Summary

- Asian stocks tracked gains in Wall Street in December although the US Federal Reserve said it would end its bond-buying in March and signalled three interest rate hikes in 2022 to tackle persistent inflation. For the month, the MSCI AC Asia ex Japan Index rose by 1.4% in US dollar (USD) terms.

- Taiwan and South Korea were buoyed by strong exports as sustained global demand for electronics supported hardware tech stocks amid widespread supply chain disruptions. On the other hand, China and Hong Kong underperformed. Chinese tech stocks continued to fall after the US placed several Chinese companies on investment and export blacklists, while a COVID-19 outbreak in Xi’an also weighed on sentiment.

- The ASEAN region saw mixed returns. Thailand was the best performer—policymakers approved new stimulus measures to support domestic consumption—while the Philippines had to delay COVID-19 vaccinations on the back of Typhoon Rai.

- The Omicron variant continues to rage across several countries, although we note a greater reluctance by the authorities to tighten restrictions compared to past waves. We believe the best policy is to stick to a fundamental led bottom-up stock selection, focusing on companies undergoing significant positive fundamental changes that can deliver sustainable returns in the future.

Market review

Regional equities edge higher in December

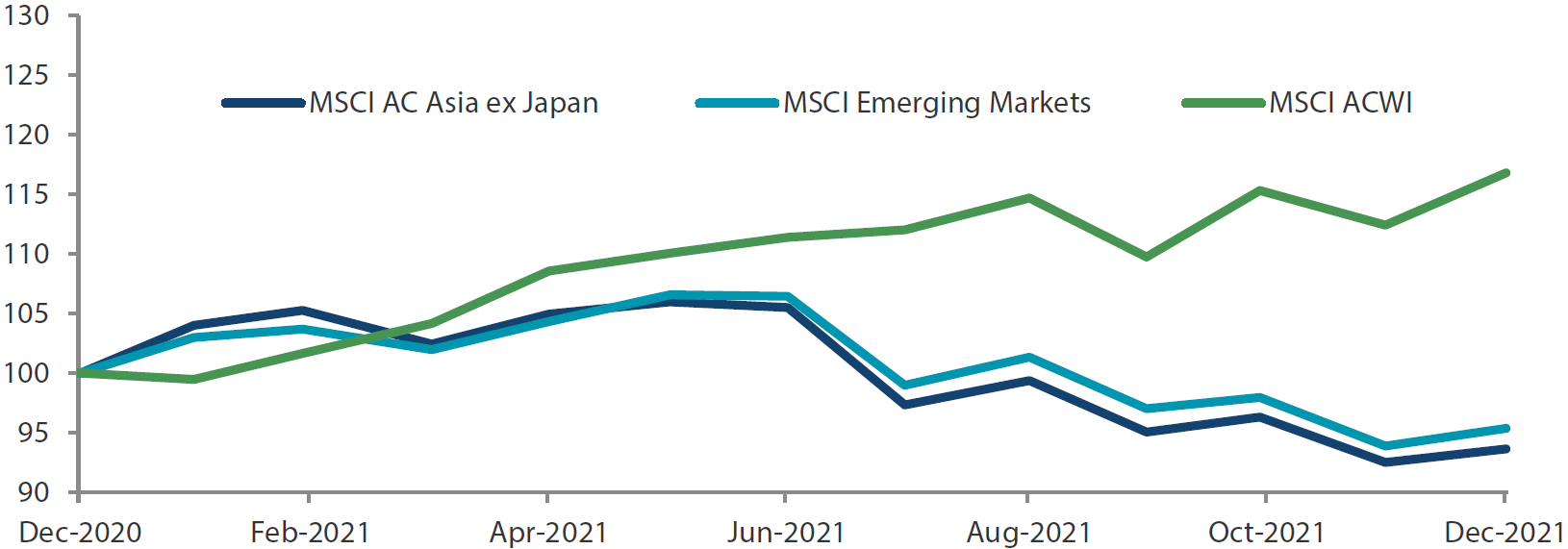

Asian stocks tracked gains in Wall Street in December although the US Federal Reserve (Fed) said it would end its bond-buying in March and signalled three interest rate hikes in 2022 to tackle persistent inflation. Easing worries about the impact of the Omicron variant also supported market sentiment. For the month, the MSCI AC Asia ex Japan Index gained 1.4% in US dollar (USD) terms. Thailand, South Korea and Taiwan outperformed, while the Philippines and China lagged.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 December 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 December 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

