Snapshot

Central bank tightening is beginning to have an impact, but less evidently in terms of easing inflationary pressures than in causing strains on the global financial system. Policymakers are beginning to blink—first with Japan intervening to support the yen for the first time since 1998, followed by the Bank of England (BOE) returning to quantitative easing (and postponing planned quantitative tightening) to ease pressures on the UK pension system following an ill-advised fiscal easing by new UK government leadership. We have worried less about the levels of tightening and more about the speed of execution when “unintended consequences” can create problems bigger than those that such policies are intended to solve.

We remain very cautious on the outlook as supply-side shortages, mainly energy, continue to add to inflationary pressures, while central banks are using the blunt tools of demand destruction which (almost always) is the wrong solution to a structural problem. Inflationary pressures can ease and perhaps lend a reprieve to risk assets, but without long-term solutions on the horizon for nagging supply-side issues, it is difficult to see how policymakers can navigate to calmer waters in the near term. Crises can be avoided, but efforts to do so only prolong measures to adequately quell inflation.

While inflationary pressures will persist, component pressures are still likely to ease while the labour market is starting to show early signs of becoming less tight. The Reserve Bank of Australia (RBA) surprised with only a 25-basis points (bps) rate hike, below the 50-bps expected. So perhaps other central banks including the US Federal Reserve (Fed) can find reasons to slow the pace of tightening. Slowing the pace can ease dollar strength, allowing for better growth conditions ahead. Asset prices are down significantly, revealing an increasing number of opportunities that will come to harvest when conditions ease at the margin.

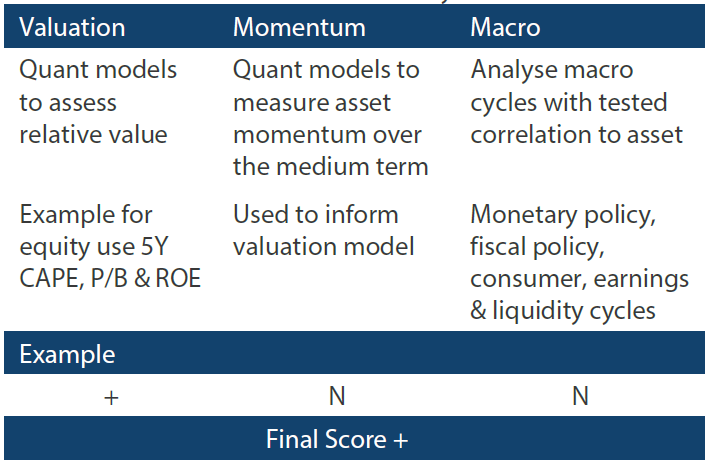

Cross-asset 1

We marginally increased our underweight positions in both growth and defensive assets. Conditions continue to tighten at an accelerating pace with rates, real yields and the dollar picking up pace to the upside, adding pressure on both growth and defensive assets across global markets. While many investors maintain hope for some easing at the margin amid the Fed’s hawkish tone, there are scant signs of this so far. The Fed has stayed firm, lifting estimates for the terminal rate in its recent Summary of Economic Projections and extending the period over which rates will remain higher.

While prior tightening cycles have typically led to rising risks across emerging markets (EM), this time around it is developed markets (DM) such as the UK, that are closer to exhibiting the sort of “unsustainable imbalances” that stoke market concerns. Insufficient rate hikes and potential policy errors in the form of tax cuts and energy cost subsidies are inherently inconsistent with the need to slow demand in pursuit of lower inflation. The UK in particular needs to attract foreign flows to fund a deteriorating current account deficit, a refrain normally associated with EM countries. Global growth has yet to meaningfully slow while job markets remain tight in most economies, so it is difficult to see how this dynamic shifts in the short term to begin the process of easing inflationary pressures.

