Summary

- The US Treasury (UST) yield curve flattened in June, with short-dated bonds underperforming. The Federal Reserve’s (Fed) hawkish pivot caused the UST curve to flatten aggressively mid-month. Notably, the median interest rate forecast dot plot for 2023 now suggests two rate hikes, up from none in the last projection in March. Overall, the 2-year and 10-year yields ended the month at 0.25% and 1.47%, respectively, about 10.7 basis points (bps) higher and 12.7 bps lower compared to end-May.

- Asian credits returned +0.43% in June, driven by the drop in long-dated UST yields despite credit spreads widening 2.3 bps. High-grade (HG) credits performed better than their high-yield (HY) counterparts, gaining 0.95%, with spreads tightening 4.6 bps. HY credits were weighed down by volatility in the Chinese property sector and retreated 1.25%, with spreads widening 38 bps.

- Within the region, headline inflation prints mostly accelerated in May. Monetary authorities maintained their policy rates while Malaysia and India announced fiscal stimulus packages. Separately, China announced a revised collection method for land sales revenue. This move is expected to defuse debt risks at local levels.

- We continue to be selective in our view towards duration exposures and are relatively cautious on low yield countries such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, in anticipation of possible further US dollar (USD) strength.

- We expect Asian credit spreads to tighten modestly from current levels, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccinations. While the macro backdrop remains favourable, and certain country-specific downside risks have eased, a degree of caution is still warranted.

Asian rates and FX

Market review

The UST yield curve flattens in June

The UST yield curve flattened in June, with short-dated bonds underperforming. The month opened with the May US jobs report modestly missing expectations, which prompted UST yields to drift lower. Non-farm employment increased by 559,000, slightly short of consensus expectations for a 675,000 gain. Yields continued to move lower thereafter, despite firmer-than-expected consumer price index (CPI) numbers. US headline CPI jumped 5% year-on-year (YoY) in May, and the core index rose 3.8%, although increases were driven partly by temporary factors. The Fed’s hawkish pivot caused the UST curve to flatten aggressively mid-month. Notably, the median interest rate forecast dot plot for 2023 now suggests two rate hikes, up from none in the last projection in March. In addition, Fed Chairman Jerome Powell indicated that the committee had begun discussions on when tapering would begin. Towards the month-end, the reflation trade regained appeal after US President Joe Biden and a bipartisan Senate group announced a compromise on an infrastructure package. Overall, the benchmark 2-year and 10-year yield ended the month at 0.25% and 1.47%, respectively, about 10.7 bps higher and 12.7bps lower compared to end-May.

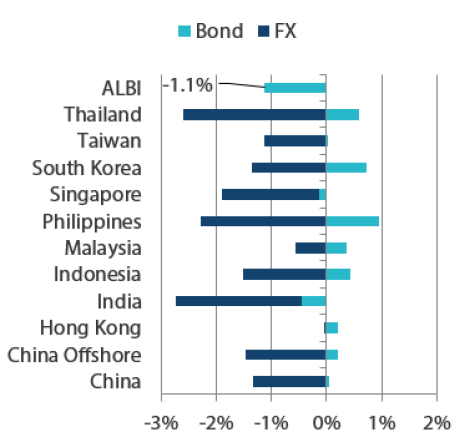

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 June 2021 | For the year ending 30 June 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Monetary authorities maintain their policy rates

Monetary policy remained supportive, with central banks in India, Thailand, Indonesia and the Philippines maintaining policy rates. Central banks in Thailand and India both lowered their GDP growth forecasts. The Bank of Thailand now expects full year 2021 growth of 1.8% (from 3.0%), and 2022 growth of 3.9% (from 4.7%). For 2021, it now projects a current account deficit of USD 1.5 billion, from a surplus of USD 1.2 billion, as assumptions on tourist arrivals have been lowered. Similarly, the Reserve Bank of India downgraded its fiscal year 2022 GDP growth projection to 9.5% YoY (from 10.5%), and marginally increased its headline CPI inflation forecast to 5.1% (from 5.0%). In the Philippines, the Bangko Sentral ng Pilipinas said that economic activity had “improved in recent weeks” but described the overall momentum of the recovery to be “tentative”. The bank also raised its 2021 CPI inflation forecast to 4.1% (from 3.9%), citing higher oil prices. Elsewhere, Bank Indonesia (BI) also left rates unchanged and kept its 2021 GDP growth forecast range at 4.1–5.1%. When asked about the potential impact from the US Fed’s tapering, BI Governor Warjiyo said the bank will prioritise supporting rupiah stability and bond markets.