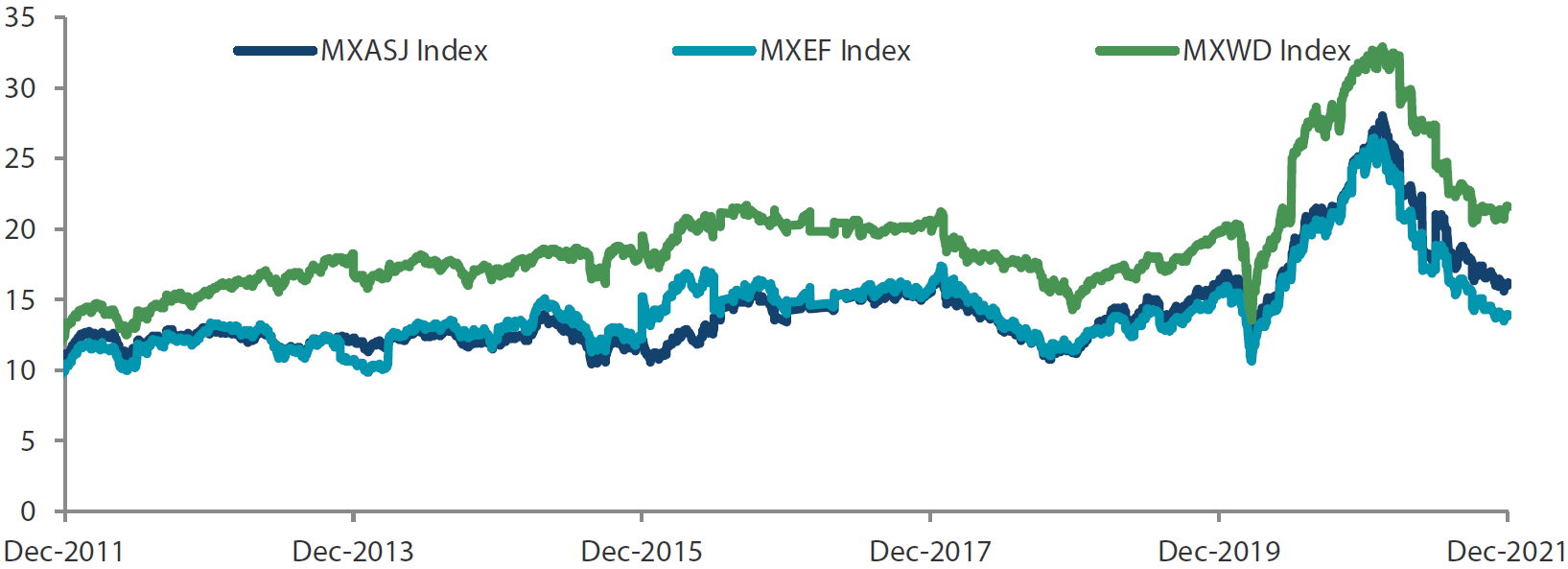

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 December 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 December 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

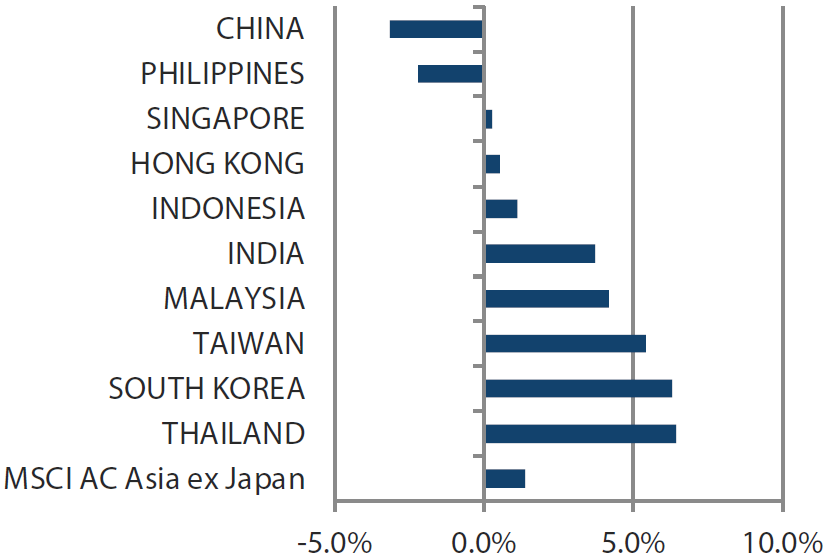

South Korea and Taiwan outperform, while China and Hong Kong lag

Taiwan (+5.4% in USD terms) and South Korea (+6.3%) were buoyed by strong exports as sustained global demand for electronics supported hardware tech stocks amid widespread supply chain disruptions. Taiwan’s central bank raised its 2021 estimate for GDP growth to 6.0% and kept its benchmark rate at a record low. In South Korea, a rebound in services spending caused the average consumer inflation rate for 2021 to reach a decade high of 2.5%, leading the central bank to leave the door open for a further rate hike in January.

