Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise— does the company have a sustainable competitive advantage?

Management— does the company make sound strategic and capital allocation decisions?

Balance Sheet— is growth appropriately financed?

Valuation— are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

Increasingly frequent extreme weather episodes, rising geopolitical tensions and rampant populism sound like the building blocks for a James Bond film plot. Instead, they are the driving forces shaping some of the recent volatility in global equity markets. Unlike the Bond films (the latest of which has just launched in the UK), it is difficult to see who (or what) will ride to the rescue—in the short-term at least.

A long and cold winter, tropical storms in the Gulf of Mexico, droughts across hydroelectric hotspots like Brazil and unusually light winds in Europe (undermining wind power generation) have all combined to firstly deplete energy inventories around the world and then slow their replenishment. China’s unexpectedly strong demand for liquified natural gas to reduce its reliance upon coal has further exacerbated the problem. With winter now getting uncomfortably close, this is far from ideal and it is probably not surprising that energy prices have responded so quickly to this squeeze in supply.

Europe’s situation has not been helped by ongoing tussling between Russia and Germany over the permits required for the successful opening of the new Nord Stream 2 gas pipeline, which may provide some of the solution. France and the UK have also been engaging in a spot of sabre-rattling, with the UK reducing French access to UK fishing grounds and France responding by threatening supplies of electricity exports to the UK.

As soon as COVID-19’s latest wave started to recede from the front pages of UK newspapers, geopolitics have taken their place, providing more than their fair share of sensationalist headlines. The dreaded “B word” (in reference to the UK’s decision to leave the European Union) has been blamed for the return of panic buying to the UK. This time played out across petrol station forecourts—predominantly across the south of the country. The mainstream media seem less interested in exploring other, less inflammatory sources of the issue, like the longstanding demographic challenges of the haulage industry (which led to a lot of retirements post pandemic) or the heavy goods vehicle (HGV) license testing bottlenecks created by COVID-19.

Although Brexit’s role in the current crisis is probably somewhat overstated, it has almost certainly been a contributor (with some HGV drivers not permanently leaving the UK for Europe). Brexit’s calling card—“taking back control” certainly resonated with a lot of people in the UK. But can you really take control over an increasingly globalised economy and what price are we willing to pay for this?

It is certainly worth exploring the role of populism on our political leadership. For instance, most people would agree that it is in the long-term interests of society to reduce our consumption of fossil fuels—given the damage done to our climate by extracting and burning them. Idealism and economic realism need to be carefully balanced, however, and a lot of politicians clearly recognise the fact that idealism plays out better with voters than economic realism.

If money really did grow on trees, we’d probably plant a lot more of them and we wouldn’t need to pursue such a black and white energy policy. Forcing all of our limited resources down the path of renewable energy certainly makes sense when you look at the future but under-investment in traditional energy sources is posing the very real risk of meaningful shortages in the short-term. Inflation is probably OK for politicians when its existence is limited to Bloomberg charts. This is less so when it starts washing up in much higher utility bills for consumers/voters. It seems likely that elevated energy prices will act as a meaningful headwind for the increased consumer spending that most economists had been expecting as economies emerged from COVID-19-related shutdowns.

China’s understandable desire to reduce obvious wealth inequalities offers a similar combination of worthwhile goals with substantial attendant risk. These wealth inequalities are probably more politically undesirable in a communist country, but the challenge is very much a global one. Time will tell if the ongoing imposition of increasing wealth taxes on asset owners will lead to a better, fairer society or just a slightly poorer one.

Our base case remains that the best form of defence in such uncertain times is to invest in companies that are generating substantial cashflows and investing this cash in innovation. If companies are making life easier and more profitable for their customers, they are less likely to see demand for their products and services diminished by any cost inflation experienced by customers. This month’s portfolio additions (Masimo, Emerson and TSMC) are all good examples, with their products helping improve process efficiency across an array of applications.

In conclusion, current equity conditions are certainly providing a challenging environment. Bond yields are rising, and equity investors are dusting off the playbook that served them well until May this year—favouring deep value sectors like Energy and Banks. Although short-term supply constraints and the structural reallocation of capital towards renewable energy sources may produce a period of rising energy prices, other economic indicators look less supportive of inflation and it seems very unlikely to us that central banks will allow bond yields to run too far. As such, we continue to prefer businesses where their long-term growth and returns are driven by more company-specific factors. Our belief in the four pillars of Future Quality have not been shaken (or even stirred).

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

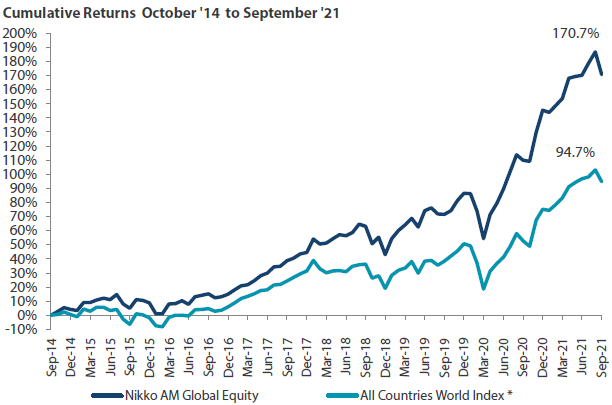

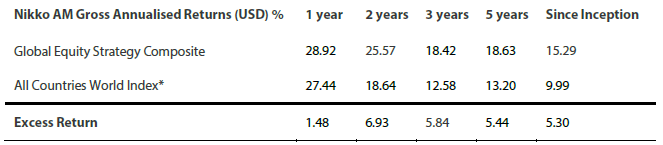

Global Equity Strategy Composite Performance to Q3 2021

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 30 September 2021.

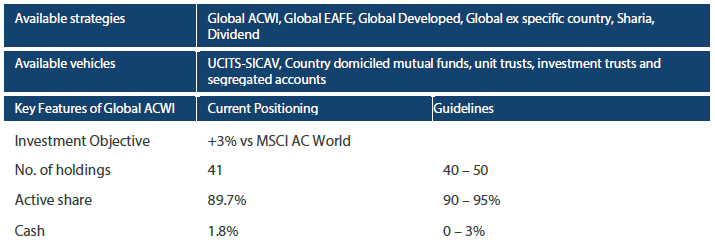

Nikko AM Global Equity: Capability profile and available funds (as at 30 September 2021)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 24 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 and are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can attain and sustain high return on investment. We believe that ESG considerations and Future Quality investments are not independent of each other and as such the team evaluate the materiality of ESG factors when assessing the Future Quality potential of each stock.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 281.8 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2021.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.