This month we kept our growth scores unchanged while maintaining a modest tilt to defensive growth sectors, including Infrastructure and REITs, but we are also in the process of implementing market defensive expressions of equity exposure in our implementation. Option volatility is relatively cheap, so we favour sticking with strong downside protection while retaining potential upside from defensive and quality-driven sectors. On the defensive assets side, we retained our positive view on DM sovereigns, while also adding to gold, given more favourable valuations and the natural hedge it provides to a potential policy mistake.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

In a multi-asset world, target returns are achieved through a combination of income and growth, which has been a fairly straightforward task since the early 1980s after inflation peaked where both bonds and equities were very cheap. For four decades, moderating inflation and macro volatility lent support to bonds and equities—starting with high yields in the early years, shifting to more reliance on capital gains through compressing risk premiums in the later years. In 2022, risk premiums are on the rise, driven by higher inflation and rising macro volatility, requiring a shift in multi-asset thinking and portfolio construction to achieve target returns.

Yields are rising, which is positive for the income component of the portfolio, but duration is currently uncompensated risk in a rising rate environment and current income levels still fall short of offsetting the inflation bite on purchasing power. Growth assets show more attractive valuations, but macro headwinds and rising recessionary risks are still a challenge to the earnings picture, so we must seek assets achieving real growth (net of inflation) that are less vulnerable to the economic cycle while expanding the toolbox for risk mitigation.

In past publications, we have discussed the benefits of owning value-tilted equities and commodity-linked equities as a natural growth hedge against rising rates and elevated inflation, and while the latter is still particularly attractive both for compelling valuations and strong earnings on the back of structural supply constraints, both classes of equity assets are vulnerable to the economic cycle, which looks increasingly at risk as central banks continue to tighten.

The key to portfolio construction for achieving positive real returns in the current environment still lies in a value tilt while mitigating the risk of an economic downturn through negatively correlated assets and hedging strategies that protect downside at a reasonable price, lending optionality to the upside and long-term positive real returns on capital that ultimately drive long-term performance to achieve client objectives.

