In 2020 the COVID-19 pandemic negatively affected a wide variety of Japanese assets, including the real estate investment trust (J-REIT) market. J-REITs have bounced back since, but their recovery has been sluggish compared to the Japanese equity market’s rebound. Despite the slower recovery, we believe J-REITs have ample upside room once the rise gathers pace.

J-REITs: A brief background

Japan’s REIT market dates to September 2001, when two J-REITs were publicly listed on the Tokyo Stock Exchange (TSE). By the end of December 2020 , the number of listed J-REITs had increased to 62. With a market capitalisation of roughly JPY 15 trillion, Japan’s REIT market is currently the second largest in the world after that of the US.

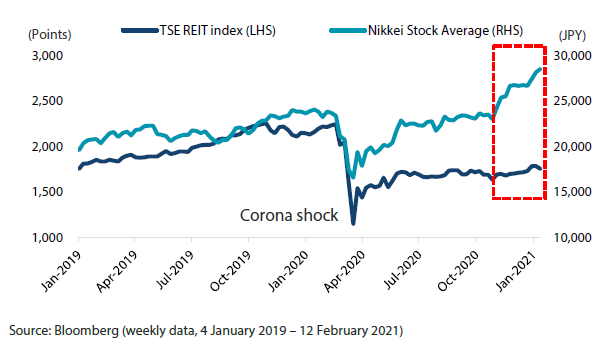

In October 2019 TSE’s J-REIT index struck a 12-year peak, rising above 2,200 points as it was spurred by investors seeking yield-bearing assets in a negative interest rate environment. The index plunged sharply after the onset of the COVID-19 pandemic, falling below 1,200 points in March 2020. It has managed to bounce back from those lows, nearing 1,900 points in February. But the J-REIT recovery has lagged that of Japanese equities. The Nikkei Stock Average also plunged in March 2020, but its subsequent bounce has been more robust, with the index reaching a three-decade high in February (Chart 1) .

1Source: The Association for Real Estate Securitization

Chart 1: TSE’s J-REIT index and the Nikkei Stock Average

Why the recovery by J-REITs is relatively slow

We identify four main reasons why the recovery by J-REITs in the wake of the 2020 “Corona shock” has been slow compared to the rebound in equities:

- A strong psychological impact from news reports of increasing office vacancies and declines in rental income

- Concerns that demand for offices will continue declining due to an increase in teleworking

- The lowering of dividend payouts by some J-REITs

- Domestic banks, the main investors in the J-REIT space, are yet to return in strength

The brisk pace of the recovery by Japanese equities also makes the comeback by J-REITs appear sluggish in comparison. A large part of the surge by equities is due to the sharp rebound by the manufacturing sector, which has made up for the still-lagging services, travel and land transport sectors. The recovery by J-REITs may appear relatively slow, but the market has already priced in most of the bearish factors, in our view. The selling of J-REITs by domestic banks after the Corona shock also seems to be dissipating; after being large sellers prior to book closings in March and September last year, banks appear poised to join foreign investors as buyers of J-REITs at market dips.

Why we believe J-REITs are under-priced and have ample upside room

In our view, J-REITs are under-priced and have ample upside room because the market has not fully factored in the future normalisation of the economy. If the economy does normalise eventually, it will positively impact the J-REIT market through the following factors:

- Once vaccinations become widespread, office vacancies will decrease and rental income will stop declining.

- Teleworking is likely to keep increasing but the change in lifestyle will also highlight the difficulties of working from home. As a result, demand will increase for coworking space in office buildings with easy access to transport hubs such as train stations, and this could spur actively managed J-REITs to reshuffle their portfolios.

- The recent drop in dividends from J-REITs is expected to bottom out on the two aforementioned factors.

- Domestic banks, the main investors in the J-REITs, will continue returning to the market (indications are that this return is already underway).

Given that the above factors have not been fully factored in by investors, we believe J-REITs are under-priced.

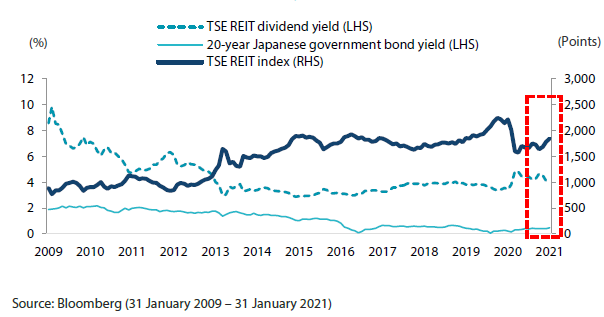

Dividend yields more important than price gains

Once the economy normalises, in theory J-REITs should eventually return to their pre-pandemic levels. While the TSE’s J-REIT index has been rising steadily since 2009 for the most part, it is worth noting that dividend yields from the index have ranged between 3 to 5% since 2012, offering significantly higher returns compared to bonds. Because the J-REIT market has grown substantially in both size and credibility since the Global Financial Crisis, its attractive dividend yields have often been overlooked (Chart 2). For investors with a long-term horizon, it would be more apt to focus on the constant returns from dividend yields rather than potential price gains, in our view.

Chart 2: TSE’s J-REIT index, dividend yield

Another often overlooked aspect is the Bank of Japan’s (BOJ) role in the J-REIT market. As a part of its stimulus programme the central bank has been actively purchasing J-REITs since 2010. In March 2020 the BOJ doubled its intended purchase amount of J-REITs to JPY 180 billion per year as it rolled out a series of measures to support the economy reeling from the pandemic. The BOJ has been flexible in its buying, however, changing the frequency of its operations and the amount of its purchases according to market conditions.

Conclusion

J-REITs may be lagging Japanese equities in their recovery from the Corona shock, but the market has ample room to catch up once developments such as the rollout of vaccines enable the economy to normalise. And once the economy begins to normalise, investors will be able to address rent income instability caused by the pandemic as new methods of working are expected to increase demand in new areas, such as office buildings in regional hubs as opposed to the main urban centres. Looking from the perspective of the history of financial markets, REITs represent breakthrough instruments that enable investors to play the role of landlords and assess their assets from both an investment and income viewpoint.