Summary

- Regional markets enjoyed another bout of strong performance in July. Global market sentiment remained buoyant due to optimism about the development of a vaccine for COVID-19; upbeat earnings of big technology companies; and assurance from the US Federal Reserve (Fed) that monetary policies would remain highly accommodative in the foreseeable future. The MSCI AC Asia ex Japan Index gained 8.5% in US dollar (USD) terms over the month.

- Taiwan, India and China were the best-performing markets. Taiwan surged 16.3% in USD terms in July, boosted by the strong performance of index heavyweight Taiwan Semiconductor Manufacturing Company (TSMC). Indian stocks reached their highest level in about four months on optimism that policymakers would continue to take steps to support the weak economy, while China was boosted by ample market liquidity and signs of an economic recovery.

- In the ASEAN region, stock markets saw mixed returns in USD terms in July. Malaysia outperformed, Indonesia saw decent gains and Singapore was flat, while Thailand and the Philippines declined.

- The second half of 2020 is likely to be tricky as markets have to deal with any number of potential disappointments—greater or longer-than-expected economic pain; stubbornly high levels of unemployment; delayed/unsatisfactory vaccine development; and a resurgence in COVID-19 cases. We continue to seek structural beneficiaries including software, healthcare, 5G, industrial automation and renewables, while being mindful of valuation.

Asian equity

Market review

Regional stocks surge, outpacing gains of global equities

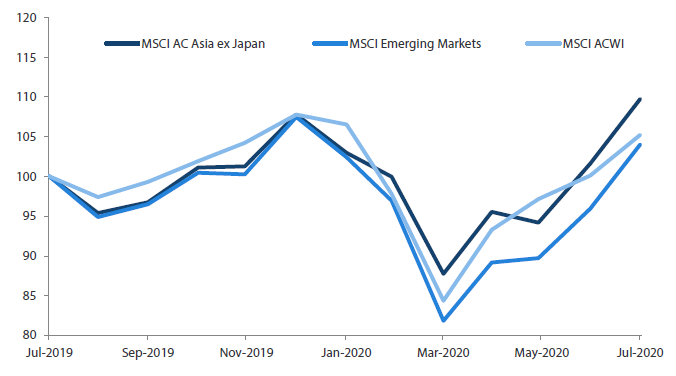

Following the sharp rally in June, Asian stocks enjoyed another bout of strong performance in July. Global market sentiment remained buoyant during the month due to optimism about the development of a vaccine for COVID-19; upbeat earnings of big technology companies; and assurance from the Fed that monetary policies would remain highly accommodative in the foreseeable future. The US Dollar Index saw its biggest monthly fall in nearly a decade. With the traditional weaker dollar trade, risk assets are catching a bid. The MSCI AC Asia ex Japan Index jumped 8.5% in USD terms, outperforming the MSCI AC World Index (+4.8%), despite the resurgence of COVID-19 cases in several Asian countries and the worsening US-China tensions.

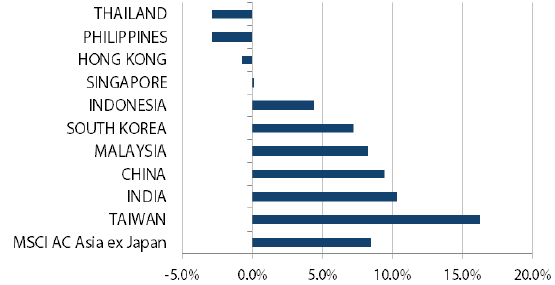

Within the region, Taiwan, India and China were the month's best performing markets (as measured by the MSCI indices in USD terms), while Thailand, the Philippines and Hong Kong were the worst performers.