Risks mitigation in slowing growth & with elevated inflation

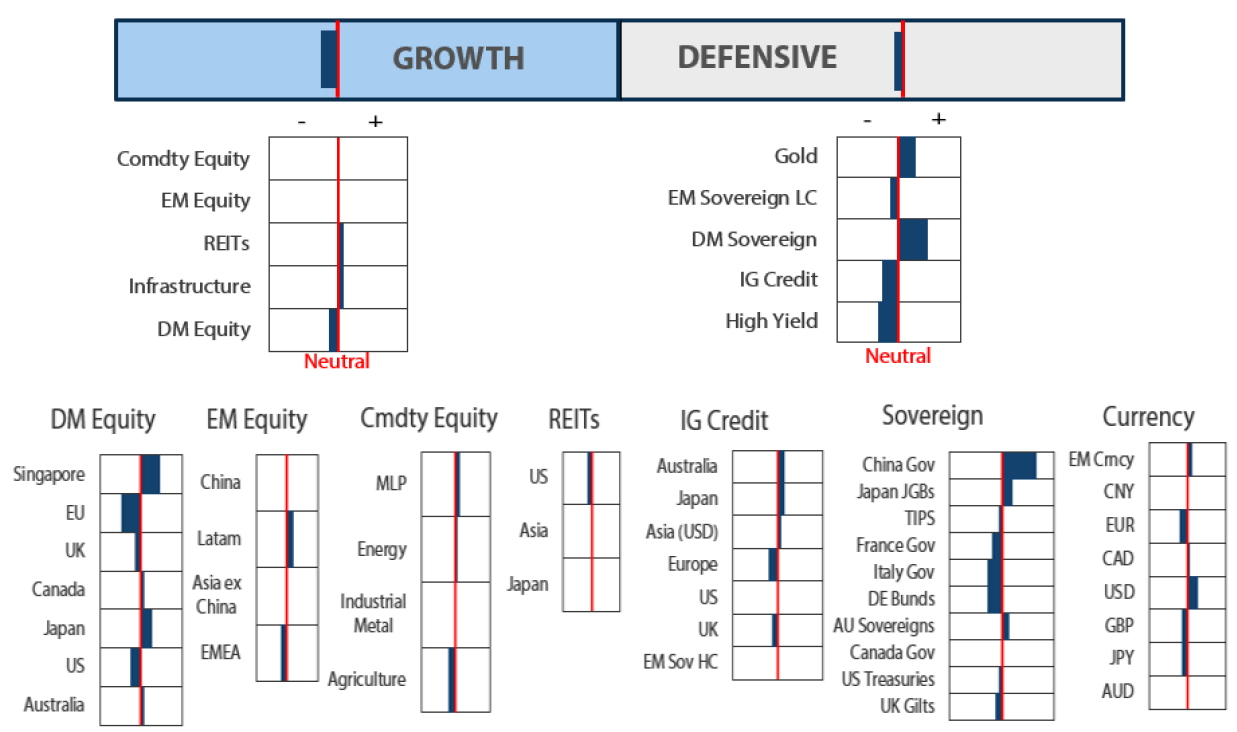

Multi-asset strategies necessarily need to adapt to shifting regimes of volatility and shifting correlations. This year, there has been a definitive shift in bond-equity correlations while volatility has risen significantly for both asset classes, so balanced strategies of years past are no longer a risk mitigation strategy—a new regime which we think could persist for some time. One asset that remains negatively correlated with rising risks is the US dollar (USD), which this year has shown to be the safest negatively correlated asset.

Chart 1: S&P 500 vs US dollar (inverted)

Source: Bloomberg, October 2022

While US Treasuries and USD had historically been positively correlated in recent decades, as fears of slowing growth has been associated with disinflation (or deflation), rising inflation no longer supports this proposition for bonds. It still supports a strong dollar as the global reserve currency where central bank tightening and slowing growth remain a tailwind for the dollar. We expect the dollar to peak in 2023 as central banks tightening draws to completion and growth slows—while growth potentially picks up in China as it (eventually) exits its “zero tolerance” for COVID-19 policy—but for now, the USD remains a negative correlated asset that offers protection.

In future publications, we will explore other techniques such as options strategies that improve risk-adjusted returns while mitigating costs. Generally speaking, rolling put options is a losing strategy for the simple reason that hefty insurance premiums erode performance over the long term versus the downside they protect, but such protection is cheaper today relative to higher realised volatility while there are techniques to significantly reduce costs versus a simplistic put-rolling program. In addition, select cash asset opportunities can be hedged with instruments that pose greater downside risk—in effect, offering relative value opportunities with significantly reduced risk. We will also explore alternative strategies that exhibit long-volatility characteristics that can help to improve performance while mitigating portfolio risk. Please stay tuned.

Conviction views on growth assets

- Still favour value: We see value assets as having better upside over the long term, while we seek to mitigate risks both to the cycle through choice of exposures and other portfolio protection initiatives.

- Cautiously constructive on commodity-linked equities: We seek a properly sized basket of diversified commodity-linked equities that are well diversified while mitigating risk through negatively correlated strategies.

- USD hedging: The USD dollar is well suited as a negatively correlated asset class to help mitigate risk to growth assets.

Defensive assets

Our cautious view on sovereign bonds remains unchanged. Central banks continue to tighten monetary policy aggressively as they try to bring inflationary pressures under control. Yield curves across most DM currencies are still rising and somewhat surprisingly, EM sovereigns have outperformed. Given the strains of a rising US dollar on EM finances, we prefer to wait for tangible signs that US dollar strength may be peaking before taking advantage of higher EM yields.

While sovereign bond returns have obviously suffered, the impact from higher rates has been amplified for corporate bonds as spreads are widening and risk sentiment is deteriorating. As global demand slows sufficiently to curb inflationary pressures, credit spreads are likely to remain under pressure. Credit quality is still robust but that is likely to change as demand slows and the margin for error is reduced. In this environment, we prefer the relative safety of government credit.

Gold has faced headwinds from rising real yields and a stronger US dollar. But at the same time, geopolitical risks abound as the war in Ukraine continues with seemingly no end in sight. Add on the risk of unintended consequences as aggressive central bank tightening continues, and demand for gold is likely to remain robust.

UK policy misadventures

While we often lament a lack of vision and conviction from our political leaders, there is a time and place for the sort of left-field policy turn witnessed recently in the UK. In the eyes of financial markets, this was clearly not the time nor the place for an expansionary mix of tax cuts and spending, on top of an already stretched UK government budget. The BOE was first amongst its peers to recognise the need to tighten monetary policy, delivering its first rate hike in December 2021. Rate hikes have then followed at every BOE meeting since, in pursuit of an objective to slow demand and reduce inflationary pressures. A significant loosening of fiscal policy at this juncture is clearly at odds with the BOE’s efforts to tighten financial conditions.

