Although the Bank of Japan tweaked its policy in July, we discuss why the move may have been a compromise given expectations the central bank will wait for more concrete signs of inflation before taking a more significant step; we also describe why the rise by Japanese equities could have “legs” this time.

BOJ tweaks YCC, but sustained inflation needed for a bigger policy shift

BOJ surprises in July by tweaking its YCC scheme

The Bank of Japan (BOJ) caught the markets off guard on 28 July by tweaking its yield curve control (YCC) scheme, with which the central bank places a cap on the 10-year Japanese government bond (JGB) yield. The BOJ’s nine-person policy board, with an 8-1 vote, decided to raise the YCC ceiling to 1% from 0.5%. The decision was a surprise as many in the markets did not expect the central bank to alter the scheme until later in the year.

YCC tweak seen as a compromise by BOJ to deal with market distortions

In short, the BOJ’s decision in July appears to be a compromise. The central bank was faced with a dilemma: it needed to address a situation in which the YCC scheme was distorting capital market functions, while it still lacked the conviction that inflation had become strong enough to warrant a shift in monetary policy. By artificially capping the 10-year JGB yield the BOJ created a kink in the yield curve and distorted pricing in the credit market, thereby hampering the ability of firms to raise funds through the issuance of corporate bonds. The latest YCC tweak, allowing the 10-year JGB yield to rise to 1.0%, theoretically enables corporate bonds to be issued at levels deemed more appropriate by the market. Under different circumstances, the BOJ may have preferred loosening the YCC scheme only when it had a stronger conviction that domestic inflation would be sustainable.

Central bank seen waiting until wages rising

As we have pointed out previously in this series, a sustained rise in wages is necessary for inflation in Japan to become a long-term phenomenon. The BOJ is therefore likely to stick to an easy monetary policy until it sees enough evidence of such increased wages; while they have been climbing steadily so far in 2023, the pace of the rise has still lagged the inflation rate. It could be a different story in 2024, as labour shortages have shown no signs of abating. Annual springtime negotiations between unions and large corporations may therefore result in wages outpacing inflation early in 2024. This could finally convince the BOJ that inflation will be sustainable in the long term, opening the door to take a more significant step such as scrapping the YCC scheme altogether. Factors that could help shape the bigger inflation picture include corporate earnings results in autumn 2023, the overall size of bonuses paid out this winter and wage hike demands presented by the workers’ unions in early 2024. The BOJ is expected to focus almost exclusively on the aforementioned domestic factors as it plots a way out of monetary easing; rate hikes by other central banks are unlikely to force Governor Kazuo Ueda’s hand as some commentators suggest.

Japan equities could have “legs” this time amid transition to secular growth

A noticeable aspect about the latest bull run in Japanese equities is that the surge has begun to catch the attention of niche, industry-specific publications in addition to the mainstream media. One such publication recently concluded that unlike in the past, when excitement over the Japanese equities was usually followed by disappointment, the market’s current phase “has legs”.

Before we assess what could be different this time, it may be worth noting the characteristics that caused past disappointments which led many investors to overlook Japan entirely. Prior to the current phase, Japanese equities tended to track economic cycles. Put another way, the market lacked secular changes and was saddled by deflationary sentiment; this made it difficult for equities to go on a sustained rise, and gains tended to be followed by equal, or even greater, losses. The introduction of “Abenomics” late in 2012 altered the trend somewhat but it never really gave the market the impetus investors hoped for.

The turnaround began during the pandemic, when strong exports, mainly to the US, led to manufacturing capacity shifting from a surplus to a deficit. Manufacturers subsequently sought to boost capex and hire more workers, triggering a labour shortage. The shortage was exacerbated as the economy fully re-opened after the pandemic, with the return of travel, tourism and leisure activities prompting a scramble for workers in the service industry. The current boost in capex and labour shortage are Japan’s first since the Global Financial Crisis, and have been accompanied by increased consumer demand. For businesses, the cost of raising wages to hire more employees would be more than offset by the resulting increase in sales. We are witnessing a big shift from a deflationary mindset into an inflationary one.

The end of the deflationary mindset would be significant as it would spell a departure from the cyclical pattern to which the economy has been captive for so long. The current environment could also prompt companies to invest in new technology in an attempt to cover for labour shortages and to invest in other facilities to increase efficiency and productivity. Reversing the typical traits of a deflationary economy—labour surpluses, stagnant sales and lack of capex allowing machinery to sit idle and age—would be a sign that Japan has broken out of it. Investors who have so far overlooked Japan may not want to miss this transition from cyclical to secular growth.

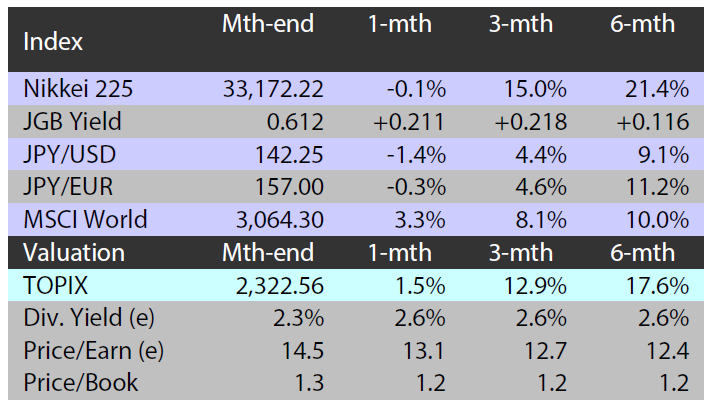

Market: Japan stocks mixed in July amid US rate hike woes, solid earnings

The Japanese equity market was mixed in July, with the TOPIX (w/dividends) rising 1.49% on-month and the Nikkei 225 (w/dividends) falling 0.04%. Macroeconomic indicators out of the US confirmed a robust labour market, leading investors to believe the US Federal Reserve is increasingly likely to continue its rate hikes. This outlook weighed down Japanese stocks, as did a rise in domestic long-term interest rates after the BOJ’s announcement at its Monetary Policy Meeting that it would tweak its YCC scheme to allow more flexibility. However, investor sentiment turned more positive after the BOJ “Tankan” business confidence survey showed improvement in large manufacturers’ outlook, as well as after the release of a succession of solid corporate earnings in the US.

Of the 33 Tokyo Stock Exchange sectors, 27 sectors rose, with Mining, Iron & Steel, and Marine Transportation posting the strongest gains. In contrast, six sectors declined, including Pharmaceuticals, Air Transportation, and Foods.

Exhibit 1: Major indices

Source: Bloomberg, as at 31 July 2023

Source: Bloomberg, as at 31 July 2023

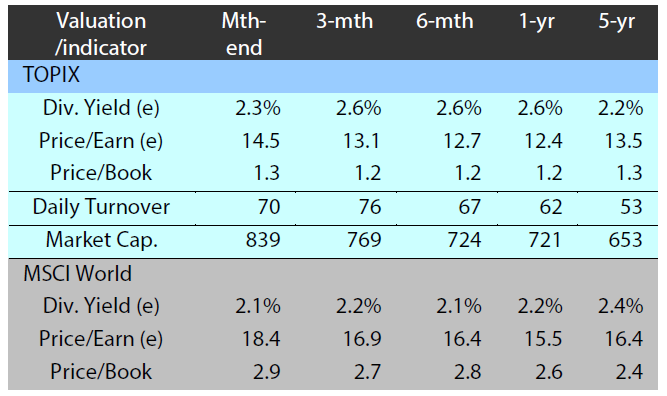

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 31 July 2023

Source: Bloomberg, as at 31 July 2023