On the other hand, China (-3.2%) and Hong Kong (+0.5%) underperformed the regional index. Chinese tech stocks continued to fall after the US placed several Chinese companies on investment and export blacklists. Meanwhile, a COVID-19 outbreak in Xi’an also weighed on sentiment, with chip makers Samsung Electronics and Micron Technology warning that the lockdown could affect their manufacturing bases in the area. To bolster the economy, the Chinese government cut its reserve requirement ratio (RRR) by 50 basis points (bps) and the loan prime rate (LPR) by 5 bps. The government also signalled further stimulus measures including targeted lending to businesses and support for the housing market.

ASEAN markets see mixed performance

The ASEAN region saw mixed returns. Thailand (+6.4%) was the best performer in the region. During the month, Thai policymakers approved a new package of stimulus measures, including tax deductions for shoppers, in a bid to support domestic consumption as the pandemic continues to hobble tourism. Malaysia gained 4.2% in USD terms. For 2022 the Malaysian parliament passed its largest ever budget, allocating over 330 billion ringgit to support the post-pandemic economic recovery. Conversely, the Philippines (-2.2%) was the only ASEAN market to post negative returns, as Typhoon Rai forced the nation to scale down and delay COVID-19 vaccinations for millions of affected citizens.

India buoyed by easing Omicron fears

India rose by 3.7% in December. Manufacturing activity grew at its fastest pace in 10 months in November, led by robust domestic demand and a strong increase in production and sales. Separately, India’s cabinet approved incentives worth 760 billion rupees over six years towards semiconductor manufacturing in a bid to position the nation as a global hub for electronics.

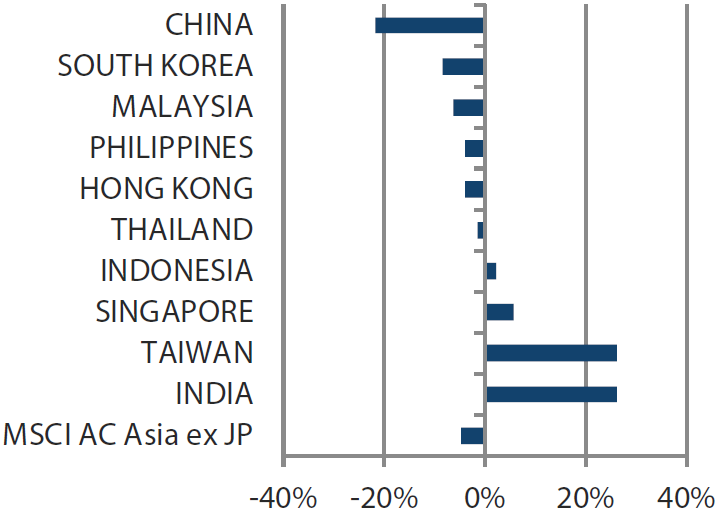

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 31 December 2021 | For the year ending 31 December 2021 | |

|

|

Source: Bloomberg, 31 December 2021

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Leaning on disciplined stock picking approach to navigate uncertain conditions

The year 2021 felt like it did not want to end. However, as we look ahead we are witnessing several conflicting market drivers. As always, we believe the best policy is to stick to a fundamental led bottom-up stock selection, focusing on companies undergoing significant positive fundamental changes that can deliver strong sustainable returns in the future.

The Omicron variant continues to rage across several countries, although we note a greater reluctance by the authorities to tighten restrictions compared to past waves. Also, the data coming out of South Africa, where the strain was first detected, indicates that despite being more transmissive, the severity of symptoms is greatly reduced despite a low vaccination rate. What’s more, the overall case count is already decreasing in South Africa. This could be a blessing in disguise if natural immunity rates increase.

Focus on industrial technology, AI software, renewables and electric vehicles in China

The one country where Omicron could have a greater impact than most is China, which has stuck to a zero-tolerance policy. We have already witnessed the lockdown of Xi’an, a city of 13 million people, which will have short term implications for global memory supply. On the flip side we note significant change in policymakers’ rhetoric from one of cleaning up excesses, most notably in the property sector, to one of ensuring “stability”. The LPR cut in December, although small and unlikely to change the economic cycle trajectory, is a natural extension of monetary easing following RRR cuts earlier in the month. With policy support coming through China continues to offer opportunities, particularly in domestically-focused areas of healthcare, software and consumer brands.