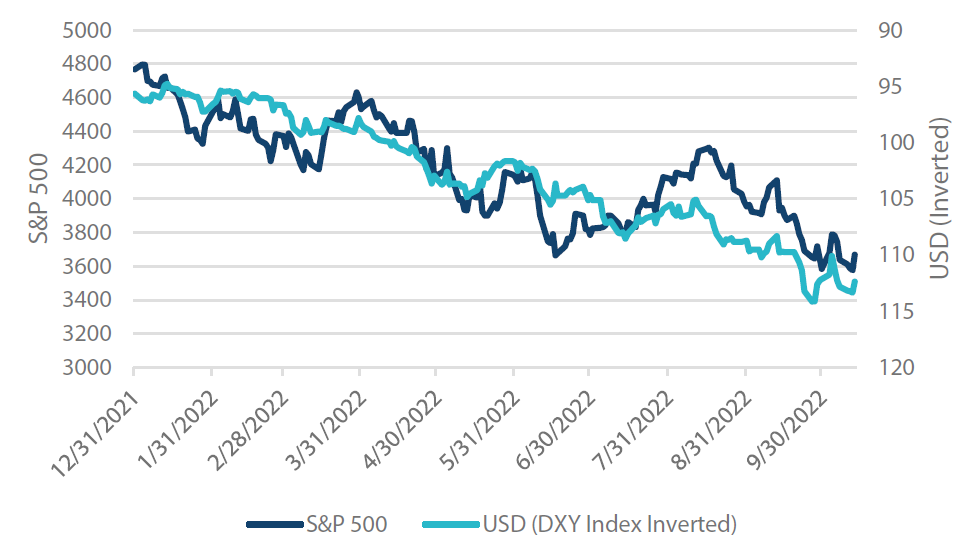

The reaction from markets was swift and painful for owners of UK assets. The government’s announcement of its new Growth Plan on 23 September sent the pound and stocks into a tailspin and gilt yields soaring. Chart 2 shows the significant increase in 10-year gilt yields, rising by 1% over the following three days and flipped from yielding 22 bps less than equivalent US Treasuries to 56 bps more. Some stability returned to markets when the BOE stepped in on 28 September and announced a gilt market operation to carry out temporary purchases of long-dated gilts to address market dysfunction.

