Banking turmoil may not shake Japan, but market volatility bears watching

The recent global banking turmoil triggered by the failure of several US regional lenders and exacerbated by the collapse of a major Swiss financial institution prompted some observers to comment that Japan could be hit by the fallout. While Japan has a significantly large regional bank sector, that does not mean its banks will be hit by the kind of tremors affecting their US counterparts.

Like their US peers, Japanese regional banks have actively invested in government bonds, including those from the US, amid a low interest rate environment. However, government bonds are not seen as comprising a major portion of Japanese regional banks’ overall holdings. Moreover, Japanese regional banks are not characterized by large deposits; this means that more account holders in Japan receive guarantees for their deposits than in the US. Japan and the US are also in different phases of their respective interest rate and inflation cycles. Loan demand in Japan could increase at a greater pace relative to the US with the Japanese economy poised to normalise after the COVID-19 pandemic, providing a tailwind for Japanese banks. Therefore, the global banking turmoil may not have a direct impact on Japan.

As for the banking turmoil’s potential effect on monetary policy, the Federal Reserve (Fed) made it clear at the March Federal Open Market Committee meeting that inflation and developments in the financial sector are two separate matters and each should be addressed independently. The Fed’s stance may have assured the Bank of Japan that it can remain on course to further tweak its yield curve control scheme and pave the way to raise rates in the future.

However, overall market volatility could still heighten momentarily, even in Japan. The confusion over Additional Tier 1 bonds (AT1s) which ensued following the failure of the major Swiss bank undermined confidence in the safety these instruments offer. Japanese investors, both institutional and retail, are seen to be sizeable holders of AT1s. The recent shock dealt to the global banking system may not directly impact Japan. But domestic investors’ appetite for risk could remain subdued as many are indirectly tied to the global financial system through their AT1 holdings. This is a situation that should not be overlooked, and fears may linger in the market for several months until investors are able to confirm the containment of the recent banking turmoil.

Though Japan may be slow to ditch the mask, demand recovery appears in sight

Japan’s mask guidelines were eased further recently, with the government recommending that the wearing of masks be a personal choice from 13 March. The change marks a significant step for the country as it tries to normalise its society and economy after the pandemic. The easing of guidelines, however, has not resulted in people removing their face coverings en masse. Masks remain the norm in public, with 74% of respondents to an Asahi Shimbun survey in March saying their mask wearing has not decreased despite the easing of guidelines.

The public’s adherence to masks is often attributed to Japanese culture, in which social conformity is perceived to play a significant role. However, we risk missing the broader picture by following such a common narrative. There remain practical reasons for many people to remain masked. The government still recommends masks on most forms of public transport. Mask wearing has always been widespread during the spring when vast amounts of pollen cover Japan. Tens of millions suffer from pollen-induced allergic reactions, and with the number of afflicted increasing each year, Prime Minister Fumio Kishida even declared that hay fever was now a “social problem”. Once the government relaxes the mask guidelines for public transport and with the passing of the hay fever season, it may be a matter of time before mask wearing decreases significantly.

Despite the persistent use of masks, the number of people traveling via air and rail is steadily increasing and helping the economy normalise in the wake of the pandemic. May could be an important month in terms of how the public approaches mask wearing. It features a string of public holidays at the beginning of the month known as “Golden Week”; furthermore, effective 8 May Japan will reclassify COVID-19 to the same category of common infectious diseases such as influenza (it currently designates the novel coronavirus in the same category as tuberculosis and SARS). We expect the Golden Week break and the reclassification of COVID-19 to lead people to remove their masks and go out more, thereby boosting domestic demand and contributing to the normalisation of the economy.

The recovery in domestic demand will obviously benefit sectors such as those linked to tourism, air travel and the hospitality industry. While foreign tourists have recently returned to Japan, Japanese traveling within their own country tend to significantly outspend foreign visitors. People removing their masks and opting to travel and eat out will likely be a gradual process. Therefore, it may take some time before changes in behaviour translate to domestic demand. When it does, labour shortages could become an issue as businesses which had reduced their workforce during the pandemic will likely scramble to hire again to keep up with increasing domestic demand.

Market: Japan stocks gain in March amid easing of financial system concerns

The Japanese equity market ended March higher with the TOPIX (w/dividends) up 1.70% on-month and the Nikkei 225 (w/dividends) rising 3.12%. Up until mid-month stocks were weighed down by concerns regarding the collapse of regional banks in the US as well as the crisis at a major Swiss financial group. The situation also prompted fears that economic conditions could deteriorate in the US and Europe due to the spate of failures at Western financial institutions. However, later in the month the market rebounded as anxieties regarding the financial system eased following reassurances by the US financial authorities regarding depositor protection as well as moves by other major central banks to provide liquidity.

Of the 33 Tokyo Stock Exchange sectors, 19 sectors rose, with Electric Appliances, Pharmaceuticals, and Wholesale Trade posting the strongest gains. In contrast, 14 sectors declined, including Insurance, Banks, and Marine Transportation.

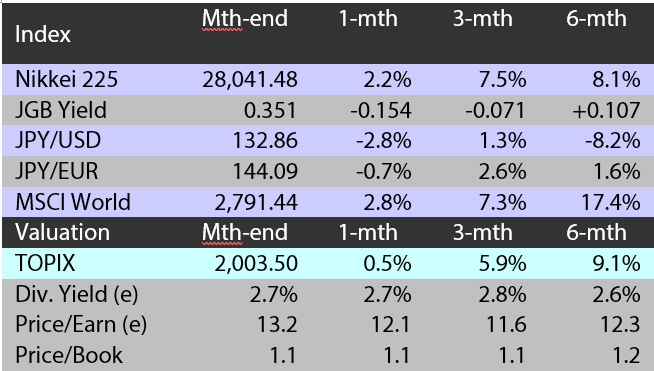

Exhibit 1: Major indices

Source: Bloomberg, as at 31 March 2023

Source: Bloomberg, as at 31 March 2023

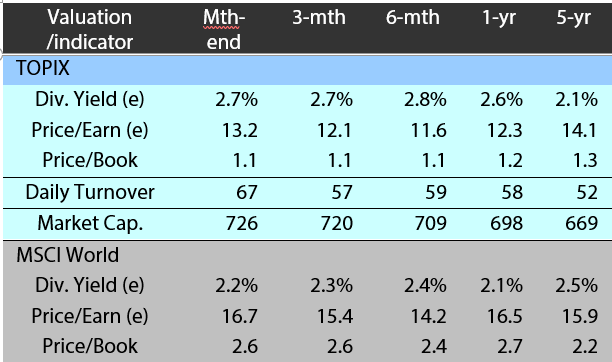

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 31 March 2023

Source: Bloomberg, as at 31 March 2023