Summary

- The US CPI rising to a four-decade high of 9.1% year-on-year (YoY) in June prompted the Federal Reserve (Fed) to react with a 75 basis points (bps) rate hike. Market uncertainty intensified as the US GDP fell at an annualised 0.9% in the second quarter of 2022 (2Q22), signifying that the US economy had slipped into a technical recession. For the month, the MSCI AC Asia ex Japan Index fell by 1.2% in US dollar (USD) terms.

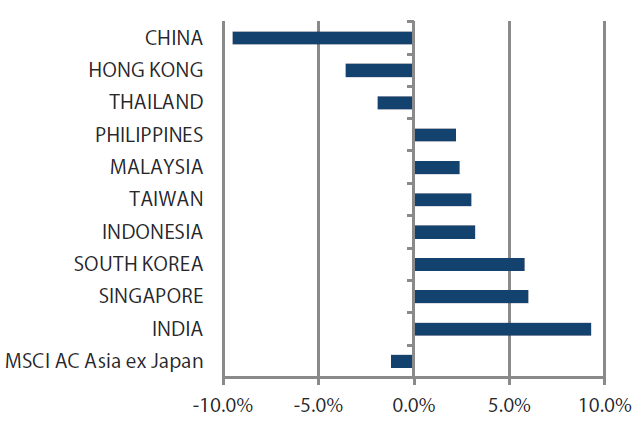

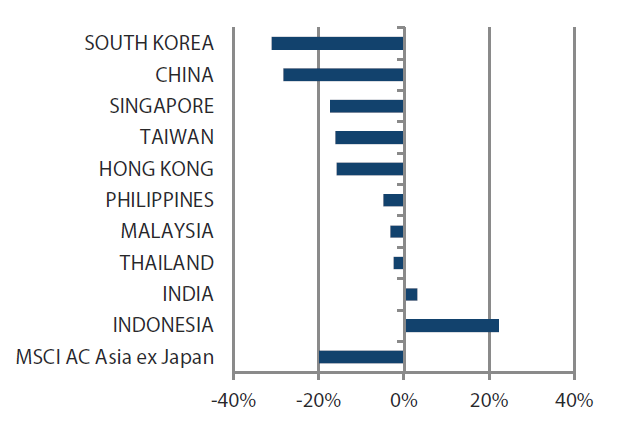

- Within Asia, higher commodity prices impacted returns, while a slip in prices of crude oil and metals benefitted many Asian nations. All countries and regions in Asia advanced except for China, Hong Kong and Thailand, when measured in USD terms.

- We expect the future trajectory of inflation to dictate the path of interest rates, which in turn is seen determining economic growth globally. China’s relatively different trajectory on monetary policy versus the US sets up an intriguing tussle between market economics and command economics, as well as a simultaneous struggle between China’s zero-COVID policy and a more liberal stance everywhere else.

Market review

Regional equities rise in July

The MSCI AC Asia ex Japan Index faltered, falling by 1.2% in USD terms. The US CPI rising to a four-decade high of 9.1% YoY in June prompted the Fed to react with a 75 bps rate hike. Market uncertainty intensified as the US GDP fell at an annualised 0.9% in 2Q22, signifying that the US economy had slipped into a technical recession. Within Asia, higher commodity prices impacted returns, while a slip in prices of crude oil and metals benefitted many Asian nations. All countries and regions in Asia advanced except for China, Hong Kong and Thailand, when measured in USD terms.

