Summary

- Asian stocks declined in March, dragged down by the Russia-Ukraine conflict. Lingering concerns over inflation also weighed on the equities markets. For the month, the MSCI AC Asia ex Japan Index fell by 2.8% in US dollar (USD) terms.

- China and Taiwan saw the biggest declines. Chinese stocks underperformed as activities in several cities in China were disrupted as authorities tried to curb the spread of the COVID-19 outbreak. Taiwanese stocks retreated as its central bank raised the benchmark interest rate to curb domestic inflation and maintain price stability.

- India outperformed despite its CPI surging to 6.07% in February 2022, above the central bank’s tolerance limit. Investor sentiment was lifted as state election results favoured current Prime Minster Narendra Modi’s party, and the nation announced measures to become a major exporter of wheat and release more oil from national supplies to combat price increases and global shortages.

- The Russia-Ukraine conflict is a fast-developing and unpredictable geopolitical crisis with profound and long-lasting changes to business outlooks. In our view, structural areas with policy support such as domestic Asian consumption, healthcare, renewables and industrial technology remain in favour in spite of the ongoing geopolitical conflict.

Market review

Regional equities fall in March

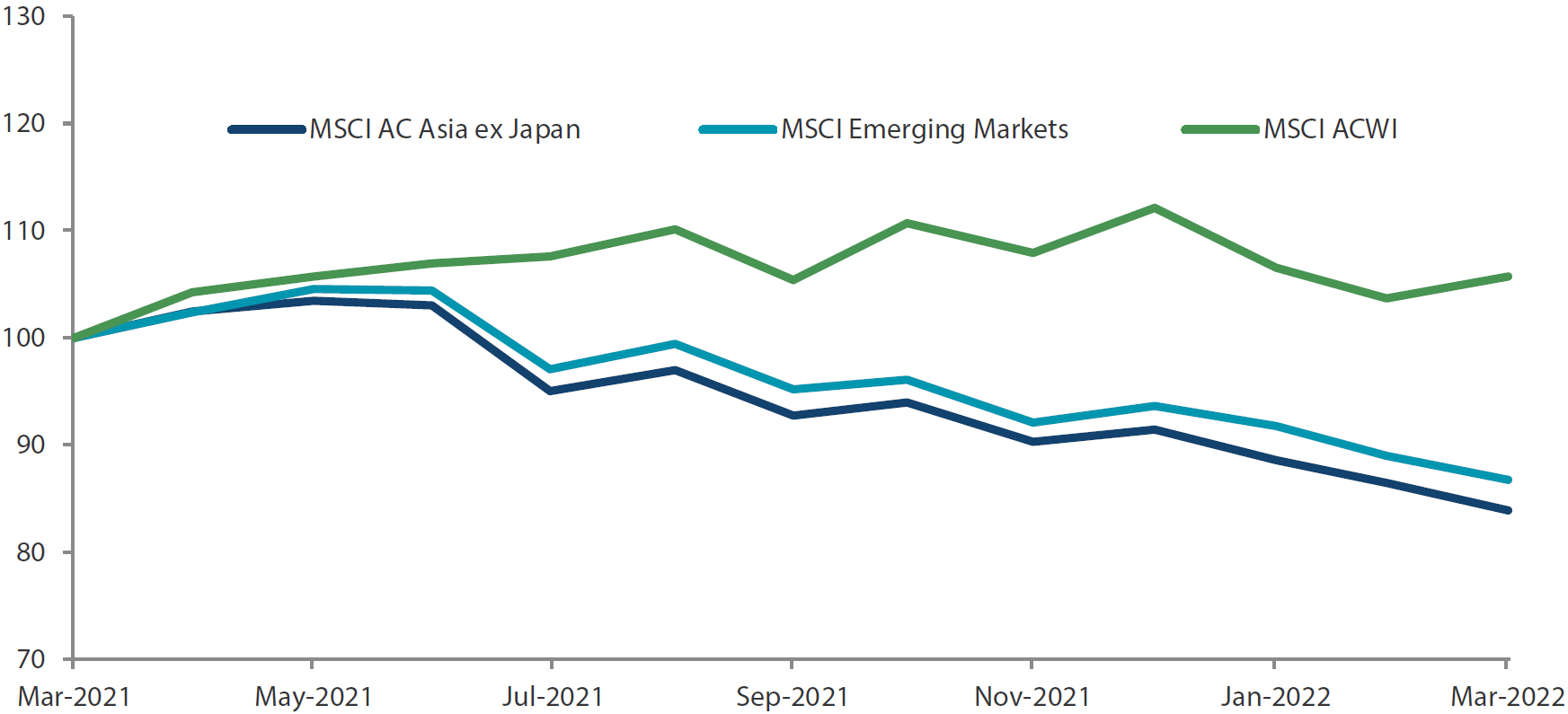

Asian markets declined in March, dragged down by the Russia-Ukraine conflict, which prompted global leaders to impose sanctions on Russia. Lingering concerns over inflation also weighed as the US consumer price index (CPI) accelerated to 7.9% in February 2022, with the US Federal Reserve (Fed) raising its benchmark interest rate by 0.25%. For the month, the MSCI AC Asia ex Japan Index returned -2.8% in US dollar (USD) terms. Within the region, India, Indonesia and Singapore were the month’s best performers (as measured by the MSCI indices in USD terms), while China and Taiwan lagged.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 March 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