Chart 2: 10-year UK gilts versus US treasuries

Source: Bloomberg, October 2022

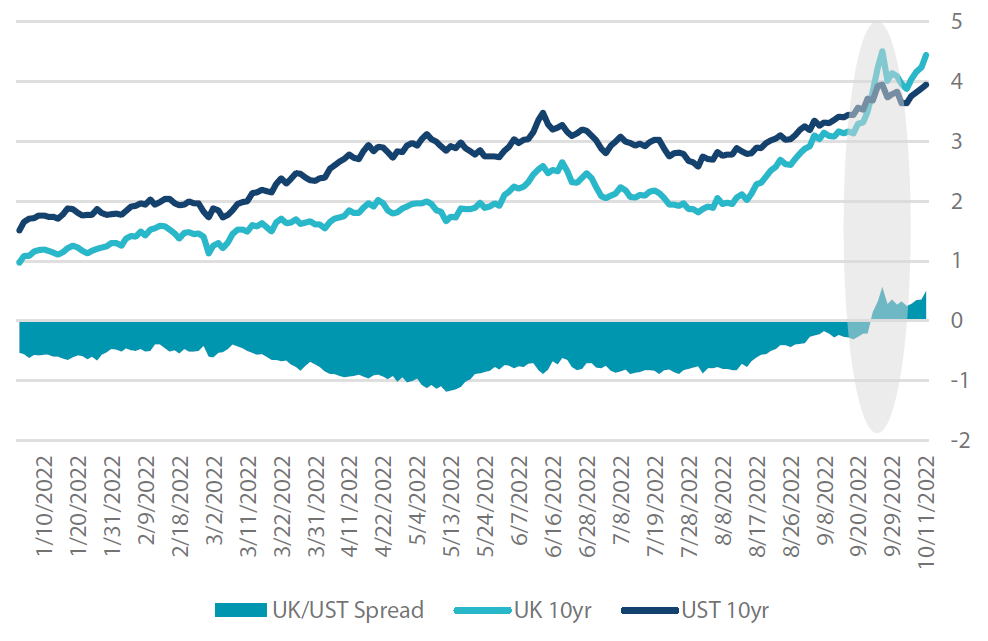

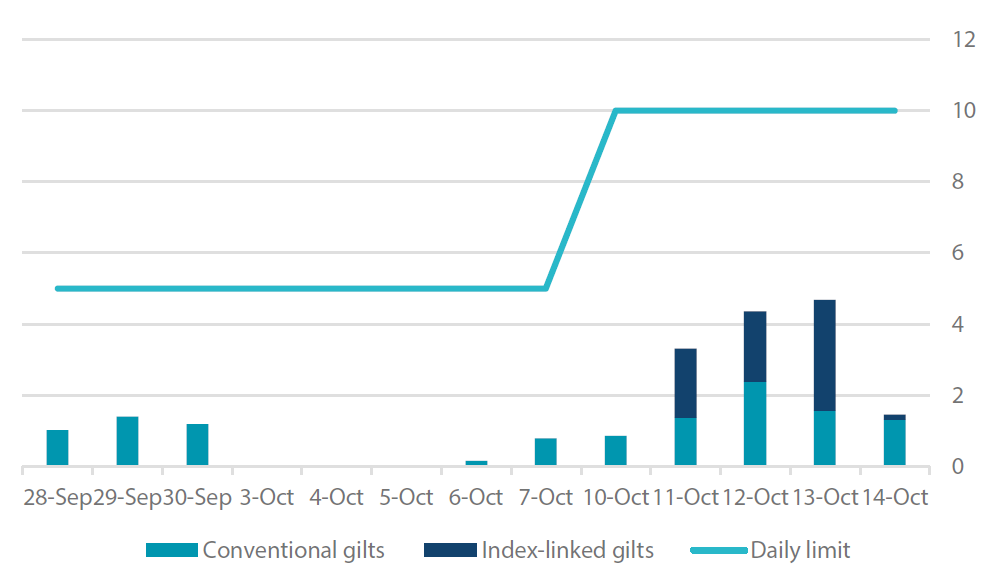

The temporary nature of the program reflected its limited lifespan, due to end two and a half weeks later on 14 October. The BOE initially capped daily buying at British pound (GBP) 5 billion and then later increased it to GBP 10 billion. The program was also expanded to include index-linked gilts and a new repo facility to provide additional liquidity. All in the name of “saving” the liability driven investment (LDI) industry and conveniently sidestepping too much focus on BOE/government tensions. Those were the announcements but chart 3 shows the actual buying performed by the BOE.

Chart 3: Bank of England temporary gilt purchases

Source: Bank of England, Bloomberg, October 2022

The main point that stands out is that the BOE buying program never came close to the daily limit during the first two weeks. Nevertheless, gilt yields responded positively following the announcement even though actual buying by the BOE was underwhelming. This did not last however, as markets began to realise that, in our view, the BOE’s heart really was not in it and gilt yields pushed higher again. Rather than reducing volatility and providing some leadership on fair value for long-end gilt pricing, the BOE seemed to leave the market to determine the movement of the gilt pricing. A reasonable strategy when markets are functioning normally, but not advisable when markets are dysfunctional. The culmination of this saga will ultimately be less about market interventions and more about a coordinated policy response from the government and BOE that addresses the twin objectives of economic well-being and lowering inflation.

Conviction views on defensive assets

- Duration risk is still high: Central banks continue to hike official interest rates and yield curves are still under-pricing the eventual terminal rates for global monetary policy.

- Prefer sovereigns over credit: As global monetary policy tightening translates to slower global growth; pressures are likely to mount on corporate credit quality and spreads can continue to widen.

Process

In-house research to understand the key drivers of return: