Key takeaways

- Asian REITs continue to be one of the fastest growing asset classes in the region

- Asian REITs offer decent yields, a sustainable income stream and exposure to the region’s biggest landlords

- Historically, this asset class has offered relatively favourable risk-adjusted returns, lower correlation to traditional asset classes and hence a level of diversification

Size of the Asia REIT Market

Real estate investment trusts (REITs) are listed companies that own or finance income-producing real estate across a range of property sectors. By providing investors with diversification and requiring a smaller capital outlay than direct investments in the property market, REITs are an excellent way to gain access to real estate without buying property outright. The underlying assets provide capital growth and a stable income stream from rents paid out via regular distributions.

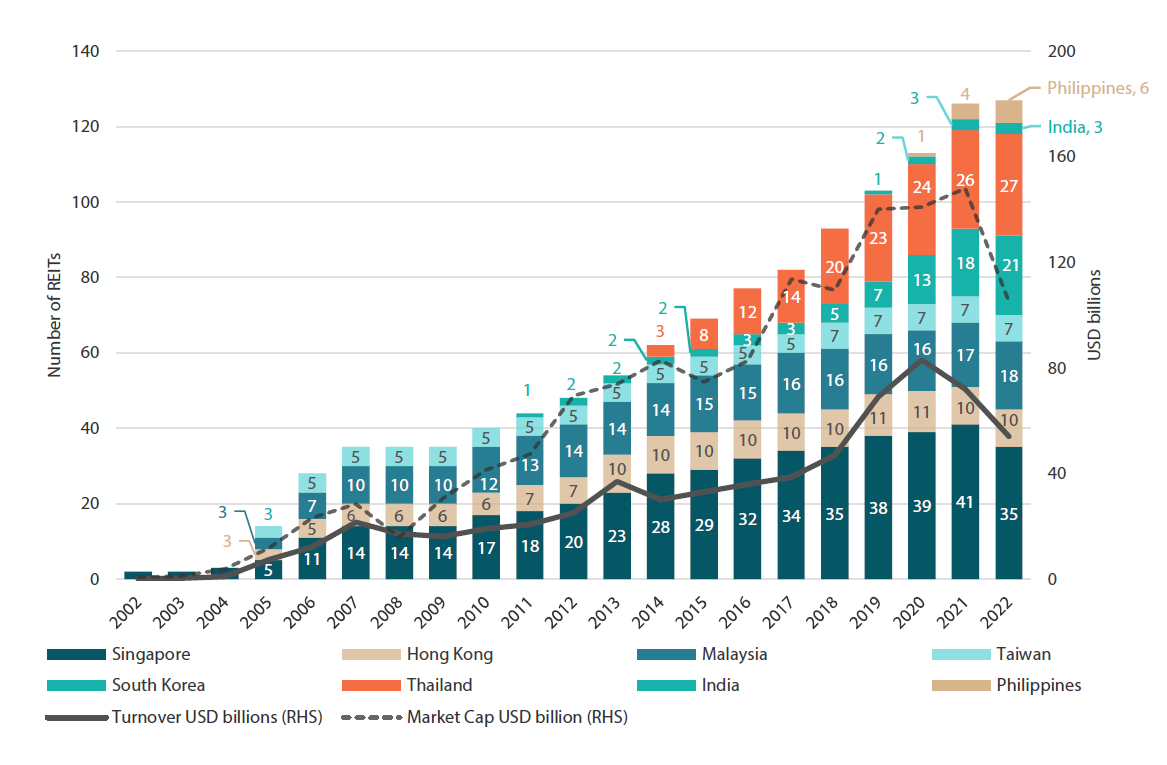

Asian REITs are by far one of the fastest growing asset classes in the region. Global investors have been drawn to this liquid market due to low transaction costs, a smaller “bite” size and less cumbersome management and administration than direct investment. The number of listings and total market capitalisation has grown significantly in the last decade, as the market has expanded both in terms of depth and breadth. This trend is broadening to different Asian markets, most recently including Malaysia, Thailand, India, Philippines and South Korea (Chart 1). We expect more countries in the region to offer REITs over time.