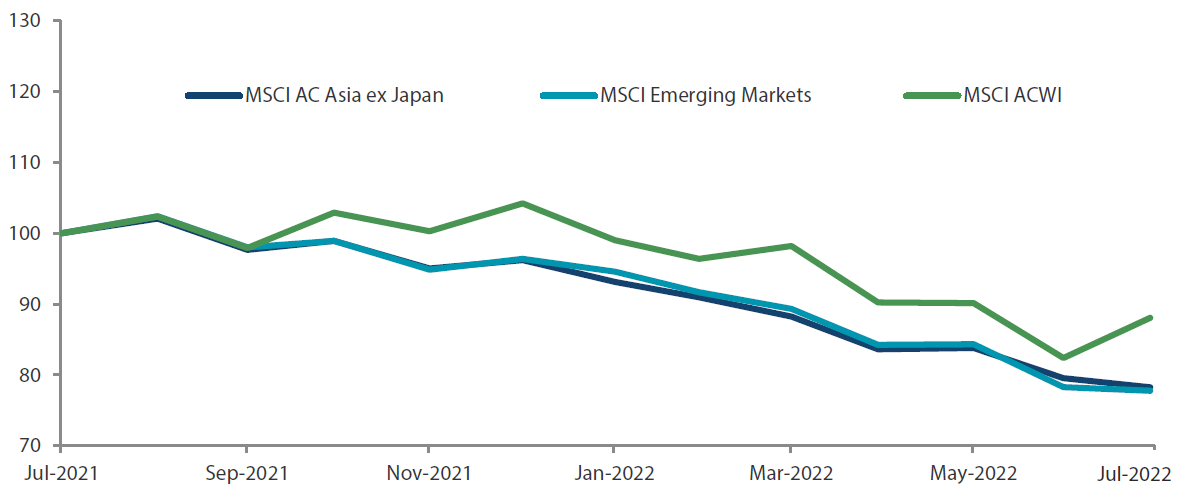

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 29 July 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 29 July 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

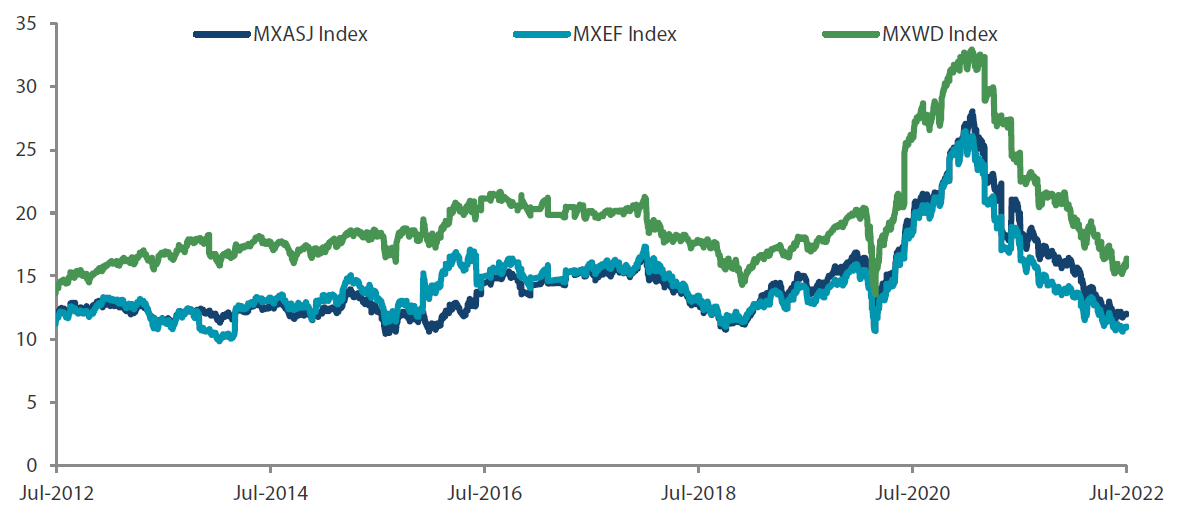

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 29 July 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 29 July 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asia sees mixed returns

China and Hong Kong retreated by 9.5% and 3.6% in USD terms, respectively. China’s GDP growth of 0.4% YoY in 2Q22 slowed from 4.8% in the first quarter as the contraction of factory activity, COVID-19 curbs and a crisis-stricken property sector took their toll. Hong Kong is prepared to revise its annual growth forecast downwards again, as exports fell for a second straight month and as the Hong Kong Monetary Authority raised its base rate by 75 bps. Taiwan and South Korea advanced 3.0% and 5.8%, respectively. Taiwan’s exports rose in June on sustained demand for its technology products, undeterred by weakened shipments to China and supply chain difficulties. South Korea’s GDP expanded 0.7% quarter-on-quarter in 2Q22 with its government continuing to shore up the economy by proposing tax cuts for companies, workers and retail investors.

