The US GDP economy held up even better than we expected, but global bonds and equities did not due to “higher for longer”

Our June meeting’s overall theme of “Good, but not fully smooth sailing, with a rising yen” seems to have been, so far, somewhat too cautious on overall G-3 economic growth, like consensus was at the time. Fortunately, we did not predict a significant recession in the US like many others did, as its economy certainly has held up quite well. Neither did we expect recessions in Japan and Europe, and while current consensus for 2H23 GDP results for them are mildly under our forecast, that for the 1H24 is higher than our forecast. Meanwhile the current market consensus for China’s GDP is moderately undershooting both consensus and our forecasts (only mildly so for 2023, but more so for 2024).

As for the markets, we were too optimistic on global bonds and equities, at least for the 3Q, as both have declined vs. our estimate of gains. After a good start in July, most of the disappointment occurred in the last few weeks. Indeed, we did not expect “fully smooth sailing” and though it was for a while, clearly it is quite far from such currently. As for our central bank expectations, they were accurate for the 3Q except that the BOJ effectively raised the YCC band before our 4Q estimated timing. We forecasted holds in the 4Q for the Fed and ECB, which is narrowly the consensus currently, but our forecasts of cuts in the 1H24, also as per consensus, were too aggressive. This “higher for longer” theme was the main negative force for markets in the 3Q, although there clearly were some other factors as well, especially the Saudi production cuts. As for bonds and currencies, because the US economy was surprisingly strong, and, thus, bond yields were much higher than we forecasted, the yen weakened, whereas we had expected strengthening based upon a narrowing of the trade deficit and a surge in inbound tourism. This also played a major role in weakening the global bond index, which is priced in USD terms and quite heavily Japan-weighted due to its high debt to GDP ratio. The euro was also weaker than our forecasts, as its economy has not been as strong as the US, while its interest rates and bond yields are much lower than the US, especially in real terms. As for geopolitics, our view that such would be worrisome but not very impactful on markets has been correct so far, although it has been a worrisome ride.

Looking forward, on 28 September, our committee decided on a macro-economic scenario (among the six presented) in which the financial and real estate sectors’ troubles in the West continue to play a role in weakening the economy and restraining investment optimism, but not stopping progress, especially as central banks finally stop becoming a larger headwind. We judge this to be very close to the consensus view in the markets. On the positive side, we expect global labour market tightness to ease and oil prices to decline somewhat. In the US, student loan repayments, the auto strike and a partial government shutdown will dampen economic growth in the 4Q, but such should prove temporary and allow for additional strength in the 1Q. As for credit conditions, we do not necessary expect any bank runs, although such are far from impossible, but private lending, private equity, commercial real estate (including CMBS and bank lending to such) are highlighted areas for likely trouble. Markets are now more attuned to the risks in commercial real estate, but given that it is fairly opaque, with booked prices often lagging reality, and that it is one of largest asset classes in Western economies that is deeply entwined with both large and small banks, it is highly likely that the risks are underappreciated, especially as conditions in several of its subsectors are further worsening to distressing levels, at least in the office sector, in the US and Europe. Other property sectors’ pricing is also hit by higher interest costs as well as higher cap rates. The risks are even more serious now that bank regulators will finally be more diligent regarding the pricing of assets and the sectoral concentration of risks, while banks will very likely be turning much more cautious anyway and forced to charge higher rates to clients given that funding costs (except perhaps for the largest banks but possibly for them too as investors continue to shift away from low-rate accounts) are rising. Overall, due to these risks, it is worth mentioning that several members of our committee felt there is more downside economic risk globally, so if we had a bias vs. our moderately upbeat scenario, it would be towards caution. That said, there is a strong interest in preventing recession during geopolitical troubles, so credit bailouts and some toleration of a delay in getting inflation back to target has been and still are playing a significant role.