Chart 1: Growth of Asia ex Japan REIT market

Source: Bloomberg, Nikko AM as at 31 December 2022

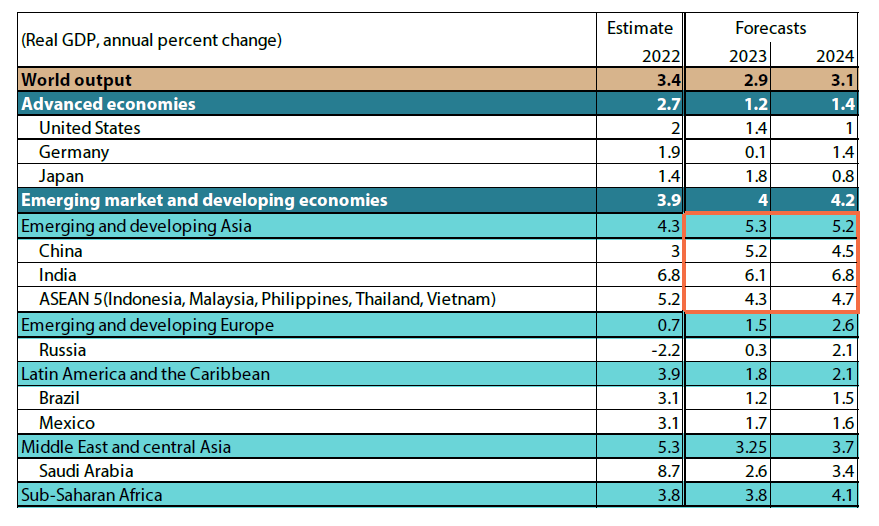

There is a compelling growth story within Asia and REITs provide exposure to various high growth sectors and demographics like the growing middle class consumer, finance hubs and tourism. As per Table 1 below, the IMF expects 2023 and 2024 GDP growth in Asia to outpace other regions.

Table 1: GDP growth across regions

Source: IMF World Economic Forecasts, January 2023

Large and growing working populations in many Asian countries are expected to boost growth over the next decade. The need for new city clusters with associated technological advances, production and consumer hubs is seen increasing urbanisation and providing a boon to the REIT market. Within Asia, Singapore and Hong Kong are the second and third largest REIT markets after Japan.

Singapore continues to gain momentum in attracting foreign investments with its high calibre of talent, stable government policies and access to Asia. Financial firms and high-tech companies have both increased investments in to Singapore. This has reinforced its position as one of Asia's top logistics hubs, with many multinational corporations establishing a central presence here. We expect continued rising demand for warehouse facilities in the region.

Hong Kong is China’s financial gateway to the world. Approximately 80% of the Hong Kong stock exchange’s market capitalisation is for Chinese companies. Further integration of the Greater Bay Area (Hong Kong, Macau and Guangzhou) is expected to lead to increased demand for Hong Kong office space from Chinese companies. Many Chinese high-tech companies and banks leased office space even during the COVID-19 pandemic.

