Summary

- • Supported by optimism about the region’s ongoing economic recovery, Asian stocks delivered decent gains in May, shrugging off concerns about a spike in COVID-19 cases in several Asian countries and persistent worries about inflation. The MSCI AC Asia ex Japan Index gained 1.2% in US dollar (USD) terms over the month.

- • India and the Philippines were the best performers in May. Falling daily COVID-19 cases and easing lockdown restrictions in some states buoyed Indian stocks, while the Philippine peso strengthened after exports expanded at the fastest pace in more than 10 years in March, driven by strong demand from major trading partners.

- • Conversely, Malaysia and Taiwan lagged as their governments tightened measures on the back of a surge in COVID-19 cases. The underperformance of global technology stocks also weighed on the Taiwan market in May.

- • As we continue the transition to a world that learns to live with new waves of COVID-19, divergences in policy, containment and vaccination rates will become ever more apparent. Compared to the West, Asia has been slower to vaccinate and very reluctant to open borders; these conditions may persist for some time. With this in mind, we continue to favour countries with large domestic markets and sectors geared to structural demand, namely healthcare, environment and areas of technology.

Market review

Regional stocks see positive returns in May

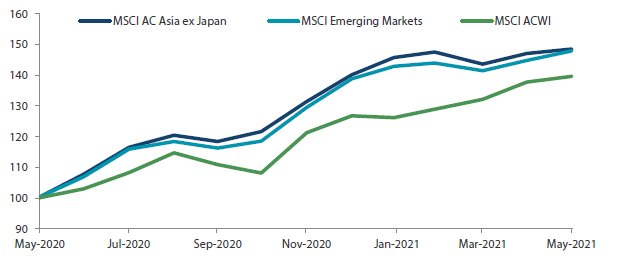

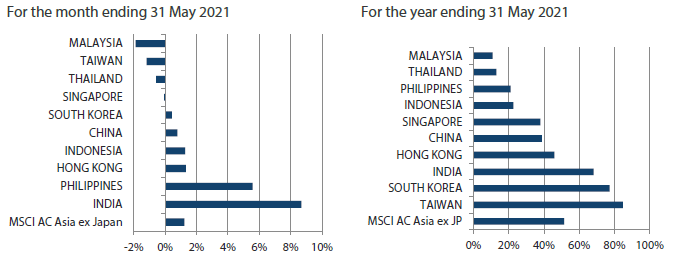

Supported by optimism about the region’s ongoing economic recovery, Asian stocks delivered decent gains in May, shrugging off concerns about a spike in COVID-19 cases in several Asian countries and the persistent worries about inflation. For the month, the MSCI AC Asia ex Japan Index rose 1.2% in US dollar (USD) terms. Within the region, India, the Philippines and Hong Kong were the best performers (as measured by the MSCI indices in USD terms), while Malaysia, Taiwan and Thailand were the worst performers.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 May 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

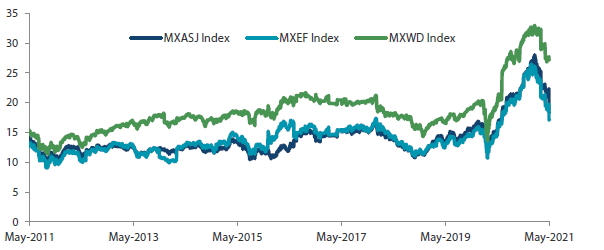

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 May 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Hong Kong, China and South Korea gain while Taiwanese stocks fall

In North Asia, stocks in Hong Kong and China turned in USD gains of 1.3% and 0.8%, respectively, in May. Hong Kong stocks gained on easing worries over inflation as Beijing vowed to curb significant prices gains in the commodities market. During the month, soft domestic factory activity in China eased worries over policy tightening, while a stronger yuan boosted foreign inflows.

Notwithstanding the underperformance of index-heavyweight Samsung Electronics, South Korean stocks managed to stay afloat in May with marginal gains of 0.4% in USD terms. The Bank of Korea (BOK) kept monetary policy unchanged in May but hinted that it is preparing for an orderly exit from record-low level of interest rates amid the economic recovery in the country.

In Taiwan, stocks fell 1.2% in USD terms for the month, owing to a surge in domestic COVID-19 cases in the country. The tightening of COVID-19 control measures in Taipei and several other neighbouring cities, and the underperformance of global technology stocks also weighed on Taiwanese stocks in May.

India outperforms, ASEAN sees mixed returns

In India, stocks jumped 8.7% in USD terms in May as daily COVID-19 cases began to fall during the month, and some states, including Delhi, started easing lockdown restrictions. Fresh series of measures to support individuals and small- and mid-size enterprises rolled out by the Reserve Bank of India also boosted Indian stocks.