Given this as a backdrop, our scenario predicts that globally, GDP will virtually match consensus in the next four quarters. Thus, we forecast: US GDP up 0.7% on a Half on Half Seasonally Adjusted Annualised Rate (HoH SAAR, as used in all references below) in the 4Q23-1Q24 period and 1.1% in the 2Q24-3Q24 period; Eurozone GDP at 0.4% and 1.0%, Japan at 0.7% and 1.1%; and China at 4.4% and 4.6% respectively. For CY23 GDP growth, the US, the Eurozone, Japan and China should be 1.9%, 0.6%, 1.9% and 5.0%, respectively with CY24 at 1.2%, 0.8%, 1.2% and 4.3%. Clearly, consensus remains quite subdued for the global economy, with several renowned economists still predicting recessions. Indeed, economic growth will likely be constrained by inflation, high interest rates and disruption related to strikes, especially in Europe and the US (but not in Japan), and if such occurred in a deeply disturbing way, a significant global recession is likely. As for China, we expect a moderate amount of economic stimulus ahead, with the central government also alleviating the debt burden for local governments, but not “spoiling” consumers with fiscal largesse. The property market is clearly a very large concern, especially given the large number of empty units held for investment, but we see some stabilisation ahead, with the government now deeply committed to preventing a larger problem, especially now that such has started to cause visible problems in the trust and wealth management industries.

Geopolitics

Not only will the Ukraine conflict continue to be a major problem, but North Korea, China/Taiwan and the Middle East require close monitoring. However, we do not expect these issues to roil markets very long, though they will likely cause occasional volatility and worrisome rhetoric. Taiwan’s election in January is likely to be one of those potholes, as a firm anti-reunification candidate is very likely to win, thus upsetting China.

As for US political risk, the country remains mired in conflict and we expect continued turbulence. House Republicans will continue to investigate Democrats, including President Biden, which will likely prove very unsettling. The net result of all of this should make risk markets and business leaders somewhat wary, but normally, as long as the economy and corporate profits are not impacted by political turbulence, US markets often overlook such. We expect annual fiscal appropriations to squeak through just like the debt limit did, but it will likely be a very ugly process, and we are already fairly deep into the Presidential election cycle, which will likely be full of major surprises and uncertainties.

Our detailed forecasts:

Central banks: Fed and ECB peak and start cuts in 3Q24, while BOJ tightens

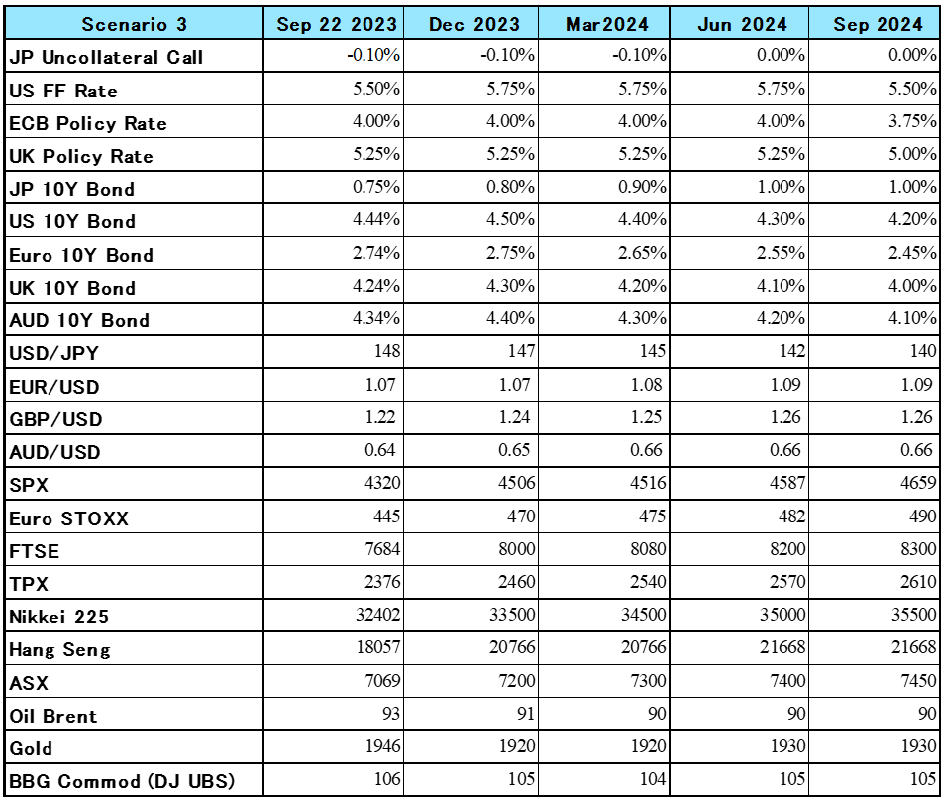

Our new view on central banks is not much different than consensus, as we expect the Fed and the ECB are finished hiking and will cut 25 bps in the 3Q24. The BOJ will likely end YCC in the 1Q and end ZIRP in the 2Q (and before such, it may tweak the negative interest rate policy’s tiering system to make it less onerous to banks). Furthermore, the Fed and the ECB will proceed with QT and along with the BOJ, reduce their balance sheets by winding down special pandemic-related lending programs.