ASEAN markets shine for the most part

In Thailand (-1.9% in USD terms), the Thai baht’s weakening against the USD hurt returns. The Bank of Thailand is looking to raise the country’s growth outlook for 2022, and in a move expected to lift the GDP, the cabinet approved additional support measures to ease rising costs and sustain demand. The rest of the ASEAN region performed favourably, with Singapore outperforming with a gain of 6.0% even as its core inflation rate rose 4.4% YoY in June and its central bank tightened monetary policy again. Market sentiment was lifted as its economy grew 4.8% YoY in Q2 and as Singapore’s local bourse announced a dual listing partnership with the New York Stock Exchange. Malaysia posted a gain of 2.4% as its trade grew by 43.3% YoY in June 2022, but the gains were capped as its central bank increased interest rates by 25 bps and as its CPI rose 3.4% YoY in June. Indonesia (+3.2%) saw a busy month, commencing quantitative tightening by selling government bonds while recording a trade surplus and a rise in foreign direct investments. The Philippines (+2.2%) advanced on the back of the country’s central bank expectations that inflation will fall back within its target band of 2 to 4% in 2023, while its central bank raised key interest rates by 75 bps to tackle inflation with the country’s CPI rising to 6.1% YoY in June.

Indian stocks also perform well

India (+9.3%) was the best performer, lifted by metal stocks as the government planned to lift export taxes on steel products. Oil producers and refiners, including benchmark heavyweight Reliance Industries, saw a good run as oil prices moderated and as the government slashed windfall taxes on local crude sales and fuel exports. Market sentiment was reinforced further as the Reserve Bank of India reassured market watchers that India is still poised to become the world’s fastest-growing economy despite general volatility globally.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 29 July 2022 | For the year ending 29 July 2022 | |

|

|

Source: Bloomberg, 29 July 2022.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Interest rates expected to determine economic growth

Following the latest 75bps hike, the Fed no longer appears to be behind the curve, at least for now. However, we expect the future trajectory of inflation to decide the path of interest rates, in turn determining economic growth not just in the US but globally. China’s relatively different trajectory on monetary policy versus the US sets up an intriguing tussle between market economics and command economics. It also sets the stage for a simultaneous struggle between China’s zero-COVID policy and a more liberal stance everywhere else, leaving the global economy hanging in the balance. The question that needs answering is whether current valuations adequately reflect uncertainties ahead or if they are still too rosy.

China’s monetary easing seen offsetting the negative effects of its zero-COVID policy

In China, for now at least, monetary easing seems to go hand in hand with its zero-COVID policy, perhaps to offset the damaging impact of the latter on the economy. It could also be a tool to alleviate the impact of the problems besetting the property sector. Observers of the Chinese market suggest an easing of the zero-COVID policy following the party congress in autumn, but that remains a matter of conjecture. What is clear are the areas the government is focused on for the longer term—greater self-reliance particularly in technology supply chains, a transition towards cleaner energy through greater energy security and “common prosperity” through better healthcare and greater wealth distribution. We remain aligned with these thrusts, while remaining watchful for ramifications from political developments.

Selective on South Korea and Taiwan

The US entering a technical recession highlights the concerns affecting South Korea and Taiwan, both tech-heavy markets, reliant on demand resilience in developed markets. Cost inflation only exacerbates these concerns. Thus, we are selective in our view of these two markets, with stock-specific fundamentals dominating the narrative.

ASEAN is a beneficiary of higher commodity prices and supply chain strategy

Higher commodity prices have aided terms of trade for exporters of said commodities—Malaysia and Indonesia are notable beneficiaries. The China+1 supply chain strategy is now a given, and ASEAN is well positioned to play a significant role. A gradual reopening post-COVID has ensured that growth has not been throttled, and this has paved the way for foreign investments. We are focused on renewable energy companies, whether they are miners of key commodities, players in energy storage or producers of “green’ energy”. The other area that we are partial towards in ASEAN is financial inclusion made possible through accelerated digitisation.

Actively monitoring India for opportunities

Ever a country of contrasts, India’s financial markets seem resilient despite mixed messages from the ground. While infrastructure construction underway in virtually every large city, the purse strings of private capital have not loosened. The shift of the grey/black economy to white is underway, as evidenced by steadily growing tax receipts, but this is a slow process. However, this aids larger companies to gain market share by exploiting scale and this is an area we continue to focus on.