Headline inflation prints mostly accelerate in May

Headline CPI inflation in China, India, South Korea, Indonesia and Singapore accelerated in May, while similar inflation gauges in Malaysia and Thailand moderated. The 2.4% YoY headline CPI print in Singapore was driven largely by higher private transport inflation as car and petrol prices rose, owing partly to low base effects. In India, CPI inflation firmed, rising 6.3% YoY in May, which was the month of peak lockdowns amid the country’s second COVID-19 wave. Meanwhile, the 2.6% YoY rise in South Korea’s headline CPI was the fastest since April 2012 and was driven mainly by a low base effect and rises in the prices of oil and agricultural goods. In Indonesia, headline CPI inflation picked up but remained low. The 1.7% YoY rise was driven by higher food inflation on the back of stronger demand during the Idul Fitri holiday. In contrast, easing food price inflation in Malaysia prompted inflationary pressures to ease in May. Elsewhere, headline CPI in the Philippines came in at 4.5% YoY, unchanged from the April reading.

Malaysia and India announce fiscal stimulus packages, Standard & Poor’s (S&P) affirms Malaysia’s credit rating

Towards the month-end, Malaysia and India announced additional fiscal support packages aimed to boost growth. We note that a substantial portion of India’s package was in the form of off-budget credit guarantees for the worst-affected sectors, and bulk of Malaysia’s package is composed of non-fiscal measures such as debt moratorium and a withdrawal facility in the Employees Provident Fund. Separately, credit rating agency S&P affirmed Malaysia’s credit rating at “A-“, citing the country’s strong external position, monetary policy flexibility and fiscal stimulus to support the economic recovery. However, S&P retained its “negative” outlook, due to “enduring pressures on fiscal and debt settings”.

China announces revised collection method for land sales revenue, People’s Bank of China reforms bank deposit rate system

Chinese policymakers unveiled a new plan that would require land sale proceeds to be paid to and managed by tax authorities instead of local-level land developments. According to the Ministry of Finance, the revamped collection method, rolled out in a pilot programme in seven cities from 1 July, would be extended nationwide from 2022. This move is expected to defuse debt risks at local levels. Separately, the central bank reformed the way banks calculate deposit rates, setting new ceilings that would lower lenders’ funding costs.

Market outlook

Maintain cautious view on rates markets and defensive stance on currencies

We maintain our cautious view on the rates market and our defensive stance on currencies. Going forward, we expect global growth recovery to gain momentum and see US rates resuming their uptrend as investors re-focus on the reflation theme. We continue to be selective in our duration exposures and are relatively cautious on low-yield countries such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, in anticipation of possible further USD strength.

Asian credits

Market review

Asian credit spreads marginally wider; total returns edge higher on UST gains

Asian credits returned +0.43% in June, driven by the drop in long-dated UST yields despite credit spreads widening 2.3 bps. HG credits performed better than their HY counterparts, gaining 0.95%, with spreads tightening 4.6 bps. HY credits were weighed down by volatility in the Chinese property sector and retreated 1.25%, with spreads widening 38.0 bps.

Asian credit spreads were largely range-bound in June. Market sentiment remained resilient, despite the Fed’s hawkish pivot. At the June Federal Open Market Committee (FOMC) meeting, the median interest rate forecast dot plot for 2023 suggested two rate hikes, up from none in the last projection in March. In addition, Fed Chairman Powell indicated that the committee had begun discussions on the tapering of asset purchases. Risk markets also seemed to look beyond firmer consumer price and producer price index reports in the US and the continued acceleration of the producer price index in China. Meanwhile, Chinese May activity data came in modestly below expectations. Towards the month-end, S&P affirmed Malaysia’s credit rating at “A-“ but retained its “negative” outlook, citing “enduring pressures on fiscal and debt settings”.

By country, credit spreads of Singapore, South Korea, India and Thailand tightened, while those of the Philippines, Malaysia, Indonesia and China widened. The economic re-opening of major cities in India as the second COVID-19 wave subsided, together with additional fiscal support measures from the government—including credit guarantee schemes—supported the tightening of Indian credit spreads. Meanwhile, concerns about credit deceleration in China and negative headlines surrounding several of the country’s property developers weighed on Chinese credits. However, China state-owned enterprise (SOE) credits, particularly HG, outperformed on the month. The US government issued a new Executive Order (EO) that entirely superseded a previous Trump-era EO prohibiting US investors from investing in certain Chinese companies with ties to the military. The new EO provided an updated list of companies, as well as clarifications on some technical aspects such as whether closely matched names or subsidiaries would fall in scope of the restrictions. Certain China SOE issuers that were either removed from the updated list or deemed no longer in scope because of the clarifications saw their credit spreads retrace much of the widening that occurred following the previous EO.