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 July 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

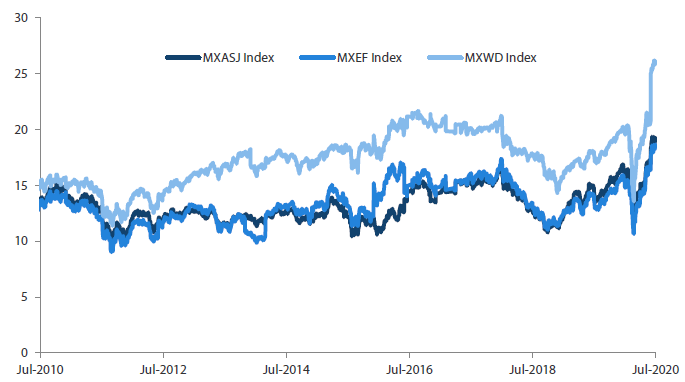

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 July 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

Taiwan, India and China outperform

In Taiwan, stocks surged 16.3% in USD terms in July, boosted by the strong performance of index heavyweight Taiwan Semiconductor Manufacturing Company (TSMC), which reported strong 2Q20 financial results and also benefited from competitor Intel suffering delays in a key node. Elsewhere, South Korean stocks tracked the regional upswing and returned 7.2% in USD terms for the month, supported by the outperformance of global technology (tech) stocks. Both the Taiwanese and South Korean economies shrank in 2Q20 on a quarter-on-quarter (QoQ) and year-on-year (YoY) basis.

Indian stocks rose 10.4% in USD terms in July. Notwithstanding the rising coronavirus cases in the country, Indian stocks reached their highest level in about four months on optimism that policymakers would continue to take steps to support the weak Indian economy.

In China, stocks turned in USD gains of 9.4% for the month, boosted by ample market liquidity and retail investor enthusiasm. Shares also rose on signs of a recovery in China's economy, which rebounded from 1Q20's contraction and grew 3.2% YoY in 2Q20. Hong Kong stocks, however, underperformed their regional peers, slumping 0.7% in USD terms in July due to rising US-China tensions and surging coronavirus cases in the territory.

ASEAN saw mixed returns

In the ASEAN region, stock markets saw mixed returns in USD terms in July. Malaysia (+8.3%) outperformed, Indonesia (+4.4%) saw decent gains and Singapore (+0.1%) was flat, while Thailand (-2.9%) and the Philippines (-2.9%) declined. The Philippine government announced it would re-impose stricter lockdowns in Manila after COVID-19 cases rose above 100,000; the Thai Finance Ministry forecasted that Thailand's economy could contract 8.5% this year; Singapore's economy contracted 41.2% quarter-on-quarter in 2Q20; and the central banks of Malaysia and Indonesia cut interest rates to support their economies.

MSCI AC Asia ex Japan Index1

For the month ending 31 July 2020

Source: Bloomberg, 31 July 2020

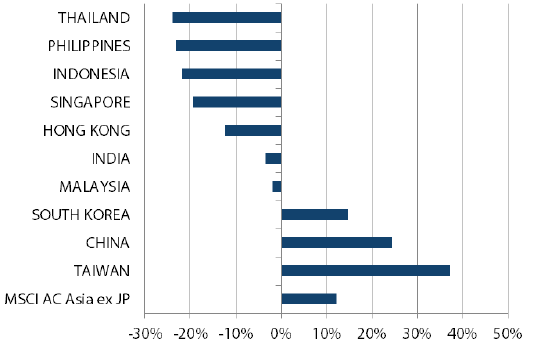

For the period from 31 July 2019 to 31 July 2020

Source: Bloomberg, 31 July 2020

1Note:Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Second half of 2020 likely to be tricky

Financial markets appear to have shrugged off the worst pandemic since the Spanish Flu and the worst economic contraction since WWII, rationalising it by using one or more of the following reasons: central bank stimulus, fiscal handouts, an imminent vaccine, TINA (there is no alternative) and FOMO (fear of missing out). We have leant on some of these arguments too. However, when acronyms start getting peddled willy-nilly, it is time to take stock.