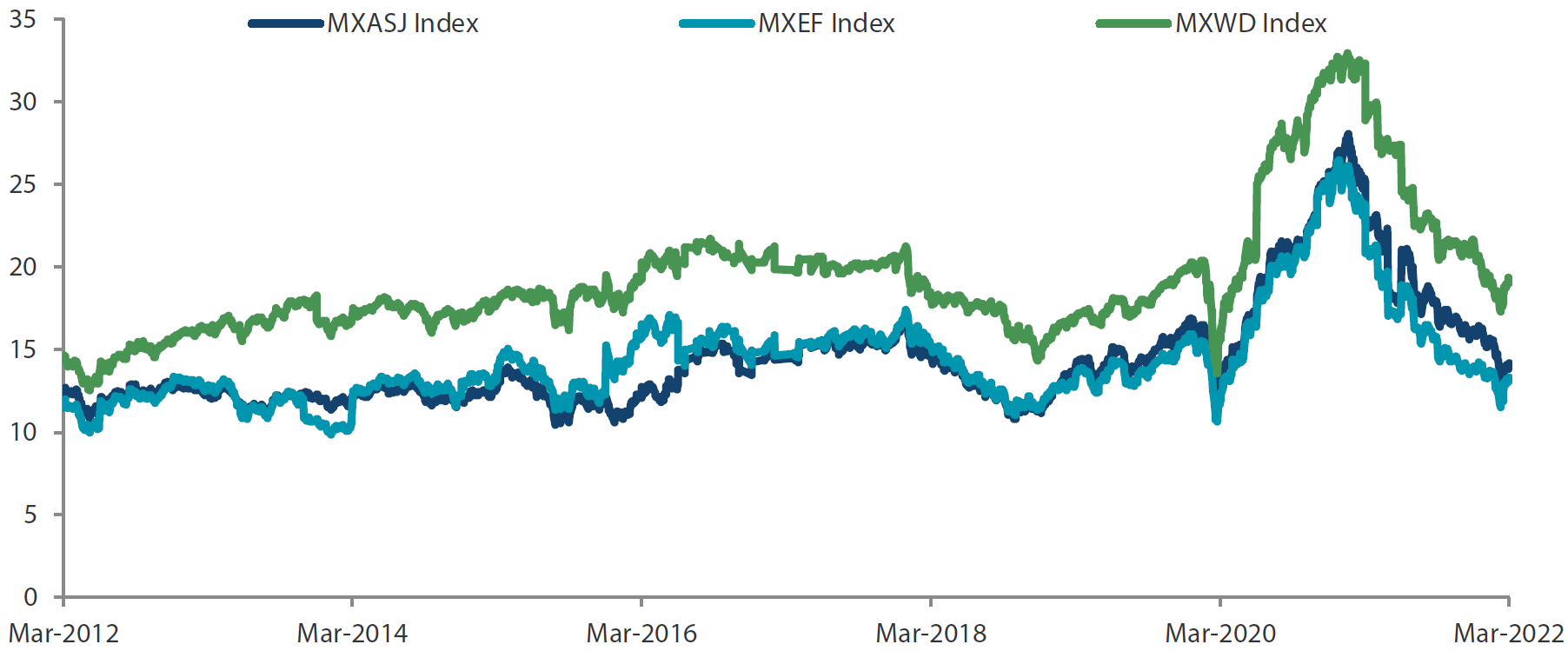

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 March 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Indian stocks climb

Indian stocks rose by 3.7% in USD terms, despite the country’s CPI surging to an eight-month high of 6.07% in February, above the central bank's tolerance limit. Investor sentiment was lifted as state election results favoured current Prime Minster Narendra Modi’s party, and the country announced measures to become a major exporter of wheat and release more oil from national supplies to combat price increases and global shortages.

ASEAN markets mixed

The ASEAN region saw mixed returns as several economies started to reopen, rolling back COVID-19 restrictions to bolster growth. Indonesia (3.3% in USD terms) kept the seven-day reverse repo rate unchanged at an all-time low of 3.50%, as its annual inflation rate eased to 2.06% in February from 2.18% in January. Singapore (0.5%) rose marginally as core inflation in February came in at 2.2% on a year-on-year basis, down from 2.4% in January. The rest of the ASEAN region fell, with the Philippines (-1.9%) being the largest detractor, as the country warned of inflation due to global commodity and food prices. Thailand (-1.3%) also weakened as its CPI rose 5.28% year-on-year, the fastest pace in 13 years, and as authorities cautioned that the economy may grow less than expected.

North Asia lags ASEAN

The North Asian region lagged its ASEAN counterpart. China (-8.0%) fell as the US Securities and Exchange Commission moved closer to delisting some Chinese firms from US exchanges for failing to comply with accounting rules. Activities in several cities in China, including the manufacturing and financial hubs of Shenzhen and Shanghai, have also been disrupted due to restrictions to curb the spread of COVID-19. Measures such as tax rebates and lower income taxes for small firms were announced to shore up the Chinese economy, which helped to cap losses. South Korea (0.1%) posted modest gains on the back of its central bank’s comments on the need to further raise interest rates to tame inflation. Meanwhile, opposition candidate Yoon Suk-yeol was elected as the next South Korean president, with the ruling party candidate conceding defeat. Taiwanese stocks (-2.2%) also gave ground as its central bank raised its benchmark interest rate by 0.25% to 1.375%, hiking rates for the first time since 2011to curb domestic inflation and maintain price stability.

