Global equity investment philosophy

Our philosophy is centred on the search for "Future Quality" in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investments.

The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

It is easy to become despondent and fearful when repeatedly confronted by the reporting of the unfolding health and economic crises. Much of the broadcast material is genuinely traumatic and there is no doubt that millions of people are suffering extremely difficult times at present. With the International Labour Organisation forecasting that up to 25 million jobs will be lost globally as a result of the lockdowns, the financial pain felt by families will likely be even worse than the physical and mental health toll of the virus.

Despite the nightly drip feed of upsetting statistics on new infections and fatalities, equity investors’ minds are beginning to consider questions such as “What might the recovery from this unprecedented shut down of the global economy look like?” and “What sectors are likely to recover the fastest as people return to work?”

It is tempting to be deliberately contrary at moments of such profound distress, but we are not convinced that weak business models going into the crisis will be any stronger as we emerge from it. Will Europe’s banks, for instance, enjoy better long-term returns as a result of anything that has happened recently? Probably not. Furthermore, the point of maximum pain for some businesses may actually come as they restart operations. When they do, businesses will need to invest again in their staff and rebuild working capital. At the same time, government financial support will be withdrawn (or at least substantially reduced in scale). If sales don’t recover as quickly as these costs are added back, a second wave of bankruptcies could result, challenging businesses without strong balance sheets and internally generated capital.

Just as important will be to recognise where businesses are enjoying improved trading conditions as a result of the virus and the resultant controls on people’s freedoms. In some cases, it is unlikely that this improvement in fortunes will persist.

Guarding against excessive investor confidence in the defensiveness of businesses and their relative valuation is also very important in times like these. Where we review our investments and discover such a situation, we will act accordingly, even where the business still satisfies other Future Quality criteria.

Market review

We have not transacted much on the portfolio at this stage, but we are beginning to make some changes. Companies that have long satisfied our requirements in terms of management quality, franchise quality and balance sheet quality, but where valuation suggested that this was already reflected in the share prices, now look more attractively priced. In some cases, these will be businesses operating in relatively cyclical industries, where they will emerge from the crisis with a strengthened competitive position.

Portfolio positioning

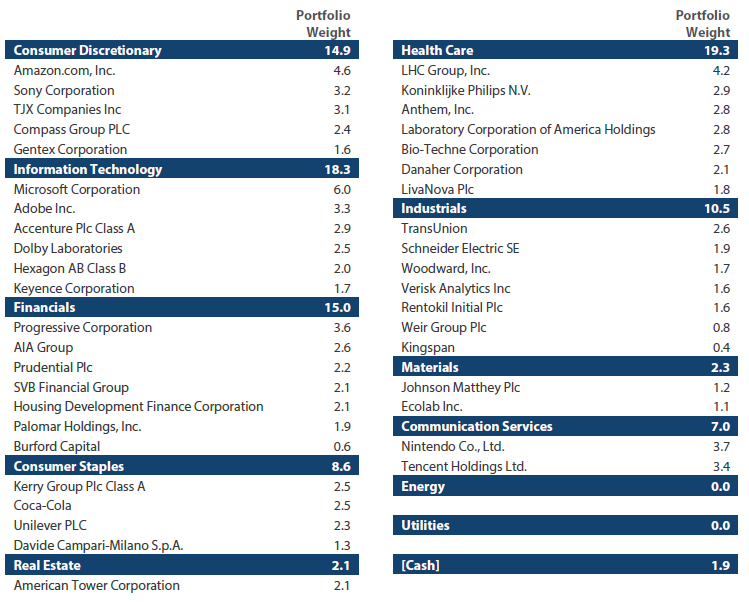

The table below highlights our Global Equity Strategy holdings as of the end of March 2020.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell

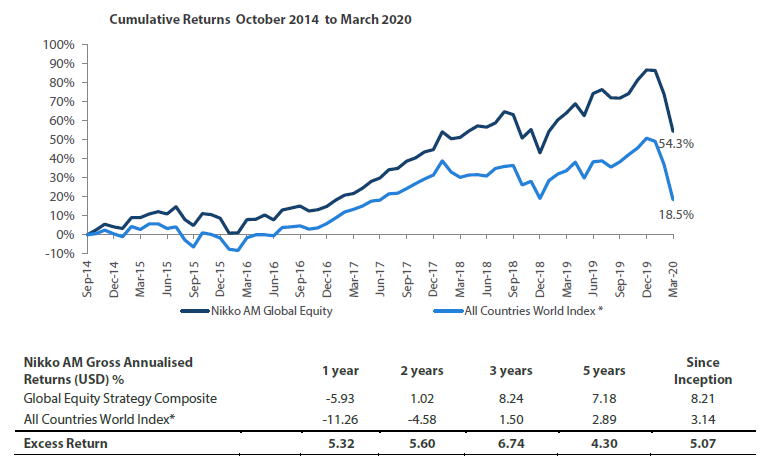

Global Equity Strategy Composite Performance to Q1 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Source: MSCI. Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS. Returns for periods in excess of 1 year are annualized. Returns are AUD based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Past performance does not guarantee future returns. For more details, please refer to the performance disclosures found at the end of this document. Data as of 31 March 2020.

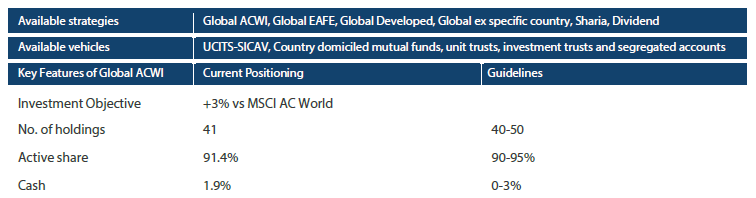

Nikko AM Global Equity: Capability profile and available funds (as at 31 March 2020)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 23 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen (joined in February 2019) and Ellie Stephenson (joined in September 2019) are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 206.6 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 March 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.