Monitoring valuations in India

While India is likely to face another COVID-19 wave, we are watching the reaction of the authorities closely. India’s vaccination rate and demographic profile is similar to that of South Africa; as such, hopes are that the Omicron wave in India will be much more placid in terms of human cost. As we have discussed in recent months, we had become more cautious on India given its market’s elevated valuations and pockets of exuberance, particularly in the small and mid-cap space. There remain some fantastic long-term sustainable return opportunities in India, in our view, especially if valuation levels become more palatable.

Tech companies in South Korea and Taiwan could find better support in 2022

The other major change occurring in December was the Fed’s acknowledgment that it is behind the inflationary curve. The word “transitory” has been removed and an accelerated tapering has commenced. Thus, the global liquidity environment is changing to become “a little less easy”. On the whole we find Asia to be in a much better position relative to its own history, and other global markets, to weather this change. Sovereign balance sheets are in good shape, banking systems are stocked with some of the highest levels of capital we have ever seen and deposit inflows have been strong. We see this as a reason to review our views and be mindful of areas that have benefited significantly from this easy money regime.

The change in the global liquidity environment has not impacted hardware and semiconductor technology demand. With increasing signs that chip and shipping shortages could ease over the next few quarters, tech companies in South Korea and Taiwan could find better support going into 2022. Localisation of technology supply chains and digitisation continue to be strong fundamental drivers. The emergence of the Metaverse as a “new” area for development is also an area both these economies will likely feature in. With valuations looking more reasonable after recent corrections, we continue to find opportunities within integrated circuit design, content enablers and industrial tech.

Focusing on new economy in ASEAN

Our preferences within the ASEAN region remain largely unchanged. The pandemic has been a critical accelerator of the new economy in the ASEAN region. Some countries are further along than others, with ingredients in place for better quality economic growth—such as Singapore, Indonesia, and the Philippines. In the case of Indonesia, we also favour several materials-related names geared to the development of renewables and electric vehicles, which are the two more sustainable areas of demand.

