Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise - does the company have a sustainable competitive advantage?

Management - does the company make sound strategic and capital allocation decisions?

Balance Sheet - is growth appropriately financed?

Valuation - are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

We have long observed that central banks have been undertaking a multi-year experiment with their endeavours in money creation via quantitative easing. What has now become clear, in our view, is that the further round of liquidity creation resulting from COVID-19 has tested the experiment to the point of failure. More specifically, the cumulative imbalance between notable growth in financial assets and the limited growth in the availability of commodities, goods and infrastructure in the real economy has been exposed. When demand has rapidly returned post COVID-19, we have had to experience supply chains that are too lean, limited labour availability and energy shortages. The Ukraine war has just magnified some of these underlying issues.

Our belief is that we have moved into a new regime where inflation will be structurally higher despite the anchors of high debt burdens, ageing societies and ongoing technological disruption. Energy markets remain constrained, labour in short supply and fiscal policies remain vulnerable to the demands from voters to alleviate the pressure on real wages, particularly for lower income groups.

Whilst this appears a reasonable thesis to us, it is also fair to observe that this has probably become the general consensus in markets. In addition, rising risk free rates and widening credit spreads are rapidly tightening financial liquidity. Hence, we may be close to the point where a peak in the current inflationary surge is clearly evident, and with weak signals from the real economy, the worst of the impact from the rising cost of capital may be behind us.

However, the growth trajectory will remain challenging, particularly when central banks will be reluctant to return to further rounds of monetary extravagance, even when evidence emerges of business layoffs and an overdue correction in frothy residential property markets. The focus for equity investors will therefore likely shift from the price paid for profits to the confidence that the expected profits are being delivered. Indeed, the pending profit reporting season will likely be a volatile one.

As focused stock pickers, the future profitability of companies is always a priority for us. Overall economies are clearly slowing rapidly, something that most companies will be impacted by. Our belief, however, is that the prior excesses of real economic activity will be in those parts of the economy that have benefitted most from the prior period of extraordinarily low cost of money. COVID-19-related demand beneficiaries are an obvious example, as shares of Peloton and the like will attest. What is less appreciated may be the degree that the financing of new startups in the public and private markets, particularly in technology and disruptive business models, has elevated as the revenue of the enablers of these firms. If we assume capital raising just reverts back to historical norms, revenue declines could be significant for some of the titans in this area.

The advantage of being active stock pickers is that we are not slave to the market weighting of prior winners with potentially bloated levels of profitability and instead can focus on companies more likely to experience positive surprises in revenue and profitability in the coming years. Required future investment in energy transition is one common theme behind several of our more recent stock picks. The current energy crisis has highlighted the clear need for economies to sustain existing fossil fuel production for supply risk reasons, improve energy efficiency and invest more in the fossil fuel alternatives such as renewables and hydrogen. There are a number of companies that are key enablers of this required investment and are able to deliver the superior level of future returns on invested capital that we seek.

Beyond energy transition, the focus is more about seeking companies that can indeed deliver enduring growth and profitability. As highlighted earlier, profit shares are under pressure from rising raw material costs, labour inflation, growing utility costs and finally increasing interest costs. Passing on these costs to customers whilst also maintaining volumes will be a key question asked by investors in the coming reporting season. Many consumer facing businesses now have demand challenges, even before price hikes are being considered and hence are vulnerable to margin pressures, particularly if inventory overhang is evident. Healthcare companies, on the other hand, typically have less cyclicality in demand and in many cases have been indiscriminately derated in the reappraisal of higher growth companies over the last 12 months. We keep finding more Future Quality picks here where the confidence in growth is higher versus sectors such as Communication Services and Information technology.

In summary, we are encouraged by the shift in which investors are back to investing capital with realistic expectations of future compounding rather than just deploying into the fashionable “pipe dreams” of the day. Whilst we caution against any expectation of a return to the giddy valuation levels experienced during the COVID-19 period, it is encouraging that valuation levels are now more in line with historical norms. The next test, however, will be the shape of future profitability, as the increasing volatility of central bank policies dampens both company and household spending. Our consistent focus on enduring high returns franchises with strong management teams, robust balance sheets and credible starting valuations will hopefully help us find a path through these current profitability challenges.

