Summary

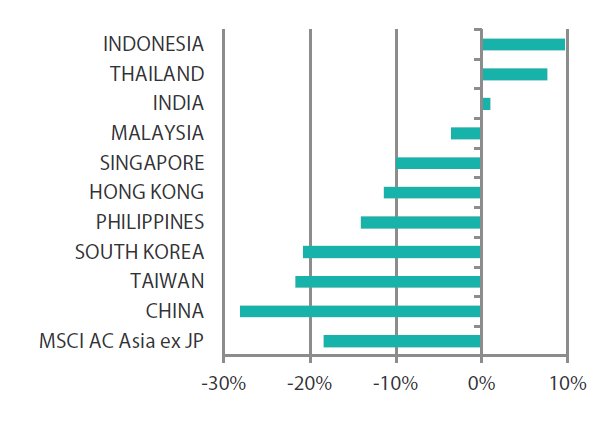

- The MSCI AC Asia ex Japan Index rebounded strongly in November, rising 18.8% in US dollar (USD) terms. US Federal Reserve (Fed) Chair Jerome Powell’s speech recently pointed to slower pace of monetary policy tightening, lifting market sentiment. All Asian markets ended in positive territory, with China in the lead with a month-on-month (MoM) gain of 29.7%.

- China stocks surged during the month despite relatively weak economic data from the country. The Chinese government signalled further easing of COVID restrictions and announced a 16-point rescue package while the People’s Bank of China (PBOC) announced a reduction in its policy rate. The other North Asian markets also recorded double-digit MoM gains.

- The ASEAN region posted positive returns for the month, as third quarter economic growth for most markets were stronger than expected. India rose 5.2%; retail inflation softened, while the country’s GDP growth slowed in the third quarter.

- With multiple policy inflections and valuations at depressed levels, we are of the view that a range of idiosyncratic opportunities can be found in China that are different from those in the developed world. November provided early signs of these opportunities being realised, as the country finally began its shift away from its strict zero-COVID policy. The region’s economic outlook may also be supported as recent Federal Open Market Committee (FOMC) commentaries increasingly suggest that that the end of the current tightening cycle is closer. We expect these overall trends to continue over the medium term and drive idiosyncratic alpha opportunities for the Asian markets.

Market review

Asian markets rebound in November

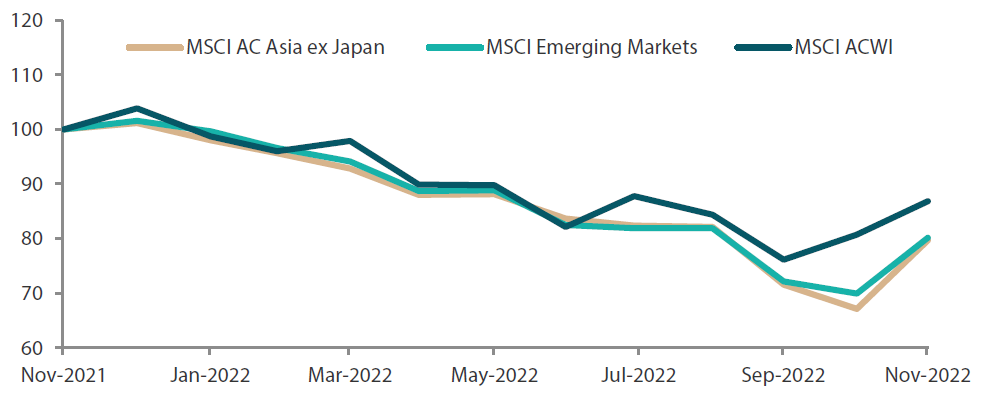

The MSCI AC Asia ex Japan soared in November, returning 18.8% in US dollar (USD) terms. Global markets ended November on a high note as US Fed Chair Powell’s speech on the last day of the month laid the groundwork for the central bank to slow its pace of monetary policy tightening in December. October’s lower-than-expected US inflation print of 7.7% year-on-year (YoY) also raised investor hopes that inflation has peaked. Beyond tracking the rise in Wall Street, the climb by Asian markets were also driven by growing signs that China is easing its stringent zero-COVID policy.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 30 November 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