Primary market activity largely stable in June

In June, 75 new issues raised a total of USD 34.5 billion in the market. There were 40 new issues amounting to USD 24.9 billion within the HG space, including the three-tranche USD 3 billion Indonesian sovereign issue from Perusahaan Penerbit, two-tranche USD 3 billion issue from Republic of Philippines and three-tranche USD 2 billion issue from Export Import Bank of Korea. Meanwhile, the HY space saw 35 new issues amounting to about USD 9.6 billion.

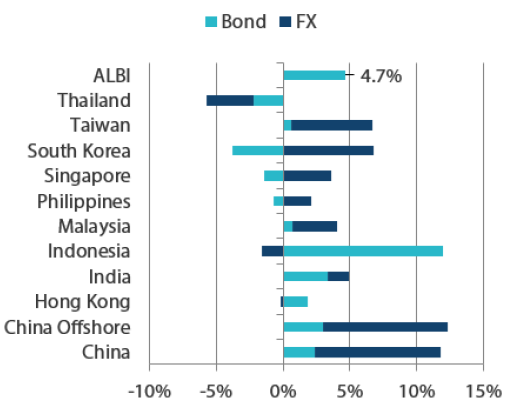

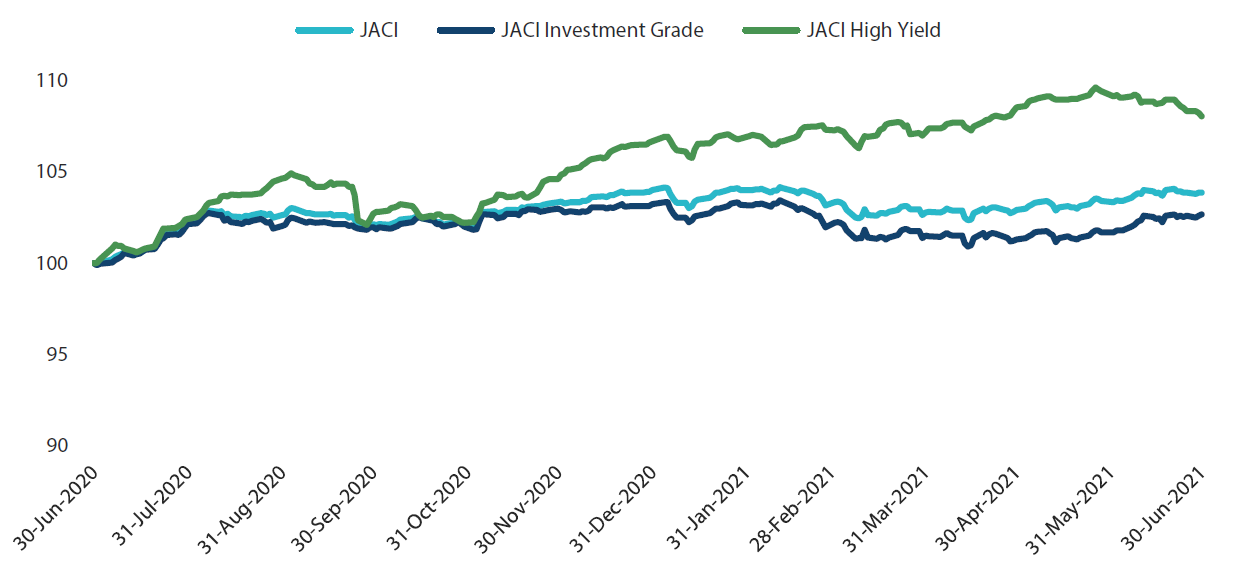

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 June 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 30 June 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 30 June 2021

Market outlook

Asian credit spreads to remain resilient, though downside risks remain

We believe Asian credit spreads could tighten modestly from current levels, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccinations. Overall corporate credit fundamentals should remain robust, leading to stronger earnings momentum in the first half of 2021. That said, valuation is more neutral now having priced in a lot of the improving fundamentals. Further spread tightening will be more laboured, with more frequent market pull-backs likely. While the macro backdrop remains favourable, and certain country-specific downside risks have eased, a degree of caution is still warranted.

With the Fed having shifted to a more hawkish tone at the June FOMC meeting, uncertainty regarding the timing and pace of monetary policy tightening in the US has risen. This, in turn, could elevate market volatility, especially around key data releases and speeches by Fed officials. Emerging market credit spreads could widen if US monetary policy tightens rapidly, although Asian credit should be more resilient given the generally more robust external balances.

In addition, the risk of US-China bilateral relations failing to stabilise remains elevated. Uncertainties relating to offshore bonds issued by a Chinese state-owned non-bank financial institution remain, but the contagion to other parts of Asian credit has been limited. Other China HG credits, both corporate and quasi-sovereign, have also recovered to a large extent, although the final outcome for the aforementioned issuer may still have an impact.