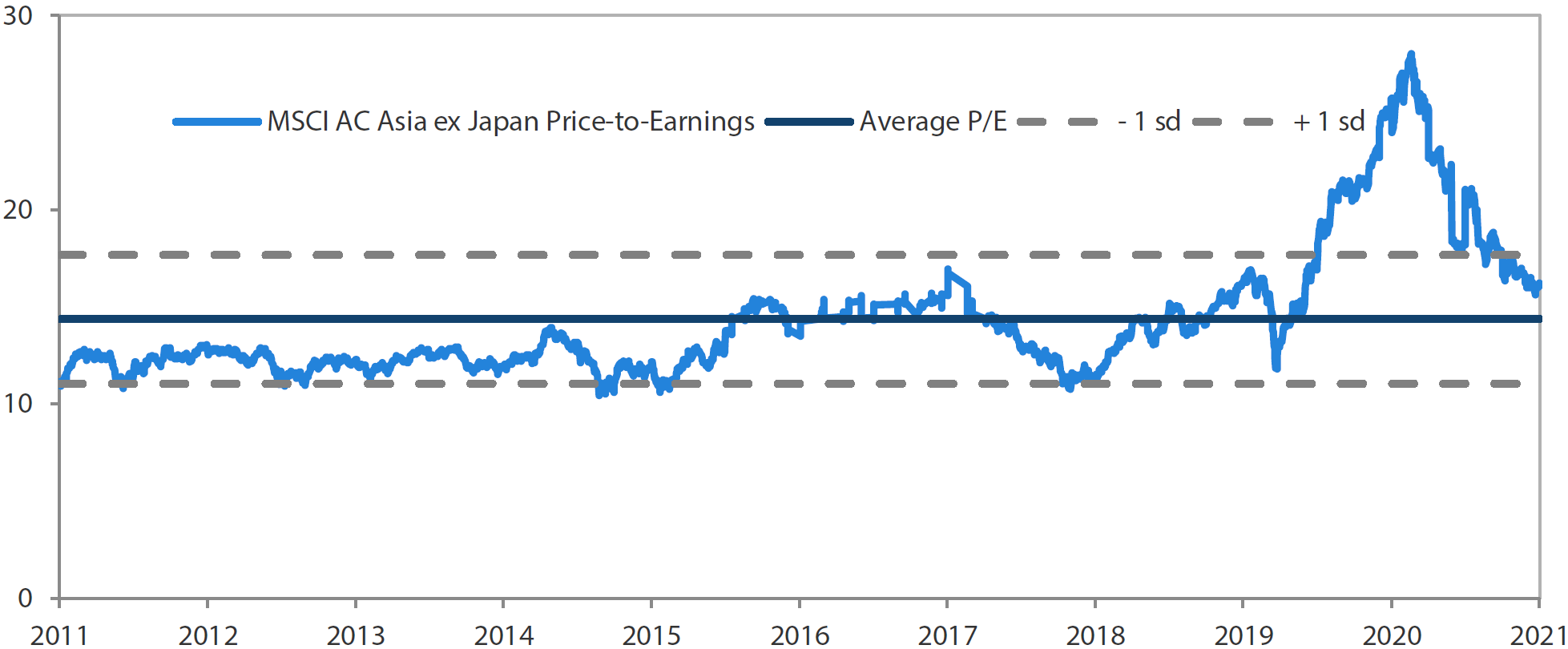

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 December 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 December 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

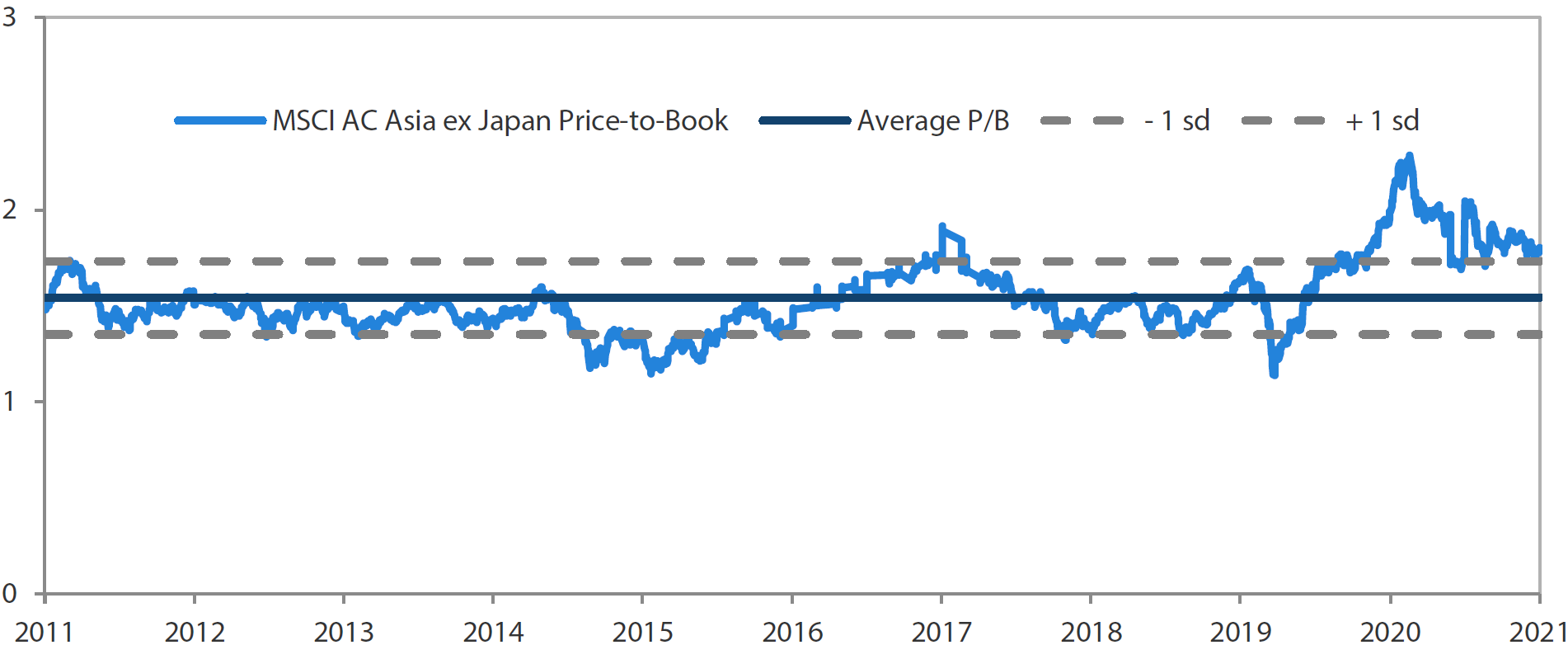

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 December 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 December 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.