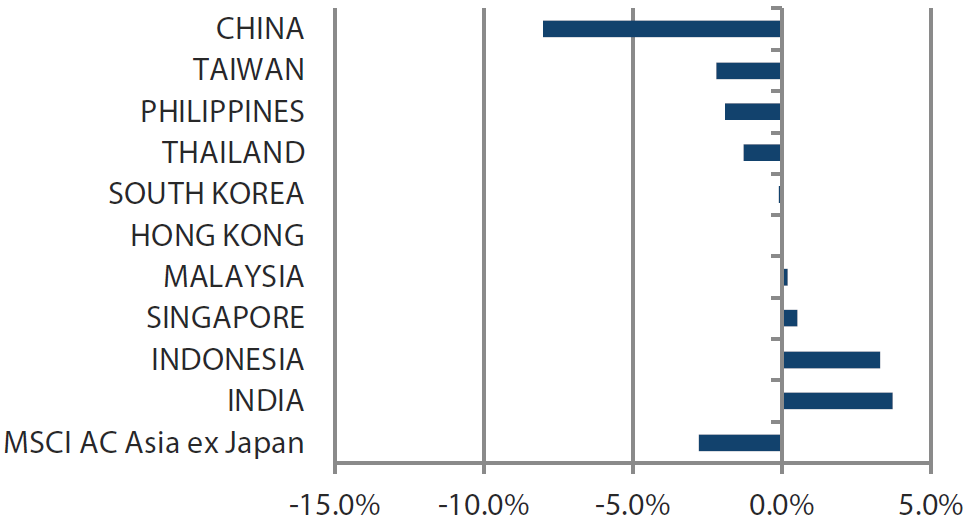

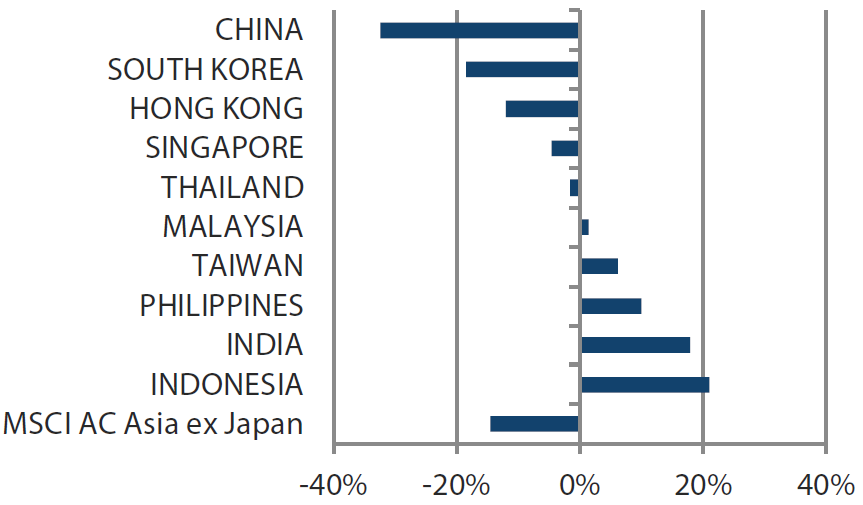

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 31 March 2022 | For the year ending 31 March 2022 | |

|

|

Source: Bloomberg, 31 March 2022.

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Geopolitical developments bring new areas under the spotlight

The Russia-Ukraine conflict is a fast-developing and unpredictable geopolitical crisis with profound and long-lasting changes to business outlooks. Changes that were already underway prior to the conflict, namely renewables demand, supply chain localisation and the inflationary outlook, have all been accelerated. New areas of focus and significant capital expenditure will likely be in energy security, food security and defence spending. Developments in such areas are expected to impact each country and industry very differently and it is important to remain vigilant to be on top of such developments.

Our bottom-up approach has primarily been focused on companies undergoing significant positive fundamental changes that can deliver strong sustainable returns in the future. In our view, structural areas with policy support such as domestic Asian consumption, healthcare, renewables and industrial technology remain in favour in spite of the ongoing geopolitical conflict. We prefer domestic demand-oriented industries and industrial companies—which may benefit from higher energy security spending—and countries set to benefit from commodity windfalls, over hardware technology and exporters.

Continued alignment with Chinese policy priorities

China should be relatively more immune to these external developments, but it has had to deal with several Omicron waves, which has resulted in lockdowns in a number of Tier 1 cities including Shenzhen and Shanghai. This complicates the policy cycle which has clearly turned more supportive—within the real estate segment, several high-level officials have made speeches aimed at easing concerns and multiple easing measures have also been implemented. However, a serious rebound in China is unlikely until COVID-19 starts to be treated as an endemic rather than a pandemic. Having been the poster child for successfully dealing with the initial virus outbreak with minimum economic or human cost, China is now one of the few economies having to sacrifice economic growth to maintain its strict “dynamic-zero” policies. We continue to be supportive of Chinese policy priorities including those in the areas of industrial technology, software, and renewables.