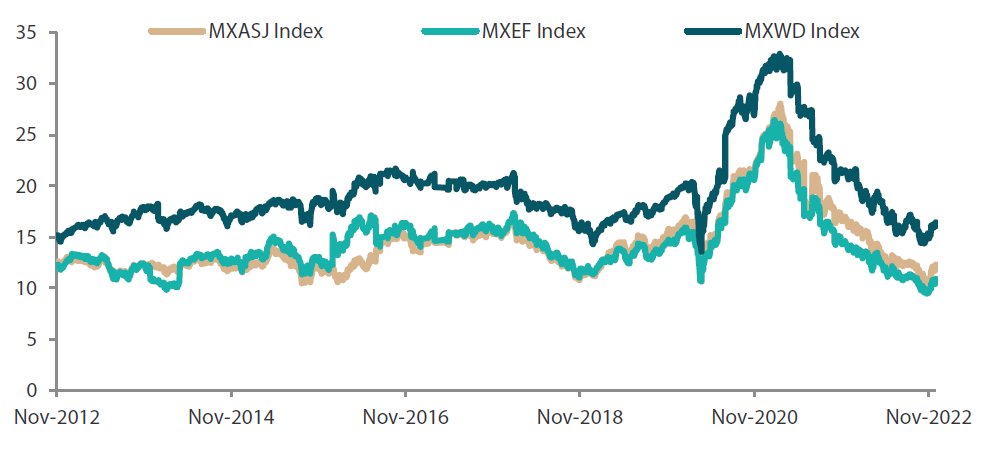

Chart 2: MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index price-to-earnings

Source: Bloomberg, 30 November 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

China market leads recovery on signs of easing of COVID restrictions

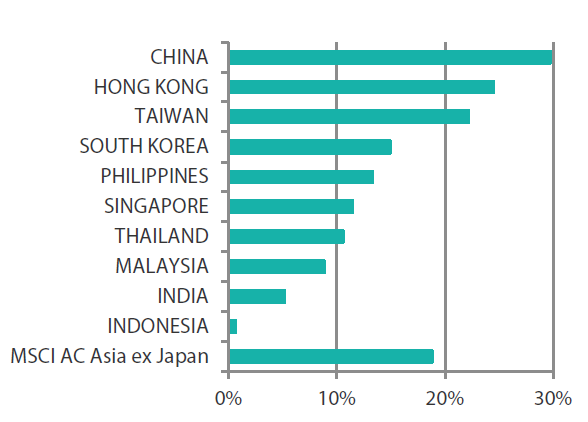

In the North Asian region, China surged 29.7% as the Chinese yuan appreciated. Economic momentum for China weakened in October, with activity data coming in mostly below expectations and showing a broad-based deterioration from September. Chinese authorities signalled further easing of COVID restrictions, despite increasing positive cases. The authorities also announced a 16-point rescue package, laying out plans to ensure the “stable and healthy development” of the property sector. The PBOC announced a reduction in reserve requirement ratio for most banks, effective 5 December 2022. Hong Kong’s central bank (+24.5%) raised its benchmark interest rate by 75 basis points (bps) to 4.25%. Subsequently, HSBC—Hong Kong’s biggest lender—announced that it was raising its prime rate by 25 bps to 5.375%.

Taiwan’s (+22.2%) economy grew by 4.0% YoY in third quarter (3Q) due to a strong recovery in domestic consumption. Overall exports held up much better than expected, totalling USD 39.9 billion in October, up 6% month-on-month (MoM). South Korea’s (+14.9%) revised GDP for 3Q showed the economy grew 3.1%, although the country did record a trade deficit of roughly USD 7 billion for November. Exports shrank by 14% YoY, hurt by a China-led cooling in global demand and a downturn in the semiconductor industry. November’s rise in consumer prices slowed to 5.0%, marking the slowest pace since April.

India remains in positive territory

India climbed 5.2% in November. Annual retail inflation softened to a three-month low of 6.77% in October, behind a slower rise in food prices and a higher base effect. Meanwhile, India’s economy expanded at a slower pace of 6.3% YoY in its July–September quarter, dragged down mainly by the poor performance of manufacturing and mining sectors.

Better-than-expected economic data bolster ASEAN markets

The ASEAN region also posted positive returns for the month, as economic growth in 3Q for most markets were stronger than expected. The Philippines (+13.3%) led the region, its GDP growing by 7.6% on pent-up domestic demand. Thailand (+4.5%) and Indonesia (+0.6%) reported GDP growths of 4.5% YoY and 5.7% YoY, respectively. Singapore’s (+11.5%) core inflation eased unexpectedly to 5.1% in October, the first moderation in eight months. Malaysia (+8.8%) appointed Anwar Ibrahim, who leads the Pakatan Harapan coalition, as its new prime minister, ending a political impasse.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 30 November 2022 | For the year ending 30 November 2022 | |

|

|

Source: Bloomberg, 30 November 2022.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