US and European bond yields decline after a relatively flat 4Q, with the yen and JGB yields rebounding

For bonds globally, low economic growth, financial sector and credit accidents, coupled with a continuing decline in inflation should help restrain yields, especially given the finalisation of ECB and Fed hikes, but continuing QT and high issuance certainly will prove to be headwinds. Thus, for US and German 10-year bonds, we expect rates to be relatively flat through December, but to decline 10 bps in each following quarters, whereas for Japan we a gradual rise to 1.0% by the 3Q24. Regarding forex, we expect the USD to decline very gradually over the next four quarters, with the yen rising to 140 by then due to: 1) the BOP trade deficit in goods and services finally returns to surplus led by increased auto exports, a further surge in tourism receipts as group tours from China (which used to account for about 50% of tourists, but has only slightly recovered so far), 2) a continued increase in foreign investment in Japanese equities, 3) a narrowing, finally, in the USD policy rate differential.

One should not forget that fixed mortgage rates, though down from their highs, have soared globally, and even if they decline a bit, they will continue to cause a major headwind to residential property market prices, which in turn should cause negative wealth effects and also credit problems. Also, in many countries, especially the UK, anyone with a variable mortgage rate will suffer major cost increases that will likely lead to a significant number of defaults. Also, overdue residential rent cases in the US are surging and many tenants will likely exit their apartments, leaving landlords and any securities based on housing (with a similar situation for commercial properties) vulnerable to shocks. The recent rebound in US home prices, in our view, will not last.

In sum. we forecast that the FTSE WGBI (index of global bonds) should produce in USD terms a 1.8% unannualised total return from our base date of 22 September through December, 4.2% at end-March and 8.5% by next September. Thus, we are very positive on bonds. For yen-based investors, however, this index in yen terms should return only 0.9%, 1.8% and 2.4% through those respective periods due to yen strength. Meanwhile, with JGBs returning -0.3%, -1.1% and -1.6% in yen terms, respectively, a preference for either hedged (or even unhedged) overseas bonds should be maintained for yen-based investors due to yen strength.

The Brent oil price will likely be volatile occasionally, but decline, in our view, to around USD 90 in each of the next four quarters. Of course, the Russia and Iran questions loom large, both geopolitically and as regards global oil supply, but we think that supply will adjust to any troublesome conditions in relatively short order. We also expect that OPEC will hesitate pushing prices higher lest a rapid shift to alternative energy occurs. Other commodity prices should decline mildly, in our view.

Despite the fact that the oddly calculated medical services component will rebound in October, we expect US headline and core CPI to approximate the consensus estimates of considerable deceleration ahead, with the former at 2.7% and 2.5% in March 2024 and September 2024, respectively, and the latter at 3.4% and 2.8%. As for further details, housing rent will likely continue to decelerate, with airfares, apparel, home furnishings and many services prices softening too due to slow demand. Eurozone and Japanese CPIs should decelerate greatly ahead too, although the Eurozone will take even longer to approach the ECB’s target, as second round effects and labour strikes continue to be quite pervasive.

Equities should rebound

Our scenario is quite positive for global equities, so we maintain a positive view on global equities for the four quarters ahead, rebounding from the disappointing 3Q performance. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will grow 5.2% through December and 11.2% through September (4.2% and 4.9% in yen terms).

In the US, the SPX’s PER on its CY24 consensus EPS estimate is quite high at 18.1, but earnings should rise YoY in the 3Q and rebound further in 2024, buybacks remain strong and the prospect of a dovish Fed and peaked bond yields should encourage investors despite some financial accidents and economic hiccups. Thus, in sum, we expect somewhat moderate gains for the SPX as follows: to rise to 4506 (4.7% total unannualized total return from our base date) at end-December (4.7% return), then to 4659 at end-September 2024 (9.5% return), with yen-based returns of 3.8% and 3.3%, respectively. We expect the US to underperform global markets in the quarters ahead.