The second half of 2020 is likely to be tricky as markets have to deal with any number of potential disappointments—greater or longer-than-expected economic pain; stubbornly high levels of unemployment; delayed/unsatisfactory vaccine development; and a resurgence in COVID-19 cases, as economies are forced to reopen because the "fix" (i.e. shutdowns/lockdowns) are worse than the "problem" (COVID-19). On the other hand, the absence of these will only be considered as "par", making for an unattractive risk-reward trade-off. Thus, we continue to favour and seek structural beneficiaries from sectors including software, healthcare, 5G, industrial automation and renewables, while being mindful of valuation.

Favouring 5G, digitisation, automation, healthcare and environmental infrastructure

China's continued commitment to quality over quantity will be tested heading into the US elections, as President Donald Trump is likely to increase his anti-China rhetoric. But the Chinese government's relatively circumspect approach thus far offers it greater flexibility should push comes to shove. The government remains focused on reform, greater self-reliance and accelerating the build-out of new infrastructure, such as 5G, digitisation, automation, healthcare and environmental infrastructure; these are areas we continue to favour.

Increasing risks of further dislocation from the US-China tech war with Huawei as the epicentre warrants a selective stance on the tech hardware sector in South Korea and Taiwan, notwithstanding a number of innovative and well-managed companies in this area.

Constructive on India’s long-term outlook

India, the world's largest democracy, is likely to continue to grapple with COVID-19, with the seasonal boost from monsoons likely to be "watered down" this year. Despite the short-term economic pain, we remain constructive on India's longer-term outlook, premised on the benefits accruing from reform instituted over the past two years. We continue to have a positive view of private banks, digital services and logistics, and select consumer subsectors.

ASEAN could benefit from the reconfiguration of supply chains

Similar to India, ASEAN markets have been hit hard by COVID-19 but are gradually recovering from the harsh disruption. Parts of the region, like Vietnam, have emerged from the crisis with a new found reputation for resilience and stability, which augur well for investments relating to the reconfiguration of global supply chains. There are, however, also countries where inadequacy of infrastructure implies a slow road to recovery, while highlighting the opportunity if they can address these shortcomings.

Appendix

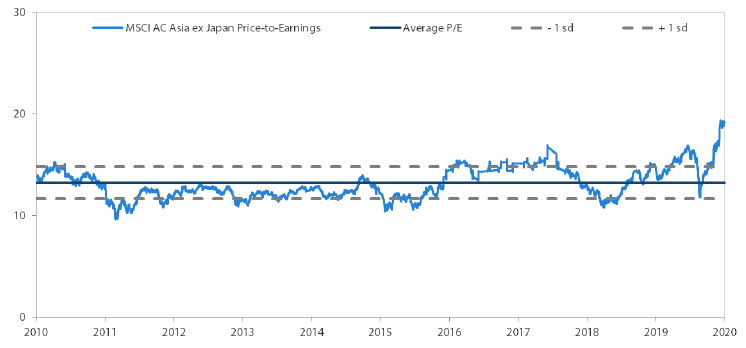

MSCI AC Asia ex Japan price-to-earnings

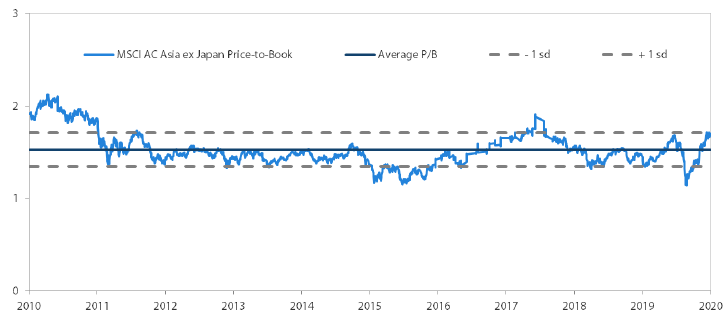

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 July 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.