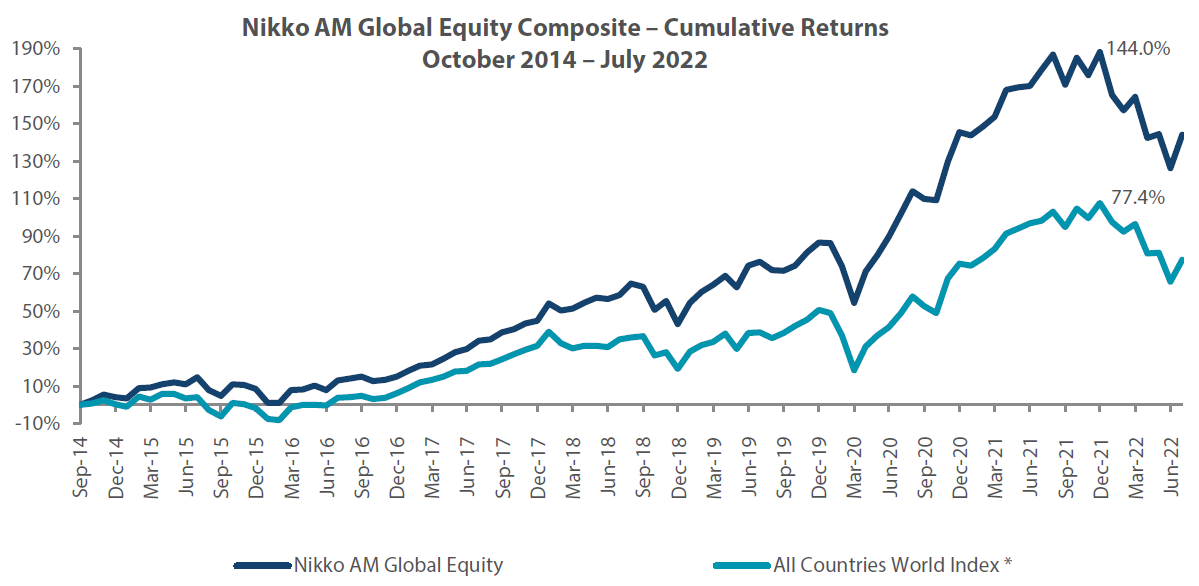

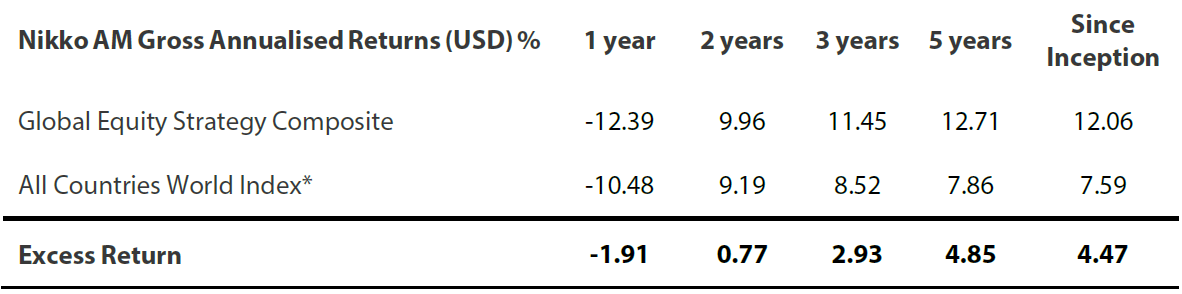

Global Equity Strategy Composite Performance to July 2022

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 July 2022.

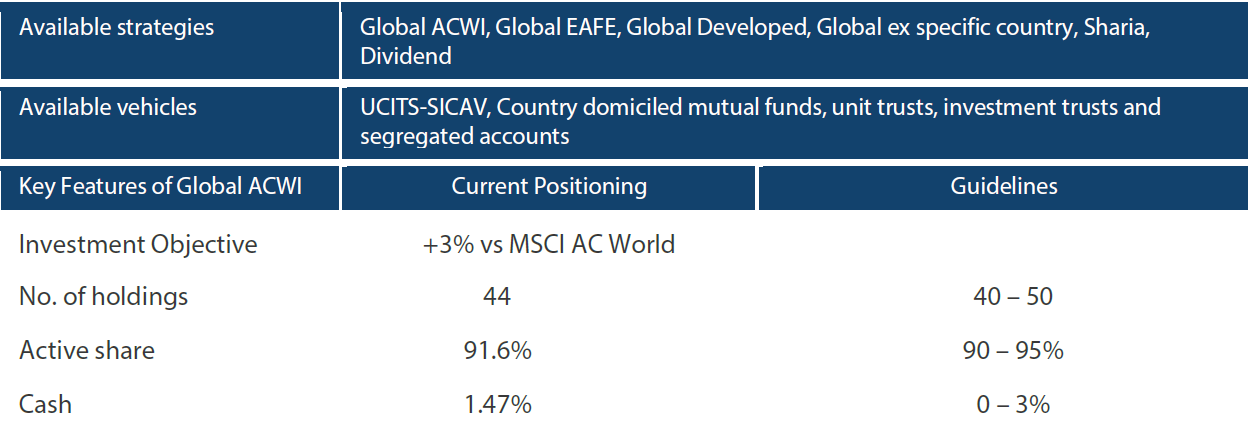

Nikko AM Global Equity: Capability profile and available funds (as at 30 July 2022)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 25 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 followed by Finn Stewart in 2022, the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can attain and sustain high return on investment. We believe that ESG considerations and Future Quality investments are not independent of each other and as such the team evaluate the materiality of ESG factors when assessing the Future Quality potential of each stock.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 206.1 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2022.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.