Differentiated returns

Historically lower volatility and risk adjusted returns

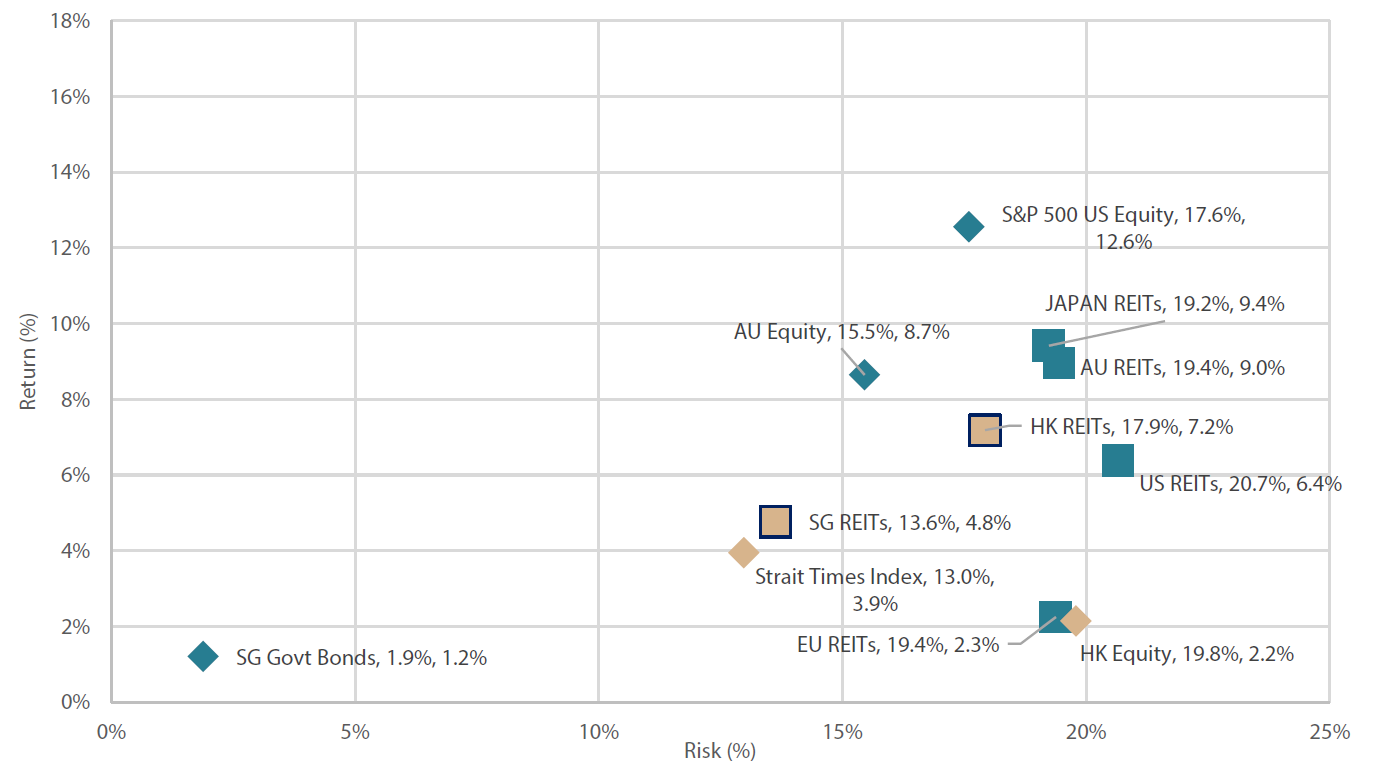

Singapore and Hong Kong REITS have historically offered relatively competitive returns per unit of volatility versus other global REIT markets. Chart 2 plots the annualised return and annualised volatility of major REIT, equity and bond markets. As per the chart, Singapore and Hong Kong REITs have offered attractive returns with similar levels of risk to their equivalent equity markets. For investors heavily focused on equity, REITs could offer a point of diversification.

Chart 2: 10-year risk-return profile (Dec 2012 – Dec 2022)

Source: Bloomberg, January 2023. Past performance may not be indicative of future performance.

Diversification

Some investors may be under the impression that Asian REITs are somewhat of a bond proxy, which is not the case. As highlighted in Table 2 below, historical correlations with key bond markets have been quite low and Asian REITs actually demonstrate a slightly closer correlation to equities. Asian REITS have a low correlation to both developed and emerging markets. In our view, this low correlation is advantageous for achieving good portfolio diversification. Asian REITS also offer segment exposure to mature and stable property markets in Singapore and Hong Kong; in addition, they also offer exposure to higher growth property markets in China, India, Indonesia, Philippines and Thailand.

Table 2: Correlation matrix

Source: Nikko AM and Bloomberg

Attractive dividend yields

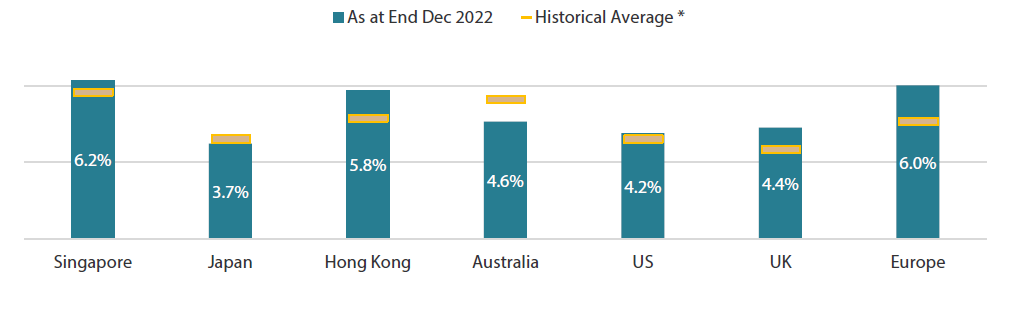

Singapore and Hong Kong REITs offer attractive yields in comparison to REIT markets in most developed economies (Chart 3). They have historically offered yields higher than those of other regions and this has provided a buffer during volatile markets.

Chart 3: Dividend yields (1-year forward estimates)

Index rebased to 100 at 29 April 2023

Source: UBS as at January 2023

*Historical averages are from September 2003, excluding the GFC period of July 2008 to December 2009. Hong Kong starts from December 2005.

Even though bond yields are rising, in our view total returns from regional REITs still look relatively appealing versus those of bonds and many other income-generating securities.

Current environment presents an opportunity

As rates have risen over the course of 2022, this has taken a toll on the capital performance of REITs. Acquisitions have been slightly more challenging due to difficulties in rising borrowing costs. However, we still believe that Asian REITS are in a good position to deal with continued volatility. For the benchmark stocks in the FTSE EPRA NAREIT ex Japan REIT Index, we estimate that 71% of their borrowings are pegged to fixed interest rates. This, in our view, could partially shield these REITs from rising interest rates. In addition, REITs may also benefit from higher rental income in an inflationary environment provided the regional economies do not fall into a recession.

Asia ex Japan REITs are currently trading at attractive valuations. According to Bloomberg consensus forecasts, the FTSE EPRA NAREIT Asia ex Japan REITs Index is now trading at a 11% discount to its book value and an expected dividend yield of 6.0%. This yield is expected to rise to 6.23% and 6.43%, respectively, in the subsequent two years.

Conclusion

We believe that the Asian REIT market will continue to see growth and remain resilient in a world where interest rates remain high. Providing exposure to emerging Asian growth, REITs present an exciting opportunity with access to a liquid asset class. Asian REITs continue to offer good dividend yields, risk adjusted returns and potential capital upside. Their low correlation to other asset classes underscore a good level of diversification. With Asia ex Japan REITs trading at a 11% discount and with a prospective yield in excess of 6%, we remain enthusiastic with regards to this asset class.