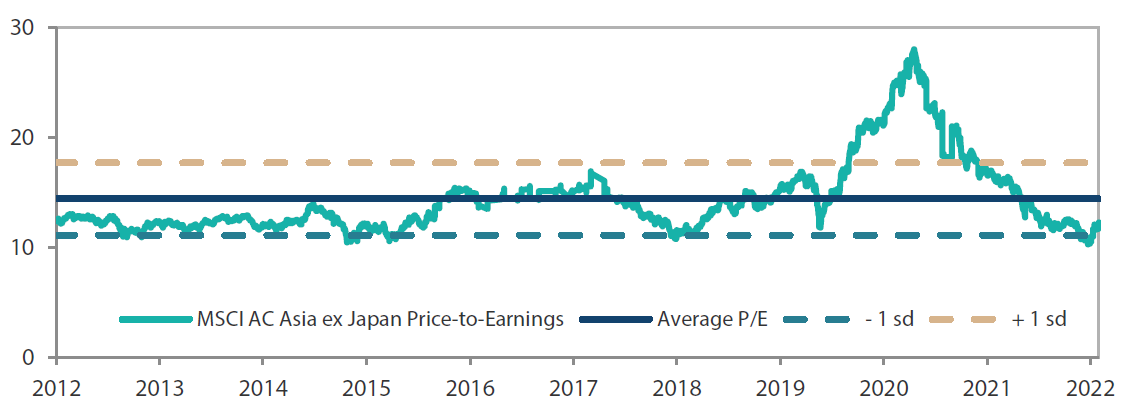

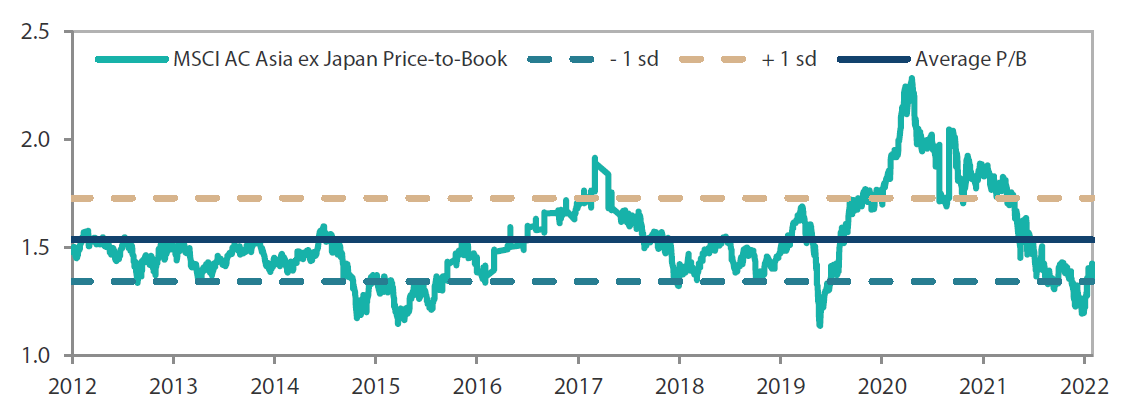

Asian markets underpinned by low valuations and rising hopes of an end of the current tightening cycle

With multiple policy inflections and valuations at depressed levels, we believe that a range of idiosyncratic opportunities can be found in China that are different from those in the developed world. November provided early signs of these opportunities being realised, as the country finally began to shift away from its strict zero-COVID policy. As China is the largest driver of regional economic activities, Asia is expected to receive a much-needed boost in turn. In addition, the region’s economic outlook may also be supported as recent FOMC commentaries increasingly suggest that that the end of the current tightening cycle is closer. We expect these overall trends to continue over the medium term and drive idiosyncratic alpha opportunities for the Asian markets.

Economic development and reforms likely to remain drivers of China’s medium-term growth trajectory

Investors outside of the region have been seemingly worried that Chinese President Xi Jinping’s further consolidation of power after the 20th National Party Congress would portend a departure from the country’s focus on economic development. However, such views may be neglecting the fact that the party’s political legitimacy is in large part driven by economic development and improving the lives of the people. Apart from President Xi dispensing with the pretence that there had been any semblance of collective leadership in the party, there were no new ideologies in the policy speech, with development and reforms continuing to dominate the narrative. The shift towards easing of the zero-COVID policy in addition to centrally coordinated property easing after the party congress were further evidence that the government is serious about economic growth. We expect China to continue moving towards a reopening in 2023, which could result in a long-awaited recovery in the country’s services sector. We continue to find opportunities in attractively priced stocks that are not only geared towards economic reopening, but also in structural areas of high-end manufacturing and market consolidation.

As China reopens, Taiwan and South Korea are also expected to enjoy some support as increasing Chinese electronics demand could partially offset a slowdown in demand from the developed world. That said, we remain positive on healthcare and energy infrastructure stocks in both markets. We are selective in the hardware technology segment, as we expect further earnings downgrades in the technology sector.

Favourable trends in India and ASEAN

Strong and improving skilled labour dynamics in both India and the ASEAN region commands a premium in today’s labour-short world. As the developed world grapples with labour shortages amidst pressure of diversifying its supply chain away from China, it is expected that India and ASEAN would enter the fray and become de facto factories of the world over the next few decades. This, together with positive reforms and targeted subsidies, is resulting in strong FDI inflows for the region. We expect countries like Indonesia, which are well-endowed with renewables related commodities, to also enjoy stronger terms of trades, potentially funding key developments in the country. As a result, we retain a positive view of areas such as banks, consumption and renewable and electric vehicle materials.

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 November 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 November 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.