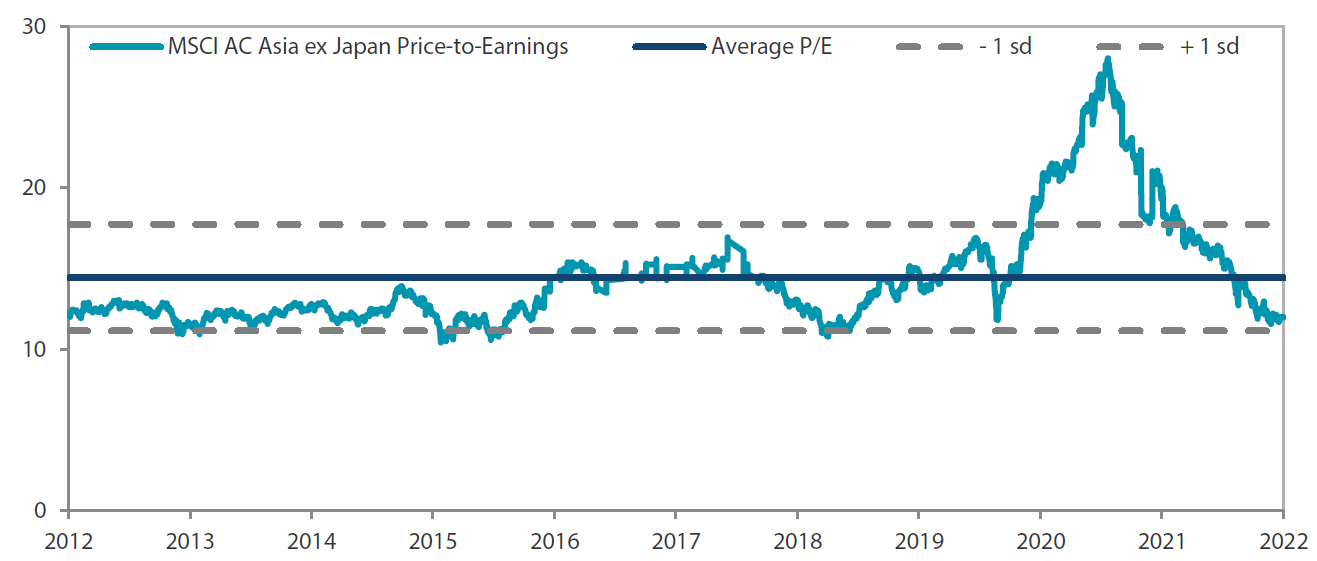

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 29 July 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

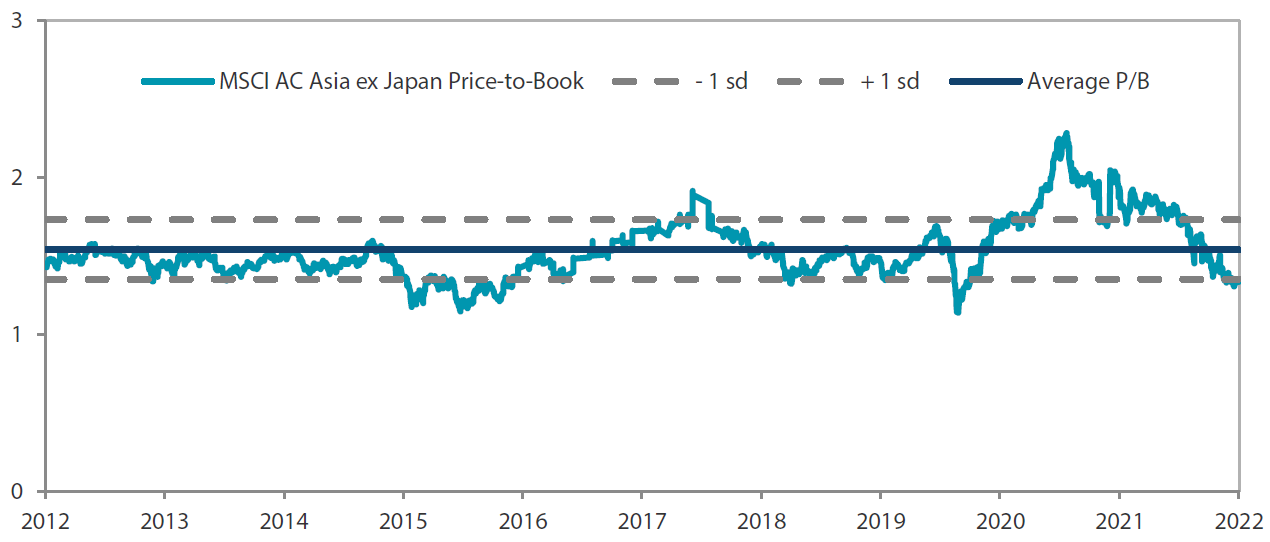

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 29 July 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.