Selective in other parts of North Asia and India

While we are optimistic about the opportunities in Asia, we are also cognisant of the markets that are vulnerable to upstream price fluctuations, supply chain disruptions and demand destruction. Energy importers such as India could be subjected to some downward pressure especially as valuations remain stretched in pockets of the market. Over the last few months, Indian stocks saw unattractive valuations as positive changes were realised and discounted into their share prices. That said, we remain very constructive on India’s longer-term growth on the back of its significant reform momentum over the last few years. As such, areas that enjoy structural growth and where valuation still offers upside continue to offer opportunities. These areas include real estate, private banks, new economy and healthcare.

Higher commodity prices pose opportunities to ASEAN

ASEAN, as major suppliers of upstream commodities and agriculture produce, could emerge as beneficiaries of higher commodity prices. For example, Indonesia could see its terms of trade improve through its exports of coal and nickel. Nickel prices have settled to levels much higher than they were prior to Russia’s invasion of Ukraine, while further foreign investment in the space has been announced from major Chinese electric vehicle makers. Elsewhere, Malaysia, as an oil producer, is another country which could prominently benefit from higher oil prices, although, in contrast, we find little evidence of foreign direct investment interest or political reforms that would likely lead to more sustainable earnings growth in the future.

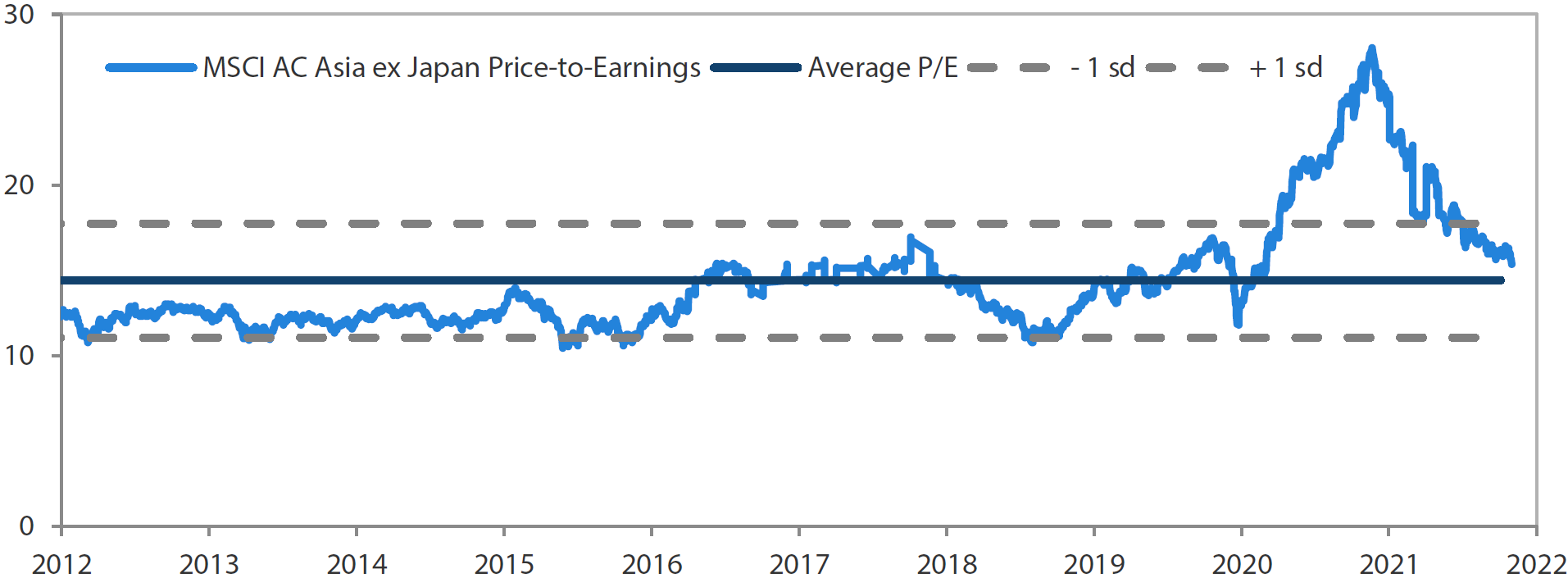

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 March 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

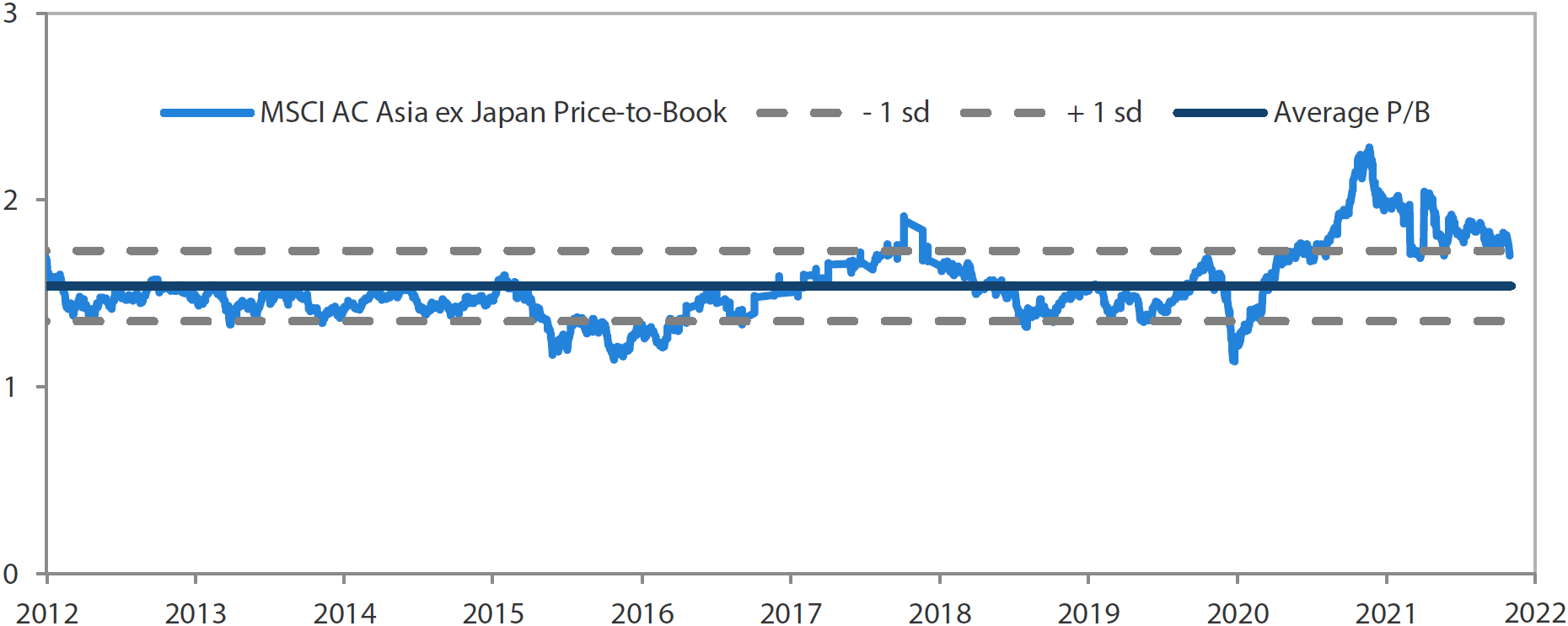

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 March 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.