In the ASEAN region, stocks saw mixed returns for the month. The Philippines and Indonesia were the best performing markets, with respective USD gains of 5.6% and 1.3%, while Malaysia, Thailand and Singapore lagged with respective returns of -1.9%, -0.6% and -0.1% in USD terms. During the month, Philippine stocks rebounded strongly from April’s weakness while the Philippine peso strengthened after exports expanded at the fastest pace in more than 10 years in March, driven by strong demand from major trading partners. At the other end, Malaysian stocks fell and the ringgit weakened after the Malaysian government announced a two-week nationwide lockdown until 14 June to curb a surge in new COVID-19 cases.

Chart 3: MSCI AC Asia ex Japan Index¹

Source: Bloomberg, 31 May 2021

Source: Bloomberg, 31 May 2021

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Chart 3: MSCI AC Asia ex Japan Index¹

Favour countries with large domestic markets and sectors geared to structural demand

As we continue the transition to a world that learns to live with new waves of COVID-19, divergences in policy, containment and vaccination rates will become ever more apparent. Multiple countries across Asia are enduring second or even third waves of COVID-19 infections, which have added to volatility within country performance.

Western nations are now emerging from aggressive vaccination programmes which will result in demand shifting towards tourism and consumer services. Asia has been slower to vaccinate and very reluctant to open borders; these conditions may persist for some time. With this in mind, we continue to favour countries with large domestic markets and sectors geared to structural demand, namely healthcare, environment and areas of technology.

China paving the way for better quality, sustainable growth

While China has refrained from any significant policy tightening, it has increased scrutiny on areas where social concerns are high and companies have been seen to be profiteering. This has led to significant changes to business models in areas of education, fintech, e-commerce and education. The property sector too has been under scrutiny for some time together with the overall composition of leverage within the system. These “reforms” will require adjustments in the short term, but we believe they pave the way for better quality, sustainable growth in the future and continue to evaluate ideas in certain sub-sectors which are undergoing such consolidations. For now, we remain invested in areas with a more favourable policy backdrop, namely those related to the environment, industrial upgrades, software and healthcare.

Tempering our positive stance on South Korea and Taiwan

South Korea and Taiwan continue to benefit from strong global demand for their exports, in addition to successfully managing COVID-19 outbreaks. Strong inflows are, however, starting to cause excessive domestic liquidity conditions and the BOK’s most recent indication of a normalisation in monetary policy forthcoming is significant and the first in the Asia region. We have tempered our positive view of both economies in recent months but continue to find some very attractive bottom-up ideas in areas of content, healthcare and specific tech sub-sectors.

India still undergoing positive fundamental changes despite risks from pandemic

In India, the most recent pandemic wave appears to have peaked, but re-opening states still remains a risk given the low vaccination rate. The government has taken measures to speed up inoculation which is welcomed and necessary for economic growth and the potential of reforms to play out. At the company level, we continue to find multiple examples undergoing accelerated sub-sector consolidation, commercialising of management and innovation development. These positive fundamental changes lead us to favour private banks, logistics, real estate and the new economy.

Internet economy remains one of the most significant opportunities in ASEAN

ASEAN is slowly emerging from the pandemic-led economic pain with a potentially enormous opportunity in the “green” economy given the low baseline. A shift away from reliance on oil- and coal-fired energy towards renewable sources will improve government finances, and the lower cost of production will offer opportunities in manufacturing. However, messy politics and/or political ennui mean that the path towards realising this potential is bumpy to say the least. In the interim, market consolidation and formalisation of these economies are where the most attractive opportunities lie, in our view. We believe that as a proportion of GDP, the internet economy remains one of the most significant opportunities in ASEAN relative to the rest of the region.

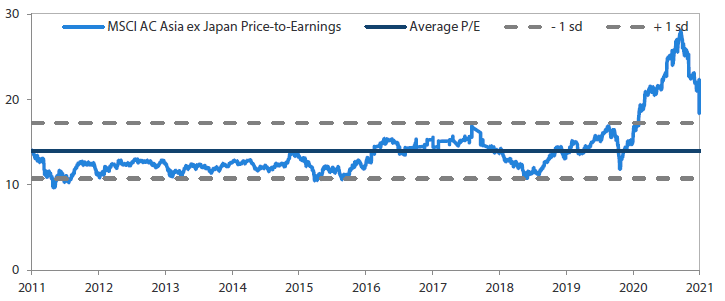

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 May 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

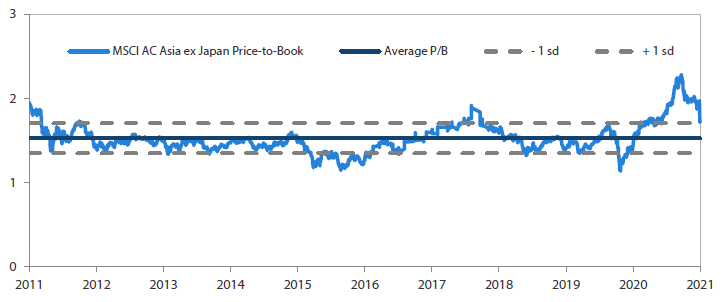

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 May 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.