European equities’ PER is only 12.1 times CY24 EPS consensus estimates, which is a bit below its historical average. A key factor for performance (along with, of course, the Russia-Ukraine situation) will be how pervasive labour strikes and the resulting wage increases are. We are a bit pessimistic on that front, given the confrontational socialist backdrop there, but we believe this problem will likely peak soon. Meanwhile, there could be some problems associated with Europe’s commercial and residential property sectors will likely cause some banking troubles, but given that EPS expectations will likely increase further due to the stable global backdrop, we expect the Euro Stoxx index to rise to 470 at end-December and FTSE to 8,000, which translates to a total return of 6.9% (unannualised from our base date) for MSCI Europe through then in USD terms (with the Euro stable for this period). Further out, we expect 490 and 8,300 respectively, pushing MSCI Europe up 16.0% through September (with a moderately stronger Euro), which argues for an overweight of the region.

Japanese equities have performed quite well year-to date through 26 September, with TOPIX, including dividends, rising 27% in yen terms and 12% in USD terms, nearly equalling the SPX’s 13% return and greatly exceeding Eurostoxx’s 8%. Corporate profit margins remain very high with sales rebounding nicely in yen terms. Given the full re-opening of the economy (including inbound tourism), consumer optimism is rebounding. High inflation, which has worried consumers, looks set to decline ahead, especially given our anticipated moderate rebound in the yen. We expect commodity prices to fall further, which should also help consumer and investor sentiment. The auto sector, which is a major portion of the stock market and economy, is further recovering, with profits abroad helped by a weaker yen and the UAW strike pushing up costs for its Detroit competitors (as well as curtailing their production). Meanwhile, global tech sector demand is widely predicted to recover ahead, which would be a boon to Japan’s exports. China’s continued economic growth should also help Japan’s exports and its factories there. As noted above, tourism will likely be boosted by increased numbers from the crucial origin of China. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalisation and alternative energy. Japan’s low exposure to Russia is fortunate, and it has secured its natural gas supplies from Sakhalin for the intermediate term. TOPIX’s PER is now 14.2 times its CY24 consensus EPS, which remains attractive. Also supporting the market are strong share buybacks and the market’s dividend yield, which at 2.2% remains extremely attractive vs. bonds. Thus, with a fairly stable global backdrop, especially from China, we forecast TOPIX to rise to 2,460 at end- December and 2,610 next September for total unannualised returns of 5.1% in USD terms (4.1% in yen terms) and 18.8% (12.1% in Yen terms), respectively, from our base date. As for the Nikkei, it should hit 33,500 and 35,500, respectively. These returns are very attractive for both domestic and global investors, so we have an overweight stance on the market.

Developed Pacific-ex Japan MSCI: Australia will likely be somewhat hampered by declining commodity prices, and the domestic downturn in property prices is a headwind for many consumers due to the wealth effect, and for banks and construction firms too. However, improved demand from China and more tourists from there and elsewhere are tailwinds, as will be the forecasted decline in domestic bond yields after the 4Q. Hong Kong’s stock market, which is dominated by PRC firms, should rebound sharply ahead as the currently pervasively negative sentiment lifts due to China muddling through its current problems, coupled with extremely low equity valuations. Hong Kong is also certainly benefitting from a revival in tourism and as global bond yields and global central bank hawkishness decline, the local property market may rebound after its recent weakness. The positive global equity market trend is bound to help local stocks too, so we expect very strong gains from Hong Kong. In sum, we expect the region’s MSCI index returns in USD terms (total unannualised) at 8.0% through December and 16.3% through September. Thus, Developed Pacific ex Japan is highly evaluated in the quarters ahead.

Investment strategy concluding view

We expect occasionally volatile, but positive trends for the global economy, financial system and markets in each of the next four quarters. Regionally, we prefer the European and Pacific Ex-Japan markets for the 4Q, and also Japan’s on a 12-month view. Overall, this clearly leads to an overweight view for equities during the year ahead. As for bonds, we are also quite optimistic globally, excluding Japan, for USD-based investors over the each of the next four quarters. Our stronger yen scenario means, however, that Japan’s investors should overweight their own stock market, not only vs. JGBs and global bonds, but vs. overseas equities, as well. Meanwhile, returns from JGBs should be moderately negative for Japanese investors, but positive for USD-based investors. As always, we can provide forecasts for our alternate scenarios upon request.