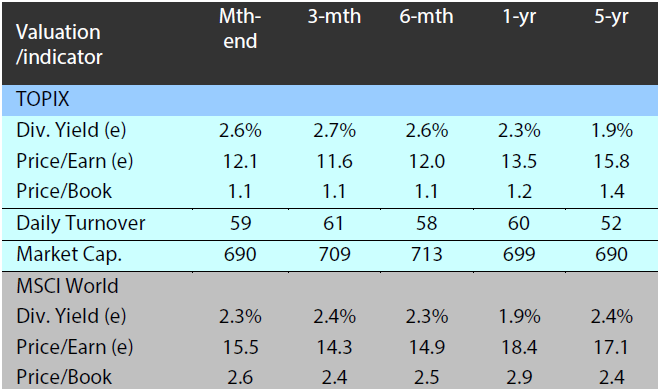

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 31 January 2023

Source: Bloomberg, as at 31 January 2023

Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.